Bearish and Bullish Megaphone pattern

Min Deposit of 20$ |

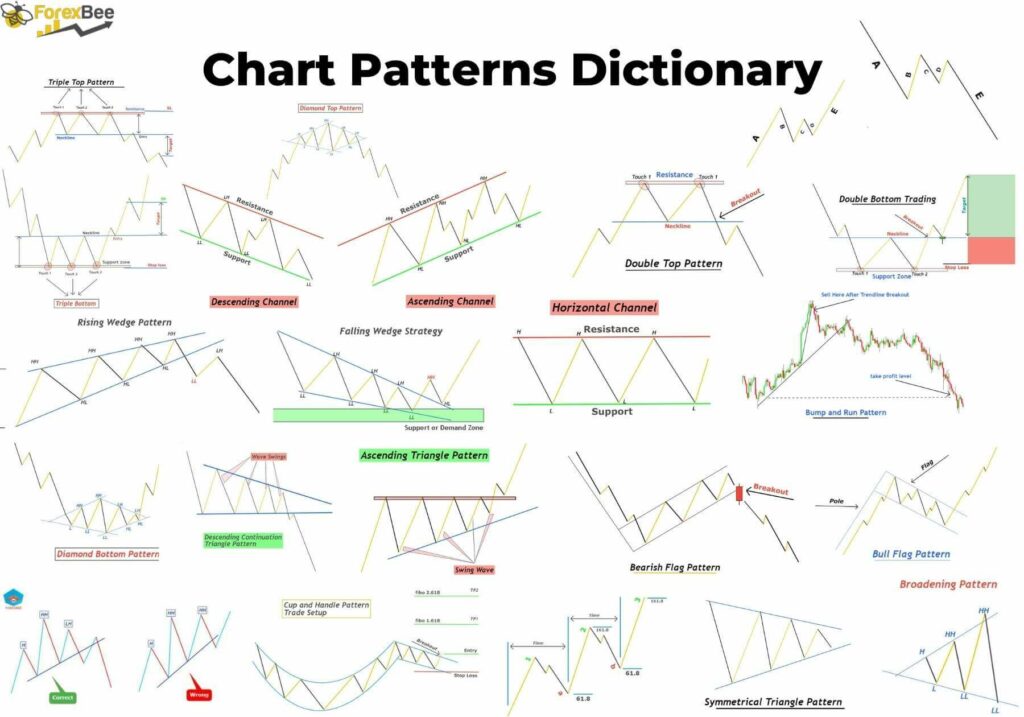

Many forex chart patterns frequently occur, like the triangle and wedges. Some are not very common, like the megaphone.

Yes, the pattern gets its name because it resembles a megaphone.

Although the pattern rarely occurs, you can easily identify it.

In this guide, we’ll talk about a megaphone pattern and how you can trade it.

Megaphone pattern definition

In 1932, Richard W. Schabacker discussed the megaphone pattern in his book, “Technical Analysis and Stock Market Profits.”

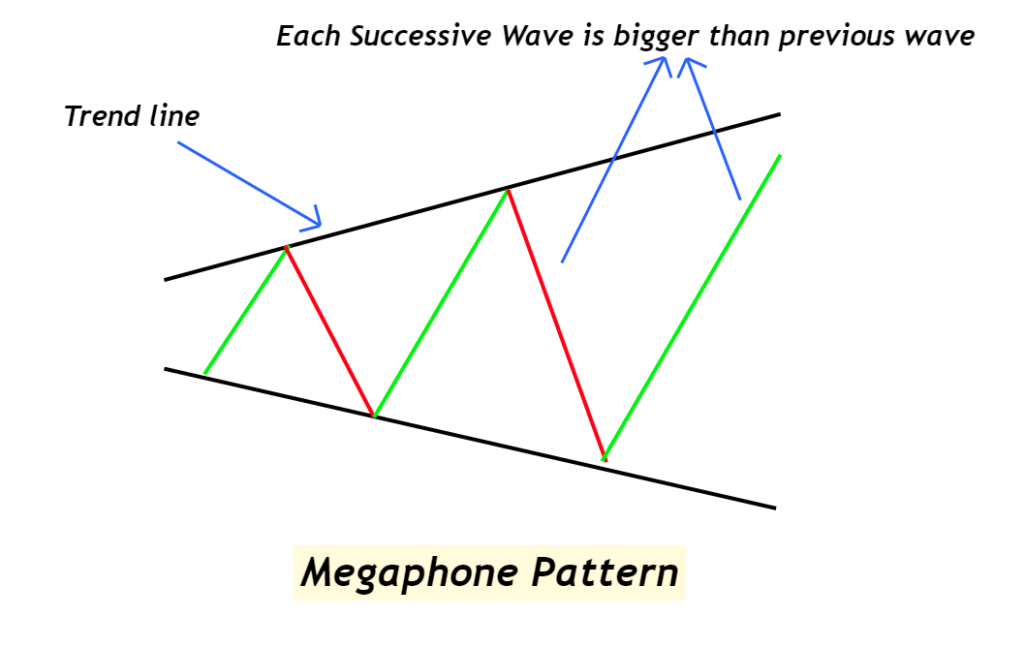

A megaphone is a chart pattern depicting a widening channel of high and low levels, forming a megaphone-like structure. It is also known as a broadening formation.

The pattern consists of two higher highs, two lower lows, and five different swings. The good thing about the megaphone pattern is you can use it as a continuous and reversal pattern.

You can create the channel by drawing upper and lower trendlines.

Types

There are two types of megaphones; bullish and bearish.

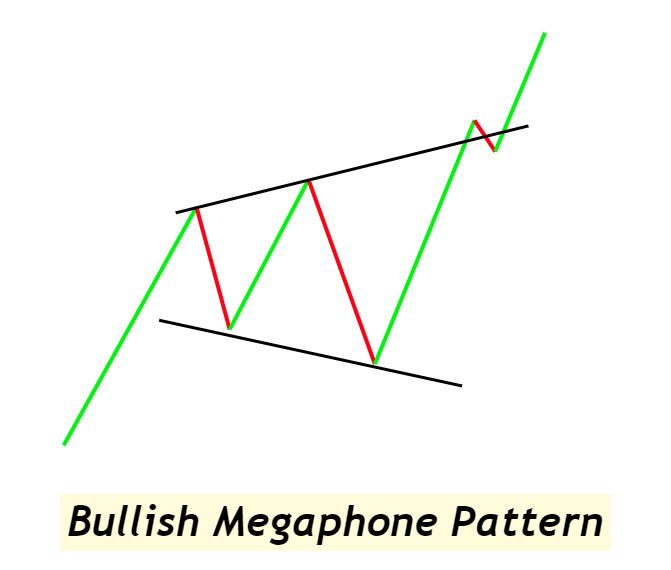

Bullish megaphone

The bullish megaphone appears when the price goes above the channel. Once the price breaks the upper level, you can take the trade at the fifth swing.

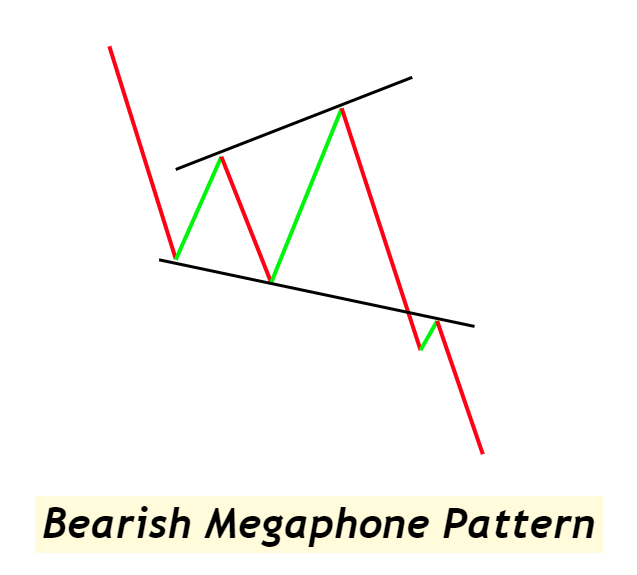

Bearish megaphone

The bearish megaphone occurs when the price goes below the channel. Here, the price breaks the lower level, presenting a short entry point.

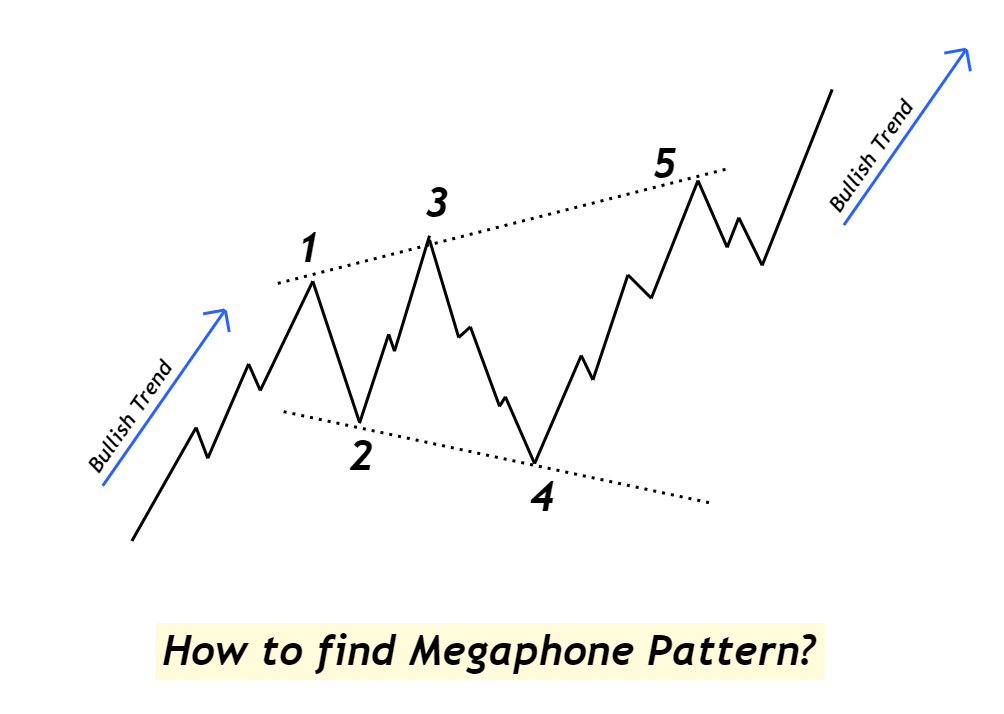

How to find a megaphone pattern in trading?

A megaphone pattern occurs during periods of high volatility. Usually, you don’t get a clear indication during volatility. With a megaphone, you have higher and lower highs at the same, identifying market uncertainty.

As mentioned earlier, the megaphone has five swings. Each swing is bigger than the previous one and represents lower lows and higher highs. You can also have minor swings between the five major swings.

As the pattern forms during high volatility, each swing is bigger than the previous one. The fifth one is the largest, and this is where you enter the trade.

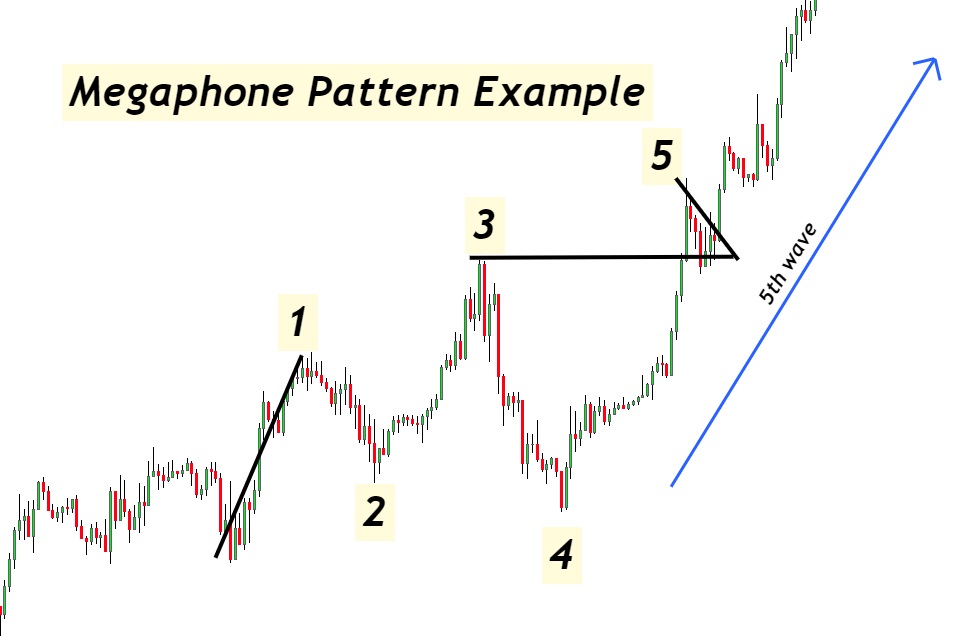

On the chart below, you can see a bullish megaphone. The price creates five swings with smaller swings in between. The fifth wave is the largest, and once the price breaks the channel, it presents a long entry point.

What does the megaphone pattern tell traders?

This pattern appears during high volatility, representing the battle between the bulls and the bears.

Buyers are entering the market and want to buy even a high price. On the other hand, sellers are looking to make a profit from the increased volatility.

It creates a tussle between the buyers and sellers; hence, we get peaks and troughs. When you connect these highs and lows, you get a megaphone chart pattern.

| Features | Pattern Characteristic |

|---|---|

| Type of Trend | Trend Continuation |

| Winning ratio | +70% |

How to trade a megaphone pattern?

To trade it, first, you need to know that megaphone comprises Fibonacci ratios. Each swing in the pattern has a fib ratio and a 1.27 to 1.62 extension ratio.

Megaphone works as continuous and reversal patterns. So, you can have two trading opportunities. You just need to place the trades after the fifth swing because the price will reverse after the fifth swing.

It may sound confusing, so let’s break it down.

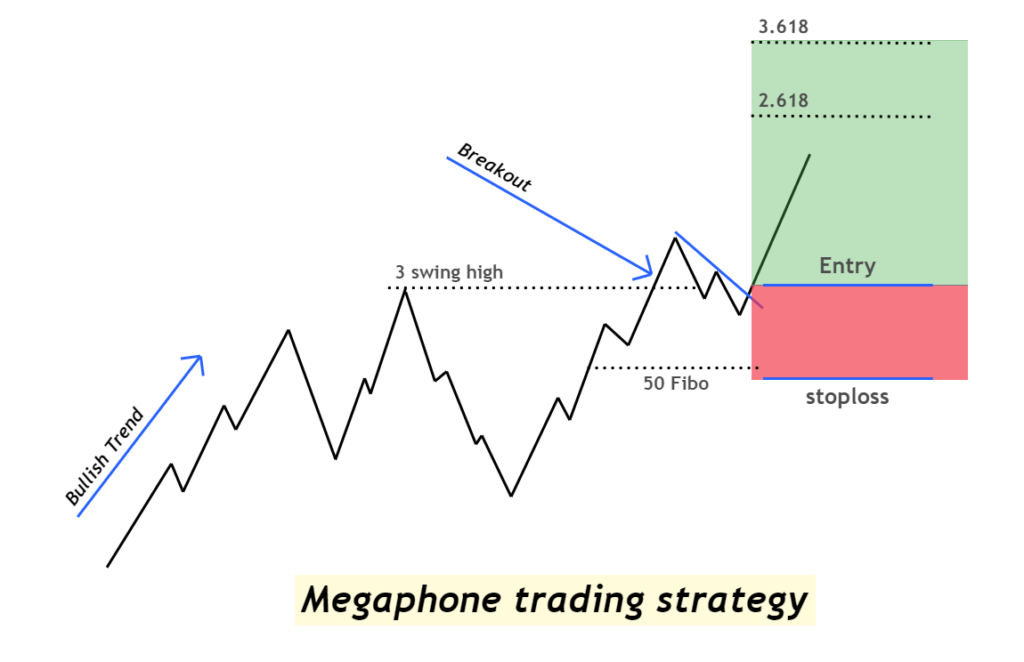

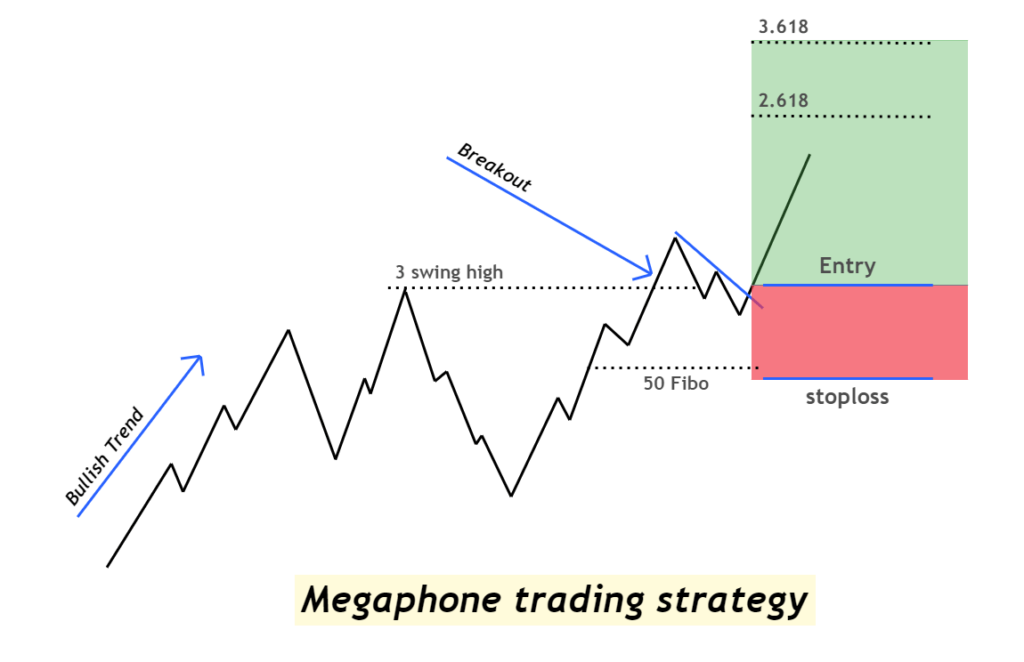

Breakout strategy

To trade the megaphone breakout as a continuation, you need to take the trade in the direction of the breakout.

You can enter a long position when the price closes outside the pattern.

On the chart above, you can see an uptrend breakout megaphone. The price created five swings, retraced at the fifth swing, and then we got our long entry point.

Conversely, you can take short positions after the fifth swing in a downtrend breakout.

You can set the take-profit using the Fibonacci ratios. When the fifth swing breaks the 3rd swing level, it creates a small range, and you can set TP at 2.618 or 3.618 from that range.

For stop-loss, you can place it 50% from the range.

Also Checkout the SUPER LOTTERY $100,000 for NordFX Broker Clients! 100 Prizes and a super prize of $20,000. It is very easy to participate.

Let’s apply the megaphone strategy. On the chart above, you can see a breakout pattern. After reaching the fifth swing, the price started to retrace but continued with the bullish move. At this point, we entered the trade.

We set the take-profit using a Fib ratio of 2.618 and 3.618. We place two TPs here, but if you want to exit the position earlier, you can set it at 2.618.

For SL, we used the 50% Fib level of the range between the 3rd and 5th swing.

The bottom line

Although it doesn’t frequently occur on the chart, the megaphone pattern is highly effective. It identifies the price continuation and reversal so you can trade it both ways.

You need to know that the longer the timeframe, the more effective pattern will be. Also, you need to identify the pattern properly.

Frequently Asked Questions

Can we use a megaphone pattern for Day trading, scalping, and position trading?

The megaphone pattern works best on longer timeframes, as there is a lot of noise on shorter timeframes. So, you can use it for the day, swing, and position trading. For scalping, it isn’t effective.

What is the winning ratio of the megaphone pattern?

Megaphone doesn’t have a fixed win ratio, but the pattern is highly effective. So, we can expect a win ratio above 70%.

Is the megaphone a trend reversal or trend continuation pattern?

The good thing about the megaphone is it’s both a reversal and a continuation pattern. So, you can trade it however you want.

Min Deposit of 20$ |

Responses