Descending Broadening Wedge Definition & Trading Strategy

The bullish trend reverser chart pattern Descending widening wedge consists of an expanding trend in the downward direction. It’s a signal of a market trend change.

Chart patterns are widely used by retail traders to predict the markets. They are unique due to their uniqueness and natural patterns.

You will find a detailed trading strategy and information about the descending triangle pattern in this article.

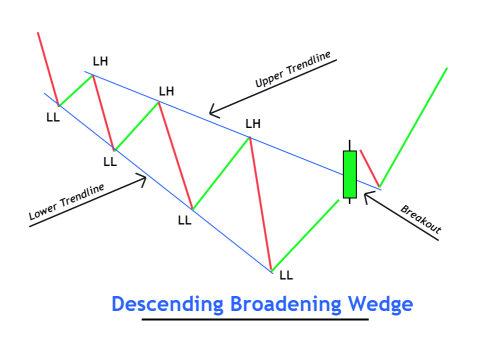

How do you identify the descending widening wedge pattern?

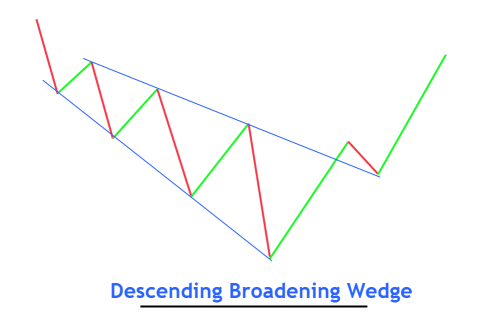

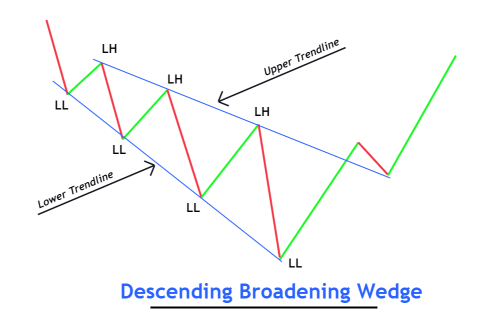

The Descending widening wedge is one type of wedge design. Wedge is an arrangement or pattern that has one thick and one narrow end. If you are using a downward broadening wedge as a starting point, your ending point is narrower than the beginning point. This shows that the price wave has expanded.

Follow these steps to find this pattern on your chart

- Determine the point at which the wave began. Price waves should have lower lows, and higher highs.

- The next wave will be larger than the one before it.

- Two trendlines should be drawn that represent the swing high or swing low of wave action.

- The wedge should not be too thin at the beginning and should also be very thick at its end.

- At least three waves must form the descending wedge.

These are just a few criteria that can be used to determine the pattern in the price chart.

For a deeper understanding, take a look below at the image.

What is the significance of the descending narrowing wedge for traders?

Trading the market is easier with price action trading. However, you don’t need to spend too much screen time to learn about price action.

Price action describes how prices behave at specific levels or under certain conditions such as chart patterns.

The price action technique can be used to master the downward broadening wedge pattern. This is because there will always be false signals and trade opportunities on the currency chart. Profitable trading can be done by filtering the bad trades out of the crowd. This is only possible if you are familiar with trading the chart pattern.

Let me tell you.

The stop loss of retail traders is always captured by institutional traders, it’s well-known. They are willing to buy when you trade a currency, asset or other asset. And they will also sell when you purchase a currency, asset or other asset.

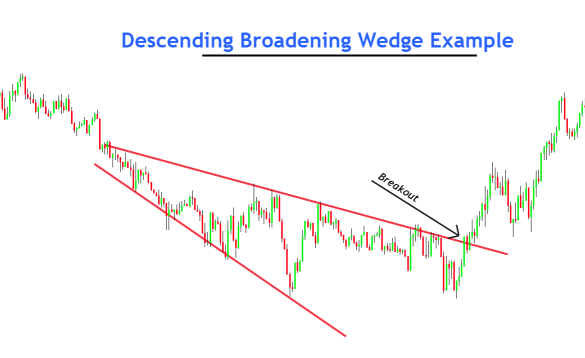

When the price falls to lower levels, each wave of the next wave is expected to be higher than the last, it’s clear that the market will have to make big decisions. However, before they make a decision, the retailers will be eliminated. The last wave of the descending widening wedge pattern, for example, will be more powerful than the previous waves.

Retail traders have been eliminated by large price swings against them. The price has been in oversold territory for several weeks due to successive lower lows. A bullish trend change is now possible. .banner-1-multi-113{border:none !important;display:block !important;float:none !important;line-height:0px;margin-bottom:15px !important;margin-left:0px !important;margin-right:0px !important;margin-top:15px !important;max-width:100% !important;min-height:250px;min-width:250px;padding:0;text-align:center !important;}

Market makers may make false breakouts to eliminate retail buyers before there is a bearish trend reversal. It is also an indicator of a trend reverse.

What is the best way to trade the descending widening wedge?

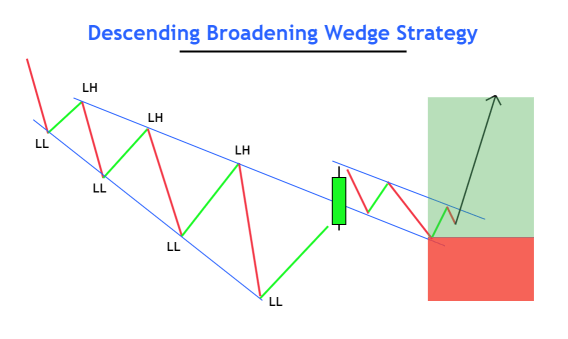

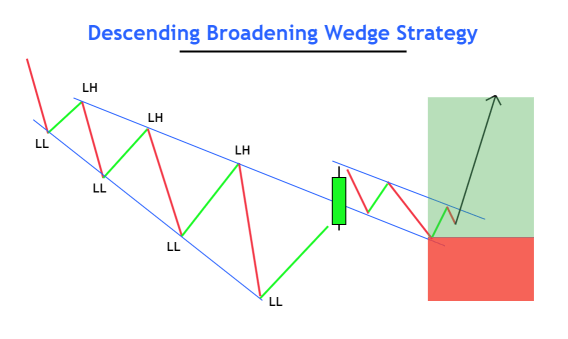

An entry, stop loss and take profit strategy is a trading strategy.

This chart pattern is easy to trade. To increase your winnings, however, you could also use technical analysis with this strategy.

- You should draw two trendslines that correspond to the heights and depths of each wave. The wedge pattern must contain at least three waves.

- You can wait for the breakout at the top trendline by using a large candlestick.

- Two options are available after the breakout. To get high risk, high reward trades you can either open buy orders immediately after the breakout. This is the best option.

- You can place a stop-loss at the lower end of any price wave.

- Set the start point for descending widening wedge patterns at the adjust the profit level.

It is easy to trade the chart pattern. But, it is possible to add additional confluences or key levels like the supply and demande indicator.

What’s the Bottom Line?

Chart patterns make up the foundation of technical trading analysis. Chart patterns can accurately forecast the price. However, it can be difficult to trade only chart patterns such as the descending narrowening wedge pattern. However, you can create a winning trading strategy by combining technical tools.

Before you use the chart pattern in live trading, make sure that it is properly backtested.

Responses