Description

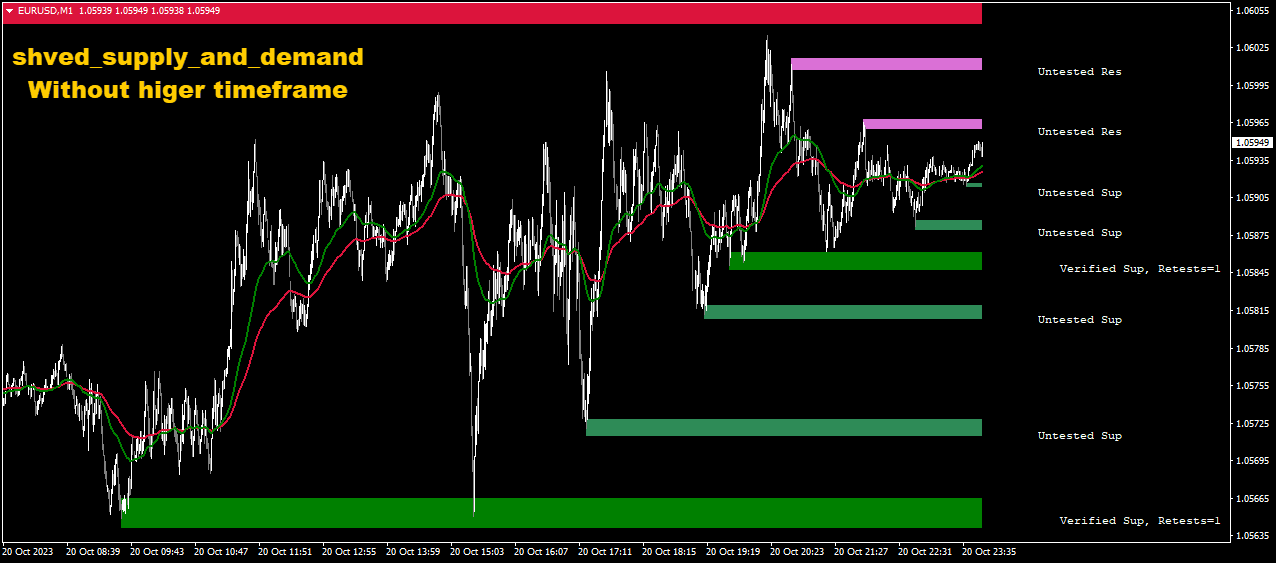

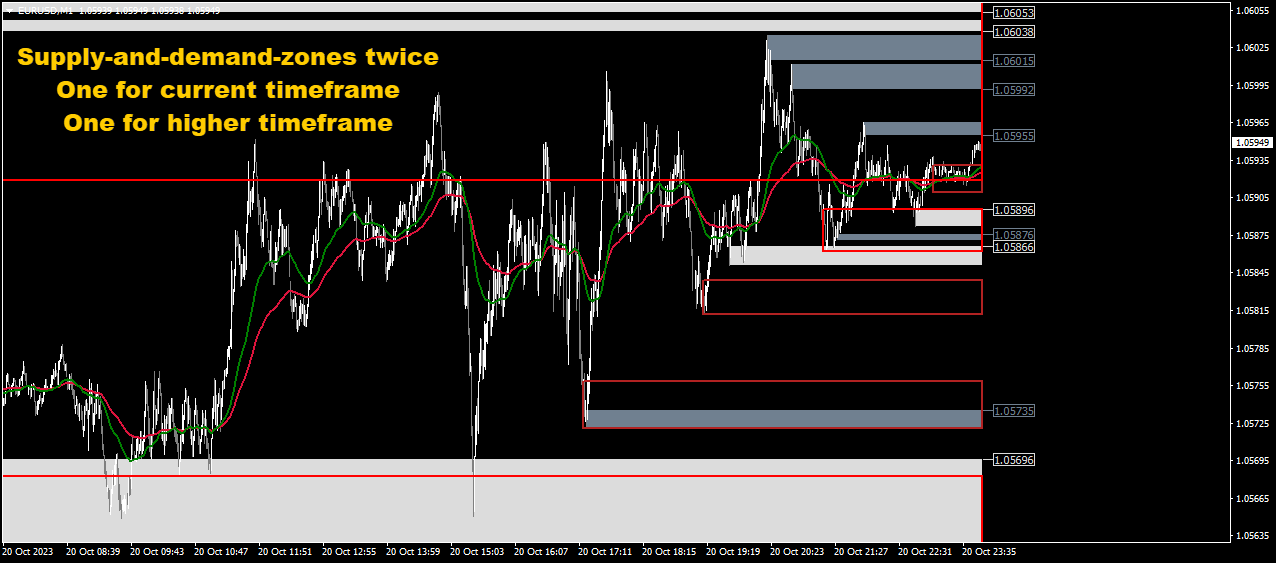

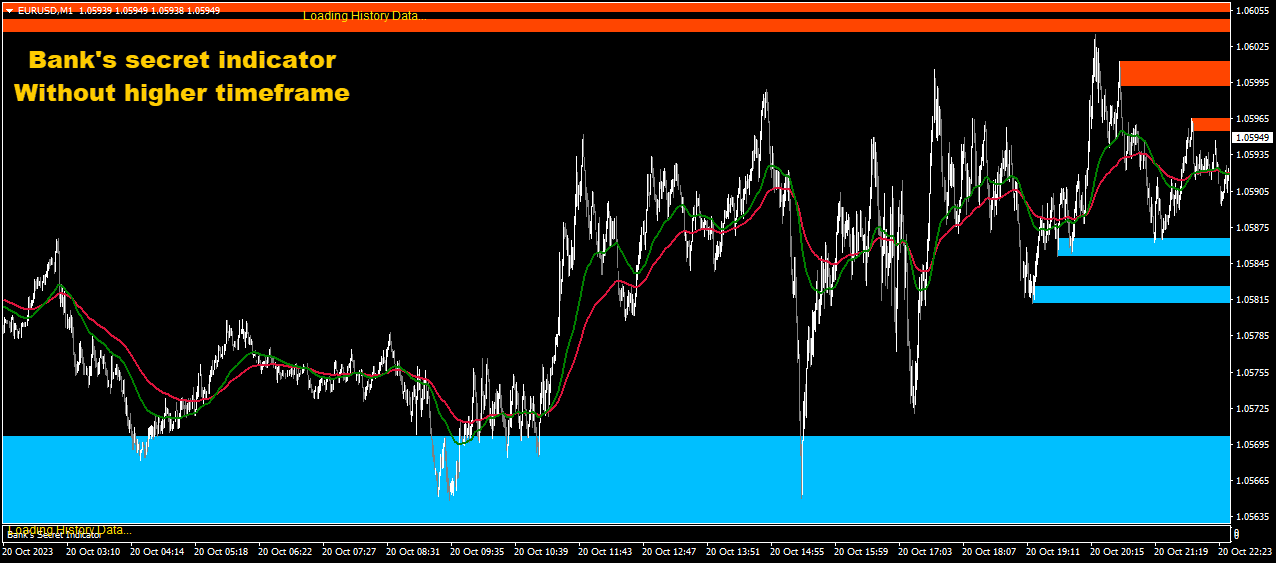

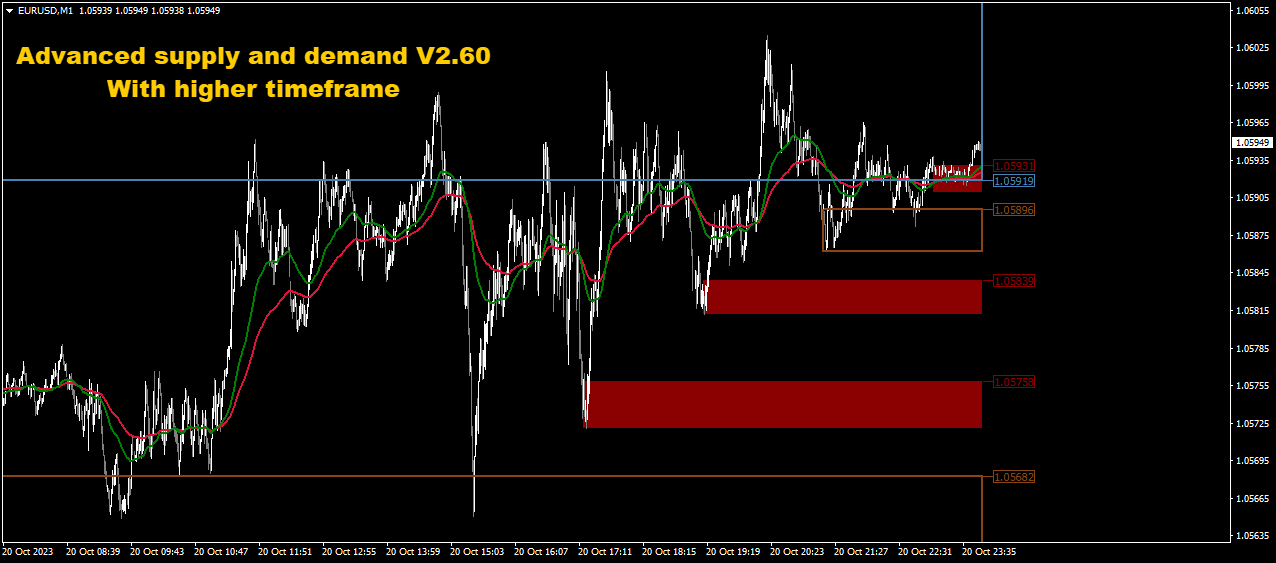

MT4 has 4 different supply and demand indicators that you can choose to use according to your preferences.

Containing 4 indicators, the Supply and Demand Indicators in Trading,These zones are considered important as they can act as support or resistance zones and influence future price action.

Reviews

There are no reviews yet.