currency strength indicator mt4

indicator to determine how strong (or intense) a currency is compared to its counterpart. To solve this problem, we have developed a free currency strength table. In this article we will explain this indicator.

The Quantum Currency Strength Indicator mt4 is designed to show you easily and quickly when a currency is moving strongly in one direction or the other, either into an oversold state or an overbought state. Currencies and currency pairs constantly move from one to the other in all time frames.

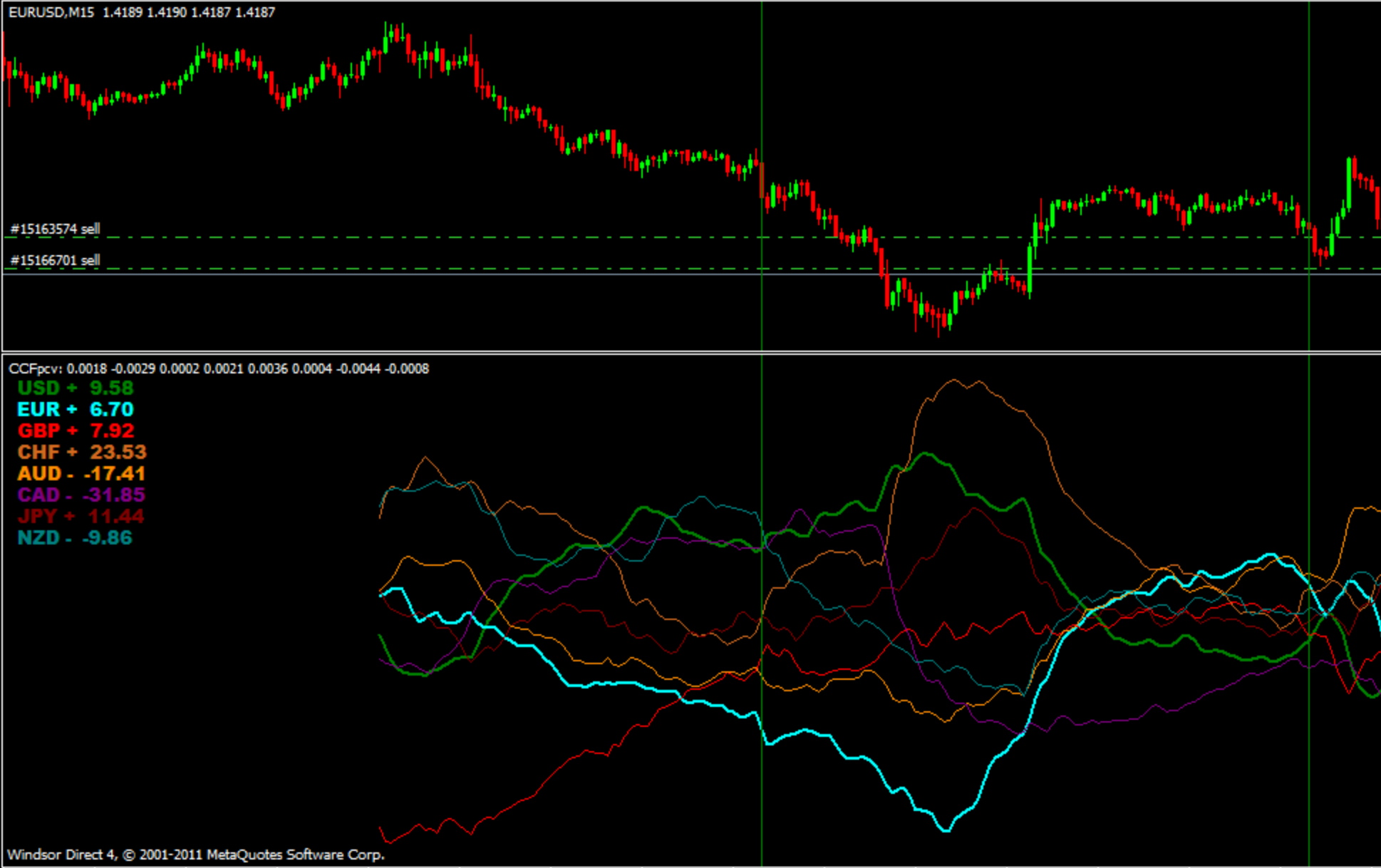

currency strength indicator mt4 The overbought and oversold regions of the indicator are defined by the dashed lines at 20 and 80. As soon as these regions are reached, this is a signal for further analysis in the chart. Using the indicator on multiple time frames is a great way to see if a currency is rising or falling across multiple time frames. This adds another dimension to your analysis and allows you to quantify the risk of a trade in a more detailed way.

What is the Currency Strength Indicator?

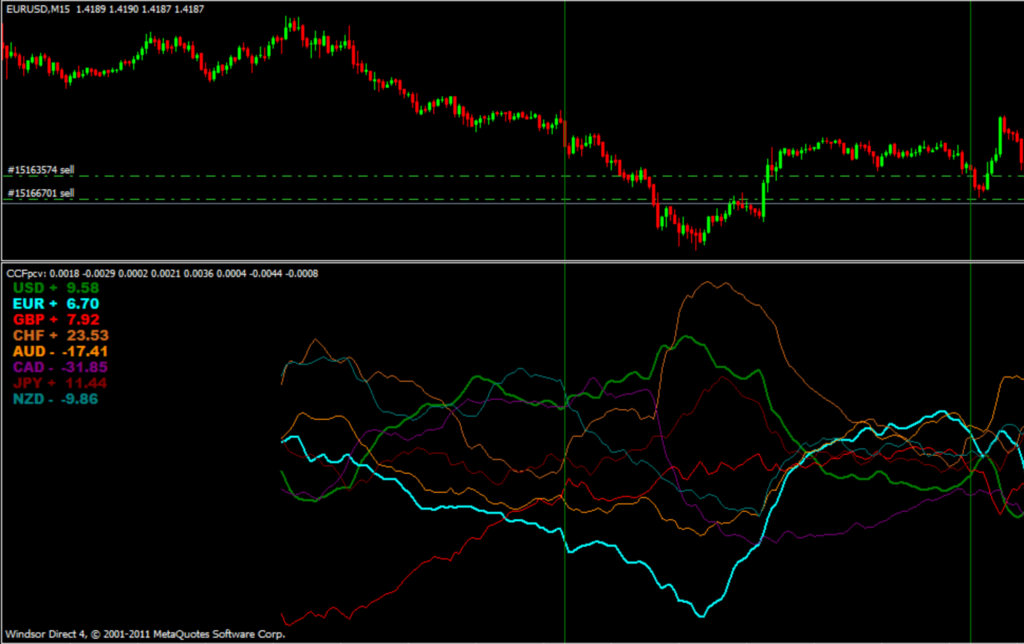

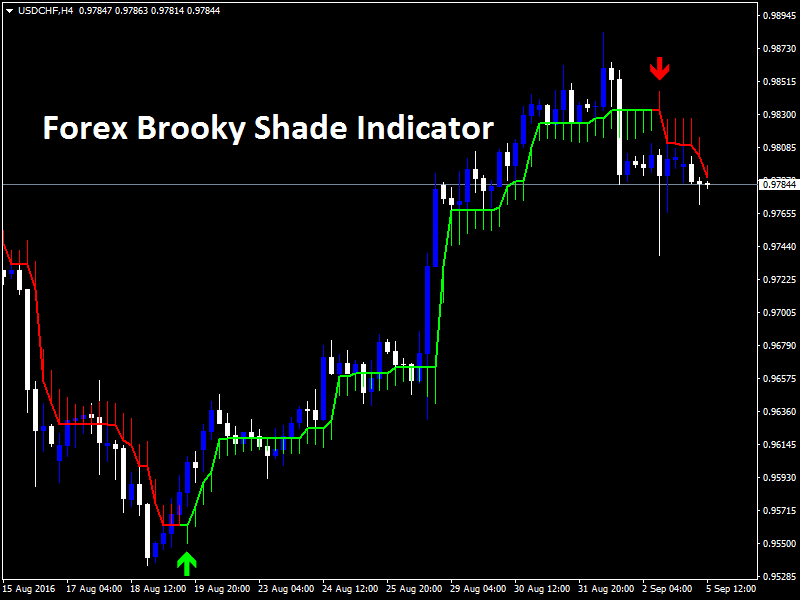

MT4 provides a few variations of the currency strength indicator. The most common one displays a line graph for each currency, with values normalized between 0 and 100. Many traders add it to a separate window below their price chart.

The relative movements between the lines highlight which currencies are strong or weak. Traders then look for trading opportunities aligned with the prevailing strength/weakness. For example, buying a currency when its line is rising while selling one that is falling.

Using currency strength effectively does require combining it with price action analysis and being aware of technical nuances. Let’s discuss the key components and applications of the MT4 currency strength indicator.

Components of the Currency Strength Indicator

There are a few settings and options that control how the currency strength indicator calculates and displays values:

Relative Strength Calculations

The indicator uses price percentage changes over a defined “lookback” period to determine the relative strength or weakness of each currency. The percent change can be based on the close, open, high or low of the period.

Normalization Methods

The indicator needs to normalize the strength values to plot them on a consistent scale. There are a few normalization options:

- Percentage method – Sets the highest strength currency to 100 and scales others proportionally

- Standard deviation method – Mean value set as 50 and values distributed within a set standard deviation range

- Min/max method – Minimum and maximum values set to 0 and 100 respectively

Timeframe Settings

The indicator can be set to reference different timeframes when measuring the price changes. Common settings are daily, 4 hour, 1 hour, 30 mins and 15 mins. Shorter timeframes are more sensitive but prone to more noise.

How to use currency strength indicator mt4?

Interpreting a Currency Strength Lines indicator for MetaTrader is not difficult. This Currency Strength meter shows the strength of a currency with a line, and there are some simple rules to read it.

There are several ways to calculate the strength, however, the main rules are:

- A line going upwards means that the currency is gaining strength.

- A line pointing downwards means that the currency is becoming weak.

- Flat lines, or almost flat, represent currencies that are maintaining their current strength.

- A line above another one means that one currency is stronger than the other one.

- A line above zero is likely to have a bullish trend against currencies below zero and vice versa.

These are the points where the currency may reverse and change its trend. The overbought and oversold areas on the indicator are defined by the dashed lines at 20 and 80, once these areas are approached this is a signal for further analysis on the chart. Using the indicator over multiple time frames is a great way to see if a currency is moving up or down over multiple time frames, adding more dimensions to your analysis.

Advantages

As you can see in the examples, knowing the strength of individual currencies can be very useful. In particular, the advantages of the Currency Strength Lines indicator for MetaTrader are:

- It shows the strength of a currency across the board, confirming or denying the price trend in a pair.

- Allows you to spot which currencies are strong and which are weak, so you can choose what pair to trade.

- Helps you understand if a trend is still strong or is exhausting.

- Helps you spot possible countertrends.

Long story short, the indicator can be a helpful instrument for your trading, and if you employ technical analysis in your trading, you want it in your tool case.

Conclusion

The Currency Strength Indicator provides useful additional data for forex traders using the MT4 platform. It offers a unique perspective on which currencies show relative strength or weakness over defined calculation periods.

However, currency strength works best when combined with price action analysis for confirmation, rather than relying solely on the strength indicator to mechanically trigger trades. It takes some experimentation to configure the indicator to best suit the individual trader’s style and preferences.

Skillful use of the MT4 currency strength indicator can definitely improve trading performance, but requires practice in the expert use of strength data in conjunction with other influencing factors. It remains one of the most valuable tools available for forex trading on the popular MT4 platform.

Responses