AvaTrade Review

What is AvaTrade?

AvaTrade, a leading global broker with more than 200,000 clients trusting it worldwide, is one of the most trusted. A Forex broker, regulated on five continents that offers sophisticated trading solutions to customers, regardless of their level of experience or knowledge.

Ava is also a multi-national business, with headquarters in Dublin and Ireland. However, it has regional offices. These include entities in Paris, Dublin and Madrid, Tokyo and Beijing, as well as in South Africa, Chile and Nigeria.

AvaTrade Pros & Cons

AvaTrade has a great reputation as a highly regulated broker. It is simple to open an account. There are many trading tools available and easy-to-use software. You can also deposit or withdraw funds in many different ways. We also love AvaTrade high tech access to a wider range of instruments and multiple platforms for algorithmic, manual, or social trading.

The negative side of the coin is that there is not 24/7 support and trading instruments are limited to Forex or CFDs.

What Type of Broker is AvaTrade?

AvaTrade is a broker that offers range from Forex pairs, CFD trading to Cryptocurrencies available to trade with no restrictions on short selling or scalping. Generally, AvaTrade is an STP and OTC broker that also uses high-technology for order executions, means quotes received from interbank and connected to the market itself.

10 Points Summary

| 🏢 Headquarters | Dublin, Ireland |

| 🗺️ Regulation | Bank of Ireland, ASIC, JFSA, FSCA, CySEC, BVI FSC, South African FSCA, ADGM FRSA, ISA |

| 🖥 Platforms | MT4, AvatradeGo |

| 📉 Instruments | 250 instruments ranging from FX pairs to Vanilla options, CFDs on Commodities, Stocks, Indices, ETFs, Bonds and Cryptocurrencies |

| 💰 EUR/USD Spread | 1.3 pips |

| 🎮 Demo Account | Yes |

| 💳 Minimum deposit | 100 US$ |

| 💰 Base currencies | 5 base currencies |

| 📚 Education | Superior level educational videos and resources |

| ☎ Customer Support | Live chat 24/7 |

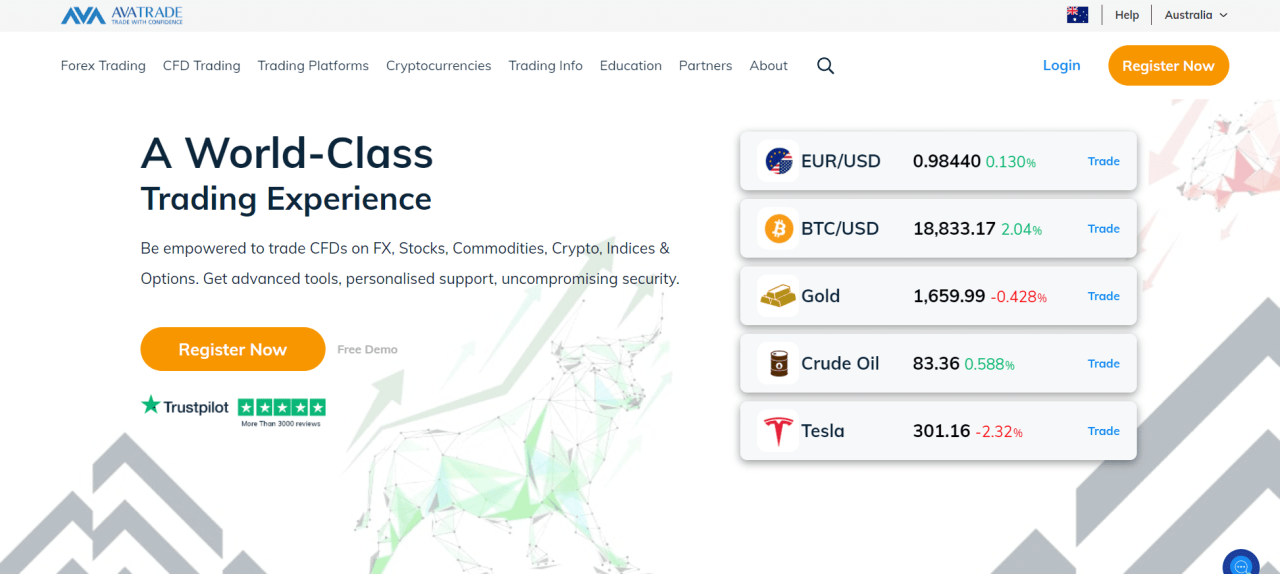

Awards

AvaTrade launched in 2006 and has seen rapid growth. AvaTrade global customers execute more than 2 million trades per month on more than 250 instruments.

Ava has won numerous industry awards over the past 10 years of her successful activities. Ava also launched many support programs. AvaTrade, formerly Ava FX, was recognized for its outstanding service and trading technology. We will explore why this is the case in our AvaTrade Review.

Is AvaTrade a safe site or a fraud?

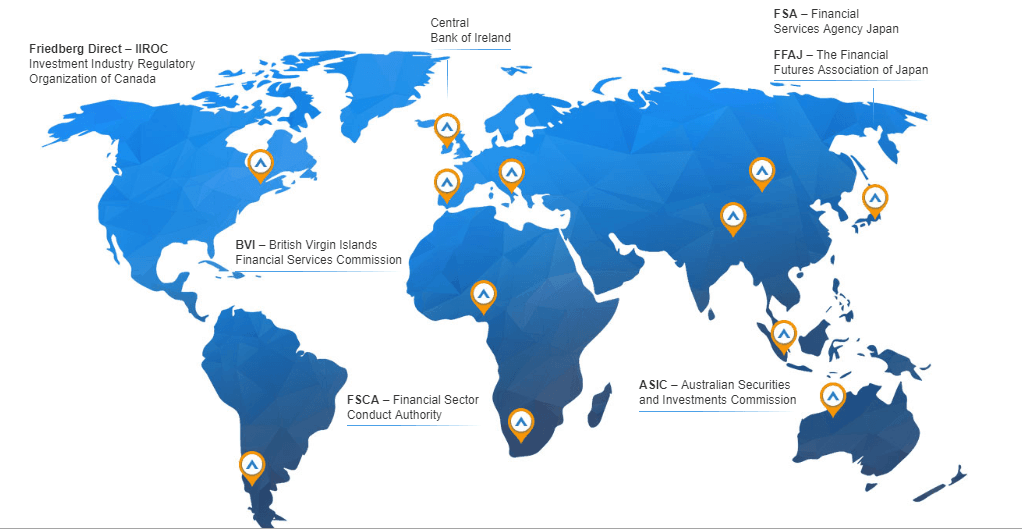

AvaTrade is not a fraud. AvaTrade is considered a safe broker to trade. It is licensed by the Central Bank of Ireland and it is licensed by ASIC. It is safe and risk-free to trade Forex and CFDs with AvaTrade.

Is AvaTrade legit?

Yes, AvaTrade, a fully licensed and regulated broker in all jurisdictions, holds the necessary licenses, and has other regulatory obligations than its main establishment standards, which are regulated by Ireland. You can find this information on the official AvaTrade website as well as the authority website. You may also find links to licenses in AvaTrade Review. Always verify that the licenses are correct.

Is AvaTrade controlled and who regulates it?

Apart from being regulated and supervised by the Central Bank of Ireland, there are many entities that Ava respectably established. This includes authorization from world-famous regulatory bodies ASIC Australia, FSP South Africa, FSA Japan, Abu Dhabi authority, ESMA European Union, British Virgin Islands, and many more.

AvaTrade has been rigorously regulated and is bound by internationally recognized laws. This ensures that brokers are reliable and can be trusted.

What can you do to be protected?

This regulation set allows protection for clients, including – funds separation. Client funds are kept separate from firm funds at international banks under encryption. The Investor Protection and Compensation Schemes ensure the security of traders’ accounts in the event that a broker goes bankrupt. Each jurisdiction is different.

Also fully audited trading processes that are closely checked by the authority on daily basis, in addition to protection.

Leverage

The leverage instrument is well-known. It increases your initial capital and can help you increase your potential gains. However, it’s best to use it wisely. Higher leverage may also work in the reverse.

Risk Level

There are many factors that determine the risk level. Leverage dramatically increases your chances of losing money.

AvaTrade, as a regulated broker, must comply with slightly different trading conditions or regulatory requirements according to the set rules established by particular authorities. This means that European traders and clients who are registered with AvaTrade European entity fall under ESMA regulation which recently limited leverage.

- European traders leverage is maximum 1:35

- I nternational trader and Australian clients may still use leverage up to 1_400

Types of accounts

AvaTrade offers a single standard account. Traders can choose to open a Corporate account, Swap-free Islamic Account or a Demo account to experience the broker’s environment. An Professional account may be available to professional traders with the right experience and proof.

Are all countries accepting AvaTrade

AvaTrade may be opened to residents of many countries in the world. There are restrictions that may be applied due to regulations in certain countries and specific laws in those countries. The US, Iran, Israel, and others are some of the restricted countries. However, Ava generally accepts most countries.

Types of accounts

AvaTrade doesn’t diversify clients through the choice of account types, but it offers a single Standard Account. This allows you to define specific conditions for Islamic Account or Corporate Account. You can also open a Demo account to try out brokers’ environments.

Accounts Swap-free are available to traders who follow the Sharia principles or traders who believe in Islam. This is a great option to offer world traders.

Additionally, if you are a professional trader and have the relevant experience, you might be eligible for a Professional account which offers additional benefits.

First, open an account. These are the steps.

This guide will show you how to open a new account.

- Click on the AvaTrade Sign in page. You can also sign up with an existing Facebook or Google account.

- Fill in the personal data required (Name, email etc.).

- Verify your personal information. A broker might ask for proof of residence, utility bills, or other information.

- To confirm your account selection and to verify your experience, take the electronic quiz

- Request an Islamic account opening if applicable

- After your account has been activated and verified, you can deposit money. For more information, see our AvaTrade Review.

Trade Instruments

What are the instruments you can trade with AvaTrade Ava offers over 250 instruments, including FX pairs, Vanilla options, CFDs for Commodities, Stocks and Indices, ETFs as Bonds and Cryptocurrencies.

Is AvaTrade a Nasdaq-listed company?

Yes, AvaTrade does have Nasdaq on its trading list. Ava has a great selection so you can find the right portfolio for you.

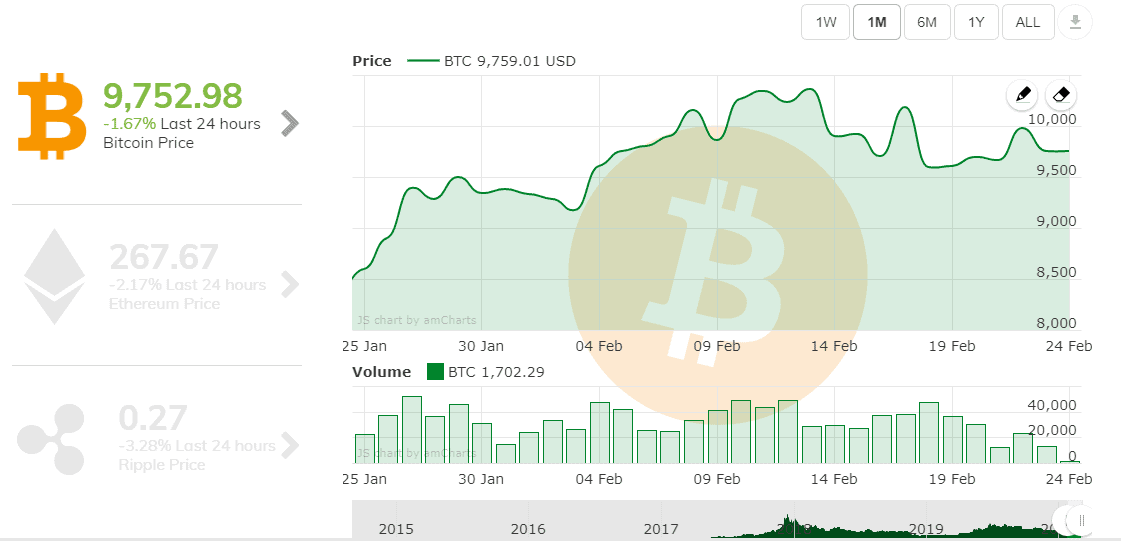

AvaTrade Cryptocurrencies

AvaTrade offers to trade pairs with Bitcoin, Ripple and Dash, Litecoins, Monero. NEO, IOTA. Zcash, Qtum, and other crypto currencies. You can trade cryptocurrency with either AvaTradeGO or MT4 Platform. There are very competitive spreads and leverage of up to 20 to 1. Also, you can start trading as low as $100.

Fees

All trading transactions performed on AvaTrade platforms are subject to the trading charges that are consisting of Spreads and Overnight fees. AvaTrade fees are consistent with the CFD spread as the main fee or commissions if applicable, while total fees are defined by additional fees like conversion fees while you hold account in different base currency. And lastly inactivity or non trading fees.

| Fees | AvaTrade Fees | eToro Fees | Plus500 Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Average | High | Low |

AvaTrade spreads generally represent average fees or low spreads compared to similar proposals or broker’s competitors. Also, you can see below a comparison table with a typical AvaTrade Spread to compare brokers with other CFD Brokers, with CFD fees and commissions, or an inactivity fee. Please note that fees are only an indication and can change depending on market conditions.

Non-trading fees

Final, there is an Inactivity Fee. This is charged if you don’t have any open trades or activity for 3 months. This will result in a quarter-time charge of 50$. The broker also charges a 100$ administration fee if you don’t use your account for 12 consecutive month. You should therefore be careful about what you do with your account.

AvaTrade Spread

AvaTrade does not charge commissions as all fees are included in a spread. This is the difference between ask and bid prices.

CFD Fees

CFD trading with AvaTrade allows you to trade Commodities and Bonds, ETFs or Indices, as well as stocks. AvaTrade CFD Fees are generally average, but Index CFDs offered at very competitive levels, such as Europe 50 CFD, is 0.6$.

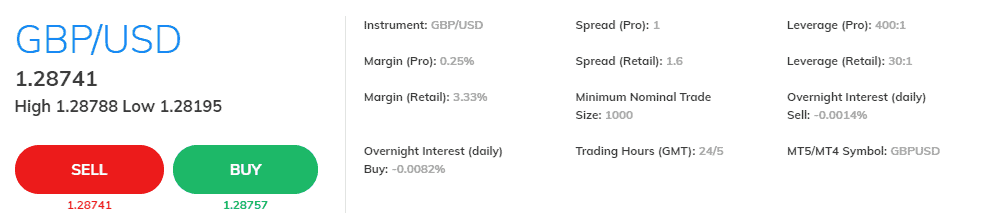

Forex Fees

The average forex fee is still at an acceptable level. However, major currency pairs offer a pleasant cost and great opportunities to take advantage of AvaTrade’s offers. Spreads between Forex and CFD assets may be slightly different, as spreads can vary depending on country rules. However, all information remains clear and transparent with AvaTrade.

| Asset/ Pair | AvaTrade Spread | eToro Spread | Plus500 Spread |

|---|---|---|---|

| EUR USD Spread | 1.3 pips | 3 pips | 0.6 pips |

| Crude Oil WTI Spread | 3 pips | 5 pips | 2 pips |

| Gold Spread | 40 | 45 | 29 |

| BTC/USD Spread | 0.75% | 0.75% | 0.35% |

Here is snapshot of AvaTrade fees

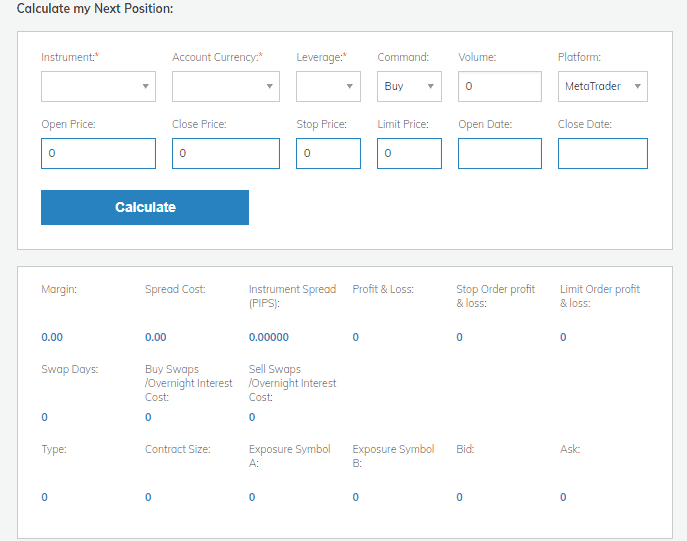

How to use the AvaTrade Forex calculator

So in order to manage your risk or not let you confused about charges, while trading you may also use great tool AvaTrade provide. Which is Forex Calculator that allows to consider and see all costs, losses or profits. Here are the steps on how to use Calculator.

- Select instrument you trade

- Choose account currency

- Add leverage level

- Set either buy or sell position

- Lastly, choose the platform you’re using

Non-trading fees

Final, the inactivity charge is applicable if there was no activity or open trades during the 3 month period. This will result in a quarter-time charge of 50$. The broker also charges a 100$ administration fee if you don’t use your account for 12 consecutive month. You should therefore be careful about what you do with your account.

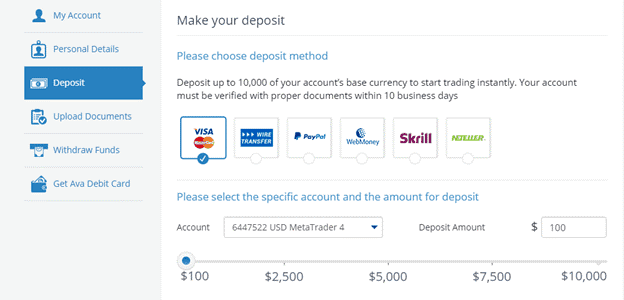

Withdrawals and deposits

Another core feature of options trading is the ability to access your funds. A deposit made through a bank account will allow you to fund your account without any complications. This is an important aspect to consider when choosing a broker. AvaTrade offers many good options.

Optional fees and deposit fees

Ava is a licensed broker and must adhere to safety measures in different jurisdictions. Ava offers many convenient ways to deposit money into your account.

- Credit and Debit Card

- Wire Transfer

- All clients, except those in the EU and Australia, can make electronic Wallet payments, including PayPal, Skrill or Webmoney.

AvaTrade Minimum deposit

AvaTrade minimum deposit via Credit Cards or Debit Cards: $250, and $500 by Bank Wire Transfer. Depending on the trading entity, you might need to deposit a smaller amount.

AvaTrade minimum deposit vs other brokers

| AvaTrade | Most Other Brokers | |

| Minimum Deposit | $250 | $500 |

Account base Currencies vs Similar Brokers

| AvaTrade | eToro | Plus500 | |

| Bank Transfer | V | V | V |

| Credit Card, Debit Card | V | V | V |

| Electronic Wallets | V | V | V |

| Base Currencies | 5 | 1 | 10 |

Why is it important to compare base currencies with similar brokers?

In simple words, it means you avoid currency conversion fee and may transferwise or withdraw money to your bank account, debit cards or credit cards, when applicable, with no extra charges. All in all it makes your money management smooth process, which is indeed very useful.

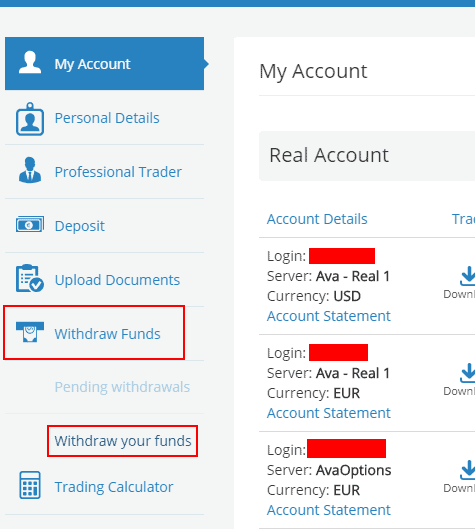

AvaTrade Withdrawal

AvaTrade usually processes withdrawal requests within 1-2 days. does NOT charge any withdraw fee. There are several withdrawal options available, including bank transfers, credit cards, and some electronic wallets. It may take longer to receive your payment due to international transfer laws and regulations. You can also compare AvaTrade fees with BDSwiss.

These are the steps you need to take in order to withdraw money from AvaTrade

You can access your account by following a few simple steps and making a withdrawal. You can always count on our great help center to be there for you.

How can you withdraw money from your account?

- Log in to your account. Click on “Withdraw funds” in the menu tab

- Complete the form and input the amount you wish to withdraw

- Select the withdrawal method

- Please complete the required forms

- Confirm your withdrawal details and submit

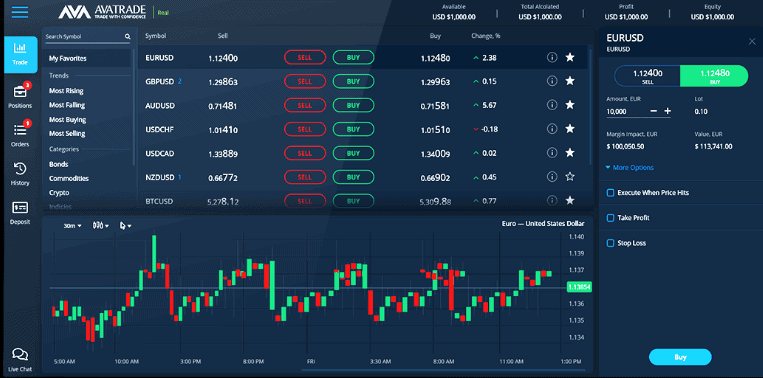

Trade Platforms

AvaTrade offers a wide range of platforms tools. It is no exaggeration to say that every client will find the right way. Let’s take a look at the AvaTrade platforms, all accessible through Desktop or Mobile apps and tailored for Android devices.

Scores & Availability of different platforms

| Pros | Cons |

|---|---|

| Great proprietary Web trading platform | None |

| A choice between Web, Mobile and Desktop | |

| MetaTrader4 and MetaTrader5 offered | |

| Specialized software for social, automated and algorithmic trading included into proposal | |

| AvaOption for Options trading | |

| Web and Mobile App AvatrageGO for iOS and Android | |

| Easy to navigate and simple to use software | |

| Support of different languages |

Web Trading Platform

Ava’s commitment to empower traders means that every level of trader is covered. Each platform offers the option to trade manually and automatically using a range of financial instruments. Spread betting options may also be available to UK clients.

WebTrader is an innovative platform that’s great for traders starting out. It features an intuitive interface, great design and easy to understand.

There are many languages available on the Web Trading Platform

AvaTrade supports many languages so that you can choose the best language for you. There are many languages available, including but not limited:

- Spanish

- Arabic

- Dutch

- Persian

- Turkish

- Polish

- Chinese

- Thai

- Portuguese

Look and Feel

AvaTrade platform, web or additional software MT4 and MT5 has a clear look and easy navigation. You will find an intuitive design and powerful tools, no matter if you are a beginner or a professional. You can also choose the best software for you, whether it’s WebTrader, AvaTradeGo App, Mac Trading, or AvaOption Platform.

This was created by Ava. It allows you to experience Options trading, FX with calls or puts, embedded tools, and an overall simple trading experience.

Login and Security

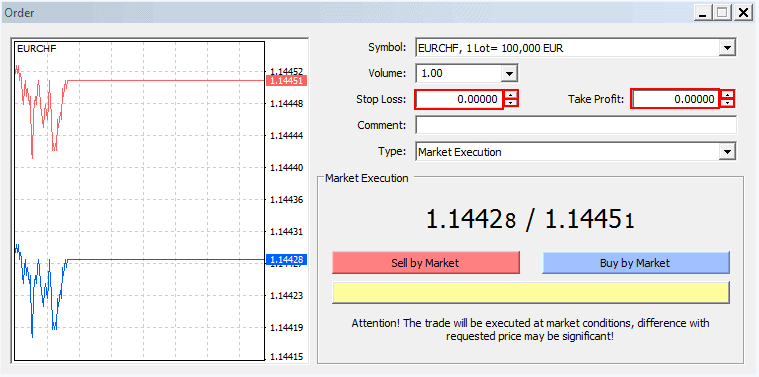

You can access your account via MT4 and MT5 as well as other Ava platforms.

AvaMetaTrader users will need to first install the program. Next, click File-> Login To Trading Account and then enter your credit information. You can then trade instantly.

Search Functions

Ava’s search function allows you to easily navigate between instruments and products that you wish to trade. You can search for the instrument you are looking for by using a simple search term or by using symbols to search for other assets.

Types of Order

AvaMetaTrader and other platforms let you set up specialized orders types to manage risk, adjust profits, or manage losses. You can set Trade Market or Pending orders, specifying Stop Loss and Take Profit as well as Trailing stop. Then, you can choose the type of executions. You can also modify your order via the Order Modification Window. You must stick to your strategy and use risk management tools to ensure a successful trading experience.

AvaTrade allows you to hold both a Sell and Buy position, which is known as a hedging strategy.

Notifications and alerts

Platforms also equipped with advanced technical indicators, charts, and real-time prices with notifications that you may receive to email. Thes

Desktop Trading Platform

You can still use it at AvaTrade Desktop Platform, which is an industry-leading software that is very common and powerful. It allows flexible trading with full auto or robot trading capabilities. You can also switch to MT4 Variable spreads which offer lower spreads starting at 0.9 pips. They are derived from market liquidity or you can choose the fixed spread. You can check the fixed spread brokers list.

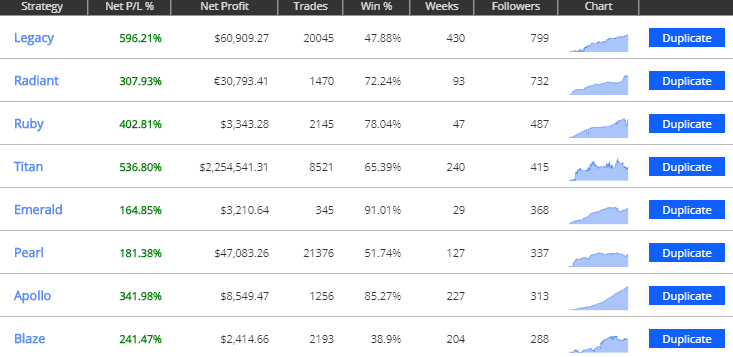

Automated trading

The AvaTrade automated trading capabilities is the final and most important tool, especially for new traders. Avar introduced a range of auto-trading programs that allow you to copy the strategies of experienced traders.

AvaTrade has a few platforms that allow you to trade autos. DupliTrade, another popular social platform, is available for your trading needs. It supports MT4 floating spreads. The platform automatically copies trades.

You can still use ZuluTrade, which is one of the most widely used auto trading softwares.

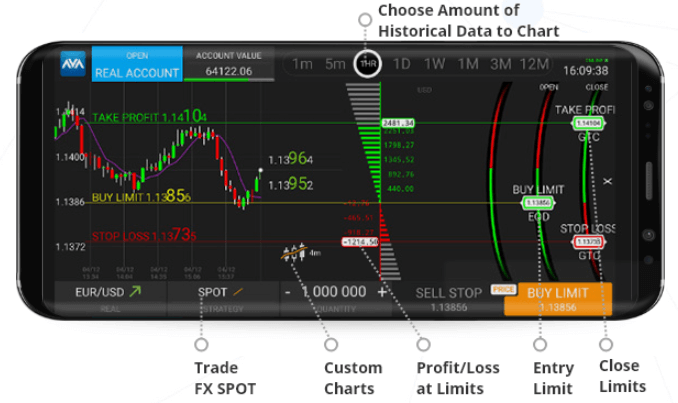

Mobile Trading Platform

AvaTradeGO is a mobile app that AvaTrade is proud of. It is easy to use and provides a lot of tools. It features a user-friendly dashboard that provides step-by-step guidance and advanced tools for trades opening, activity feedback, and support.

The platform allows you to manage multiple MT4 accounts and switch between real, demo, and variable spreads accounts.

| Pros | Cons |

|---|---|

| Proprietary App | No Face login |

| Customer friendly and easy to navigate | |

| Price alerts with notifications right at your mobile | |

| Fee Report | |

| Many languages supported |

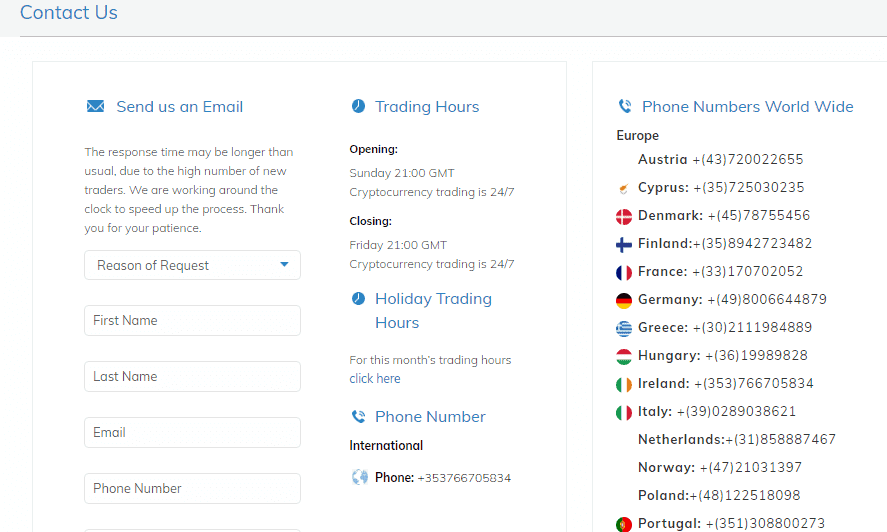

Customer Service

So getting to AvaTrade customer support it provides 24-hour live support available through live chat, email, phone support in 15 languages. Eventually, AvaTrade offers some of the greatest quality support with fast and reliable answers and a huge range of free of charge lines all around the world.

Education

All clients have access to exceptional education resources, in addition to the high-quality trading offerings. Ava says that the most important part of daily trading is inspiring and broadening horizons.

AvaTrade Demo Account

You can also choose a risk-free account in the first step of AvaTrade, known as a demo account allowing you to test strategies and evaluate the offered systems. AvaTrade has the perfect tool for you professional trader.

Education center is constantly developing and featuring both Forex and CFDs trading information, Live Webinars. Technical Analysis. Educational tools. This unique, premium source also offers video tutorials that can be divided by trader level.

Research

You can also find great resources and materials at A VaTrade. Autochartist is another option for MetaTrader trading. Other user-friendly tools include calculator and great charting with built in News Feed. You can also sign up for the latest market analysis provided by Sharp Trader, a professional AvaTrade educational website.

Conclusion

AvaTrade Review reveals a broker that has a more comprehensive trading strategy, a different way of dealing clients and market participants. This is a broker who has a trusted and respected reputation. Their positive aspect includes their flexibility with regard to platforms, currency pairs, and the availability of many solutions. The broker provides excellent education material that is suitable for traders at all levels.

Responses