Reversal Candlestick Patterns PDF Guide

Trend reversal candlesstick patterns are candlestick patterns which change the trend’s direction from bullish to bullish, or vice versa. Technical analysis

Numerous patterns have been shown to predict a trend reversal. Every pattern is unique. You can use some for forex trading and others in stocks or in indices trading. Some patterns are also universal candlestick patterns.

Steve Nison introduced the major candlestick patterns in his book “Japanese Candlestick Charting Techniques”. Many more candlestick designs were later introduced.

Check out these trend-reversing candlestick designs

This cheat sheet contains 12 reversal patterns for candlesticks. These are useful in technical analysis and are used to forecast a trend reversal.

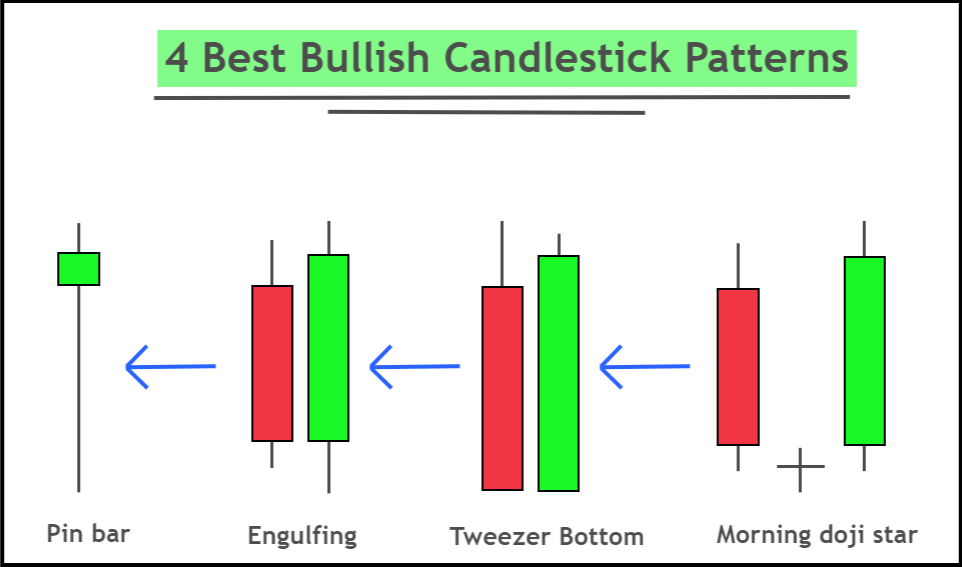

- Engulfing candlestick

- Candlestick for pin bar

- Candlestick piercing

- Tweezer top & Tweezer bottom candlestick

- Morning & Evening Doji Star candlestick

- Bullish & Bearish Abandoned Baby candlestick

- Candlestick for three white soldiers

- Three candlesticks with black crows

- Three stars for the south candlestick

- Deliberation candlestick

- Candlestick kickoff

- Bullish & Bearish belt hold a candlestick

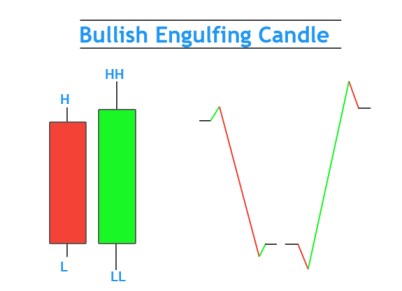

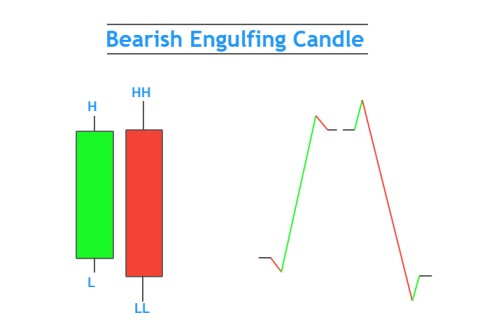

Candlestick pattern for Engulfing

The candlestick is made up of two candlesticks with opposite colours. When the second candlestick completely covers the first, it will be called a “double” candlestick. The formation of a higher and lower high will be technical.

Based on the nature and direction of the trend, it is divided further into two kinds.

- Bullish engulfing candlestick

- Candlestick bearishly engulfing

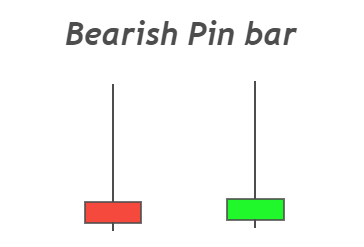

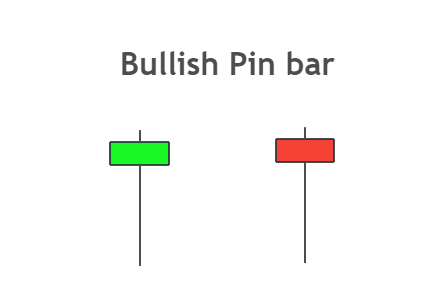

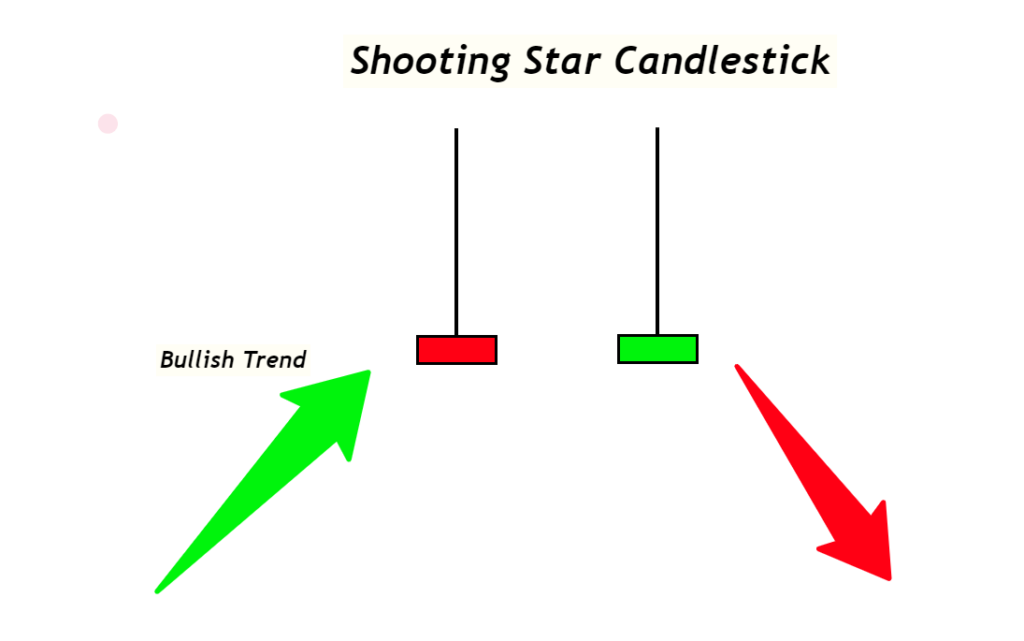

Pin bar candlesticks

This is a simple candlestick pattern that has a tail at the top or bottom and a smaller body. You can also categorize it into bearish or bullish pin bars.

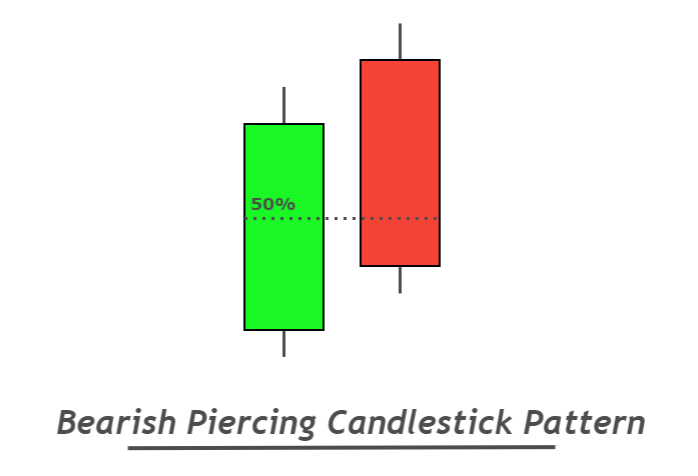

Pattern for Piercing Candlestick

Two candlesticks of opposite colours are used to create the piercing pattern. The second candlestick must be 50% Fibonacci higher than the original candlestick.

The pattern can be further classified into bearish and bullish candlestick patterns.

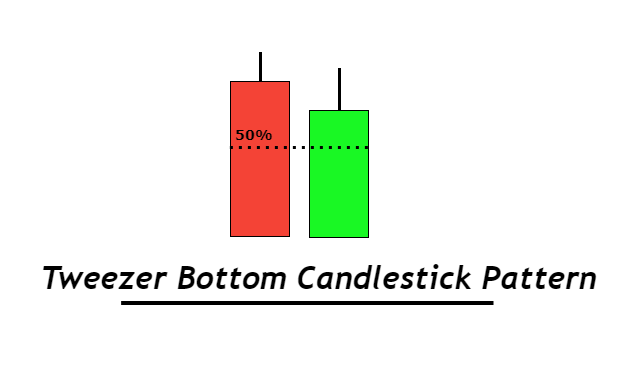

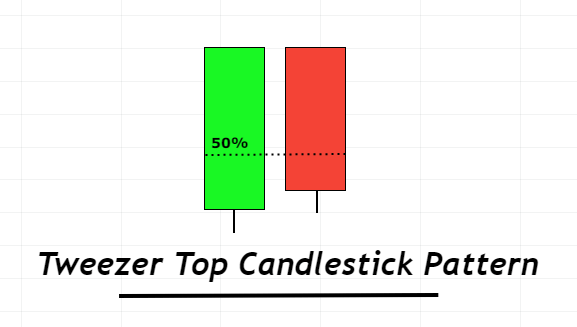

Tweezer top & Tweezer bottom candlestick pattern

Two opposite patterns of candlesticks are Tweezer bottom and top. Tweezer bottom will have both bearish and bullish candlesticks without wick/shadows. Both candlesticks close at the same time.

Both candlesticks in tweezertop will have no shadows on their upper sides, but they will appear at the top. The first and second candlesticks will have the same closing prices.

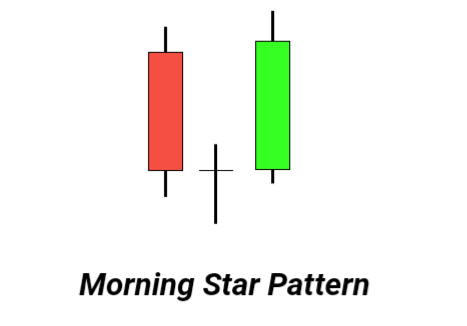

Morning & Evening Doji Star pattern

Morning doji stars are a bullish trend reverser candlestick pattern that consists of two candlesticks opposite and one Doji star between. See the structure of morning doji stars in the picture below.

The evening Doji Star is a candlestick pattern that resists bearishness and features two candlessticks with opposite ends, as well as a Doji star at one end.

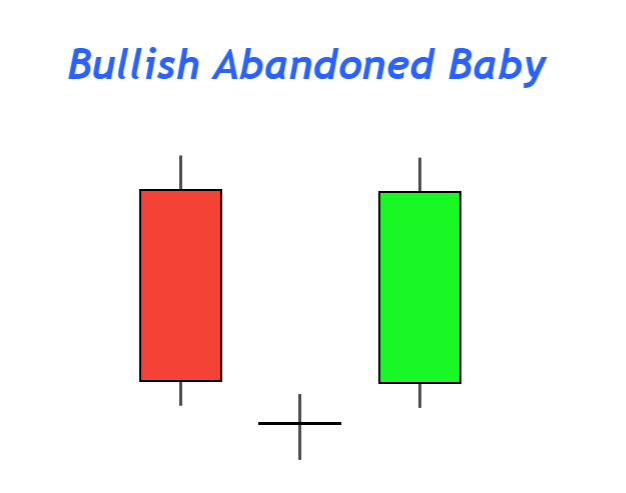

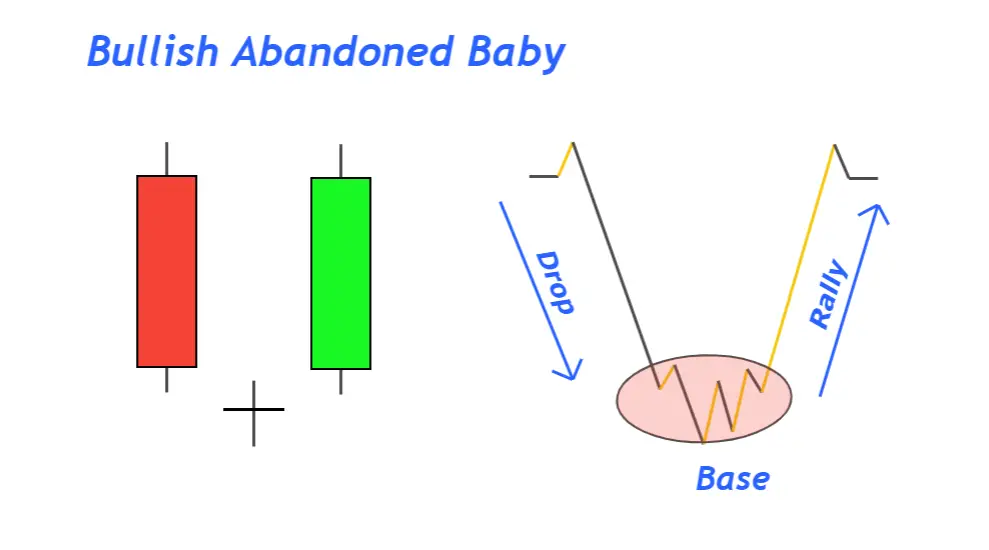

Pattern for a baby candlestick that has been abandoned

Similar to the morning/evening Doji Star candlestick, an abandoned baby candlestick can also be used. There is a difference: the Doji candle forms in an abandoned baby pattern, with either a gap up (or a gap below).

This candlestick is classified as both a bearish and bullish abandon baby candlestick.

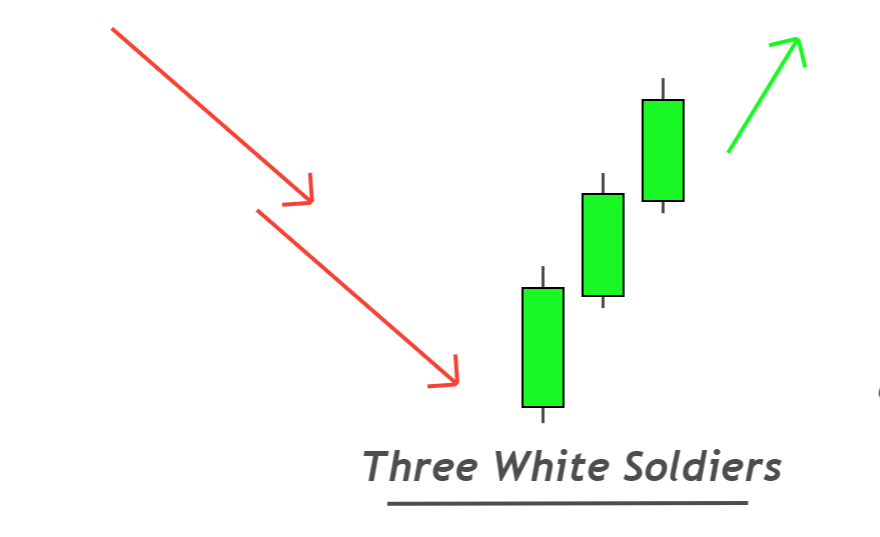

Pattern of three candlesticks for white soldiers

The candlestick consists of three bullish big candlessticks that are located at the bottom on the price chart. The bullish trend reverse pattern of three white soldiers candlessticks is called the “bullish candlestick”“. Prior trends should be bearish.

To get high-probability trend reversal signals, this pattern must form in the demand or support zone.

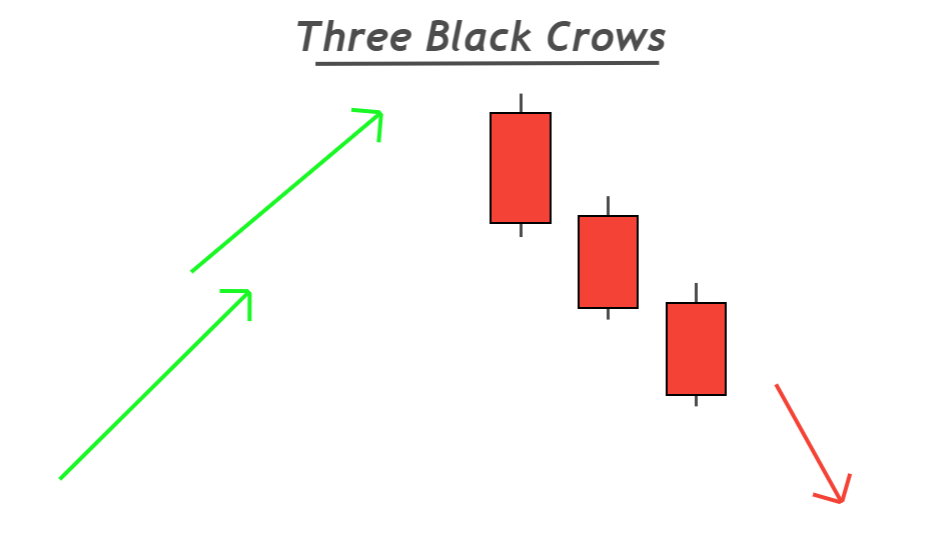

Pattern of three candlesticks with black crows

This chart consists of three huge bearish candlesticks located at the top price chart. The three candlesticks must form in one row.

A bearish trend reverse pattern is the three black crows candlestick. This candlestick’s previous trend should have been bullish.

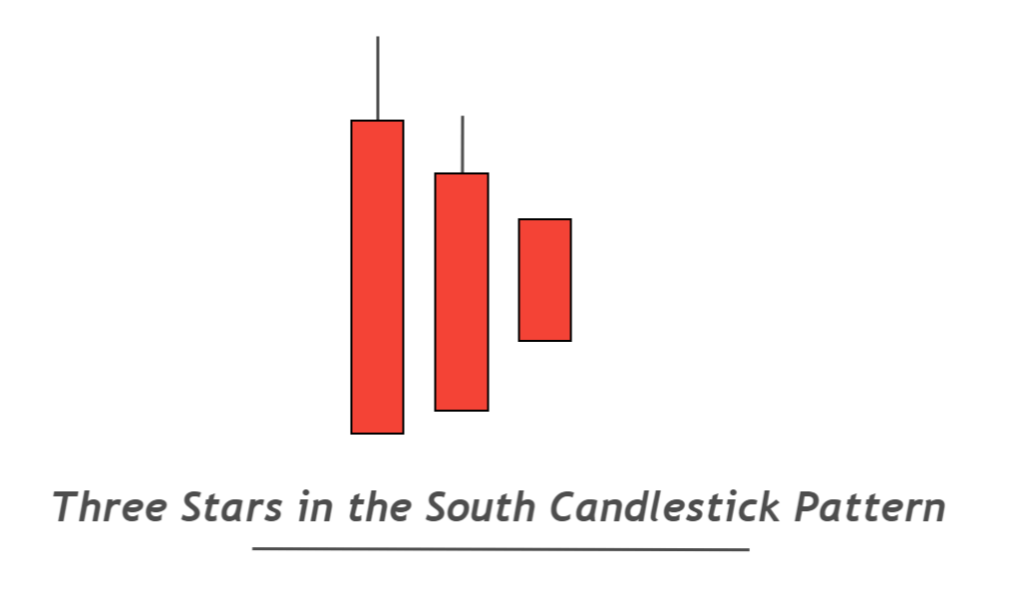

Three stars in the south candlestick design

There are three bearish candles in the star-shaped south candlestick. Each candlestick, however, will be within the size of its predecessor candlestick.

This pattern will most likely form in stocks and indices. For a deeper understanding, read the entire article

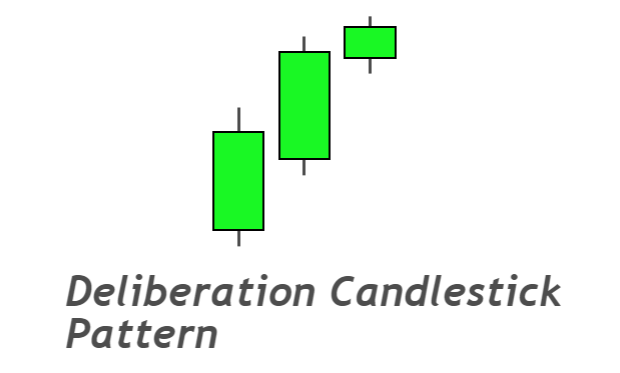

Deliberation candlestick pattern

Three bullish candlesticks make up the deliberation, which is a bearish trend reversal pattern. This pattern’s structure can be seen in the picture below.

This is used primarily for technical analysis of stock and indexes. It’s not useful in forex trading.

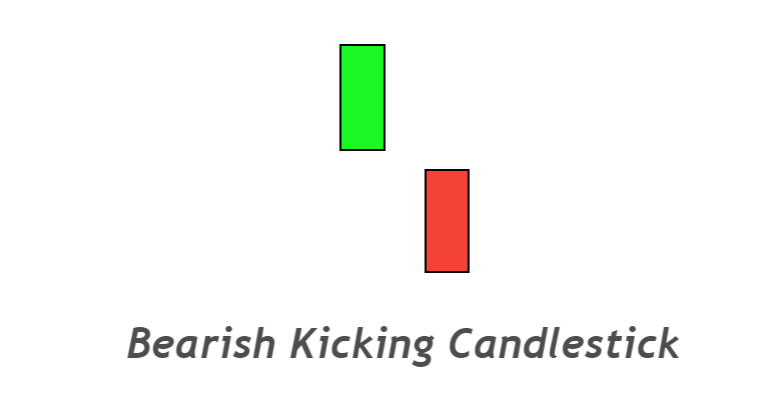

The candlestick pattern is kicked

Two marubozu candlesticks of opposite colors are used to make the kicking pattern. There is a space between them. You can also classify it as a bullish or bearish pattern.

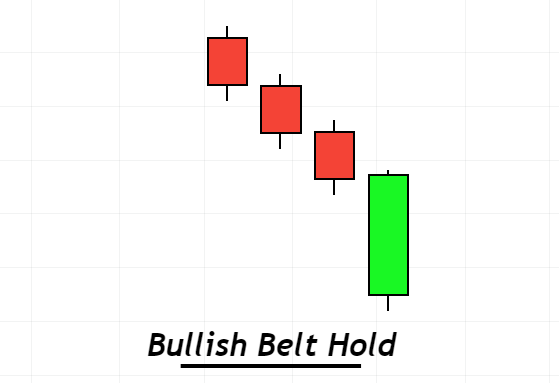

Candlestick patterns for bullish and bearish candles

A belt hold also includes two candlesticks with opposite color. After the bullish candlesstick closes, the bearish pattern will have the next candle open. The gap will be up and the closing percentage will not exceed 50%.

The bullish belt holds, when the bearish candlestick forms, will see the next bullish candle open with a gap and close at 50% above the level of its predecessor.

Conclusion

Your trading strategy should be based on trend reversal. This means you need to add trend reversal candlesstick patterns. This will enhance the performance and effectiveness of your trading strategy.

You should backtest every candlestick pattern.

Responses