Double Doji Candlestick Pattern

Double doji refers to a pattern of candlesticks in which two candlesticks with doji symbols form simultaneously. This pattern shows the market’s varying structure and signals a pause of price trends.

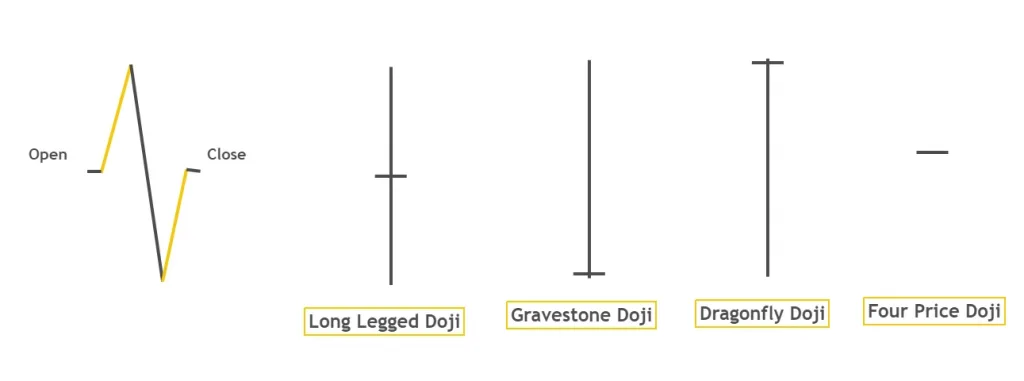

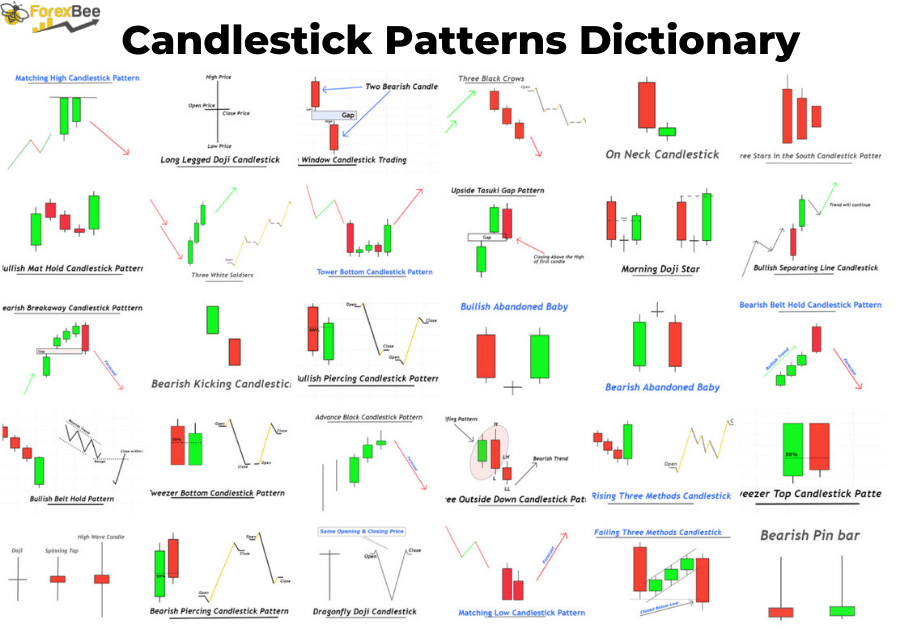

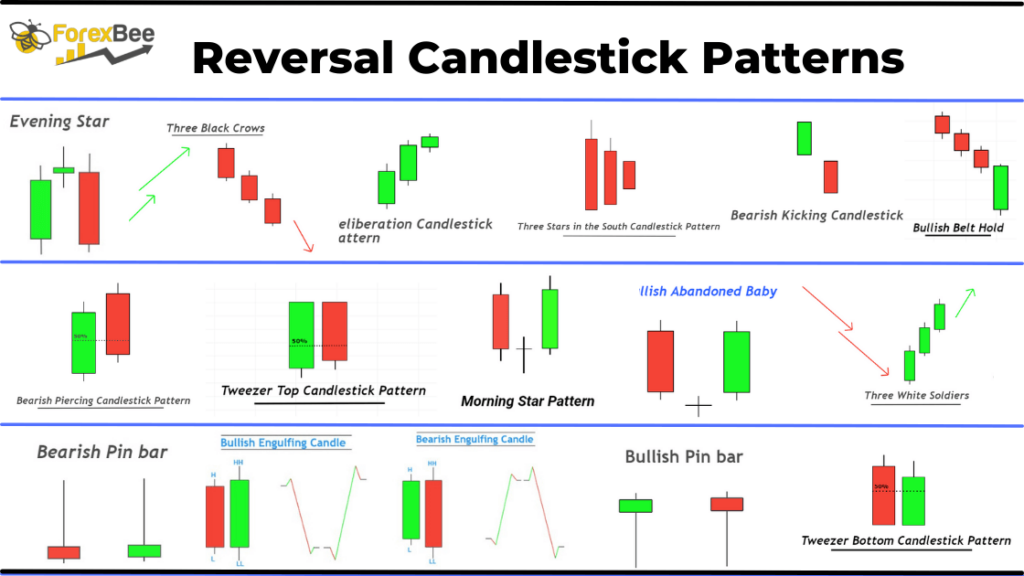

There are four kinds of doji candlessticks. Each pattern can have a unique meaning. This also depends on where the pattern is located on the chart.

You will find out about double-doji candlesticks and the different types they are. This article will also explain how to trade dual doji.

What is the best way to recognize a double-doji candlestick pattern.

There are many types of doji candlesticks

- Doji

- Doji of Dragonfly

- Gravestone doji

- The long-legged doji

Each candlestick of doji reflects a different view point for institutional traders. As with Dragonfly, gravestone doji indicates a market trend reversal. Doji Cand long-legged Doji signals a pause and change in the market’s structure.

A powerful pattern for price is Due-doji candlesticks.

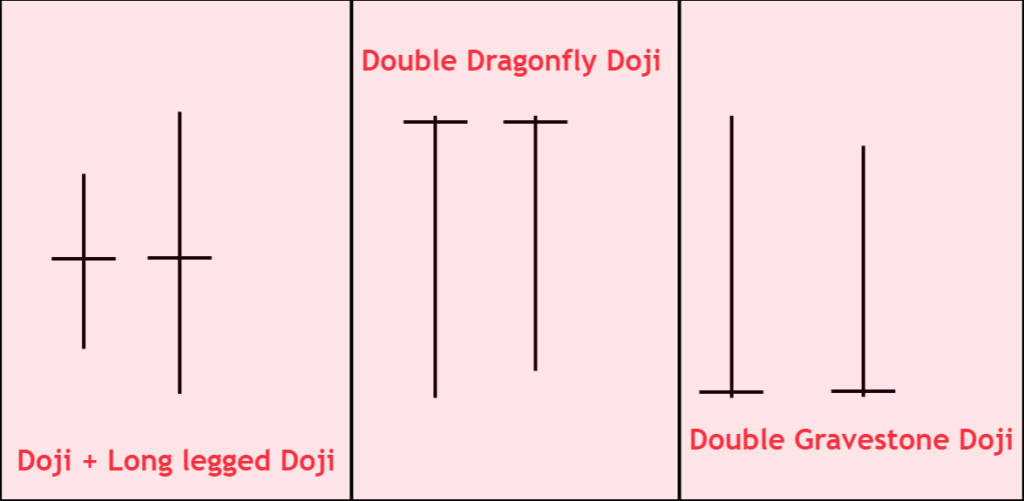

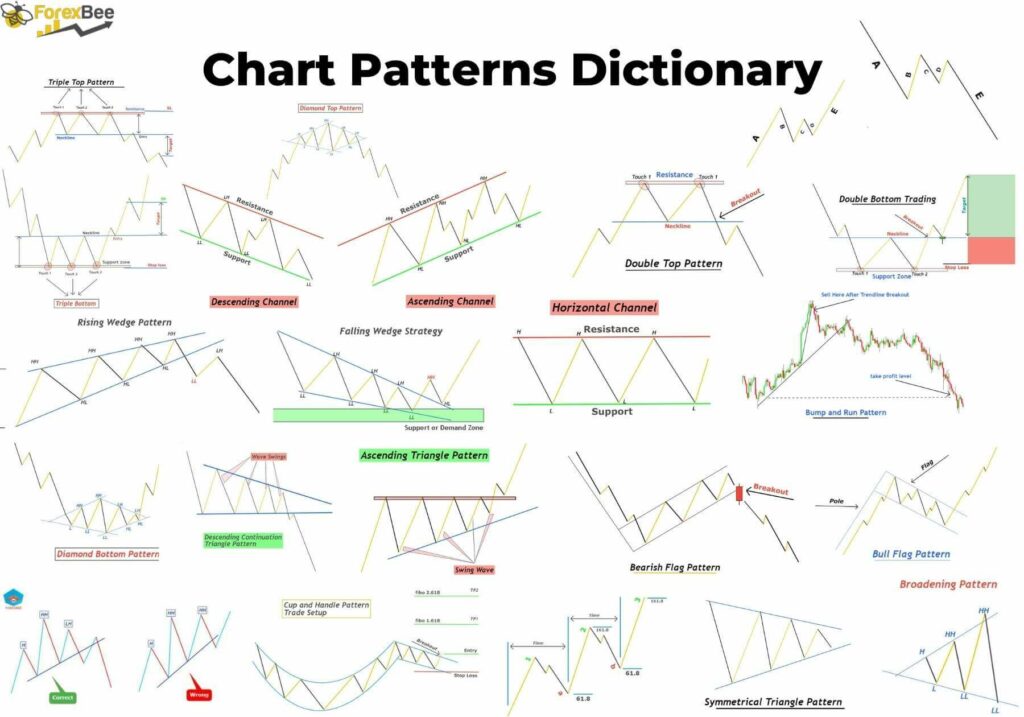

Double doji patterns

Three pairs can make a double-doji pattern. Each pair is made from two doji candlesticks.

- Pair of doji and long-legged Doji

- Two pair of dragonfly doji candlessticks

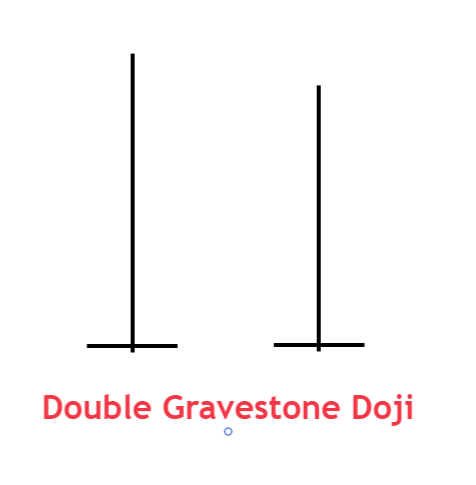

- Two Gravestone doji candlesticks pair

There are many combinations that can be made, however I’ll only show you the most powerful double-doji patterns.

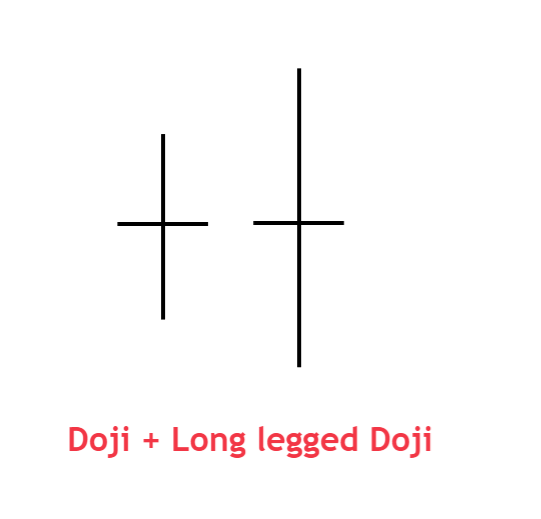

Doji and long-legged daoji

Sideways movement in price occurs when these two candlesticks appear consecutively. The broadening formation also signifies that the market is setting its direction. At this point the market will choose between a bullish and a bearish trend.

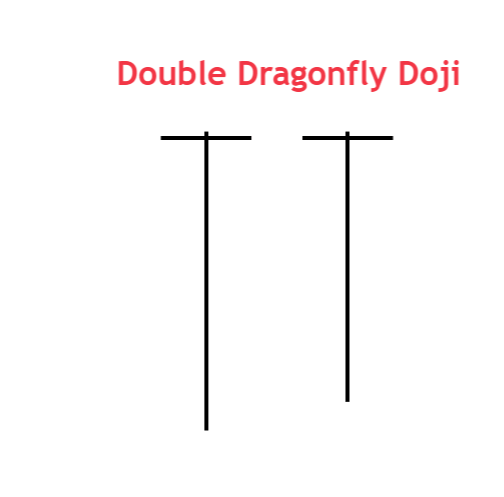

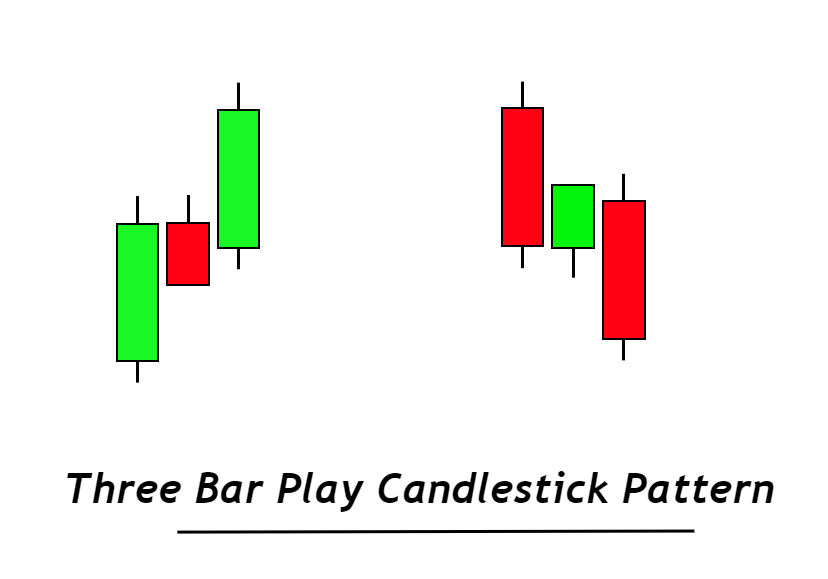

Two dragonfly doji candlesticks

The dragonfly candlestick shows a bullish trend reverse. A candlestick’s body will show a long shadow that indicates rejection at a key level. Buyers are more willing to purchase from this level than sellers if they receive rejection from the key level. That’s why they are pushing the market up in the form of a long shadow below the candlestick’s body.

The probability of trend reversal is higher if the rejection happens twice. That’s why the formation of two dragonfly doji candlesticks increases the probability of bullish trend reversal compared to a single dragonfly doji.

Two gravestone doji candlesticks

The bearish trend reversed by one gravestone doji. A long shadow at the top of the candlestick signifies price rejection below the key level.

The probability of a bearish trend reversal is increased when there are two consecutive price rejections in dragonfly-doji.

Before you use the double gravestone candlestick, it would be a good idea to first learn how to trade one gravestone vase doji candlestick.

What can the double-doji pattern reveal to traders?

One candlestick cannot explain all of the market structure in a chart. A doji candle may show a trend slowdown, but what is the duration of a trend slowdown? The answer to this question is not possible with a single Doji.

It increases your chances of winning in analysis if you have two doji candlessticks. An example of this is a gravestone and dragonfly doji, which indicate a trend reversal. The probability that the candlesticks will form in a series of two similar types increases if they are made consecutively.

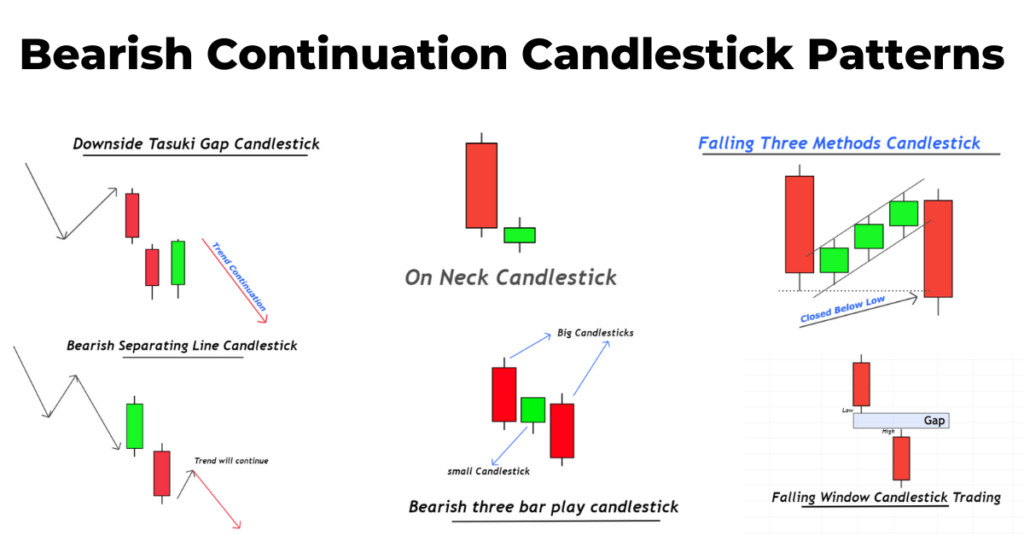

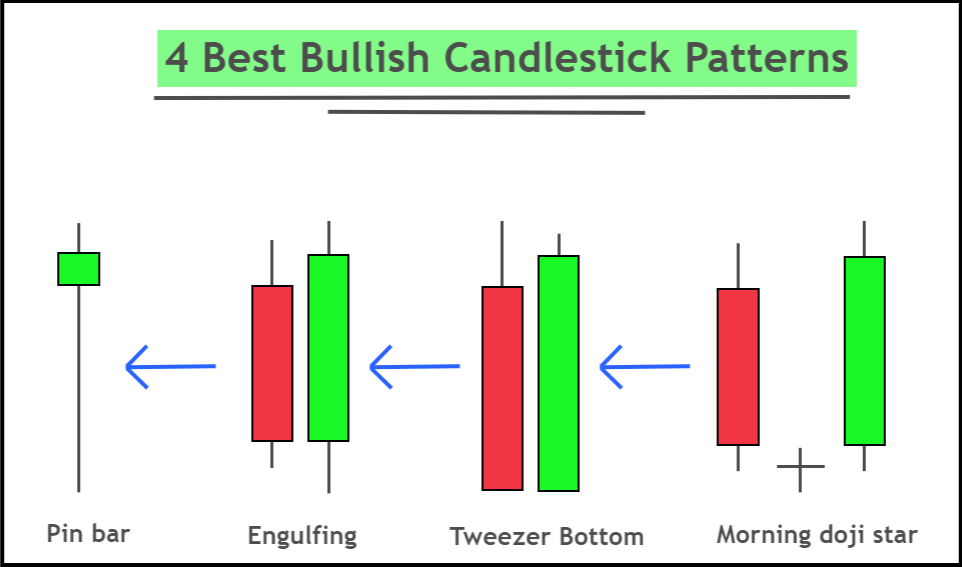

What is the best way to trade double doji pattern candlesticks?

The combination of supply-demand and support zones or levels of resistance, as well as a double doji candlestick patterns is this trading strategy.

You can place a purchase order

If a double dragonfly-doji pattern appears at the demand level or support zone, you can place a purchase order. You might set your stop loss at a level that is a little lower than the area or level.

You can open a sale order

Place a stoploss order if a double-gravestone doji pattern forms in the resistance zone or supply area. A stoploss order will be placed just a few pips higher than the zone.

Tip: The candlestick patterns cannot be used to predict take-profit levels. That’s why it is advised to target previous price swing levels or use the Fibonacci tool to get target levels.

Let’s get to the bottom

Candlestick patterns show the market’s repetitive behavior. For us to be able to trade successfully, we need to understand how these patterns work.

Responses