Piercing Pattern Trading Strategies

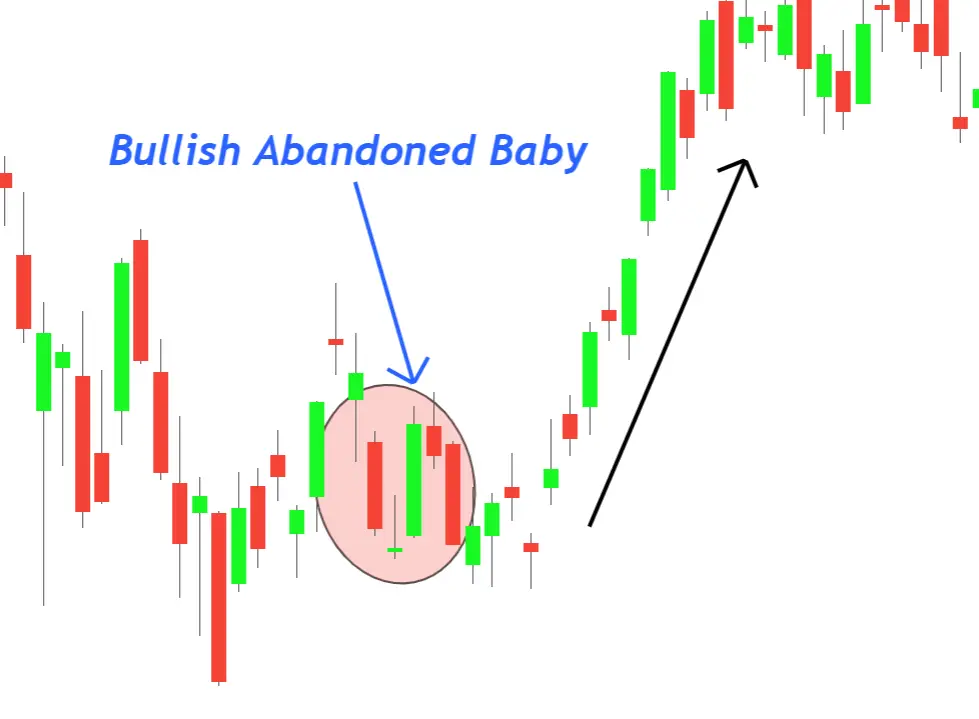

The price structure is the same as that of the morning star doji candlestick. The gap between Doji candles is different. This candlestick is rarely seen on a price chart. You will usually see this pattern on the price chart for stocks and indices.

How do you identify an abandoned baby Candle?

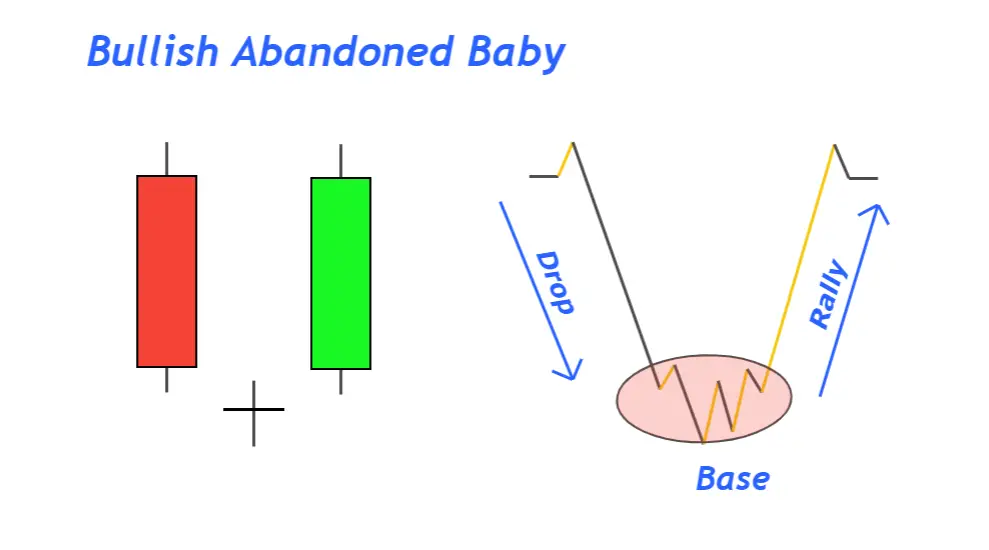

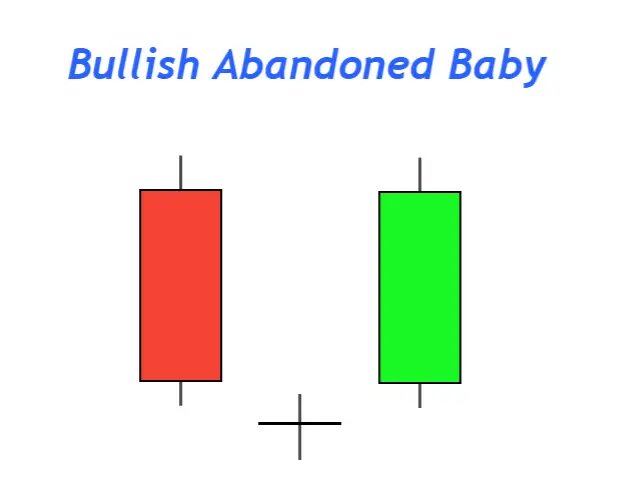

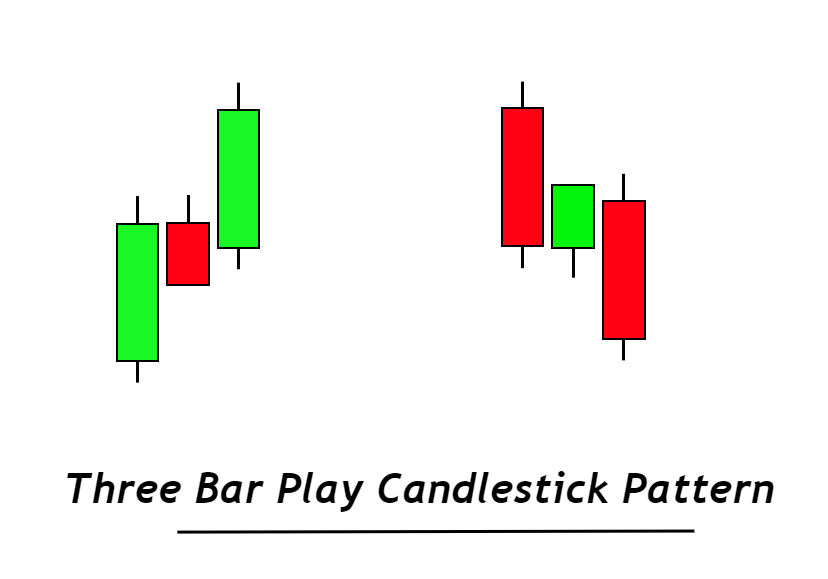

This is a pattern of three candles in which the candlesticks are arranged in a certain order. Making rules can help you reduce the chance of false patterns.

Please follow the rules below

- Rule 1 The first candlestick is a bearish, with a body-to-wick ratio of at least 60%. The previous trend should have been bearish.

- Rule 2: A doji should open with a downward gap and form below the ranges of bearish candles.

- Rule 3: The third bullish candlestick should have an opening gap and a body-to-wick ratio of 60% or higher.

The conditions of an ideal bullish abandon baby pattern are as follows: The pattern can still have more than one Doji after the first bullish candlestick.

Bullish Abandoned Baby: Information Table

| The following are some examples of | Explanation |

|---|---|

| Candlesticks | 3 |

| Prediction | Bullish trend reversal |

| Prior Trend | Bearish Trend |

| Counter Pattern | Baby abandoned by a bear |

The technical analysis of the abandoned baby candlestick

To make the best decisions when trading, you must first understand the psychology behind the candlestick pattern.

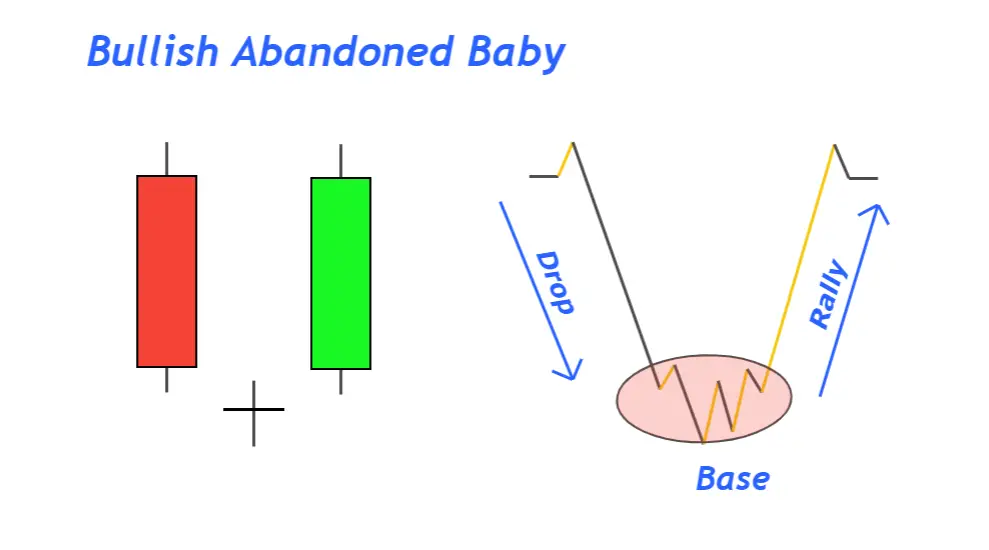

Rule 1 says that sellers are in charge if there is a bearish pattern before the candlestick. A significant bearish candlestick indicates that a key level has been broken.

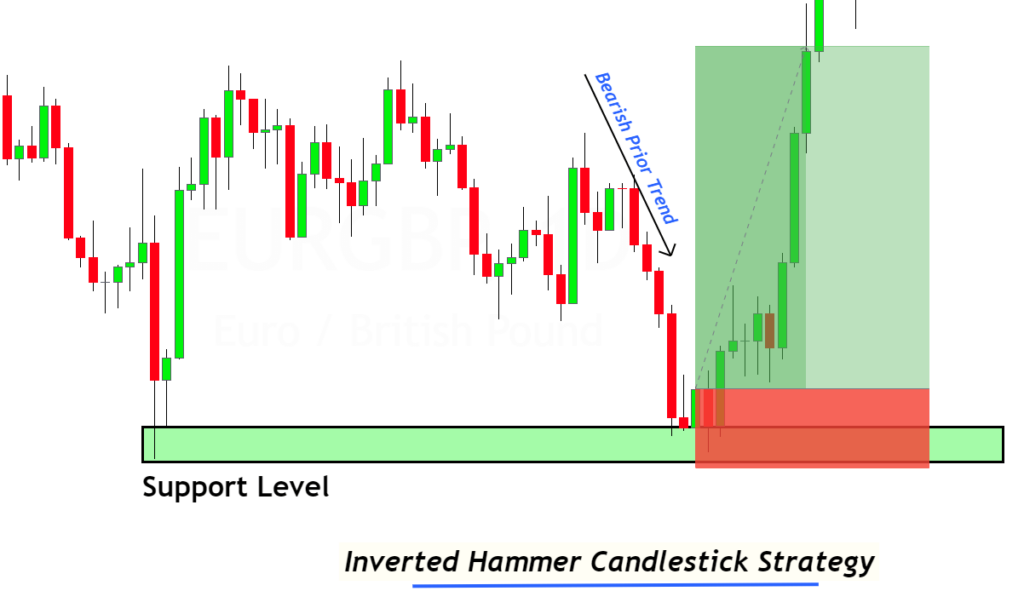

A Doji candlestick with a gap will appear after the breakout. This shows oversold market conditions and a pause to the trend. The market will then be in a state of indecision. It can either continue the previous trend or reverse that trend.

The formation of big bullish candles with a gap after Doji candles shows that the market is decided and buyers are now in control. The price has now closed back within the key area after a false break out. It is an indication of a bullish reversal.

They will now increase the price of the product in the future.

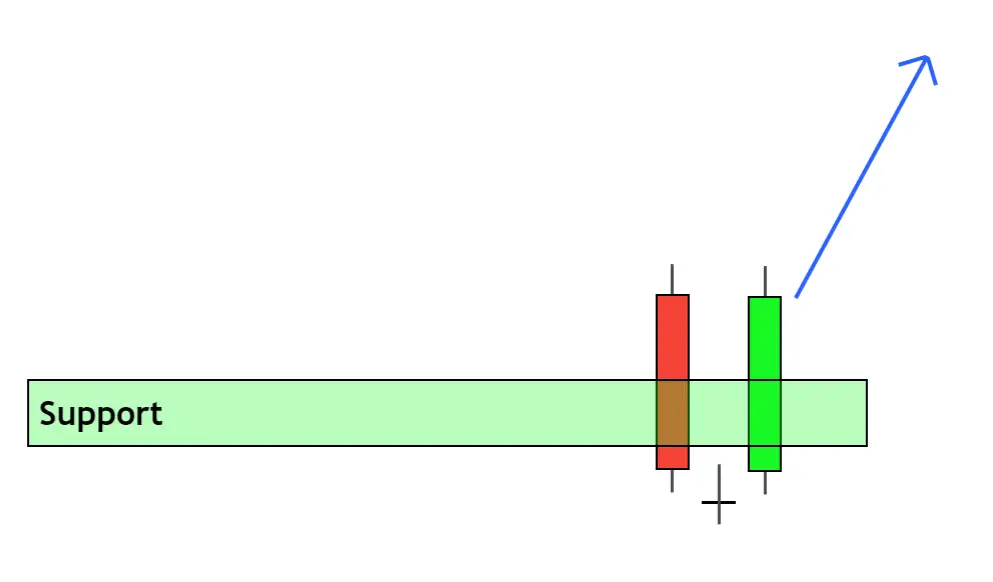

Baby candlesticks: Best conditions for working

- The support zone or demand zone should be formed

- This candlestick pattern will be more powerful if the oversold condition is present.

- This pattern is not suitable for trading in range-based market conditions.

Difference between Bullish abandoned baby & morning doji star pattern

The morning Doji star is very similar to the bullish abandoned baby. They are similar, but there is a small difference between the Doji candles.

- The doji-shaped candlestick will have a gap at the bottom of its opening and closing, similar to an abandoned baby. The morning doji stars, on the other hand, will have the doji candlestick open at a level that is almost the same as the previous bearish candles.

- The morning doji stars pattern has just one doji, but the abandoned baby pattern can have more than one.

Both candlesticks are bullish trend reversal candles. Baby candles that have been abandoned are rare in forex charts, but they can form on stock charts.

The Bottom Line

This trading setup is difficult to find in forex currency pairs due to the tight market conditions. It is therefore recommended that you trade this candlestick pattern on stocks and indices.

This indicator can be used only to determine if the trend is reversing in forex. I won’t recommend making a strategy for trading based on a chart candlestick that has a very low chance of formation. The candlestick chart can be useful in many ways. For example, you can use it to determine if a trend is reversing, or analyze a pair of currencies, and set stop-loss limits.

Responses