dmi indicator mt4

DMI (Directional Movement Index) This indicator (Directional Movement Index) is a technique for determining direction. It was invented by Wels Wilder in 1978. The distinctive feature of this DMI indicator is that the method used is not based on the closing price of the bar chart, but on the analysis of the highest and lowest prices.

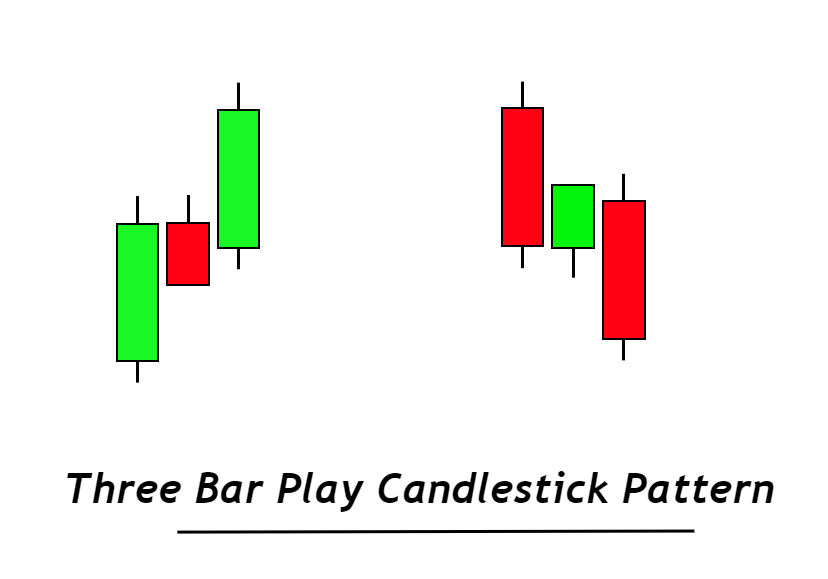

It is the DMI (Directional Movement Index) indicator is a measure of the area of the bar chart related to the first appearance of the candlestick. Thus, in the case that the low and high of the latest candlestick exceeds the value of the previous candlestick. Then the part of the bar that protrudes upwards relative to the previously appeared candlestick is considered to be in an uptrend. If the price of the low and high is less than the previous bar i.e. the most extreme part of the candlestick extending downward relative to the previous candlestick is considered to be in the upward direction.

What is the function of the DMI indicator?

DMI can be described as an oscillator that is very easy to understand for traders who are just starting to trade, also due to its visual appearance. The indicator displays three colors. Each of them indicates a specific phase of the market. Gray marks a consolidation. Green shows the beginning of a bullish phase of the market. Orange shows as the market enters a bearish phase.

However, you may also notice some noise in this indicator, which is a subjective issue for each instrument you study with this indicator. Therefore, it is recommended to experiment with signal periods and DMI periods. You may also consider switching to a different time period to reduce the noise.

Indicator trading strategies for DMI

Here is a basic approach based on the DMI indicator.

The DMI indicator is a buying strategy used to buy

Observe if the indicator color changes to green.

Check if the indicator value is at or above zero.

Observe if the candlestick of an uptrend is ending.

Start a long trade and set a stop loss at the recent low of the swing. Set a profit target at the next resistance level.

DMI Indicator Sell Strategy

Observe if the indicator color changes to green.

Verify that the indicator value must be greater than zero.

Observe if the candlestick of the bullish trend is ending.

Start a long trade using a stop loss placed near the current swing low. Set a profit target at the next resistance level.

Conclusion

The DMI indicator can play an important role in your analysis of the technical aspects of the market. However, it should not be used as the only method for trading. It is recommended to verify your entry by using other tools.

Responses