Time Zone Indicator mt4

The Forex market is open 24 hours a day, except for Sundays and Saturdays. However, there are different time zones in which different sessions start. These time zones include Asian time zones, European time zones and North American time zones.

The Forex market has been shown to behave according to individual time zones. In addition, not all regions are suitable for placing any type of order. Certain trading hours, such as the London session, tend to be more volatile and liquid. While other hours, such as the Sydney session, are more fragile. Therefore, traders need to know every time zone in the Forex market, and this can be done with the help of time zone indicators.

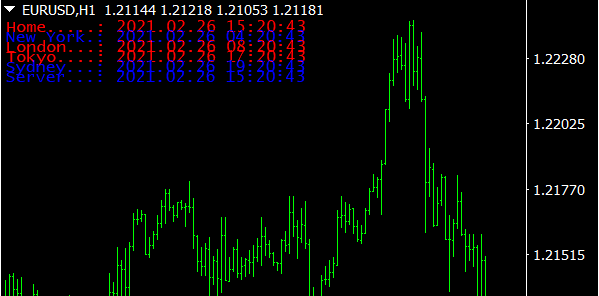

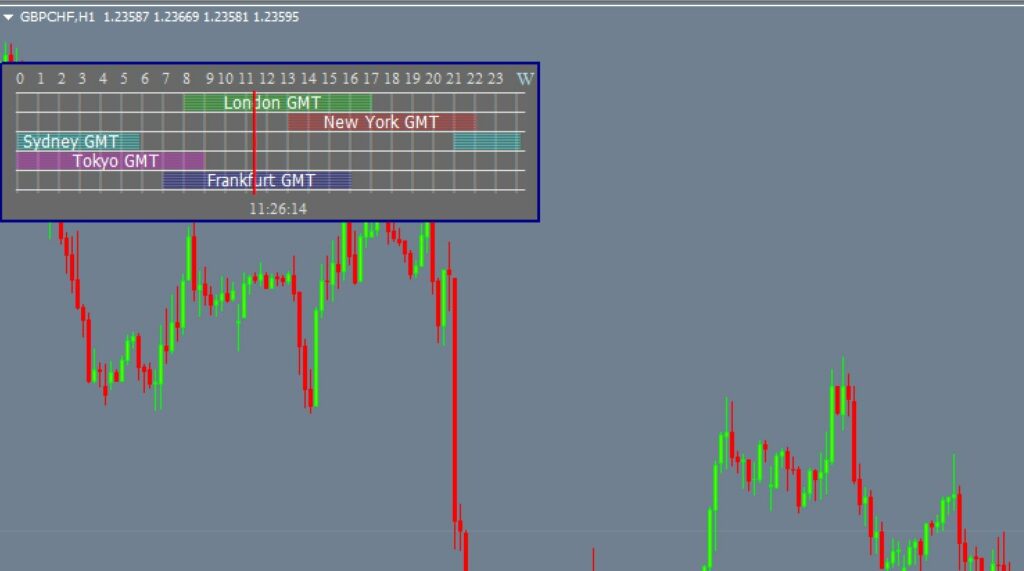

The Time Zone Indicator shows the time of trading and its duration and timing, as well as the current session in which the market is trading. The indicator shows the New York, London, Sydney and Tokyo trading sessions. The indicator shows the current trading session in red on the chart, as shown in the chart below.

In the chart, we can see that the market is in the Sydney trading session at the moment. This can be seen by the time zone indicator in red. At the end of the Sydney trading session, this indicator will change the chart for the next trading session.

This indicator is very useful because traders are sure that an important trading session is about to start so that they can open positions. Also, traders can use this indicator to determine when a particular session will end so that they can close their trades. With this indicator, traders in the Forex market can know when they should trade and when they should exit the market.

How to use the Time Zone Indicator

In order to effectively use the Time Zone Indicator to MT4, traders need to know the specifics of each trading session.

The first session to open is the Asian session. The Asian session includes the Tokyo and Sydney sessions. These trading sessions account for about 20% of the total Forex trading volume.

In some cases, due to the low trading volume, liquidity can be very high. Due to this lack of liquidity, most currency pairs trade within a narrow range. During the Asian session, economic news about Australia, New Zealand and Japan was reported. The stronger trend was evident in the pairs consisting of the Japanese yen, Australian dollar and New Zealand dollar.

The second session included the London meeting. This London session happened to be the largest of all. More than 32% of all trades were made during this London session. This session is known as the London Session and is known for its liquidity due to the high volume of trading.

This session is the one with the lowest spreads. Volatility slows down in the middle of the London session, but this does not happen until the New York session. The trend of the market may change before or at the end of the session and London traders may decide to lock in their profits.

The last session will be the New York session. This session is the second largest after the London session. The New York session accounts for about 19% of the total Forex trading volume.

This session is known for its huge potential for market movement. In fact, almost 85% of the trades are made in US dollars. When the New York session is combined with the London session, its liquidity is high. It is during this overlapping period that the Forex market experiences the most trading volume.

Conclusion

MT4’s time zone indicator helps traders understand the time of ongoing trades and make critical decisions.

Responses