Valutrades Broker Review

It was founded in 2012, Valutrades is a regulated ECN broker that focuses on providing the best trading environment for serious beginners and experienced traders.

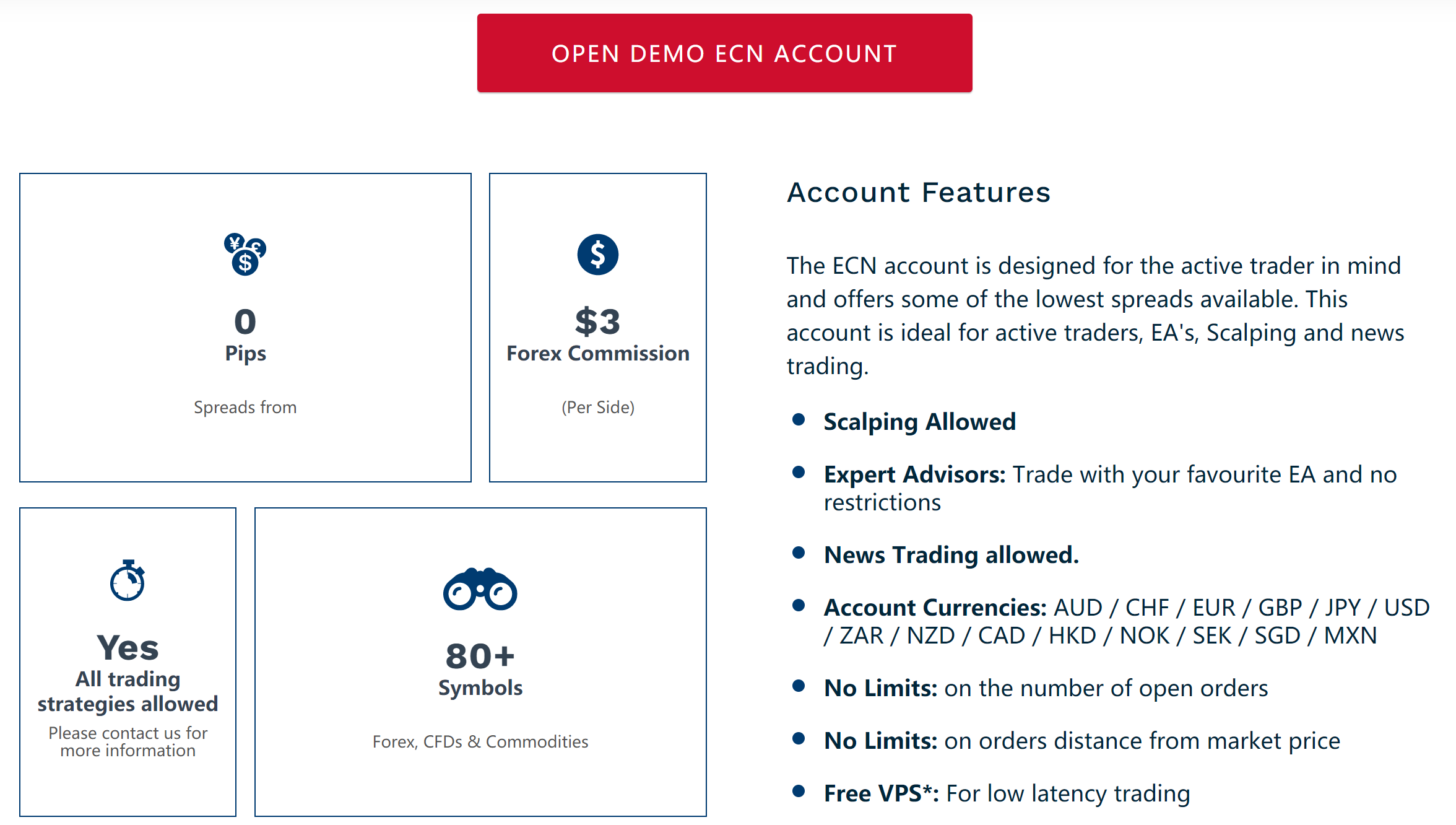

Valutrades has only one live ECN account, yet offers trading in a diverse range of trading instruments, including over 75 forex portfolios, commodities and indices. Compared to other ECN brokers, Valutrade has superior trading conditions, their spreads start from 0 pips, they charge $3 per lot, and there is no minimum deposit requirement. The broker supports both MT4 and MT5, and professionals will be pleased with the variety of tools they offer, including various sentiment and technical indicators, as well as the FIX API, a web-based trading interface that lets clients develop their own trading strategies and run their own algorithms.

Trading Fees

Valutrade’s one ECN account for live trading and pure live trading has lower trading fees than other similar brokers.

Valutrades offers accounts with more minimum deposits and lower spreads than many other brokers offering a variety of accounts, and Valutrades offers an active ECN account with no minimum deposit requirement.

Is Valutrades safe?

Yes, Valutrades is a reputable trading broker. It is regulated by the FCA in the UK and the FSA in Seychelles.

Founded in 2012 and based in London, Valutrades is regulated by the Financial Conduct Authority (FCA) in the UK and the Seychelles FSA. valutrades is also a UK member of the FSCS (Financial Services Compensation Scheme).

Valutrades offers trading in three main markets

Forex trading on more than 80 major and minor markets and exotic markets.

Commodities – – Trade precious metals and oil, such as gold and crude oil

Index CFDs trading global indices such as the FTSE 100 and S&P 500

Spreads and Commissions

Valutrades offers competitive spreads starting from 0.2% for major currency pairs such as EUR/USD. Typical spreads for crude oil are around 0.018 and in the FTSE 100, spreads are around 0.7.

Commissions on Forex are set at $3 per day for a normal ECN account. Other fees such as bonuses, swaps and rollovers, as well as end of day rates and margin rates can be listed on the “Trading Products” page of the broker’s website.

Mobile Applications

Its MT4 as well as MT5 mobile applications allow users to view market information and have full control of their accounts throughout the day, no matter where they are. In addition to providing technical analysis tools such as one-click trading and market depth, it also offers mobile-friendly features such as mobile live chat or push alerts.

The mobile apps are compatible with iOS and Android smart devices. They can be downloaded through the App Store and Google Play store.

Deposit

Accounts can be funded through a number of fast and free payment methods. They include bank wire transfers as well as debit and credit cards, and e-wallets such as Skrill and Neteller. There is no minimum deposit, which makes Vuetrades an option that can be used even by novices.

Bank wire transfers usually take 3 to 5 business days, while debit and credit card transactions are usually credited on the same day.

Withdrawing Funds

The withdrawal process is the same method, but with a minimum amount of $50 in the desired currency. Brokers strive to have all withdrawals processed within 24 hours.

Valutrades offers free withdrawals to all clients every month. The offer is renewed every month. A 5% processing fee will be charged for the fourth withdrawal. However, clients can choose to postpone the fourth withdrawal to the next month to reduce the amount of the charge.

Regulation

Valutrades Limited (UK) is licensed and regulated through the Financial Conduct Authority (FCA) under registration number 586541. Valutrades (Seychelles) Limited is licensed and regulated by the Seychelles Financial Services Authority under its Securities Dealer Licence number. sd028.

Under both regulatory frameworks, Valutrades holds clients’ funds in segregated accounts with reputable banks. Protection against negative balances is also provided. In the case of Valutrades UK, investor protection is also offered as part of the Financial Services Compensation Scheme (FSCS), up to £85,000 per individual.

Additional Features

Valutrades offers additional resources for those who are just starting to understand the basics and for professionals seeking to enhance their knowledge. The Education Center has training tools for economic indicators and forex trading strategies, blogs, webinars and useful tools such as an economic calendar and custom indicators designed for MT4.

Responses