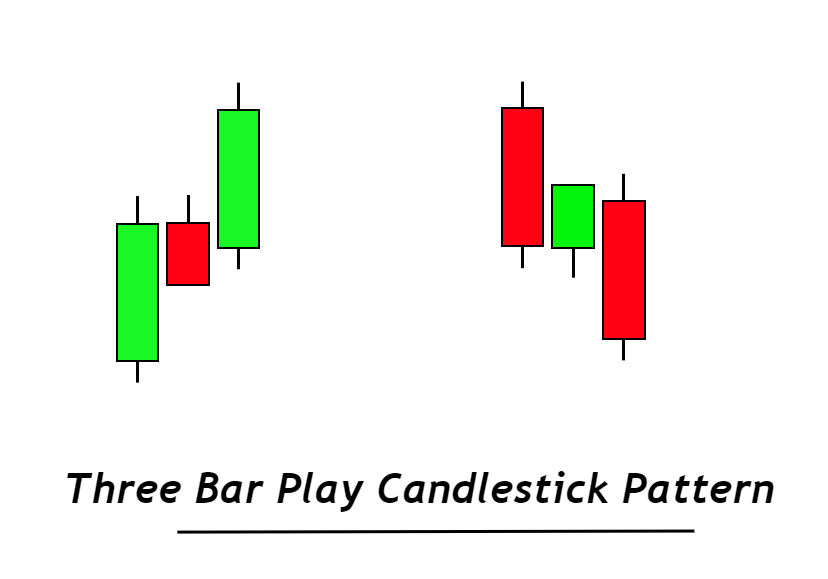

Three bar play Candlestick Pattern

Three bar play refers to a trend continuation pattern of candlesticks that is made up three candlesticks. This forecasts the continuation of the trend in the market.

To determine which direction the trend is heading, retail traders employ this 3-bar play candlestick pattern. In order to make the most of the market’s trend, traders trade against it. Trades against the market maker are not a good strategy. Trading in the trend will only lead to failure.

In this post, you’ll learn a detailed guide to three bar play candlestick patterns and a day trading strategy to trade with three bar play patterns. You can read the entire post.

How do you identify the 3 bar pattern?

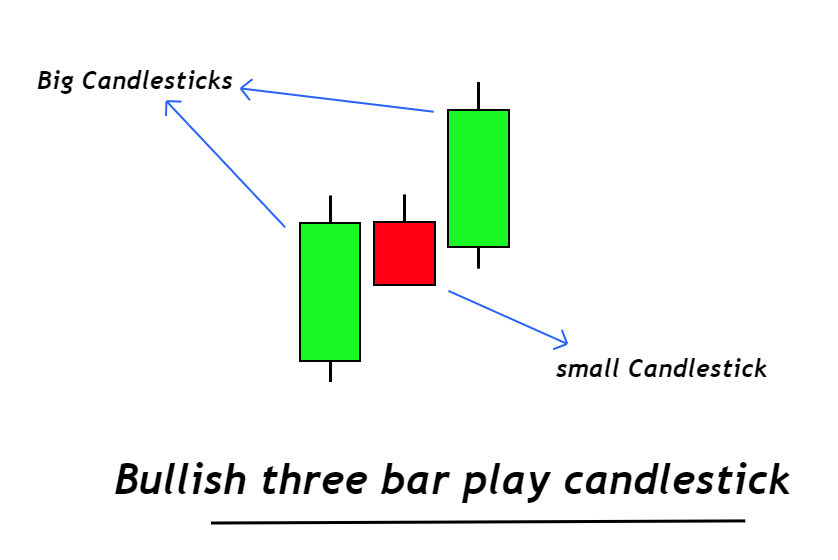

The three-bar candlestick pattern is made up of three candles. Three bar pattern consists of three candlesticks: two big, bullish candlessticks and one small candlestick. Between the two large candlesticks, a small candlestick forms a continuous pattern.

Three types of bar play

These candlestick patterns can be divided into two categories based on candlesticks and trend direction.

- Avoid the three-bar play pattern

- Three-bar bullish pattern

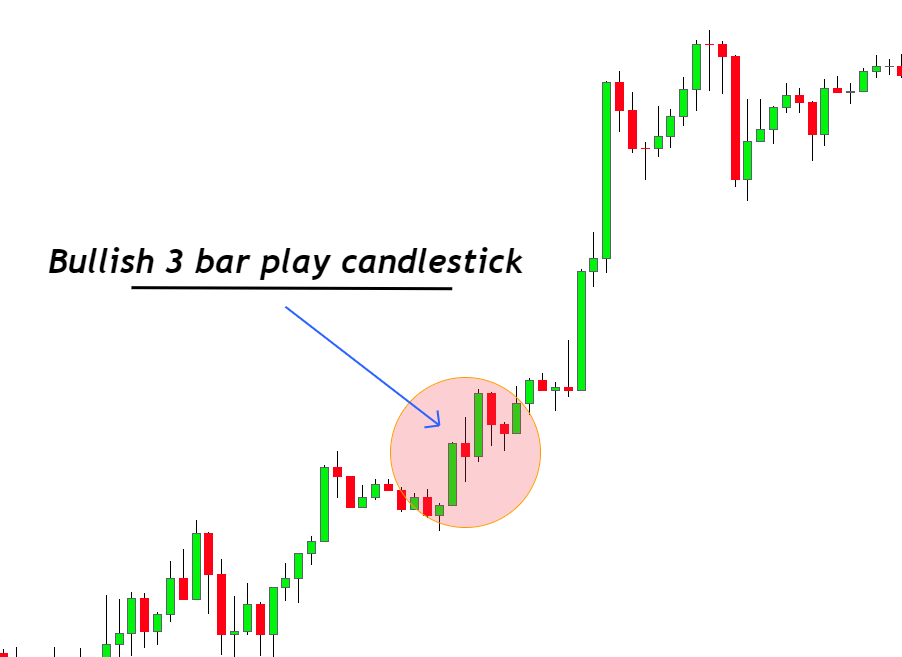

Three bars of bullishness

The bullish trend rising/bullish 3-bar play candlestick patterns forms during the bullish trend. This pattern is made up of two huge bullish candlesticks along with one small pullback candlestick. It contains the smaller pullback candlestick.

This shows the market will remain bullish.

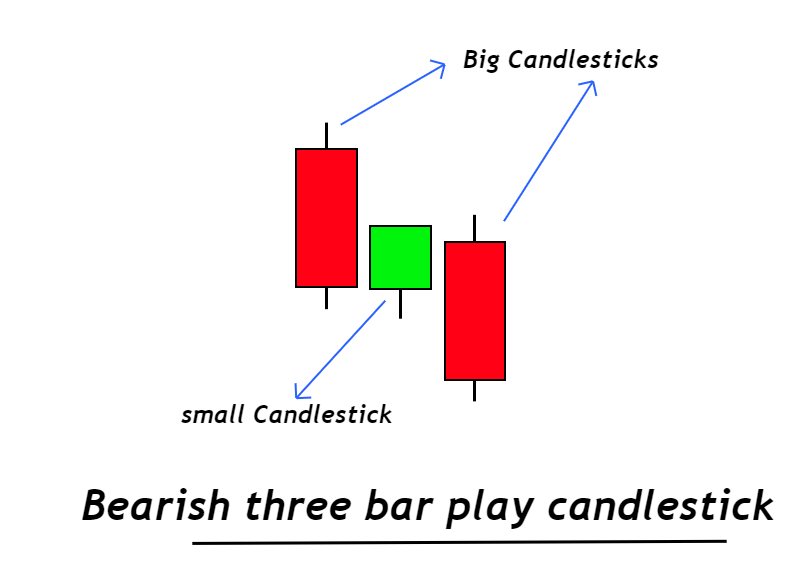

Avoid three-bar play

During the bearish trend, a falling/bearish triangle bar play pattern is formed. This pattern consists of two large bearish candlesticks and a smaller pullback candlestick.

This means that bearish trends will be continuing in the market.

Three-bar play candlestick with rules to determine bullish or bearish

These are the three main rules that will help you filter the chart’s best patterns.

- Minimum 60% should be the ratio of body to wick in both the first and second candlesticks. You should have the exact same color. Both candlesticks in bearish tendencies should be red while those in bullish should have green.

- A price pullback is represented by the inside candlestick in big candlesticks. The inside candlestick within the big candlesticks will be much smaller than those in the larger candlesticks.

- At a key level, the three-bar play pattern must always be formed.

What can the three-bar pattern reveal to traders?

Forecasting the market maker’s activity behind the chart using price action will make you a winning trader.

Trading is a decision-making process that is most crucial. Without a strong reason to make a decision, your chances of trading losses will rise. However, the chances of loss will decrease when you make decisions by analyzing the trader’s activity behind the chart. By incorporating different factors, trading can increase the chance of winning.

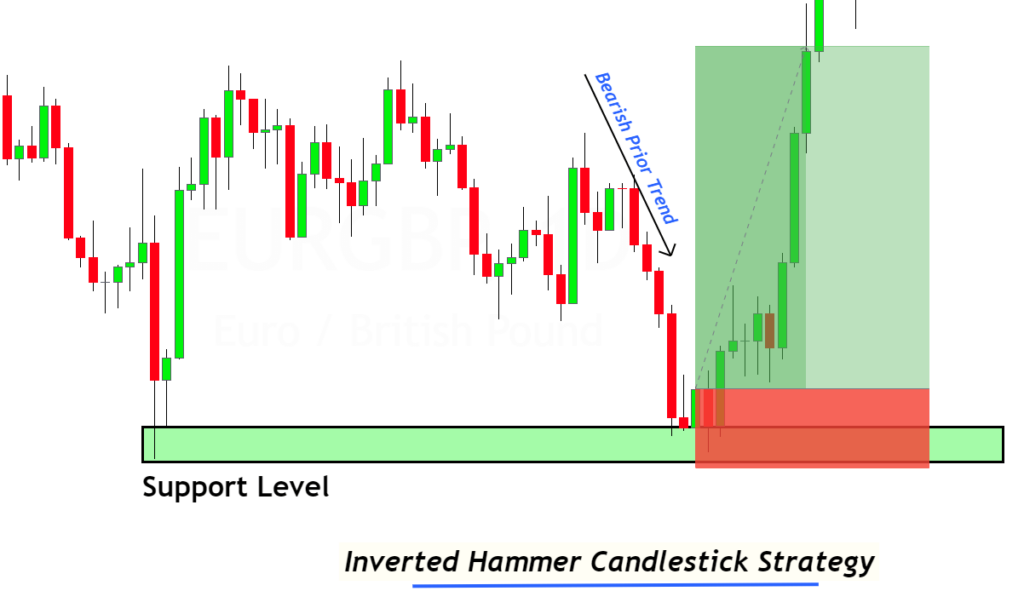

Let’s break down the structure

A bullish candlestick that forms at a key level is the first sign of buyers taking control. It also shows that sellers have failed to break a key level. After the breakout retail traders will attempt to sell at the resistance level. The price will then show a slight pullback, which will confirm that the price has fallen. This will bring in more retail sellers. This was actually a market maker trap that attracted more traders to the market and increased volatility.

Market makers will then return to the market, creating a huge bullish candlestick, indicating that market makers are still in bullish trends. The upcoming trend is also bullish.

So, if you trade with the bullish trend, you’ll also make profits; however, if you trade like a retail trader, you’ll lose most of the time.

A bearish pattern can also form if market makers favor the bearish trend.

What is the best way to trade 3 bar candlestick patterns?

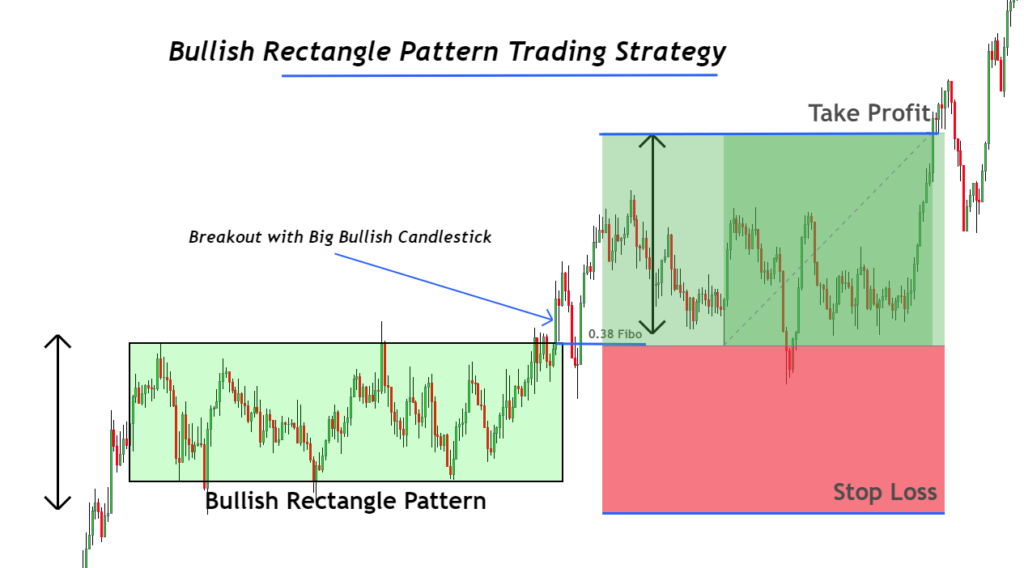

The trading strategy includes breakout, pullback and continuation price patterns. After a pullback, we will trade and keep the trade open until the trend continues.

Stop selling

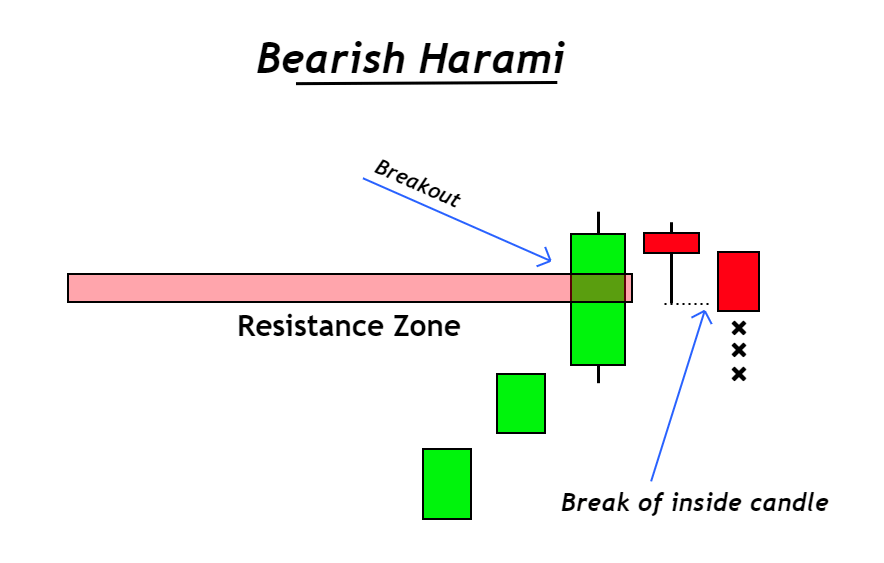

A breakout candlestick is a bearish candlestick that forms at major key levels. After a breakout candlestick the price will pullback into a smaller candlestick.

You can open a sell order below the price of a small candlestick. When the price trend continues, your order will automatically be fulfilled. Candlestick confirmation will keep the trade open until trend reversal, and then after a three-bar play pattern. Close the trade if there is a third bearish candlestack.

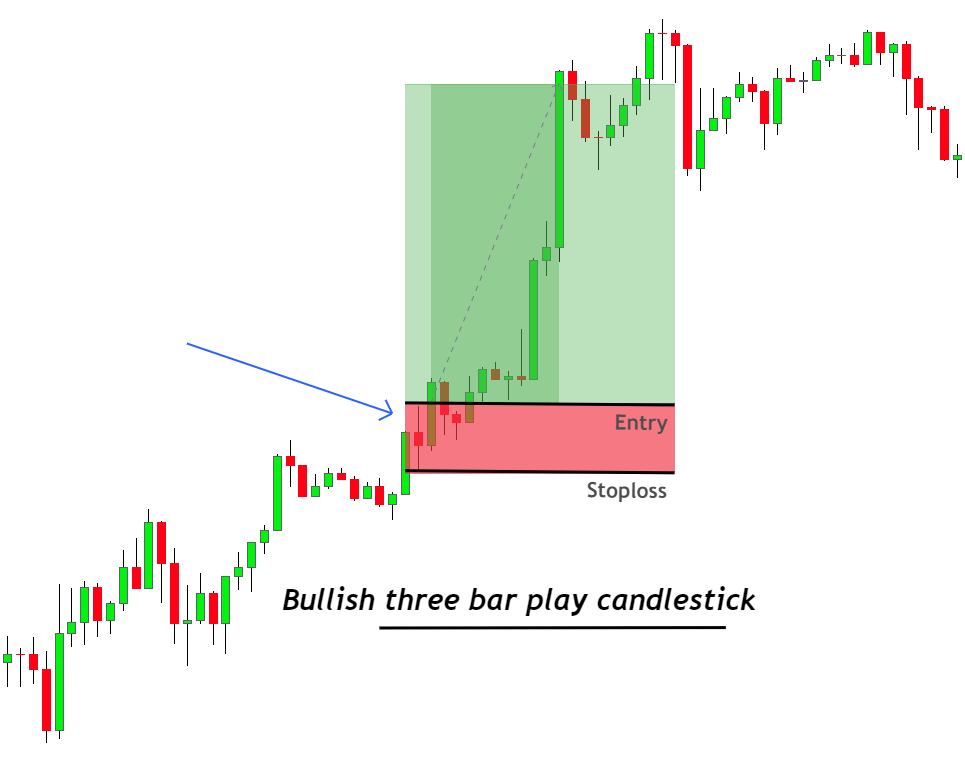

Make a Buy-Stop Order

If a large bullish candlestick crosses a strong key point, then the price will experience a slight pullback. Next, open a buy order at the top of the small candlestick.

The third candlestick should not show a bullish or large body. If this happens, close the order. If the third candlestick does not have a bullish body or meets criteria for three bar play, close the order and look for another opportunity.

Tip: If a small candlestick is found within the same range as the big one before it, then you need to choose the big high/low candlestick over the smaller.

Let’s get to the bottom

Candlestick patterns can be used to build technical analysis for trading. There are many hidden aspects in price patterns. This will help you decide if you want to reuse a particular pattern. This is the price action that you’ll learn with screen time.

Responses