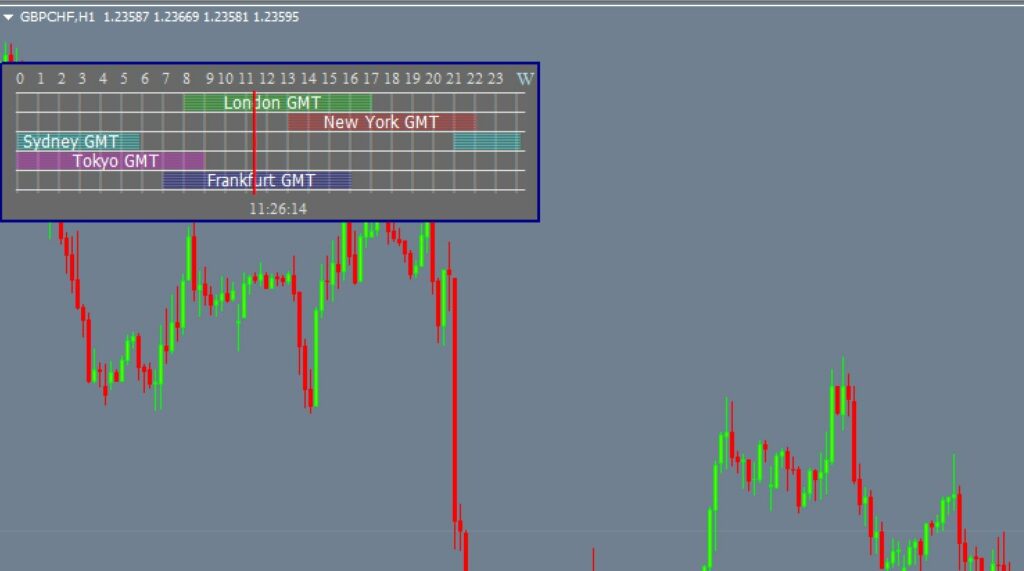

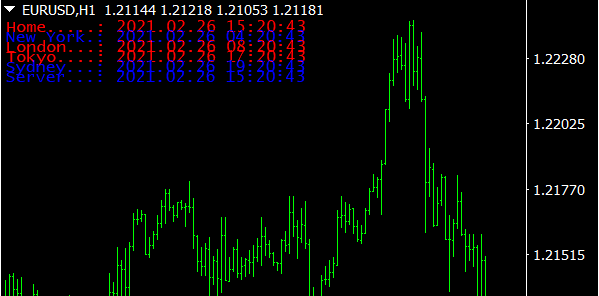

market session indicator

It is a Forex market time GMT trading session indicator that can best be described as a worldwide trading clock. It provides schedules for five trading sessions, including the Sydney, Tokyo, Frankfurt, London and New York sessions.

The Forex market is available at all times of the day, seven days a week. Each trading day is divided into three main sessions, including the Asian, European and North American sessions.

The characteristics of price movements and market volatility vary with the time of day of the market. For example, during the Asian session, one can see slower price movements than throughout the London or New York sessions. Depending on your trading style, it is important to decide on the most appropriate time to schedule your trades. In addition, your trading schedule plays an important role in developing your strategy regarding entry and exit.

- Automatic time zone detection. The indicator automatically detects the local time of a trader based on the computer settings. This feature relieves you of the need to convert the Universal to your local time.

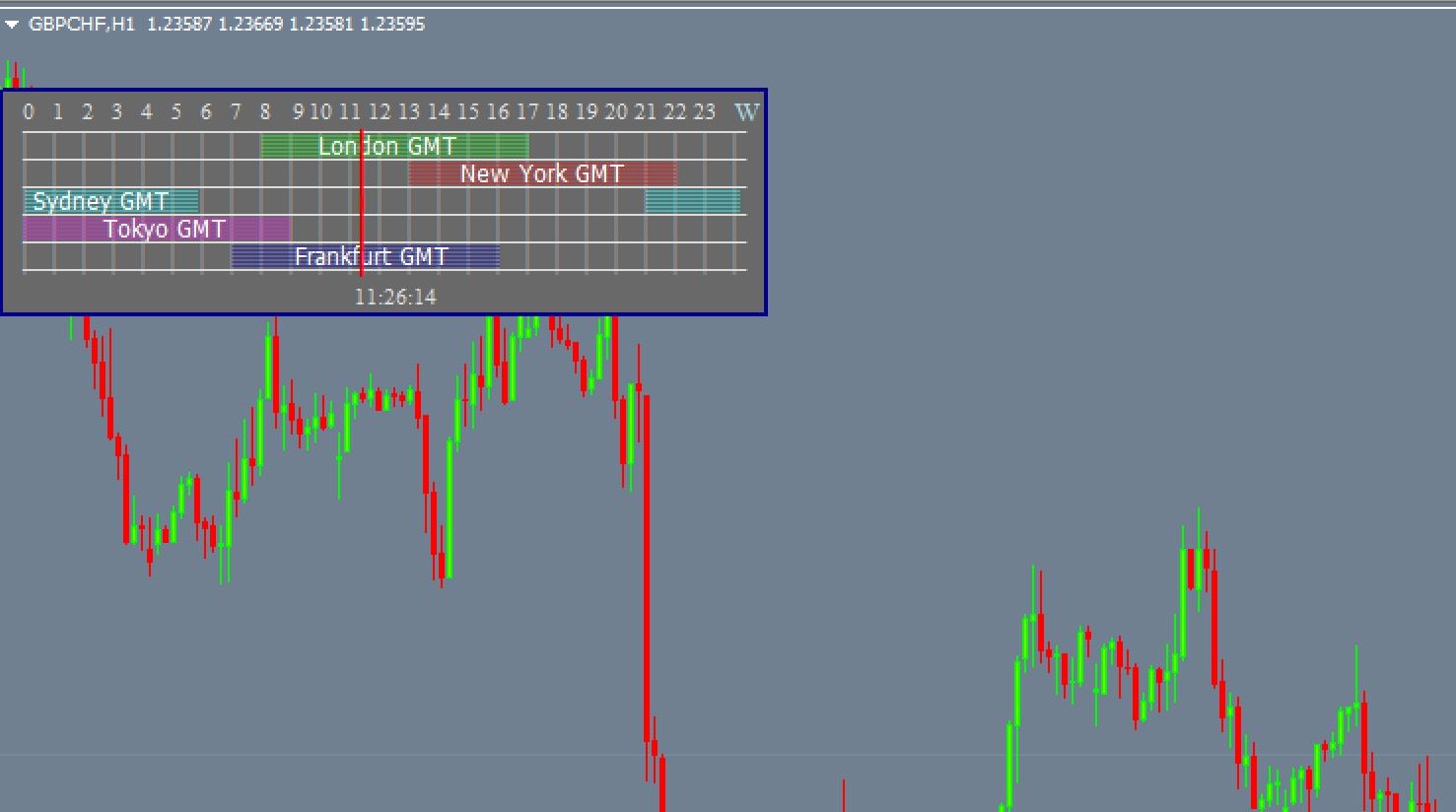

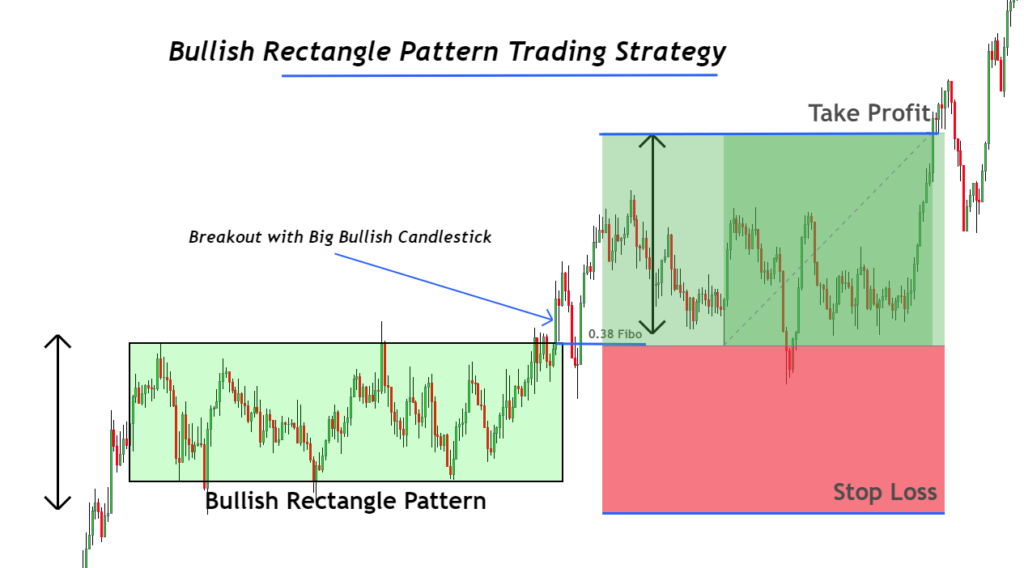

- Simplified display mode on higher timeframes. A trading session usually lasts 8 hours. The given time period can be displayed as a rectangle only on lower timeframes such as M1, M5, M15, and M30. Starting from H1, it makes no sense to draw rectangles. Therefore, only the open of the closest trading session is indicated as a vertical line on higher timeframes.

- Semi-transparent background of rectangles marking up trading sessions. When enabled, the indicator won’t interfere in working with your chart and will also allow you to display the overlapping trading sessions correctly. If necessary, you can disable the filling in the indicator settings and keep only the contours of the rectangles.

- Displaying not only current sessions but also past and future ones. You can decide on their own, which sessions should be displayed on the chart, and set the number of sessions to be displayed in the settings.

How does the Forex Market Hours GMT trading session indicator work?

When you open the chart, you will be able to quickly determine which trading session you are in. In addition, you can check the schedule of upcoming market sessions and develop your trading strategy based on the time frame.

In addition, this indicator helps to understand the overlap of market sessions. Expert traders choose their trading assets based on current market hours and overlapping hours.

According to expert market analysis, London and New York sessions are the best time frames for trading Forex pairs and precious metals such as gold (XAUUSD) or silver. Therefore, it is equally crucial for novice and experienced traders to know the session times.

Advantages of Forex market time GMT

It shows when the market is closed and open.

Describes the agenda for the 5 main sessions.

Helps you understand the overlapping periods between trading sessions.

What Kind of Problem Does the Indicator Solve?

This particular indicator automatically displays forex trading sessions as rectangles on the chart of a currency pair. It eliminates the need to remember the trading hours of exchanges and calculate the difference between the local and the global time.

The indicator is good for novice traders since it can help to reduce the number of errors when planning trading strategies. It is also useful for experienced traders, as it makes it much easier to work by visually displaying the trading hours of sessions on the chart.

Lateral sides of the session box representing its opening and closing hours. The upper and lower sides depict the high and low of a price range formed during the trading hours of the session.

The indicator automatically marks up the four most significant trading sessions:

- Pacific (Sydney);

- Asian (Tokyo);

- European (London);

- U.S. (New York).

How to Use Sessions in Trading

Each session has specific characteristics that we can use in Forex trading.

If you know the trading hours of sessions, you can spot the most volatile time intervals throughout the day and thus choose the most suitable time for the successful implementation of your trading strategy. You also can select the optimal currency pairs for each trading session.

There are strategies targeted exclusively at the flat Pacific session, as well as those designed for trading in the most volatile period when the London session overlaps the New York session.

For example, sessions with high trading activity better fit the needs of those market participants who practice aggressive strategies. In contrast, sessions with low trading volumes and volatility are suitable for traders who prefer minimizing their risks.

Pacific (Sydney) session

This session marks the beginning of a new trading day. As a rule, it’s characterized by low volatility and the lowest volumes of currency transactions. This is especially true for the time period between 22:00 and 00:00 (UTC), while the Sydney financial center is closed.

At this time, most market participants are not involved in trading, since price movements are usually minor and unpromising in terms of profit. However, the early Pacific session may be a convenient time for traders who prefer to limit their risks as much as possible.

Trading activity surges after 0:00 (UTC), not only because of the opening of the Sydney financial center but also due to the beginning of the Asian session.

During the trading hours of the Pacific exchanges, the most volatile are currency pairs with the Australian and the New Zealand dollars. AUDUSD, NZDUSD, and AUDJPY are in particularly high demand.

Asian (Tokyo) session

Most often, the Asian session is a quiet period of volatility as well. However, trading during this time can yield good profits, if you plan your strategy with the specific features of the Asian exchanges in mind. As a rule, such strategies imply trading currency pairs with the Japanese yen.

Usually, the USDJPY pair has the highest volatility during the Asian session. Also, AUDUSD and NZDUSD pairs are actively traded, since the trading hours of the Asian exchanges overlap with that of the Pacific session.

European (London) session

The European session is very volatile. This is because its opening coincides with the trading hours of the largest Asian exchanges, and its closing coincides with the opening of the American exchanges. The simultaneous trading activity of five major financial centers – London, Frankfurt, Paris, Luxembourg, and Zurich –also plays the role.

European currency pairs that include the US dollar are probably the most actively traded. For example, EURUSD, GBPUSD, and USDCHF are in particular demand.

The European trading session is well suited for strategies that involve making money on intensive price movements. For example, a good way to make money during this period is scalping.

The European session is also a favorable period for strategies based on the fundamental analysis since this is usually the time when most of the news releases come out.

U.S. (New York) session

The U.S. session is also very significant in terms of market trading volumes and the strength of market movements. It is based on the activity of the two largest financial venues in the United States – the New York Stock Exchange and the Chicago Mercantile Exchange that start their work an hour apart.

The U.S. session is the most active period of Forex trading. The highest trading volumes occur during the first two hours of the session when the London Stock Exchange is still open.

Due to active trading during the New York session, there are often sharp swings in the currency exchange rate. It is especially true for pairs with the U.S. dollar. Trading such currency pairs is very risky, but at the same time, they can generate high profits to those market participants who have experience in trading with aggressive strategies.

Conclusion

Forex Market Hours GMT Trading Session Indicator shows the correct schedule for each trading session. In addition, it will automatically change the time of the market according to the daylight saving time. Moreover, it is very easy to use and is a great tool.

Responses