Best ECN Forex Brokers (True ECN Trading Platform)

What is an ECN Forex Broker?

An ECN broker can be described as a broker that automatically matches trade orders for purchase or sale through an ECN as well as an electronic communications network, an ECN is a bridge technology that connects retail forex traders or market participants with liquidity providers. This means that ECN bridges are non-dealing desk bridges with straight-through processing execution, allowing for immediate connection of execution between the two parties.

ECN brokers typically match orders at the most competitive price among liquidity providers or market participants (learn about Nasdaq market participants), but sometimes, the EUR-USD spread can be zero points.

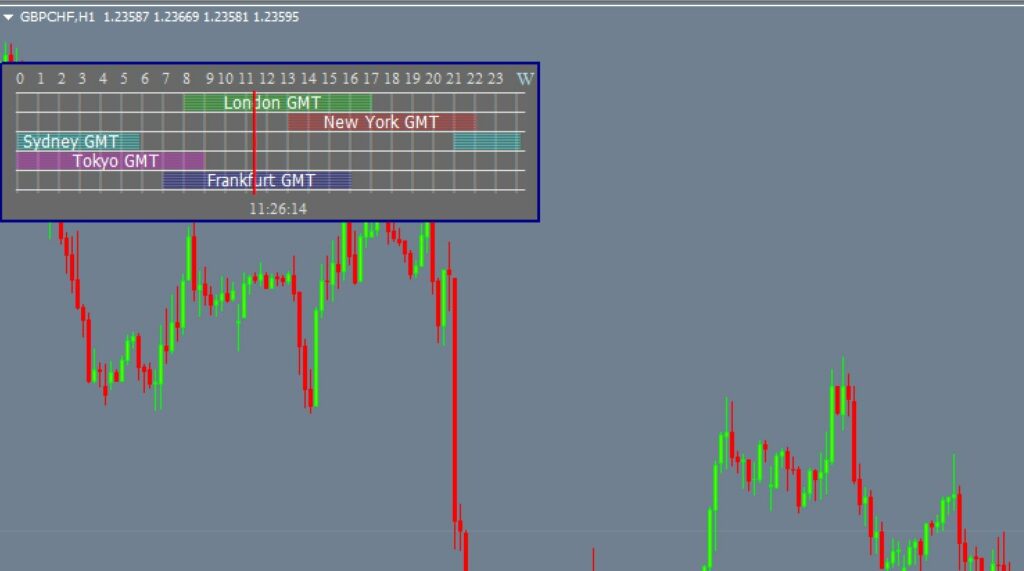

In addition to competitive trading costs, due to its capabilities, ECN technology can lead to longer trading hours, highest automated trading efficiency and a wide range of strategies for both institutional and retail traders.

Strategy-based ECN spreads from 0 pips do not necessarily mean less trading costs, but for some strategies with fixed or variable spreads, the option of trading fees is a better choice. ECN brokers and technologies are more suitable for experienced professional traders or those with larger volumes. Market makers with standard accounts and execution models can be an option for beginners or for certain strategies, they are not suitable for larger traders.

Benefits of ECN brokers

In general, ECN brokers are considered an alternative to dealing desk brokers for a number of reasons. They include.

ECN brokers do not trade with their clients, and because they do so, conflicts of interest between traders and brokers are eliminated.

ECN brokers offer better rates and more cost effective trading conditions.

More transparent trading environment ECN brokers cannot change prices.

Fast execution of market orders – a better alternative to algorithmic trading.

Tighter spreads. Some brokers offer ECN accounts with no spreads.

ECN trading is more beneficial for day traders, scalping and algorithmic trading.

What are ECN fees?

Brokers offering ECN accounts and connections usually offer interbank spreads starting from 0.0 pips, as well as a non-movable commission on each amount as a transaction cost or fee.

What is an ECN?

Due to the growing popularity and rising trend of ECN trading, there are many brokers who boast about their brokers ECN status for Forex. The only legitimate ECN brokers are those that have been approved by regulatory authorities and have solid legal obligations.

ECN vs. Standard Accounts

The main difference between standard and ECN accounts is the fee structure. Standard accounts do not have commission accounts and have variable or fixed spread basis. In contrast, ECN accounts are ECN are based on a commission fee model, while ECN fees are divided by the spread between banks starting from zero and the commission cost per lot.

Best ECN Forex Brokers

Here is the top selection of ECN brokers by category. They include registered brokers with the most favorable ECN trading conditions. Reliable operating standards and clear terms and conditions.

Min Deposit of 20$ |

Responses