currency pair correlation indicator

The Currency Pair Correlation Index is specifically designed to be used by Forex traders. It shows the average of prices between two currency pairs over the appropriate time frame. The data for these two currencies can provide forex traders with three different results. First, the positively correlated currency pairs follow the same path. In addition, the negatively correlated currency pair is in the opposite direction. Then, the relationship between them is completely random. These results provide Forex traders with the advantage of choosing the best option.

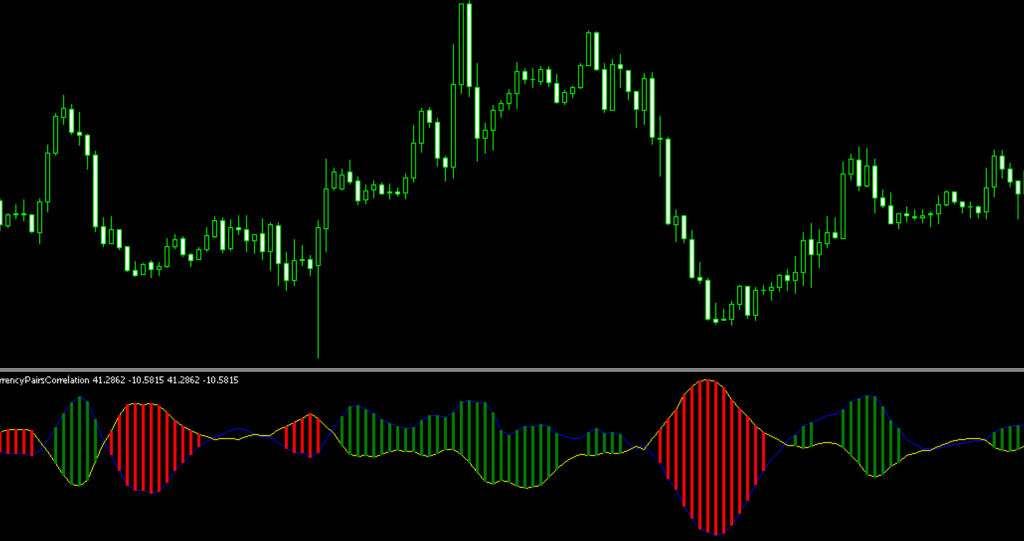

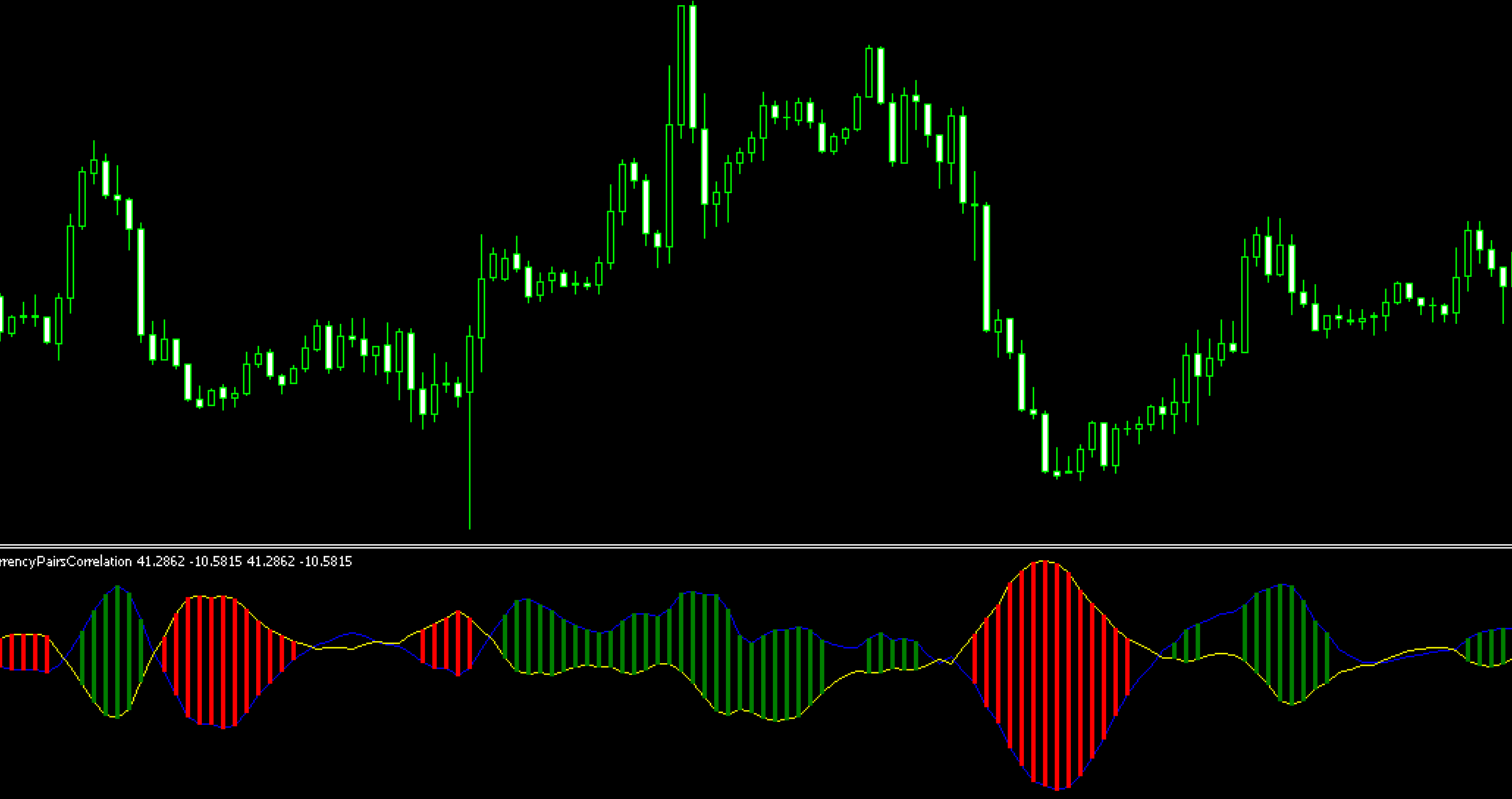

Most currency correlation indicators provide results in monetary form, such as charts or tabular lists or calculators. MT4’s currency pair correlation indicators give them in the form of bar charts within the indicator’s window. The indicator shows the correlation between two currencies in the form of red and green bars.

Currency pair correlation MT4 indicator trading method

Currency pair correlation MT4 indicator trading method

This EURUSD chart illustrates the relationship between the EURUSD and USD/CHF exchange rates. When the trend changes, the histogram turns tonal and there is a negative correlation. Forex traders can confirm a change in trend by checking if the currency pair is actually in both pairs.

If the two currencies are positively correlated. They will move in the same direction. Therefore, Forex traders use this feature to compare the trend of one currency with another in related currency pairs such as GBPUSD and GBPJPY, AUDUSD and NZDUSD and XAUUSD, and EURJPY and GBPJPY. USDJPY and EURJPY and AUDUSDUSD and USDCAD. Forex traders place their orders across two currencies to reduce risk. This is because each of these currencies may react differently to market conditions.

However, negatively correlated currency pairs tend to be in the opposite direction. Forex traders use negatively correlated rates to offset each other. Hedging is a successful way to manage risk. It is widely used by forex traders who take opposite options against the EURUSD as well as the USDCHF, EURGBP and GBPUSD.

The currency pair correlation indicator determines the fact that currency pairs vary randomly from each other, rather than being correlated with each other.

New traders are often prone to take negatively correlated positions at the same time, and these trades can in fact cancel each other out. Therefore, the currency pair correlation mt4 indicator will help new traders avoid making this mistake. On the other hand, experienced traders will incorporate correlations into their trading strategies.

Summing up

It is clear that the currency pair correlation indicator is by far the most effective tool for Forex traders to understand correlations and use them in various trading strategies.

Responses