Description

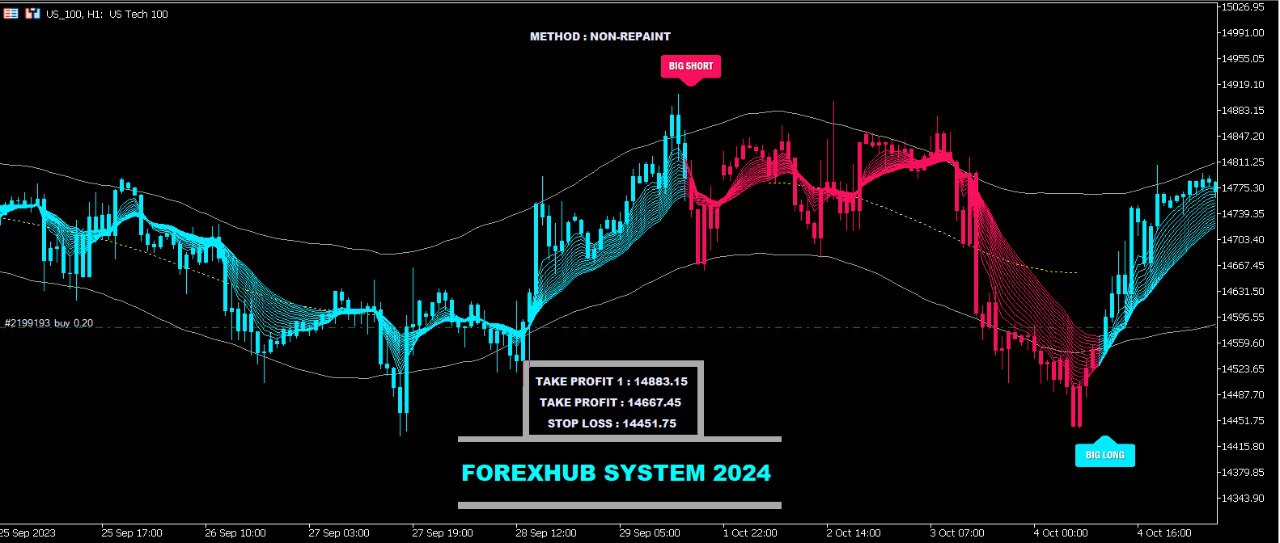

– Indicator and EA included

Serial Key: fx141.com

– Maximum accuracy up to 97%, one of our best to date!

– Automated trading is also available, including free EA’s – minimum required amount – $10.00

– High precision bands for 100% confirmation

– Volatility entries and reversal entries (depending on timeframe)

– Finally added news filter

– Low retracement of 2%, up to 10% expected, also changeable on the spot!

– Works on all currency pairs and CFDs, including indices

– No repainting, no lag

– Up to 300% weekly returns

– Fresh signal types for real performance

– All types of alerts for the indicator

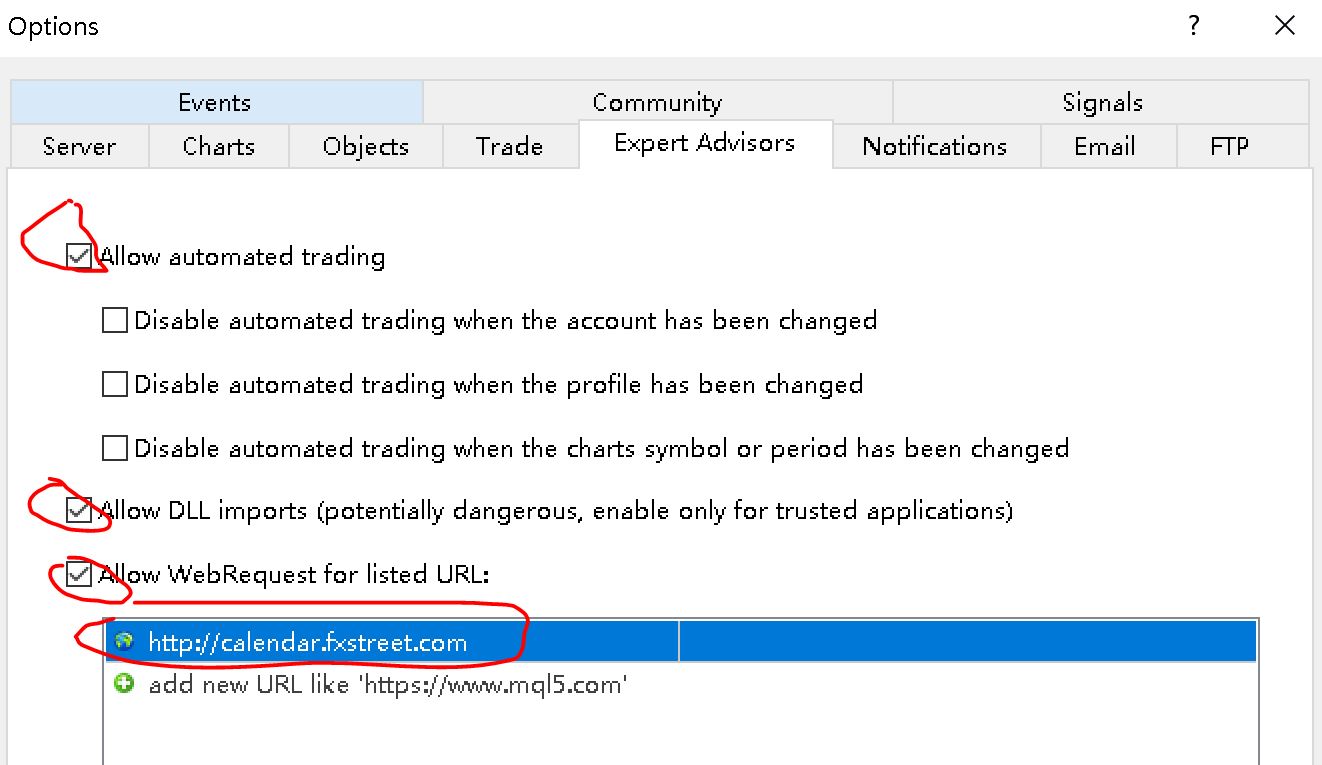

Setup EA:

http://calendar.fxstreet.com

Recommended Currency Pair: gbpUSD/Gold

Recommended Timeframe: 5 minutes

Range bar trading is based on a unique charting method that plots price action differently than traditional time-based charts. Range bars represent price movements within a specified price range, rather than time intervals, allowing traders to filter out market noise and focus on price movement. Here’s a breakdown of a range bar trading strategy:

Understanding Range Bars:

- Range Definition: Each bar represents a defined price movement or range (e.g., 5 points, 10 points, etc.) instead of time intervals.

- Volatility-Based: Bars form only when price moves by the specified range, filtering out periods of low volatility.

- Uniformity: Regardless of time, each bar encompasses a fixed price range, offering clearer trend visibility.

Range Bar Trading Strategy Components:

- Determining Range Size:

- Choose an appropriate range size based on the market’s volatility and your trading style. Higher ranges capture more significant price movements but may reduce trade frequency.

- Trend Identification:

- Use multiple range bar charts to identify trends. Higher-range bars can highlight the primary trend, while smaller-range bars can reveal short-term fluctuations.

- Entry and Exit Signals:

- Breakouts: Look for price breakouts above or below the range bar patterns to signal potential entry or exit points.

- Reversal Patterns: Analyze range bar patterns (like double tops/bottoms) for potential reversal signals.

- Risk Management:

- Set stop-loss orders based on the range bars’ volatility and your risk tolerance.

- Calculate position sizes relative to each trade’s range, ensuring risk aligns with potential profit.

- Backtesting and Optimization:

- Test the strategy on historical data to evaluate its effectiveness.

- Optimize range sizes and entry/exit conditions to suit different market conditions.

- Continual Monitoring:

- Monitor range bar patterns and price action for potential changes in market conditions or trends.

Advantages of Range Bar Trading:

- Reduced Noise: Filters out insignificant price movements.

- Clearer Trend Identification: Helps identify trends more accurately.

- Adaptability: Works well in various market conditions.

Challenges:

- Initial Setting Selection: Determining the right range size can be subjective.

- Execution Complexity: Requires close monitoring due to fewer but more precise trading signals.

Caution:

- Always combine range bar analysis with other technical tools or indicators to validate signals.

- Practice risk management to protect against potential losses.

Remember, range bar trading requires understanding price action and constant adaptation to changing market dynamics. It’s essential to test and refine the strategy based on your trading preferences and the market’s behavior.

Reviews

There are no reviews yet.