Description

Download and install on the MT4 platform now.

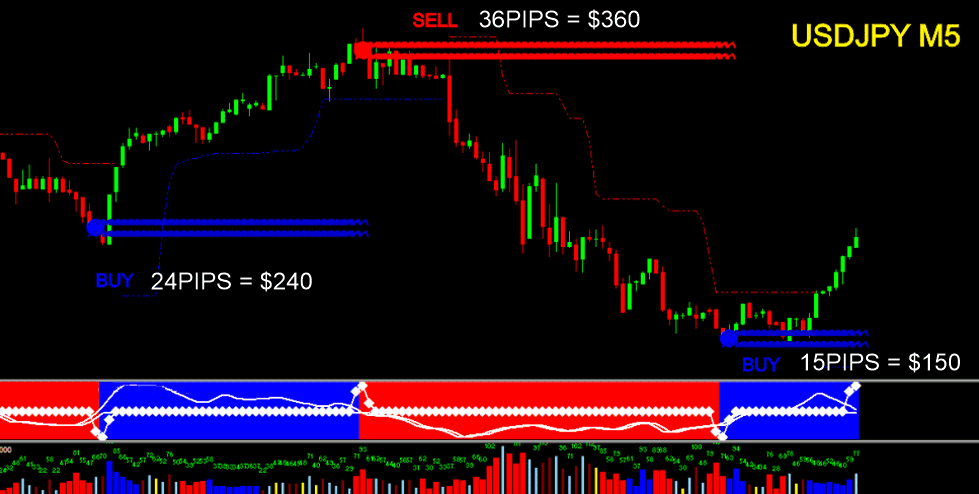

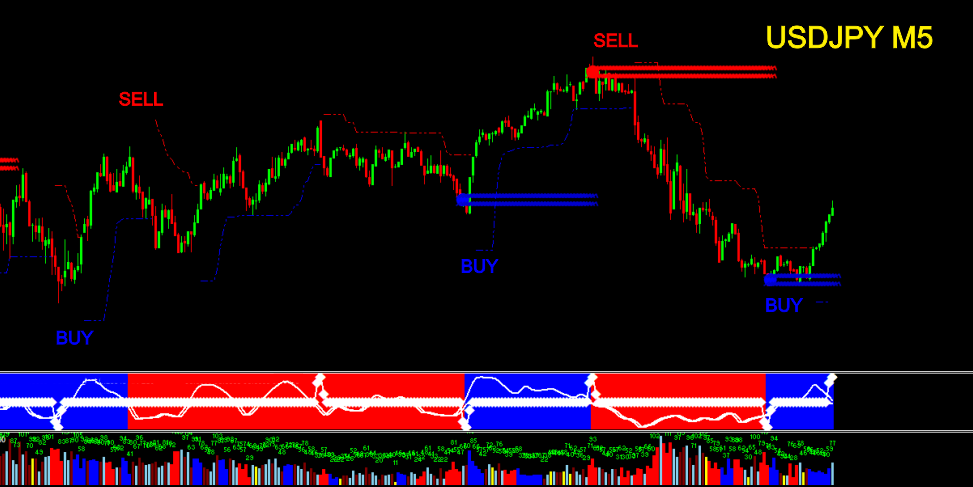

Watch for trend reversal alerts.

A buy signal appears when the indicator turns green.

When the indicator turns red, a sell signal appears.

In just 30 minutes a week, you can make profitable trades.

Unlimited License

Market price: US$209

Unlimited User Accounts

Lifetime License

A system designed for Forex, but it is very profitable in binary.

Here you only pay: 89.98 USD

System is designed for all trading styles

Yellow Bulls

Day Traders

Swing Traders

Reviews

There are no reviews yet.