Shooting Star Candlestick Pattern

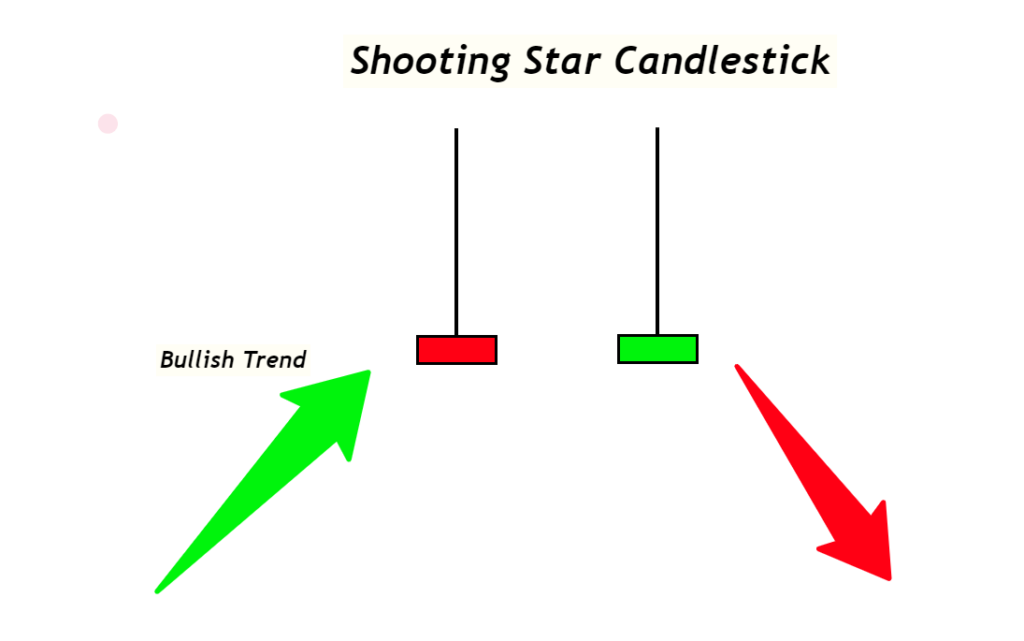

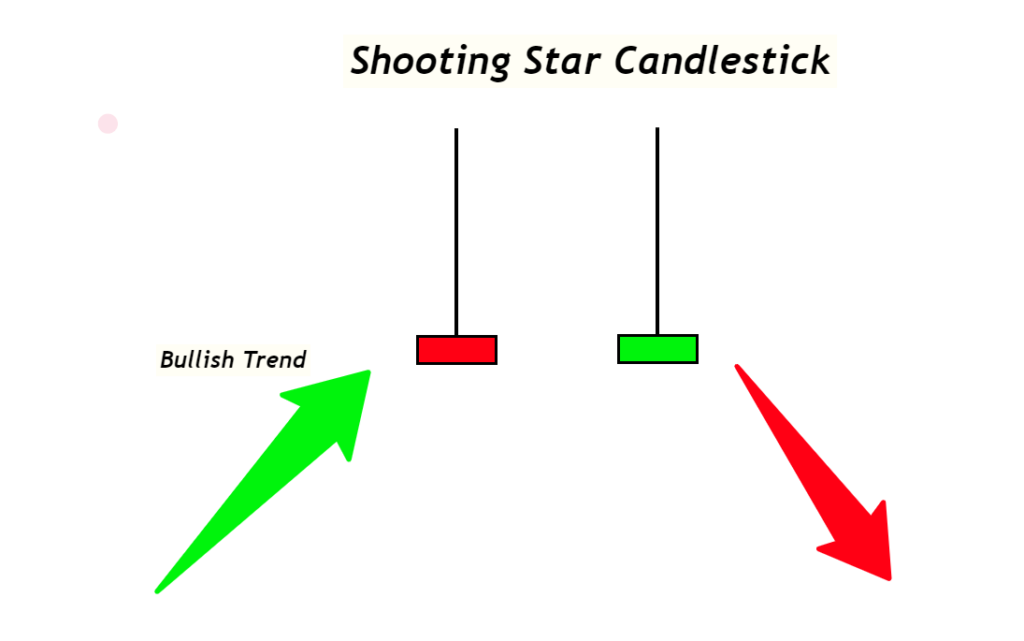

It is a pattern of bearish reverse candlesticks that consists of a single candlestick, with an extended upper shadow and a smaller body at the bottom. The pin bar bearish pattern is also represented by it.

Shooting star candlestick patterns are widely used by retail traders to forecast market price trends. Shooting star candles are a sign of strong sellers and market control. It transforms a bullish market trend into one that is bearish.

In this post, you’ll learn about the shooting star candlestick pattern’s structure, significance, trading psychology, and trading guide.

What is the best way to make a shooting star pattern for a candlestick?

Three stages will be required to identify the perfect pattern for a shooting star candlestick.

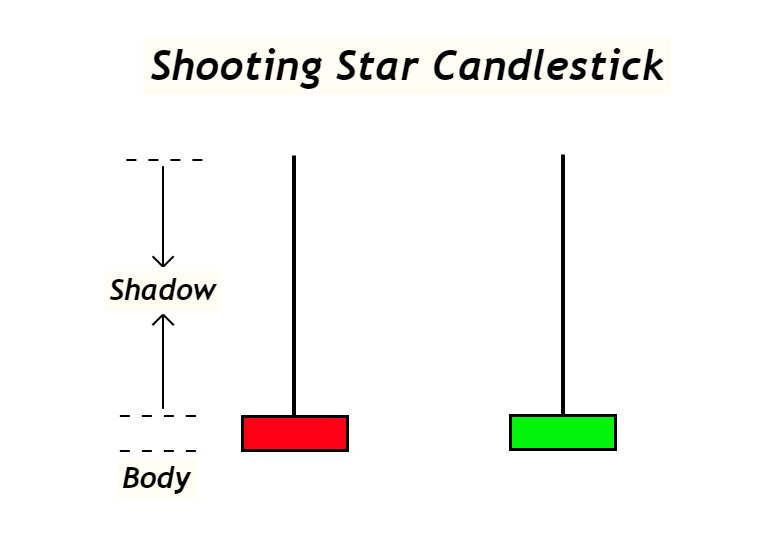

Candlestick structure

It consists of an upper shadow with a smaller body at the bottom and a shooting star candlestick. It should cover 70% of the body. The body must be less than 40%.

The candlestick must have no shadow or very little below its body. If it is not, the candlestick will not shine like a shooting star.

It does not matter which colour the shooting star pattern has, green or red. The shape of the candlestick is important.

Prevailing Trend

Should be bullish the trend that preceded the shooting star candle. Because it indicates overbought conditions and a false breakout, this is an essential condition of the shooting star candle.

The previous bearish trend will be the pattern of choice.

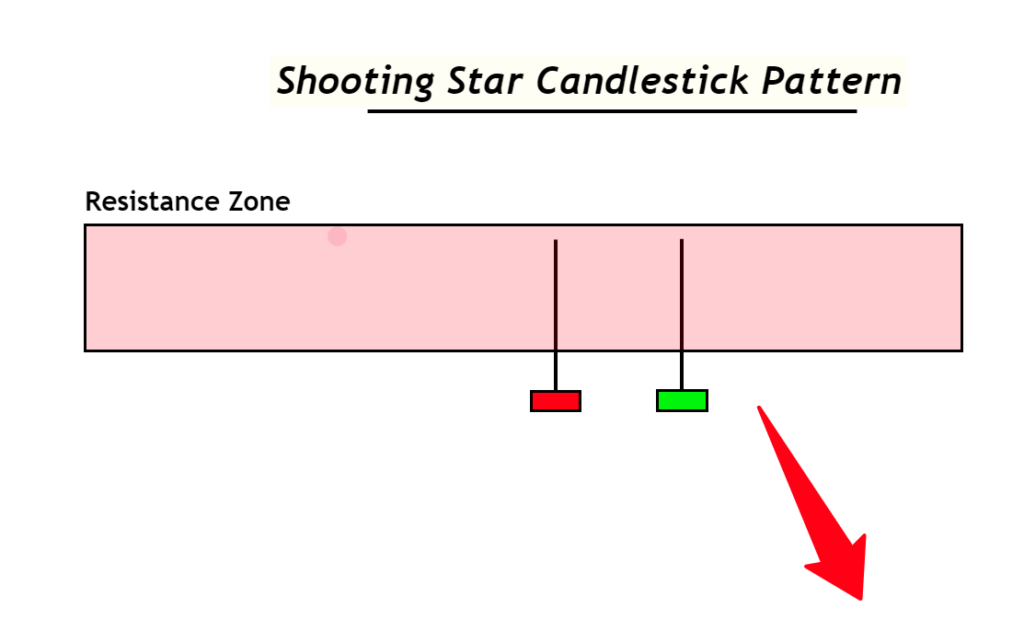

Where to place the candlestick

A key level, or strong resistance level is the ideal location for the shooting star candlestick patterns. It will indicate that the price is rejecting the key level and it can be a sign of a bearish trend reversal.

Remember that long shadows should not form within the same range as the candles.

Shooting Star Information Table

What can the trading star symbol tell us?

You must understand the psychology of a pattern before trading it. The psychology of candlestick patterns requires that you answer these questions.

What is the reason for the shooting star shape?? How do you make the shooting star formation look so beautiful?? Is this the right pattern??

After finding the answers to the above questions, you will understand a pattern correctly, and you’ll be able to find the most accurate patterns from the price chart.

Let me explain in detail

A candlestick’s shadow always indicates a rejection of a given price. Sellers are waiting to get their buy orders filled when buyers increase the price. When sell orders are triggered from a certain level, the price will decrease again, showing sellers’ dominance over the buyers. The sellers were defeated because the buyers couldn’t keep pushing up the price.

In technical analysis, if the price goes up and then closes below 50% of the total candlestick’s range, it is a sign of the strength of sellers.

There are other reasons to be thankful for Trend reverse The overbought condition is important for shooting star patterns because it means that the previous trend has to be bullish. The chances of the trend reversing from resistance levels increasing when the price has already reached the overbought level are higher. This confirms that the bearish trend is reversing by the formation of the shooting stars candle at the resistance level.

It is this simple psychology that explains the shooting star candle, which every retailer trader should learn through technical analysis.

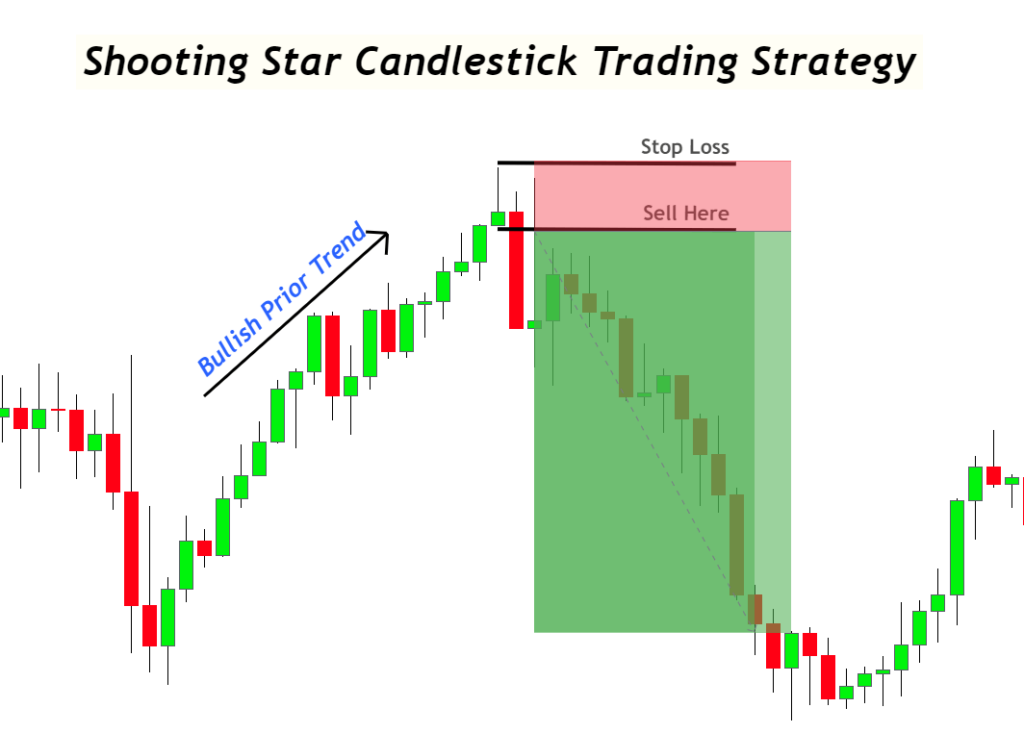

What is the best way to trade with a shooting stars candle?

You must identify the order entry, stop loss and take profit levels when trading the shooting star patterns. But, trading the candlestick pattern by itself is not my recommendation. Trading strategies must include the combination of several technical tools in order to maximize the chances of success.

Tip: A candlestick pattern doesn’t tell us what the take-profit levels are. Candlestick patterns can only be used to identify a trend reversal. They cannot however, serve as indicators of stop loss or order entry levels. To find the take-profit levels in trading, I recommend a combination of technical tools such as chart patterns.

Shooting star trading signal

Once a shooting star candlestick has formed at resistance, place a buy order immediately. For high risk entry and a high reward ratio, place your stop loss level just a few pip above the shooting star candlestick’s high. If you prefer a more conservative trading setup, place your stop loss higher than the resistance zone.

Let’s get to the bottom

Candlestick patterns were developed by Japanese traders and are now widely used worldwide by retail traders for technical analysis of the asset’s trend.

First understand the structure of the candle. Then learn about its psychology. Finally, use that knowledge to create a trading strategy. Trading candlestick patterns is easier when you do this.

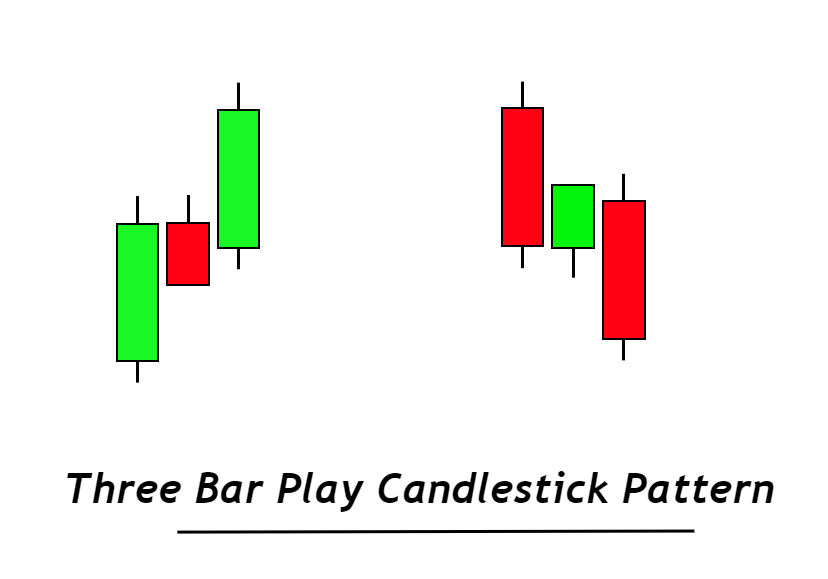

There are several candlestick patterns, but you shouldn’t confuse yourself to finding the best one. You can master the four most popular candlestick designs by simply choosing one.

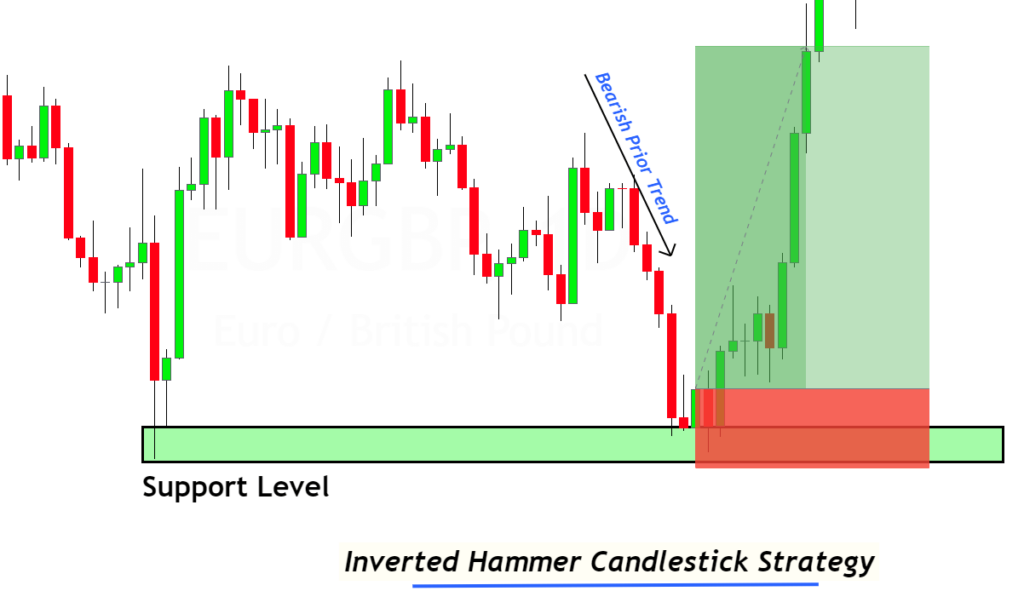

Is there a winning percentage for shooting star candles? It is dependent on timeframe, risk management, and financial asset that the winning percentage for a candlestick pattern depends. It is possible to win more than 60% if the risk/reward ratio is 1:1 and you add overbought and resistance conditions. How will it turn out if a shooting star candlestick appears after a downtrend is over? This will create a trend reversal signal, even if there is a formation of a candlestick in a downtrend. However, the inverted hammer candlestick name will be used instead of shooting star. That’s why understanding trading psychology is very important. You can change the position on the chart to alter the sense of a pattern in candlesticks. What is the color of the shooting stars? It doesn’t matter if the candlestick is red or green. The only thing that matters is the candlestick’s location, prior trend, and structure. The candlestick will always forecast a trend reverse in a bearish direction.

Responses