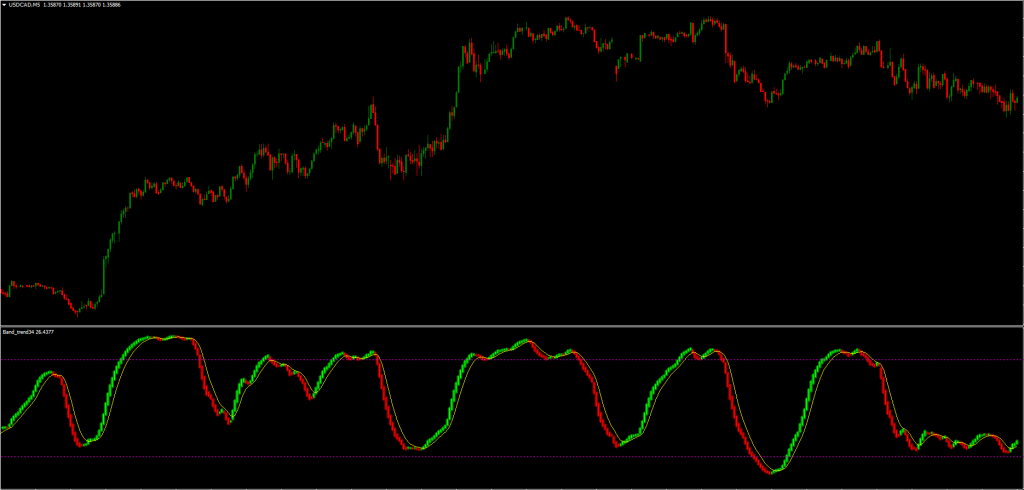

This Alfa Trend indicator for MetaTrader is a tool to follow trends built with the relative vigor indicator (RVI), an axis line, and indicators for trend reverse. It is believed that the RVI and centerline work together to detect trend reversal and bias zones.

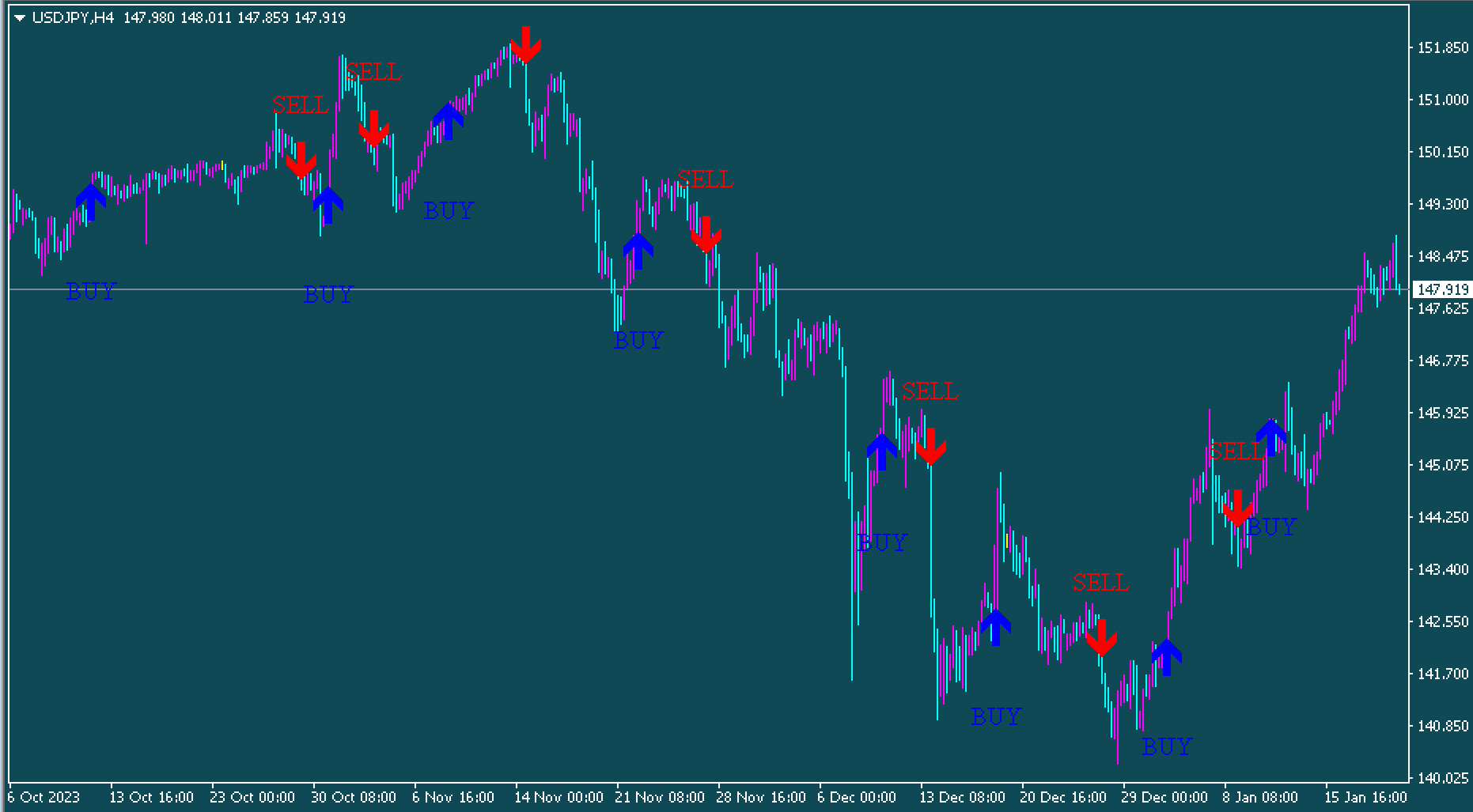

The indicator displays a red or blue arrow that signals a buy or sell signal, and vice versa. The signal of the indicator is suggested to be utilized in conjunction with price action for greater effectiveness. Furthermore, it is appropriate for scalpers, daily, intraday, and swing forex traders.

How to Trade With the Alfa Trend Indicator

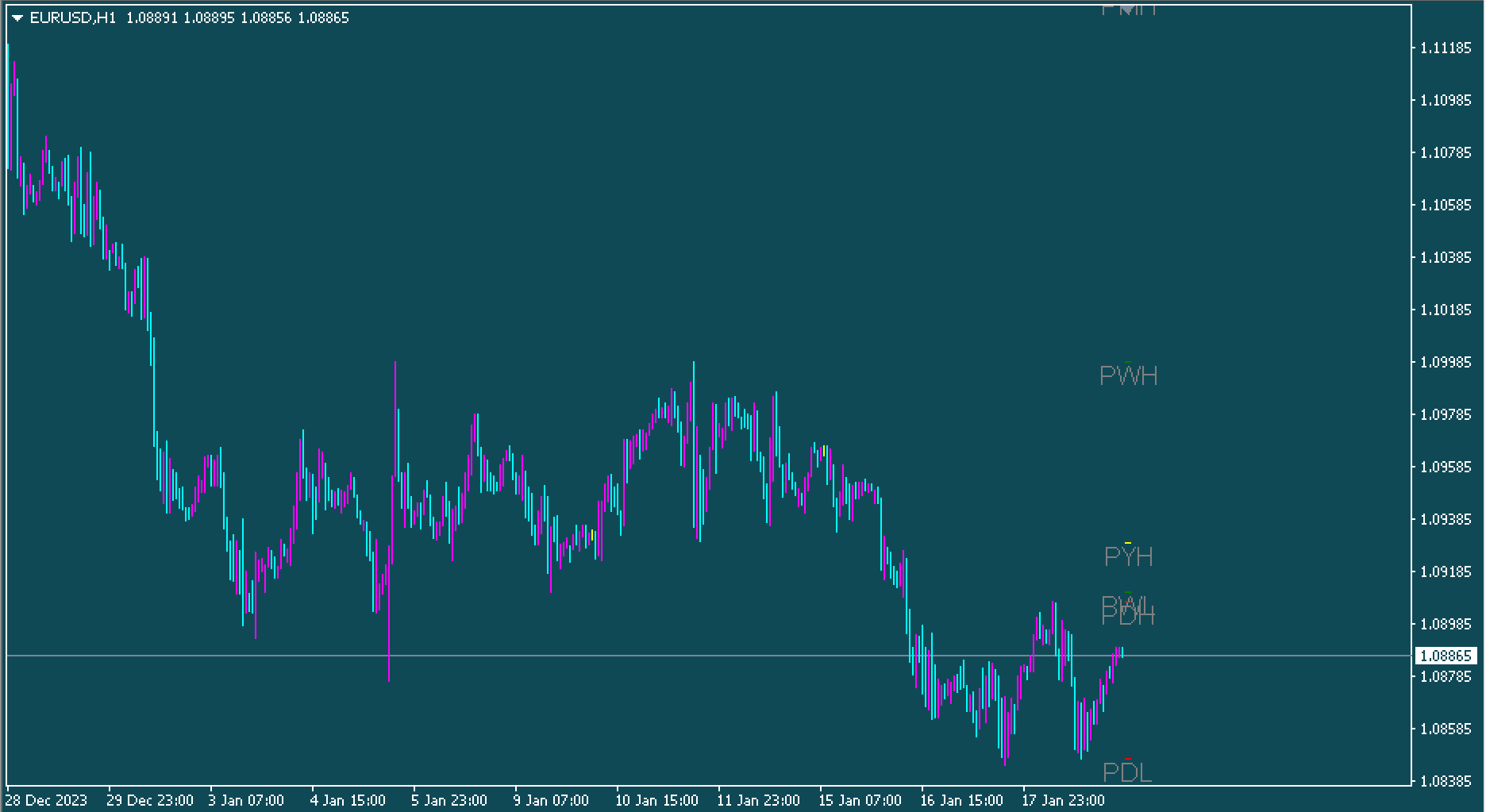

This buy sign (blue arrow) that is visible in this picture was drawn on a candlestick, which has impressive bullish momentum. Additionally, the bullish momentum candlestick was also preceded by a bullish engulfing chart pattern of candlesticks, an indication of a possible upward trend.

However, this signal of selling was legitimate since the indicator drew an arrow of red on the bearish engulfing candlestick pattern chart. Additionally, the signal is in sync with the trend reverse signal illustrated on the bearish candlestick, which was drawn in the upper part of the.

Conclusion

The Alfa Trend indicator for MT4 is a trend-following instrument that draws a buy/sell sign at the trend reversal zone. In addition, it’s available for download at no cost.