Description

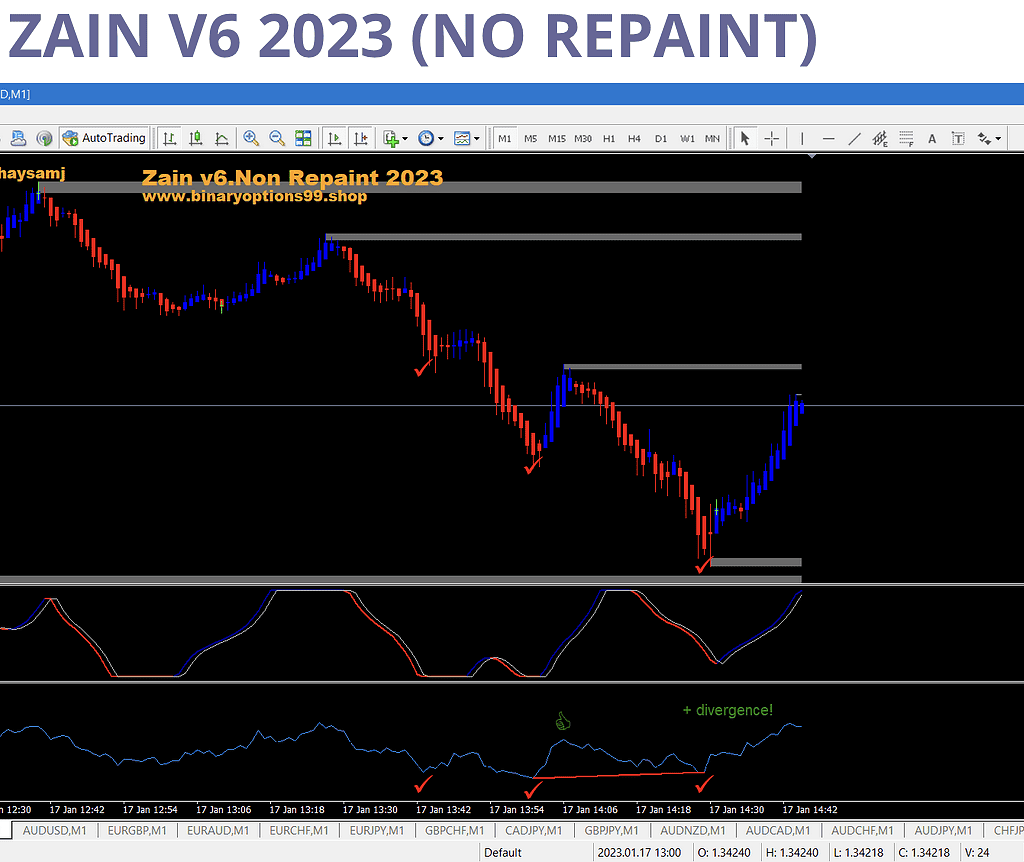

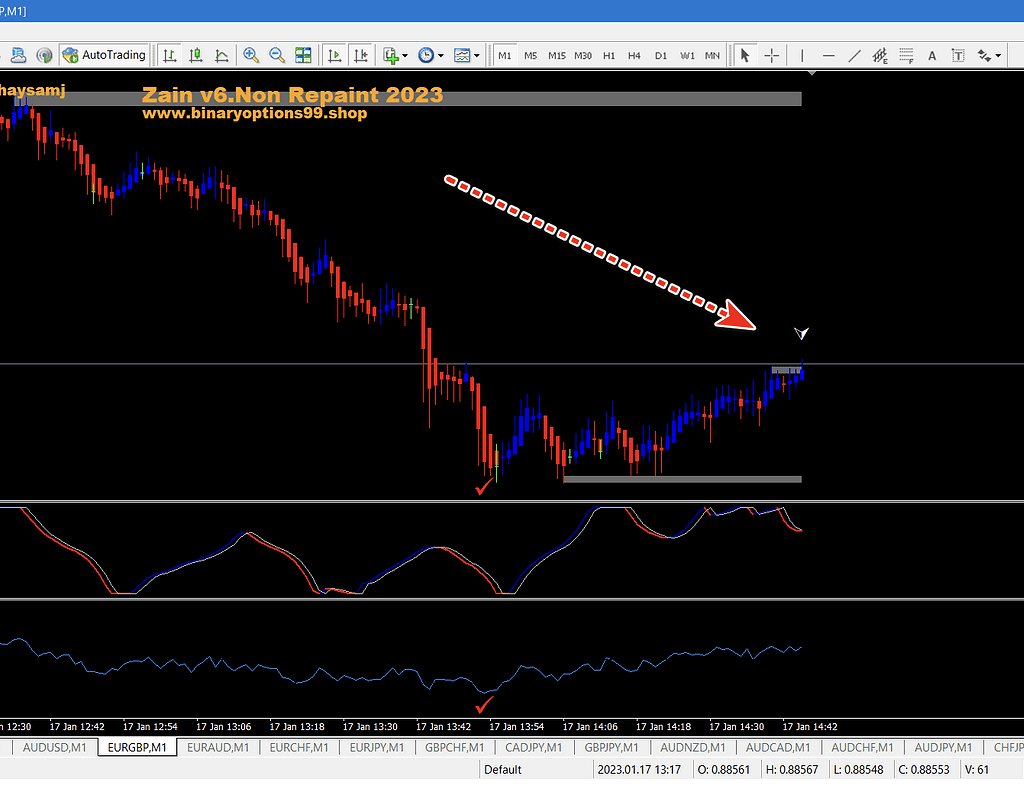

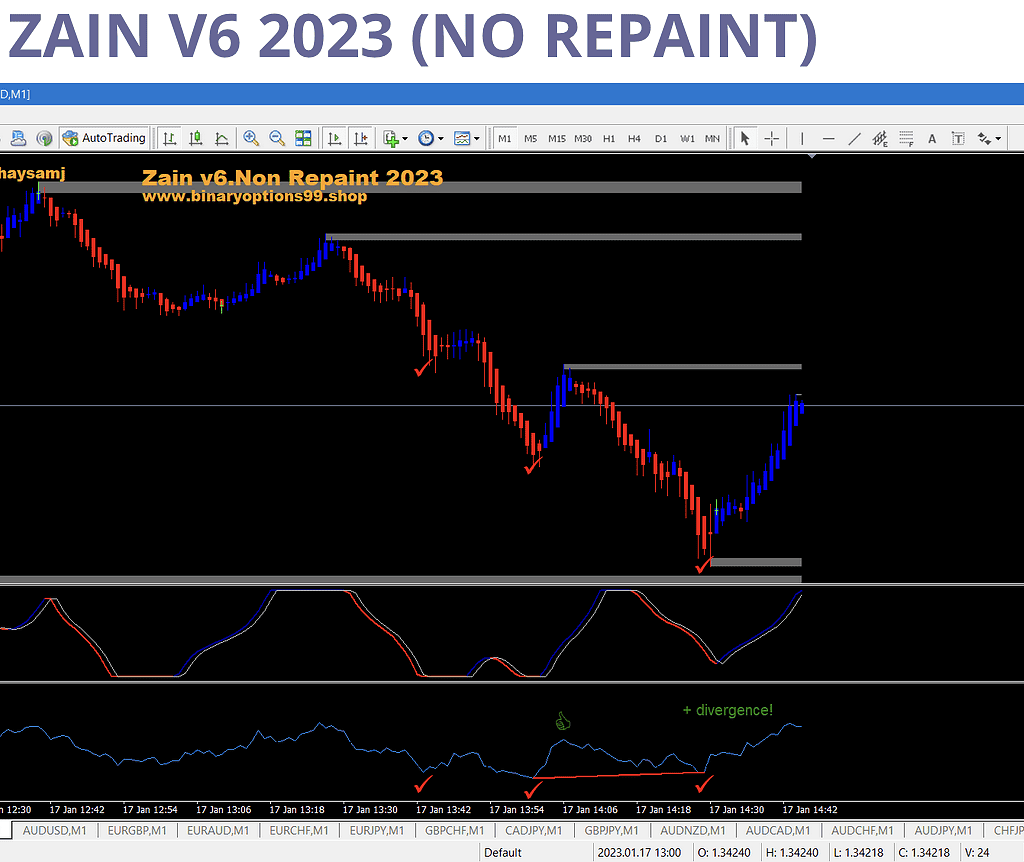

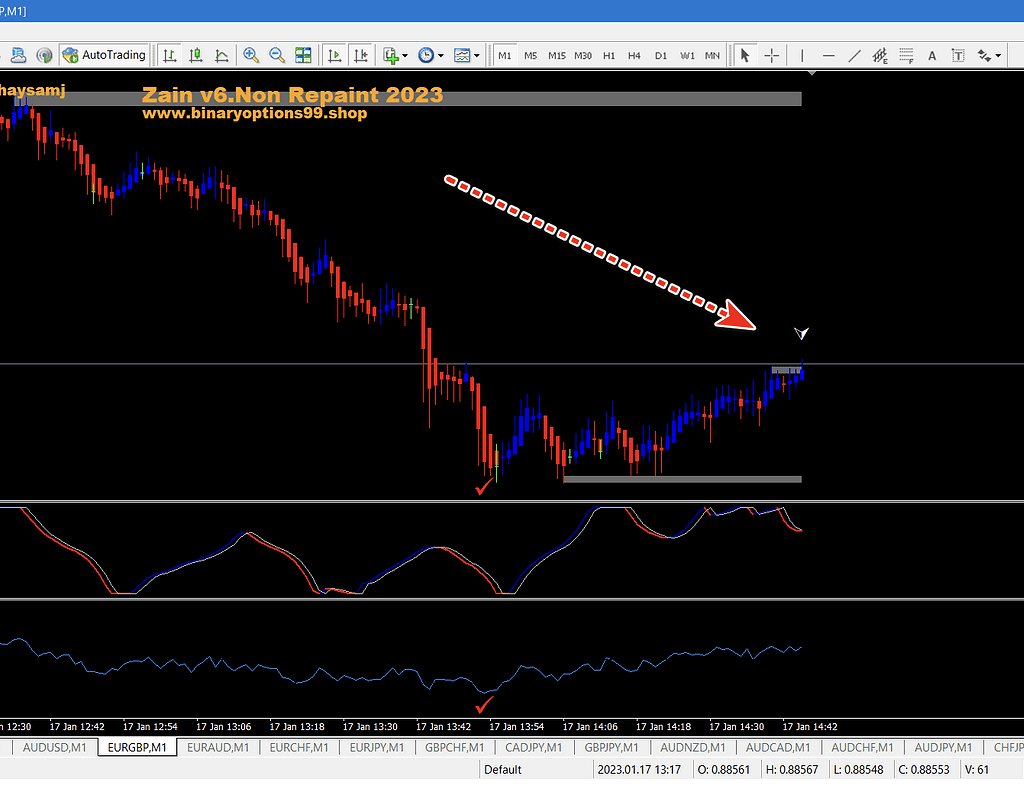

Content: Indicators: zain.ex4, zain v6 rc 2023.ex4, ZAIN V6 2022_fix.ex4, zain co v6 2023.ex4, stochastic-cg-oscillator.ex4, Heiken Ashi-.ex4, Template: ZAIN V6 2023.tpl, How to install MT4 files.pdf

Content: Indicators: zain.ex4, zain v6 rc 2023.ex4, ZAIN V6 2022_fix.ex4, zain co v6 2023.ex4, stochastic-cg-oscillator.ex4, Heiken Ashi-.ex4, Template: ZAIN V6 2023.tpl, How to install MT4 files.pdf

Please confirm you want to block this member.

You will no longer be able to:

Please note: This action will also remove this member from your connections and send a report to the site admin. Please allow a few minutes for this process to complete.

Reviews

There are no reviews yet.