IC Markets Review

IC Markets, founded in 2007 and based in Sydney, is the first Australian forex trading broker, and one of the biggest in the world. They have also been booming in recent years. IC Markets is renowned for its cutting-edge ECN technology, a factor that has enabled it to become one of the best brokers in terms of spread. For this reason, IC Markets is often the first choice of scalpers and day traders, i.e. traders with a high volume of daily operations.

Added to this attraction is the fact that IC Markets are very well-regulated by ASIC and CySEC, two of the most recognized regulatory bodies in the forex trading industry. They also boast some of the very lowest spreads for forex traders. This means that the spreads start from 0 pips on trading in many major markets. IC Markets also offer lightening fast order execution which has them widely considered as one of the best brokers for forex trading.

| 🏢 Headquarters | Australia |

| 🗺️ Regulation | ASIC, CySEC |

| 🖥 Platforms | cTrader, MT4, MT5 |

| 📉 Instruments | FX, Equities, Commodities, Futures CFDS, Stocks and Bonds, Crypto trade |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 0 US$ |

| 💰 EUR/USD Spread | 1 pip |

| 💰 Base currencies | 10 currencies offered |

| 📚 Education | Included on a free basis |

IC Markets Pros and Cons

In the table below you will find some of the key IC Markets advantages and disadvantages highlighted:

| IC Markets offer | Advantages | Downsides |

|---|---|---|

| Demo Account | Unlimited trial | It will expire after 30 days of inactivity |

| Minimum Deposit | $0 | Conversion fee may be applied |

| CFDs and Forex | Fast execution | Limited amount of tradable assets |

| ECN Account | Low spreads (0 pips) and commissions per lot (from $3) | Limited amount of tradable assets |

| Copy Trader | Available through external services | ZuluTrade partnership only for EU traders |

| Swap-free Account | Same trading feature of others accounts | There is an extra fee which starts from $5 |

IC Markets CFDs and Forex Trading Review

When it comes to trading CFDs with IC Markets, you’ll find assets available in a variety of areas. This means all the major Forex currency pairs you would expect to see and more. CFDs on commodities, bonds, stocks and cryptocurrencies can all be traded here.

Despite the wide range of market options, the total number of assets available is limited compared to some other assets. This means that traders may find a limited total of more than 200 assets, although it is still a large number of carefully selected assets.

While it lacks depth, it has low trading costs. The raw spreads here are the best, starting from 0.0 pips, while the average EURUSD spread is only 0.1 pips. Overall, these low costs and spreads make IC Markets very attractive to those looking for the best all-around trading experience.

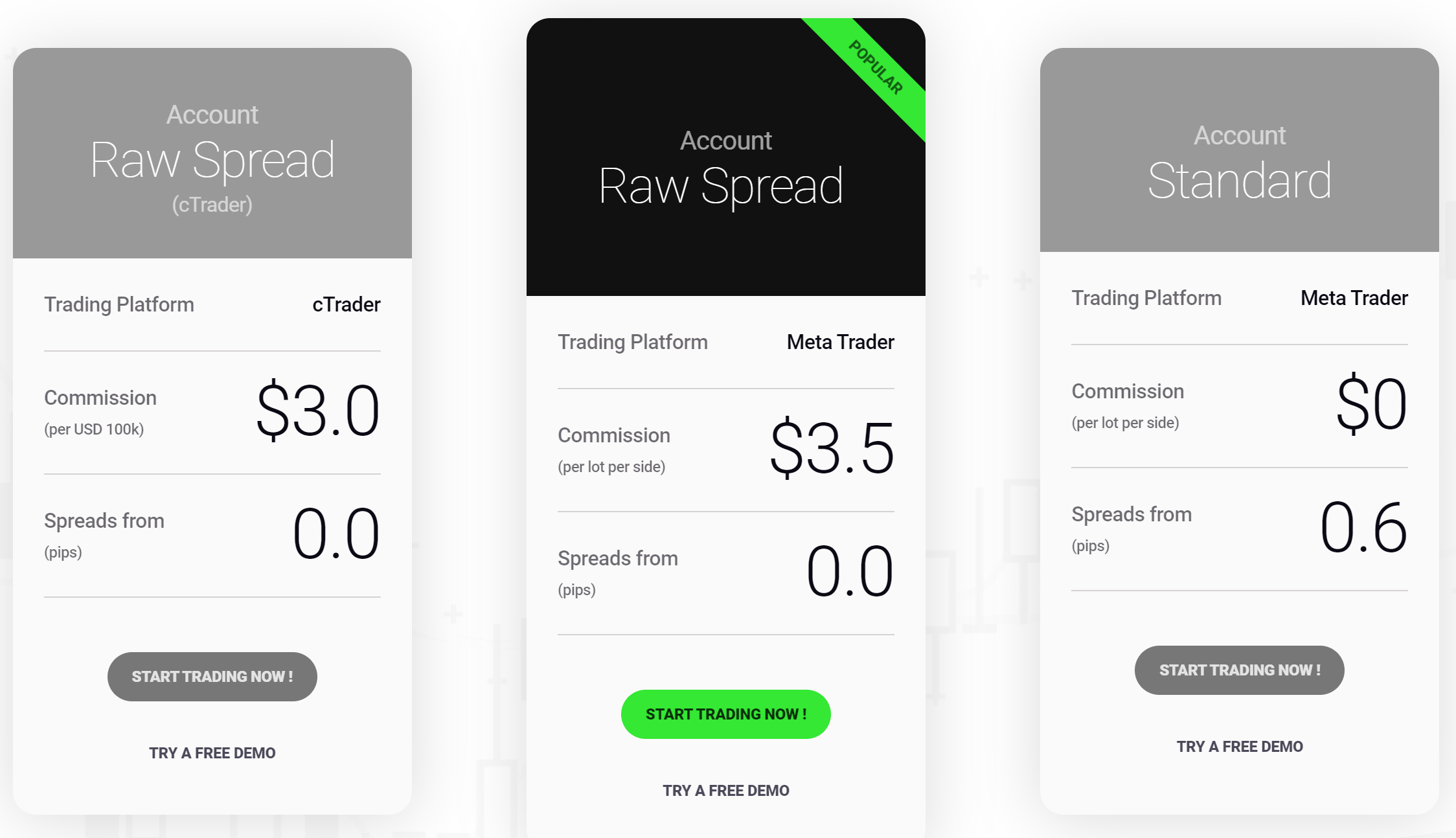

Types of accounts

It is possible to choose from three main types of accounts that have the same features and compatibility offered by the company, however, they are created to meet the expectations and requirements of various trading styles. Two accounts are the first to offer original spread conditions and commissions per trade, with a choice of MT4 or Ctrader.

- Mobile Platform

Mobile apps are also available and are very useful for traders who want to stay up-to-date with the latest market developments on the move. In addition, MT4, MT5 and cTrader can be accessed via Android as well as iOS devices, along with the ability to manage accounts and control positions.

Automated trading

In addition, automated trading is compatible with all brokers’ platforms, with EA on MT4 and MT5, myfxbook on cTrader and, as an additional feature, ZuluTrade. zuluTrade is one of the top social trading platforms, which allows users to choose among hundreds of skilled traders and also to monitor for free the trading signals of its traders.Customer Support

IC Markets strives to provide not only the most advanced technology, but also high-quality customer support and service. The broker’s support is available 24 hours a day and has customer offices in different regions to ensure that every world has an IC Markets available to answer or help team.Education

Finally, the IC Markets team has many years of experience in the Forex market, which is why they know exactly what traders need and want. Educational resources are free and allow you to gain an accurate understanding of the subject through regular technical analysis reports and video tutorials, as well as webcasts, information tools and more.Tools for research are also readily available, with built-in analytical tools within the platform, as well as a market analysis blog and economic calendar designed for IC markets and trading strategies on the platform.

Spreads

The Standard Account enabled through MetaTrader4 with CNS VPS Cross-Connect and spread only basis from 1.0 pips. While the True ECN account or Raw Account allows micro lot trading from 0.01 size, deep institutional grade liquidity, ECN spreads from 0 pips and commission of 3.50$ per 100k traded available at MT4 also.

Spreads on EURUSD averages at about 0.1 pips 24/5, which is as per the IC Markets expert advisors is currently the tightest average EURUSD spread globally.

cTrader ECN account offering approximately the same feature as MT4, but with the difference of the platform that is used by mainly professional traders of a bigger size. The applicable spread also starts at 0.0 pips and commission of 3.00$ per 100k traded that serves execution through Equinix LD5.

Deposits and Withdrawals

IC Markets offers 10 flexible funding options in 10 major base currencies AUD, GBP, JPY, HKD, SGD, NZD, CHF, CAD, EUR, USD. Which is great, since you may choose the suitable one for you and avoid extra conversion fees.

Deposit Options

From the client secure area, there is an ability to deposit or withdraw funds throughout

- Cards,

- PayPal,

- Bank Transfer including local ones,

- Neteller, Skrill, WebMoney, Qiwi,

- China UnionPay, FasaPay and more.

IC Markets minimum deposit

Minimum deposit for IC Markets is 200$ for Standard Account on MetaTrader4, along with other two account types available at IC Markets.

Responses