19 Chart Patterns PDF Guide

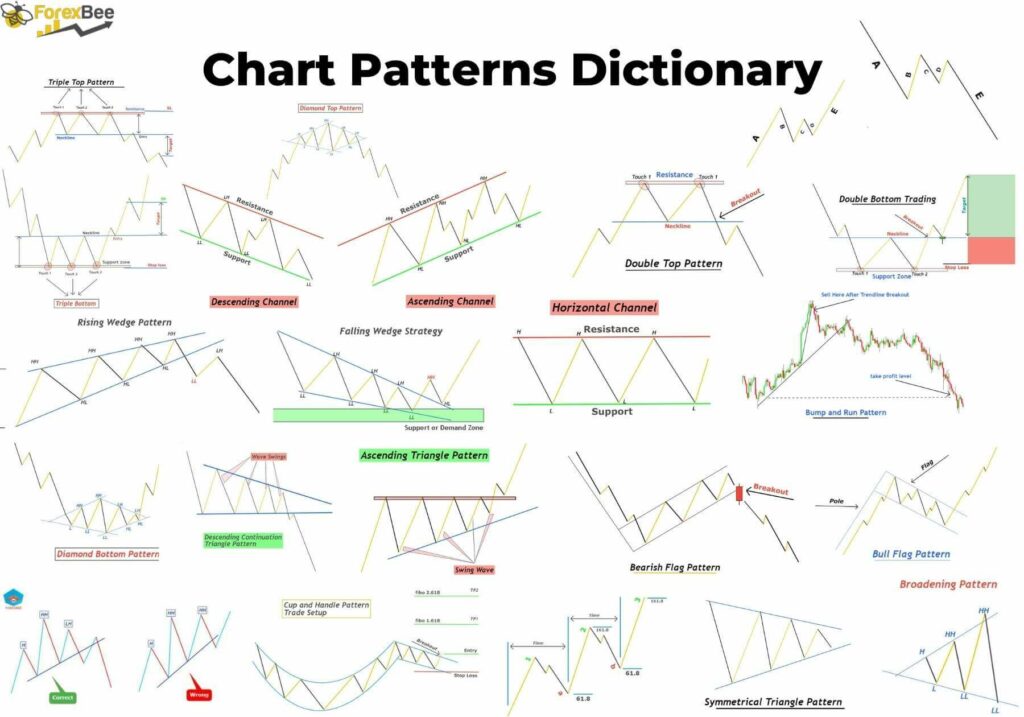

In this article, we have discussed 24 different chart patterns. To forecast price, retail traders often use chart patterns.

This article will give you a brief description of each chart pattern. The learn more button will allow you to explore the chart patterns in conjunction with your trading strategy. For backtesting purposes, you can find the PDF link to chart patterns at the bottom of this article.

Chart patterns are crucial tools in technical analysis, helping traders identify potential price movements and make informed trading decisions. These patterns emerge from the price movements on a chart, reflecting the collective behavior of market participants. Here’s an overview of some common chart patterns:

What do chart patterns look like?

Chart patterns refer to natural price patterns which resemble natural shapes like wedge patterns and triangle patterns. This is due to natural phenomena. These patterns are repeated over and again. These patterns are used by traders to predict the future of markets.

Chart patterns can be described as price swings or waveforms in the candlestick chart. These include head and shoulders, double top and triple top patterns.

Chart patterns of different types

The trend direction is the primary factor that distinguishes chart patterns.

- Bullish chart patterns

- Bearish chart patterns

Based on market structure and shape, these two patterns can be divided into many chart types.

Here’s a list of the top 19 chart patterns

Technical analysis can use many chart patterns, however I’ll only be focusing on the 24 most common. These patterns are highly likely to win.

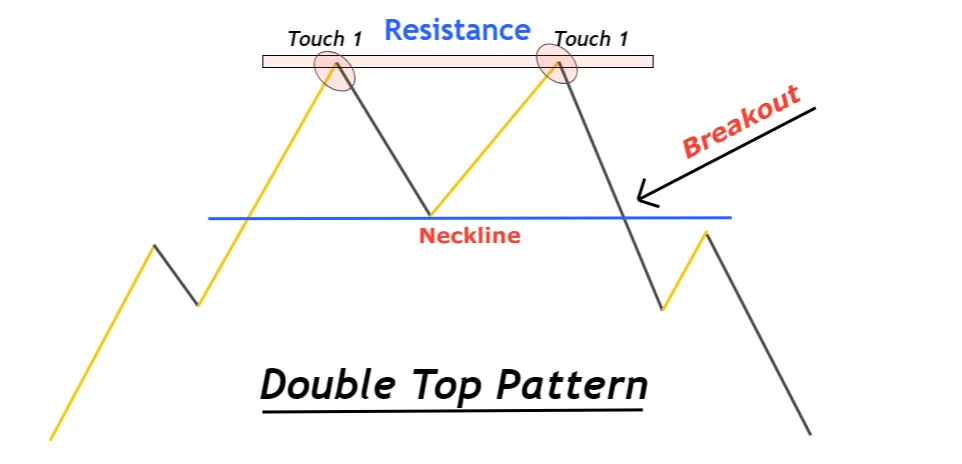

Double-top

A double top, which is a chart pattern that indicates a bearish trend reversal at resistance levels, shows two price tops. A bearish trend reversal occurs after the breakout of the neckline.

You draw the neckline by using the lowest swing low of two tops. It should form after the completion of bullish trends.

This chart pattern shifts the trend to bearish from bullish.

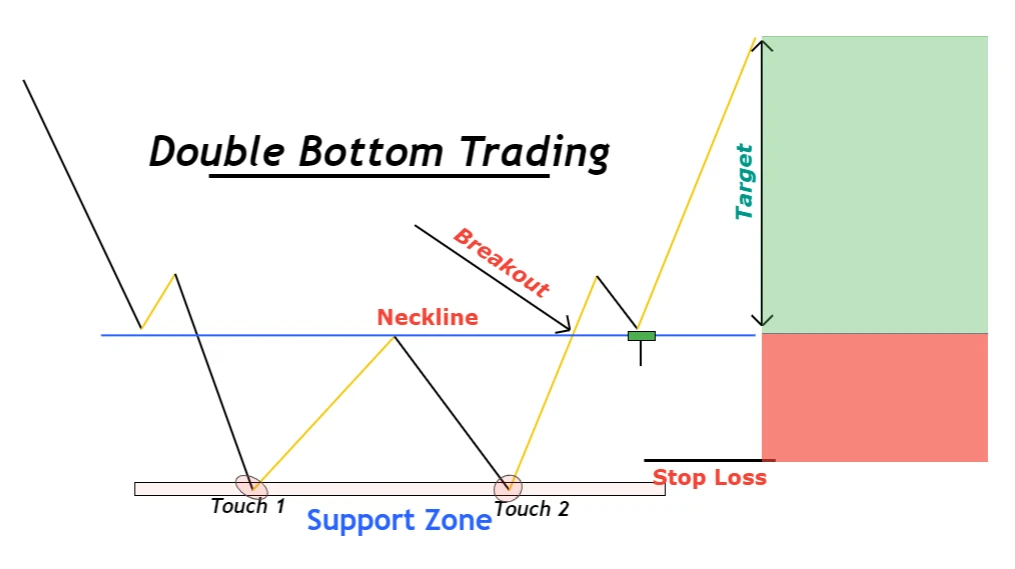

Double bottom

Double bottom refers to a bullish trend reversal chart pattern. It indicates that there have been two consecutive lows within the support zone. A bullish trend reverse occurs after the breakout of the neckline.

The neckline is drawn at two prices bottoms after the price swing that occurred. It must be bearish and form after the previous bearish trend.

The chart pattern can change the trend in price direction from bearish towards bullish.

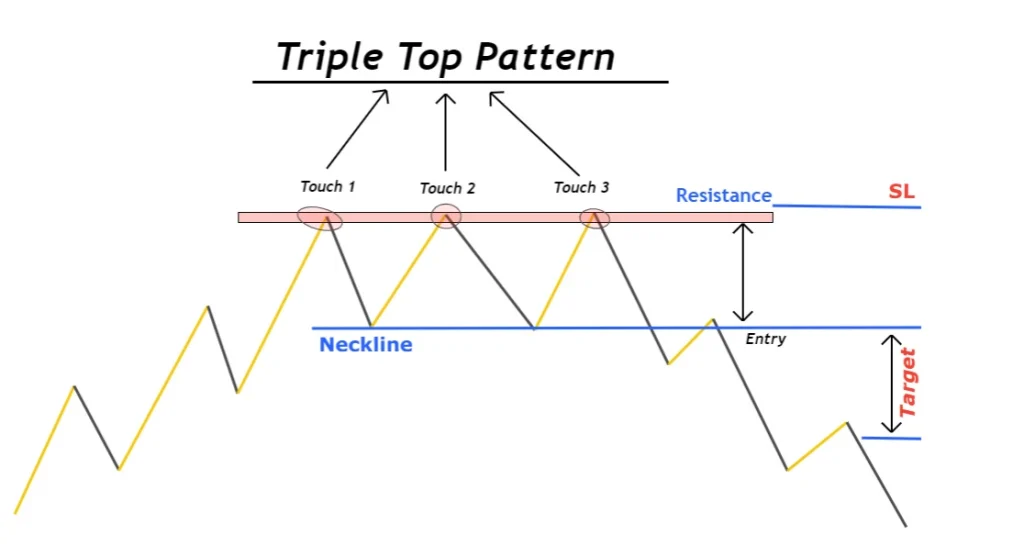

Triple Top

Tripe top, a bullish reversal chart pattern that sees price form three tops consecutively at the same resistance level is called a bearish tripe top. This chart pattern is widely used by traders in technical analysis.

Connecting the pattern’s two swing lows, the neckline will form. The triple top pattern is confirmed by the trend line breakout.

This chart pattern transforms the bullish trend into a bearish price tendency.

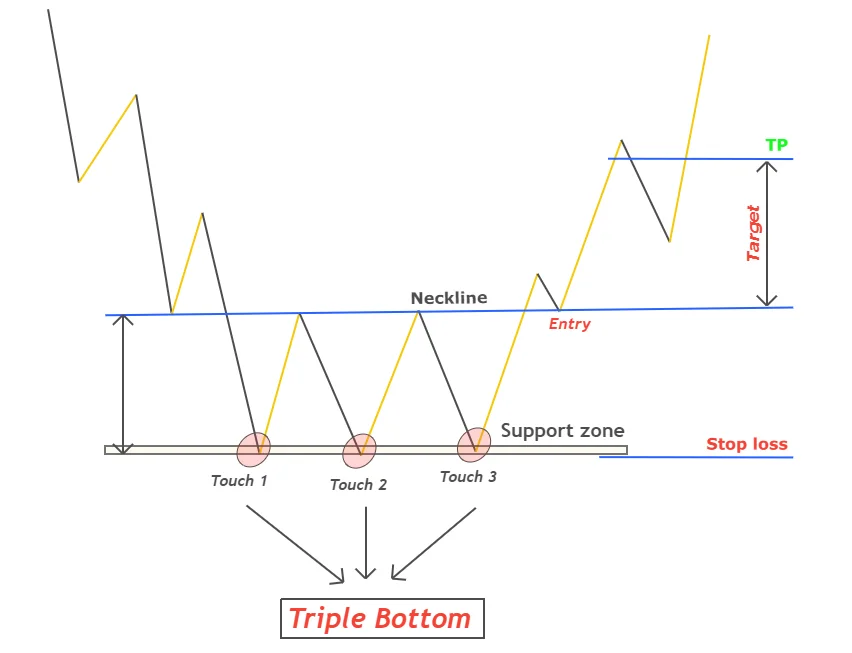

Triple bottom

A bullish reversal chart pattern, the triple bottom sees price form three bottoms consecutively at the same support level.

You must first be able to understand price swings, impulsive waves and how they affect trading triple bottom patterns.

After linking the three swing highs and a trend line, the neckline appears in the Triple Bottom pattern. This trendline has been confirmed to be bullish by its breakout.

Pattern for the head and shoulders

The head & shoulder is a reversal chart pattern that consists of three price swings. The head is the highest priced swing, while the two waves to the right and left of it are the shoulders. That’s why it is named as head and shoulder pattern.

The market will reverse a bearish trend after the formation of this chart pattern.

Inverse head and shoulder patterns are opposites to these and they represent a bullish trend reversal.

During this trend, a neckline is also formed. This pattern is confirmed by the rising neckline.

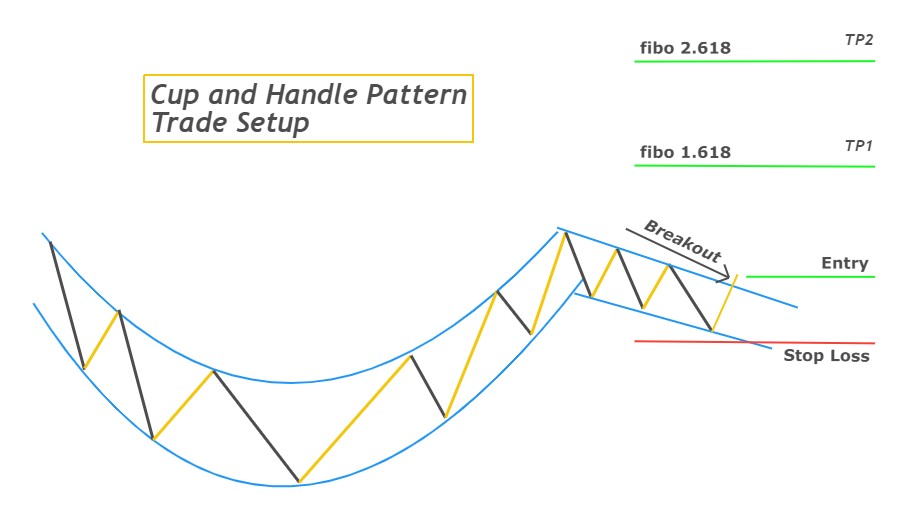

Cup-and-handle chart pattern

The cup & handle is a continuation chart pattern in which price forms a round bottom with a handle shape at the end of the pattern.

The chart pattern may also be used to reverse a trend. It is dependent on whether it occurs during a bullish or bearish trend.

An indication of a bearish tendency is the inverse cup-handle chart pattern.

Keep in mind, however, that there are clear differences between V-shaped waves and round bottom waves. Rarely does the price chart show a rounded bottom. That’s why you should backtest this pattern correctly.

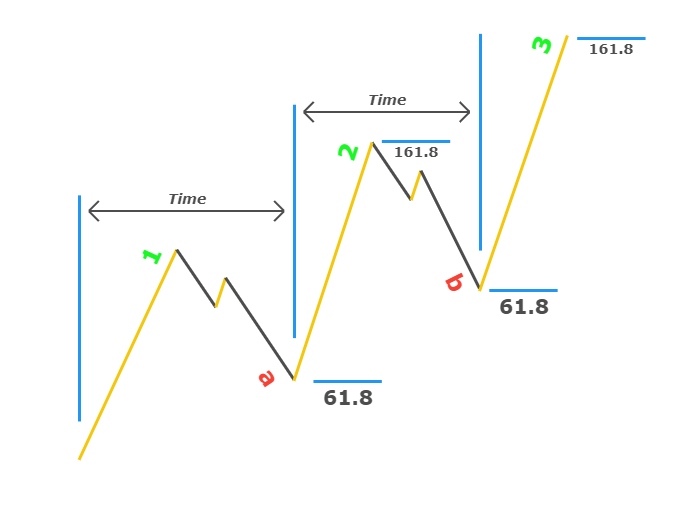

Diagram of three drives

This is the reversal chart pattern. It shows three attempts by big traders to reach a key level or break it. A trend reversal occurs in the market after that.

It is divided into two categories based on the trend direction

- Bullish Three Drive

- Be patient with three drives

A 3-drive chart pattern is composed of three impulse waves and two trace waves. It is important in trading because the number 3 also serves as a Fibonacci number. That’s why the three-drive pattern is also a natural phenomenon.

Pennant chart pattern

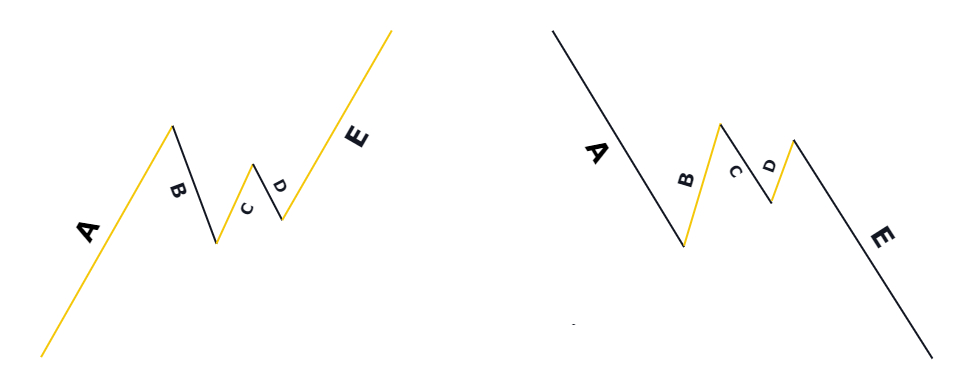

A continuation chart pattern that uses five ABCDE waves, Pennant can be described as a pennant. This chart shows that the trend continues after a brief pause.

The chart pattern is composed of three retracement wave and two impulse waves. The market consolidated inwards during the retracement waves, which indicates market indecision. The trend will continue after indecision when the trend breaks.

Pennant patterns are formed when there is small inward consolidation combined with an impulsive trend.

Further, the pennant pattern can also be divided into two kinds

- Bullish pennant pattern

- Bearish pennant pattern

Pattern for a wedge chart

A trend reversal chart pattern called the wedge is one in which price structures resemble a wedge. The outer portion of a wedge is wider than the inner. This natural pattern also depicts price’s natural behavior.

It is composed of two trend lines (upper, and lower) as well as more than 3 waves. As the wave size decreases with time, the trend reversal in the market occurs following the breakout of the trend line.

Two types of wedge pattern are classified based on their price structure, higher high-low formation or lower low.

- Falling wedge design

- The Rising Wedge design

The market is experiencing a bearish trend reverse, while the rising wedge indicates that it’s about to turn.

Learn in detail

Diagram of a diamond chart

The diamond pattern, which is both a continuation and reversal chart pattern, in which the price creates a diamond structure on the chart. The diamond pattern can be made from two different market patterns, inward consolidation (broadening) and forward consolidation (inward consolidating).

It will determine whether the pattern is a trend reversal or continuation depending on where it is located.

It is divided into two categories based on its location.

- Chart pattern of bullish diamonds

- Chart pattern of bearish diamonds

A bearish trend reversal can occur if a diamond pattern is formed at the peak of the trend. A bullish trend reversal can occur if the pattern forms near the bottom of the bearish trends.

If it forms in between the trend and this chart, it will serve as a continuation pattern.

Learn in detail

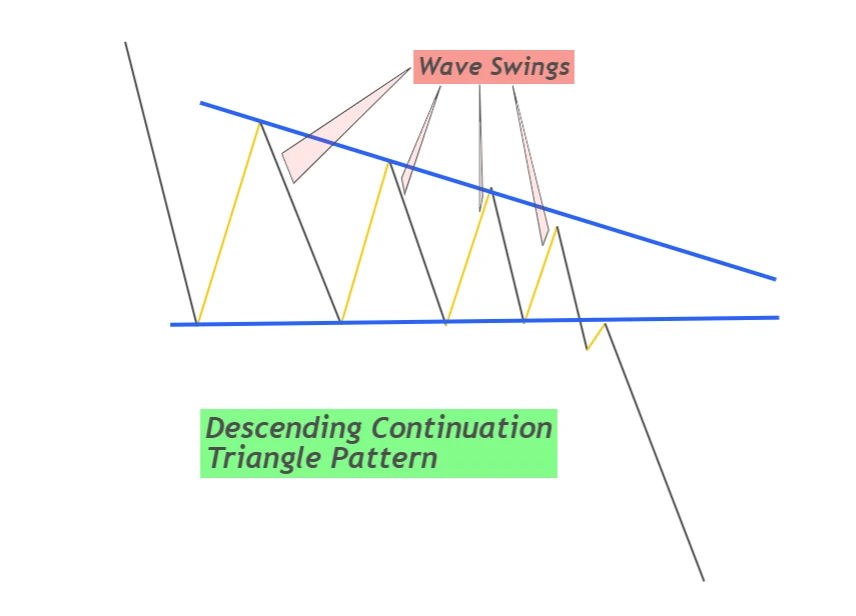

Triangle pattern with descendent triangles

A bearish continuation chart pattern, the descending triangle, is where price forms a triangle shape that looks like a triangle with a horizontal line at its base and a vertical line at its left.

For a more detailed understanding, take a look below at the illustration.

This pattern is characterized by price swings. Each wave will have a smaller progressive swing than the one before it. The bottom of all swing wave’s is also a support zone.

When the support zone is broken, a bearish trend continues on the chart.

Although it can be used in a reversal pattern chart, its primary purpose is to continue the trend.

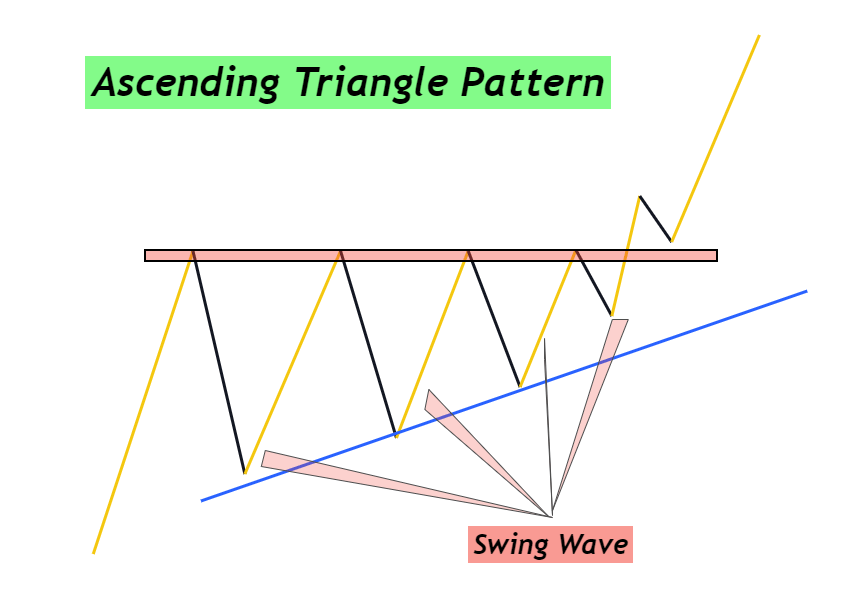

Triangular ascending pattern

A bullish continuation chart pattern called the ascending triangle. It is where the price forms an ascending triangle with a horizontal base at its top.

Remember that in ascending triangle patterns, the support or base zone is at the bottom, while the resistance zone/base zone is at the top.

This pattern is the reverse of the ascending triangle. The bullish trend will continue after the resistance breakout. Swing waves are formed. This pattern is easy to spot and you have a high chance of winning.

Tip: GBPJPY pairs make an ascending triangle shape on their price charts for different time periods.

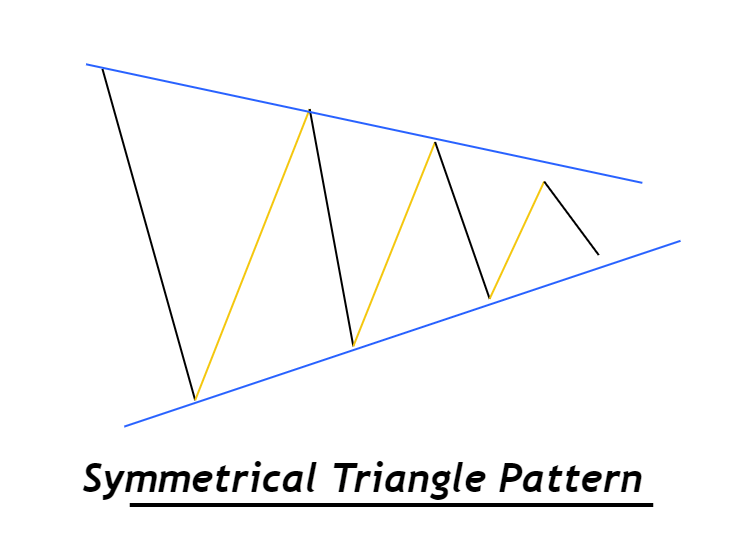

Symmetrical triangle pattern chart

Because of the equal chance of either a bullish, or bearish trend, the symmetrical triangle patterns can be used as both a continuation and reversal chart.

This is a sign that the market makers make decisions. This means that the price can move inwards or sideways. Every wave that is inward consolidated will be smaller than previous waves.

What is the best way to identify the trend direction with a symmetrical triangle? The breakout method.

We draw trendlines when this pattern develops. They correspond with lower highs, and higher lows. This is a sign that sellers or buyers are in control of the market.

The market will be seized by buyers if it breaks the upper trendline.

The market will be dominated if the lower trendline breaks.

Flag chart pattern

Flag patterns are a continuation trend chart pattern that consists of both an impulsive and a trace wave.

The most commonly used flag chart pattern and the most advanced. The chart pattern’s psychology is so deep that it can be used in many different ways to predict forex market direction.

Two types of flag patterns are classified based upon wave structure.

- Bullish flag pattern

- Bearish flag pattern

The bullish flag’s flag pattern is made up of an impulsive bullish wave combined with a bearish-retracement wave. Retracement is similar to the shape on a pole. The shape of an impulsive wave looks like a pole. It is a sign that bullish trends will continue.

Combine a bearish impulsive wave with a bullish wave of retracement to create a flag pattern that is bearish in nature.

This occurs most often in assets, currencies or commodities.

Learn in detail

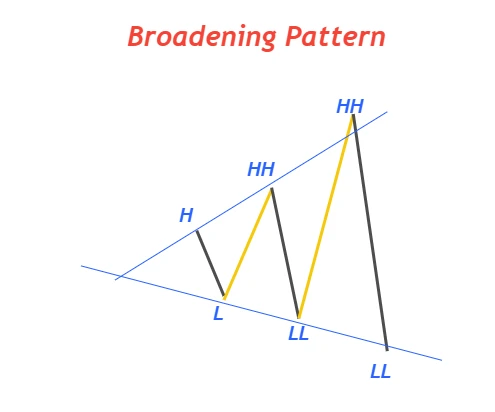

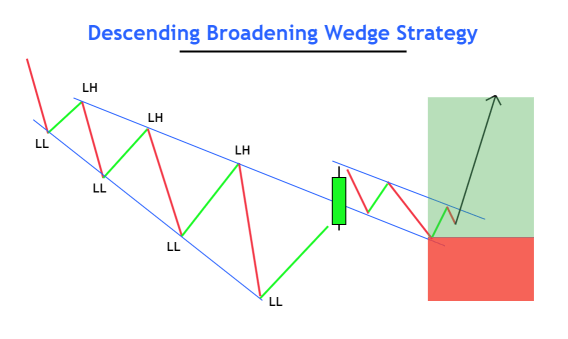

Broadening Pattern / Megaphone pattern

A broadening chart pattern refers to a chart structure in which each wave is greater than the one before it, creating an almost megaphone-like structure at the price chart.

It also symbolizes indecision on the market and a sign of major trend reversal.

Megaphone charts patterns can be classified based upon their structure and geographical location.

- Megaphone design

- Ascending broadening pattern

- Descending broadening pattern

The ascending broadening patterns result in lower lows and higher highs while the descending pattern results in higher highs/lows.

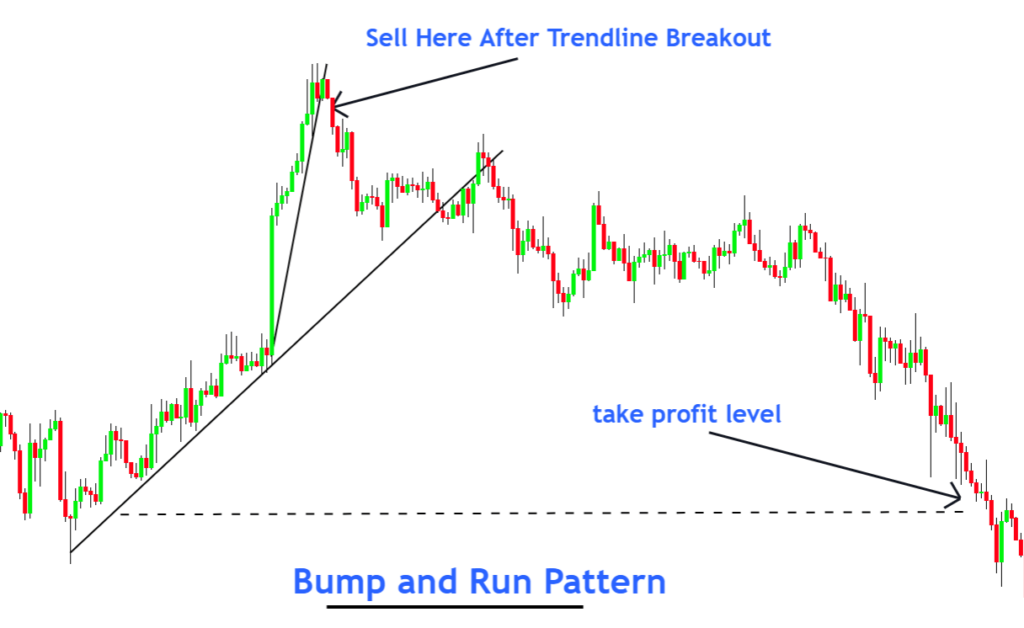

Bump-and-Run chart

A chart pattern called the Bump and Run is made up of two phases: the Run and the Bump.

The Bump phase sees the price move up or down with ultra-force, which is a breaking of major key levels. Following the Bump phase ends, the run phase begins.

Market makers also use this strategy to trick retail traders.

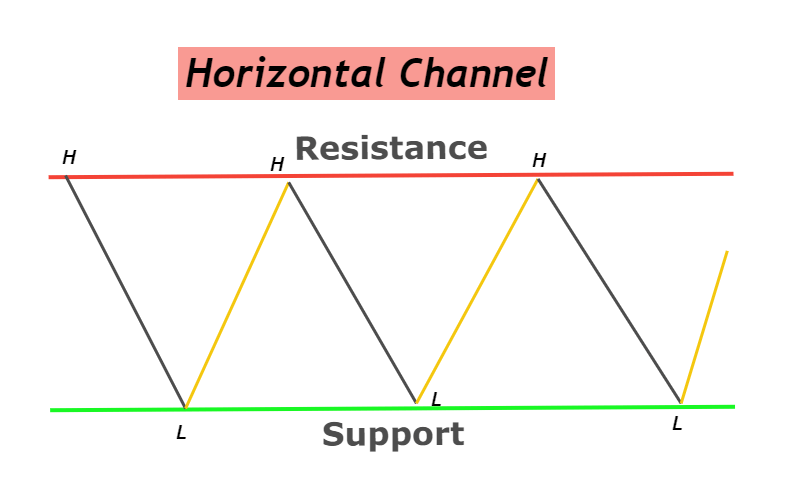

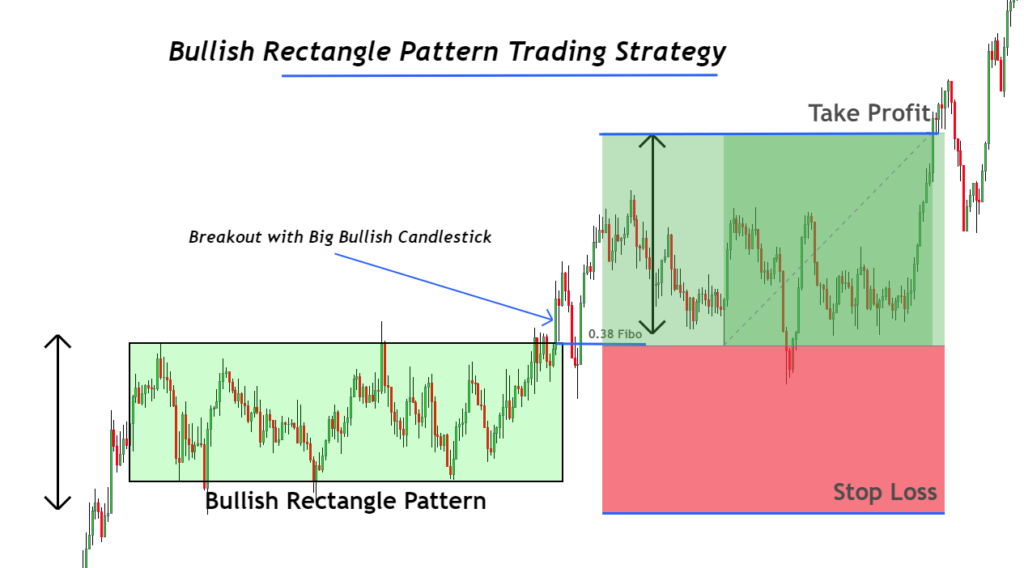

Horizontal trends channels

Trend channels indicate price channel sideways movements in between a resistance area and a support region.

The price trend shows that buyers and sellers are equally powerful. The price trend is therefore skewed in the opposite direction. A breakout of trend channels indicates the direction the price trend will take. When the support zone fails, it is a sign of a bearish or bullish trend. If the resistance zone falls, it’s a sign that he has formed a bullish pattern.

Horizontal trend channels are price movements that take the form swings, making highs/lows. This market is also known as the ranging one.

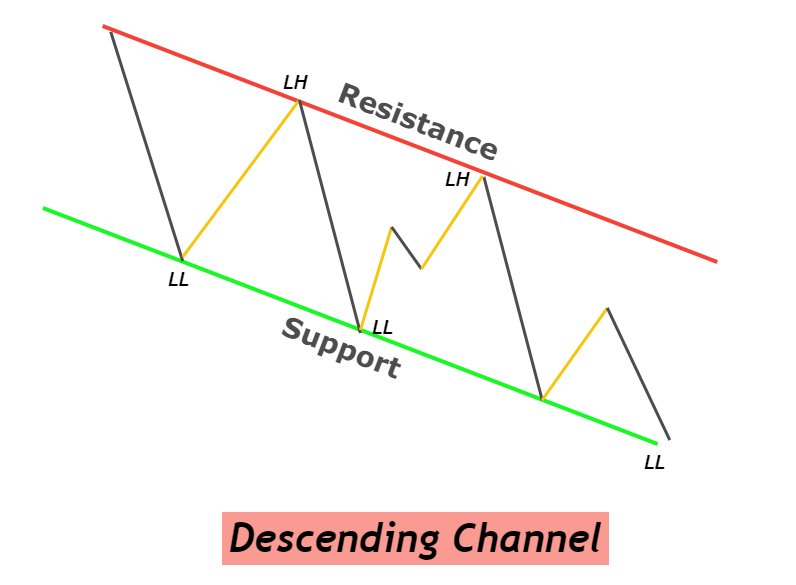

Descending channel pattern

The bullish trend reverser Descending Channel is when price moves inside a descending channels. After a break of an upper trendline breakout, the bullish trend begins.

This channel pattern has lower lows than higher highs. The lower price swings have lower highs than the upper trendline, while the lower price wave has lower lows.

This is a chart pattern that shows a bullish trend reverse.

Because the trendlines of the descending channel’s descending channel are parallel, it is best to not confuse the descending wedge with the descending channel.

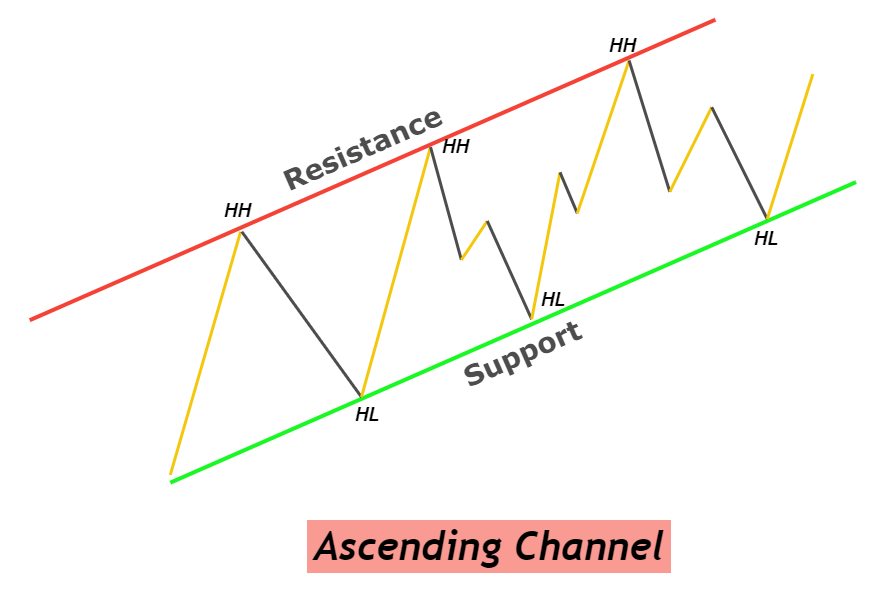

Ascending channel pattern

An ascending channel, a bearish pattern that reverses trend in the direction of a trendline is an ascending channel. It’s characterized by higher price highs than lower lows.

The higher trendline is the upper, while the lower one meets the lower lows. The upper trendline is a resistance line and the lower one acts as support.

When a low trendline is broken by a bearish candlestick, it’s called a bearish trend. This is a pattern that transforms the bullish price tendency into a bearish one.

Print the PDF

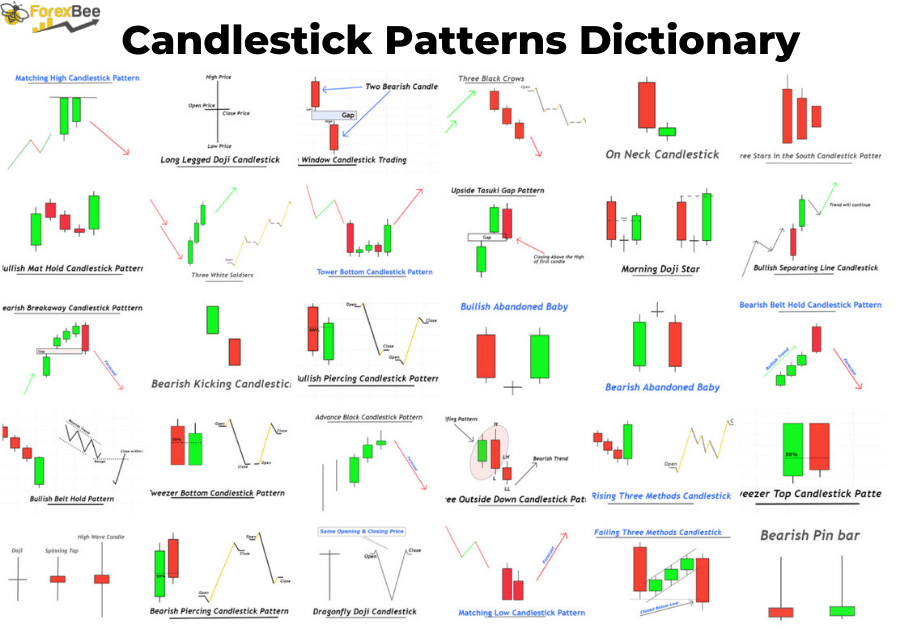

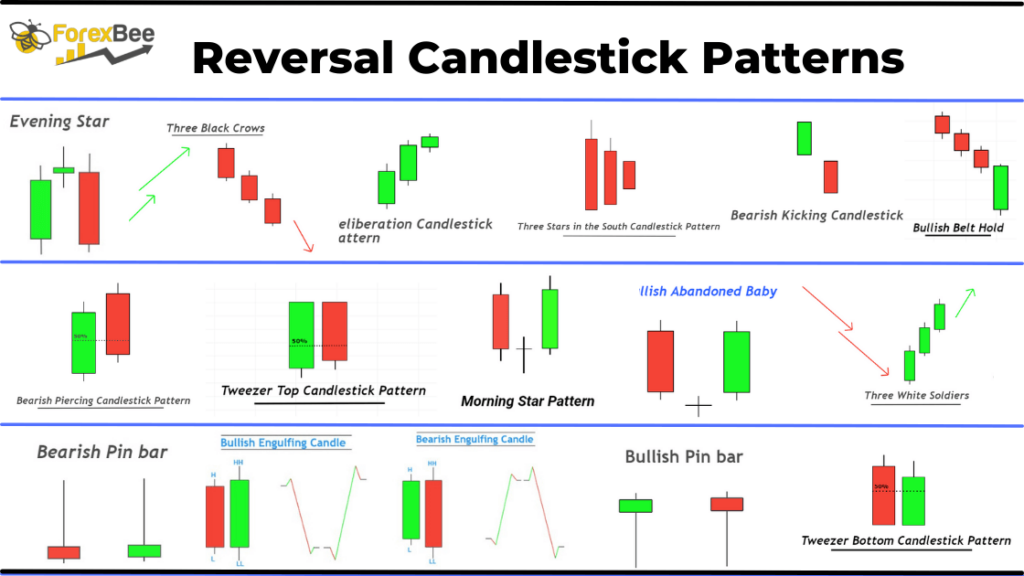

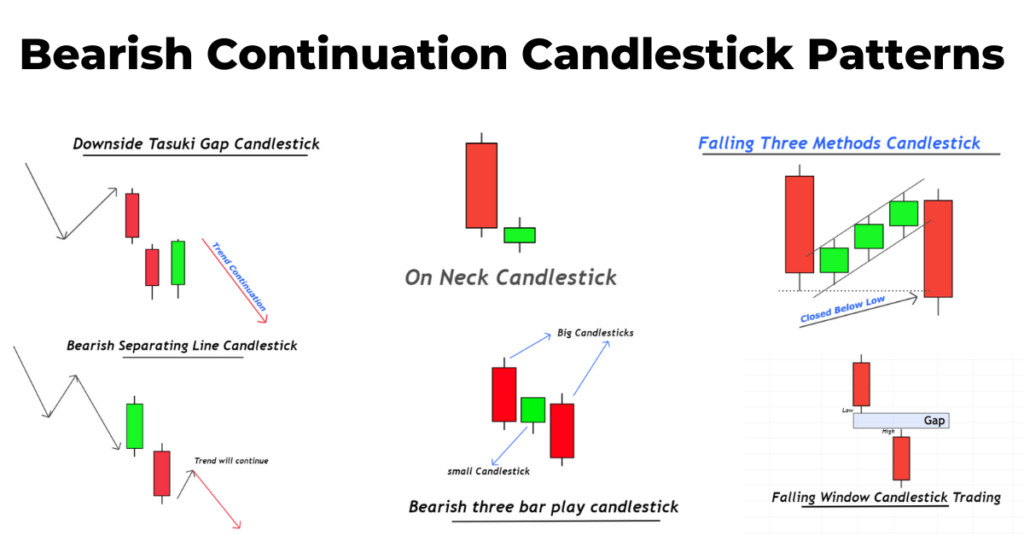

For backtesting purposes, please click the button below to access the PDF file of the candlestick pattern images.

Conclusion

Chart patterns are used extensively by retailers traders to forecast market conditions. Chart patterns refer to patterns that are repeated with time in the charts of currencies.

When trading, I recommend chart patterns. These patterns can be combined with other technical tools such as candlestick patterns, to improve your trading success.

Responses