Description

DESIGNED FOR ALL TYPE OF TRADERS

Newbie Friendly Interface. Suitable for Scalping, Daytrading and Swing Trading.

software does not repaint. Not in real time nor in any other conditions.

Whenever a new signal will arise, you will get an instant alert:

– Standard MT4 Pop Up + Sound

– Email Notification

– Push (Mobile) Notification

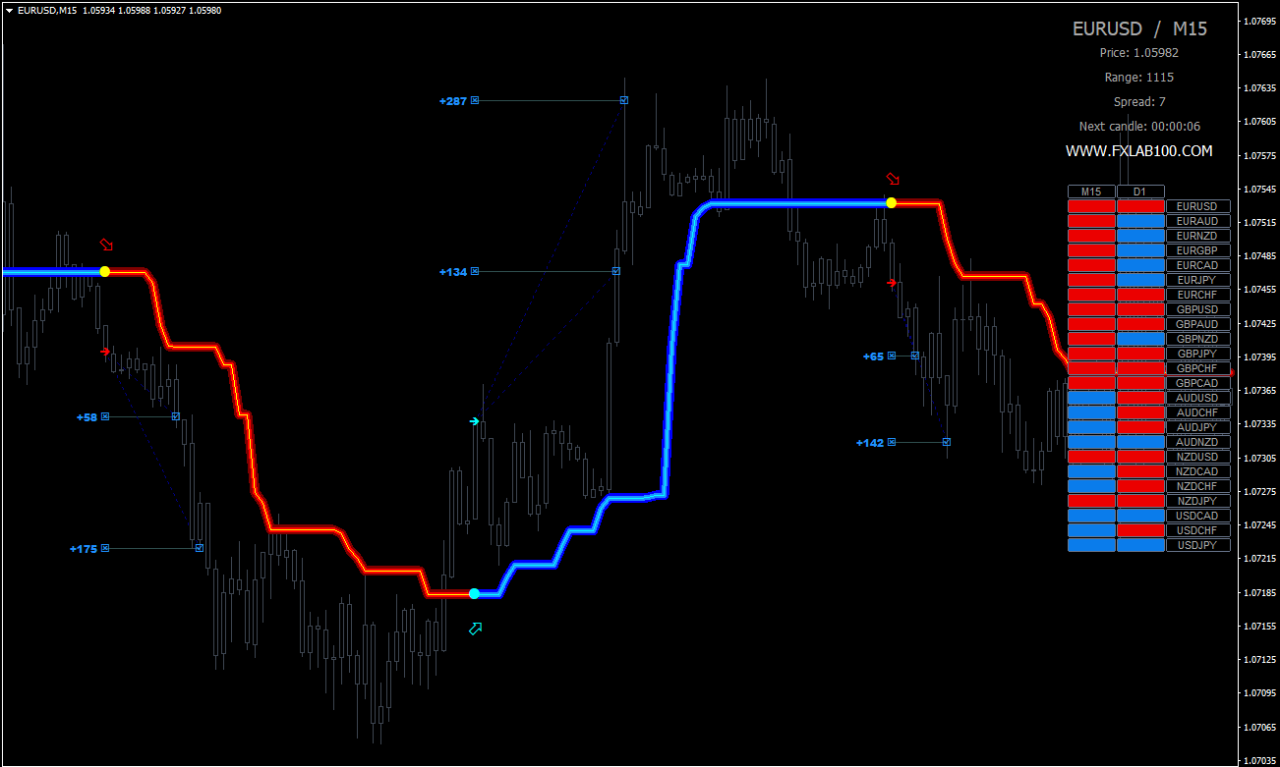

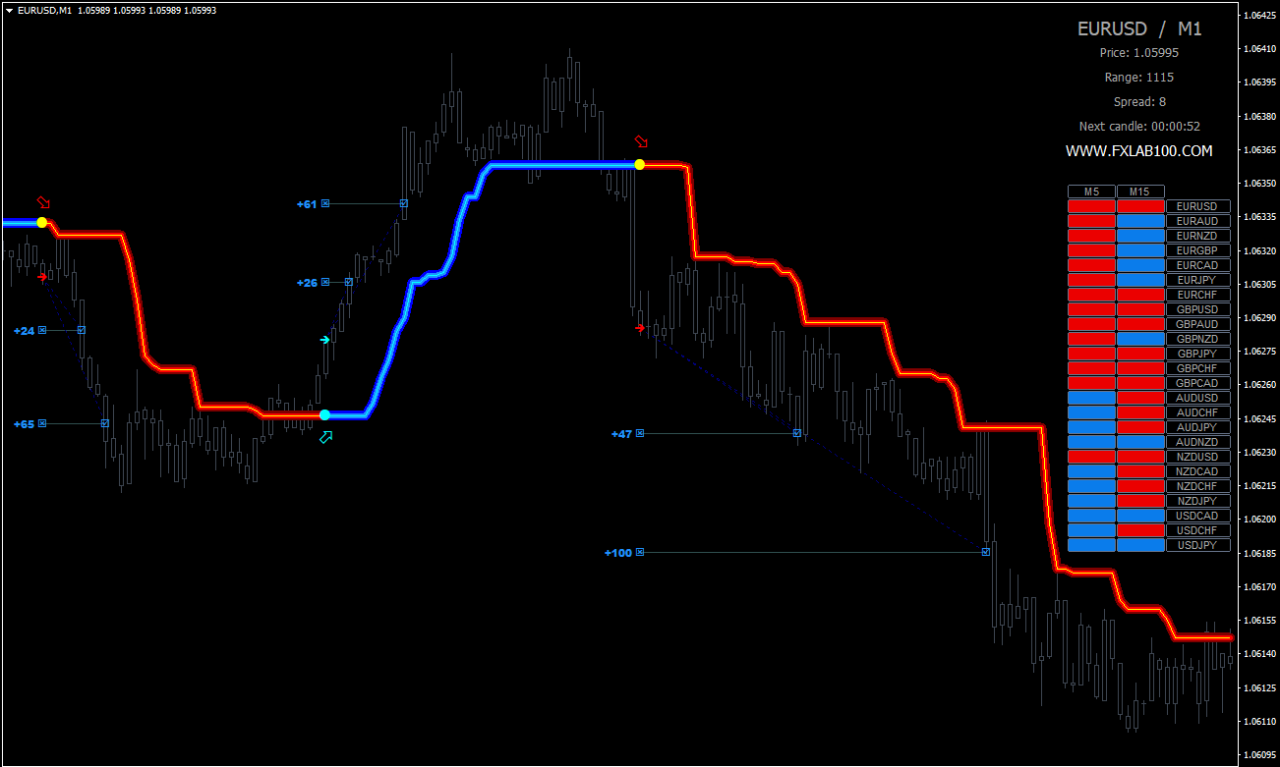

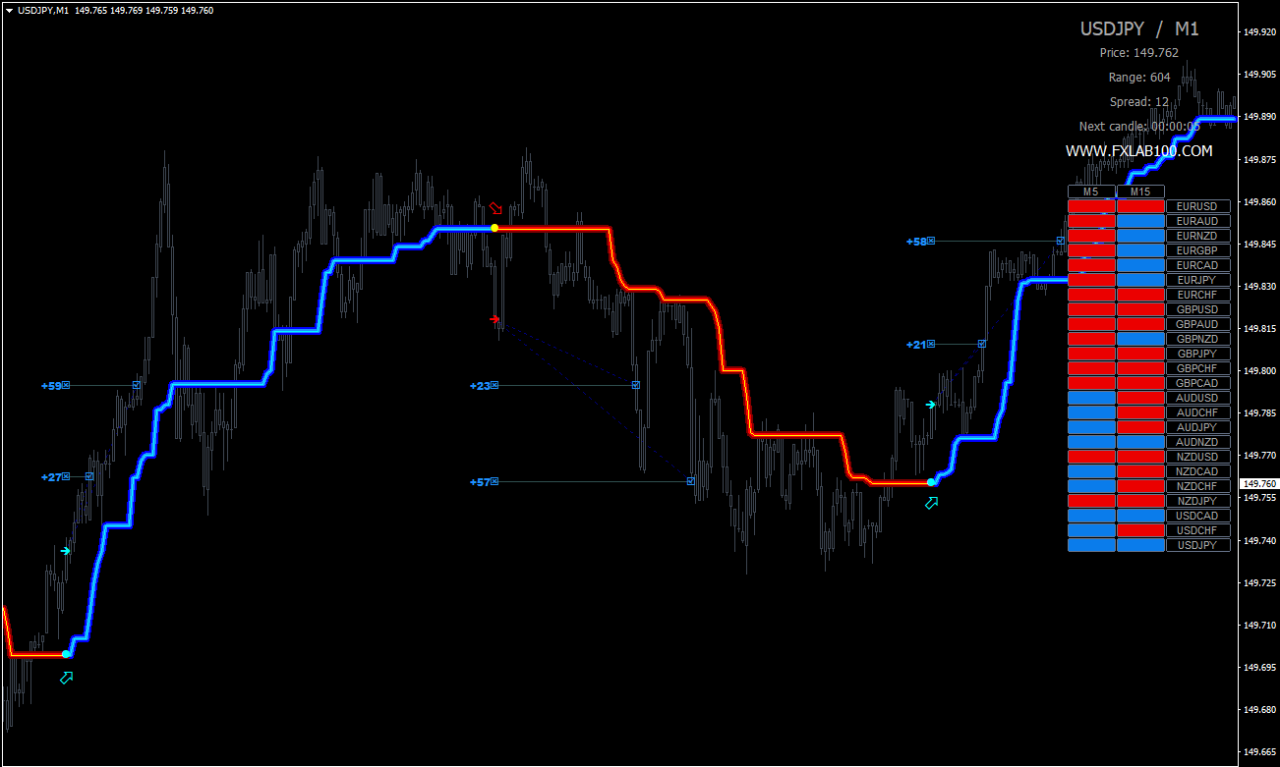

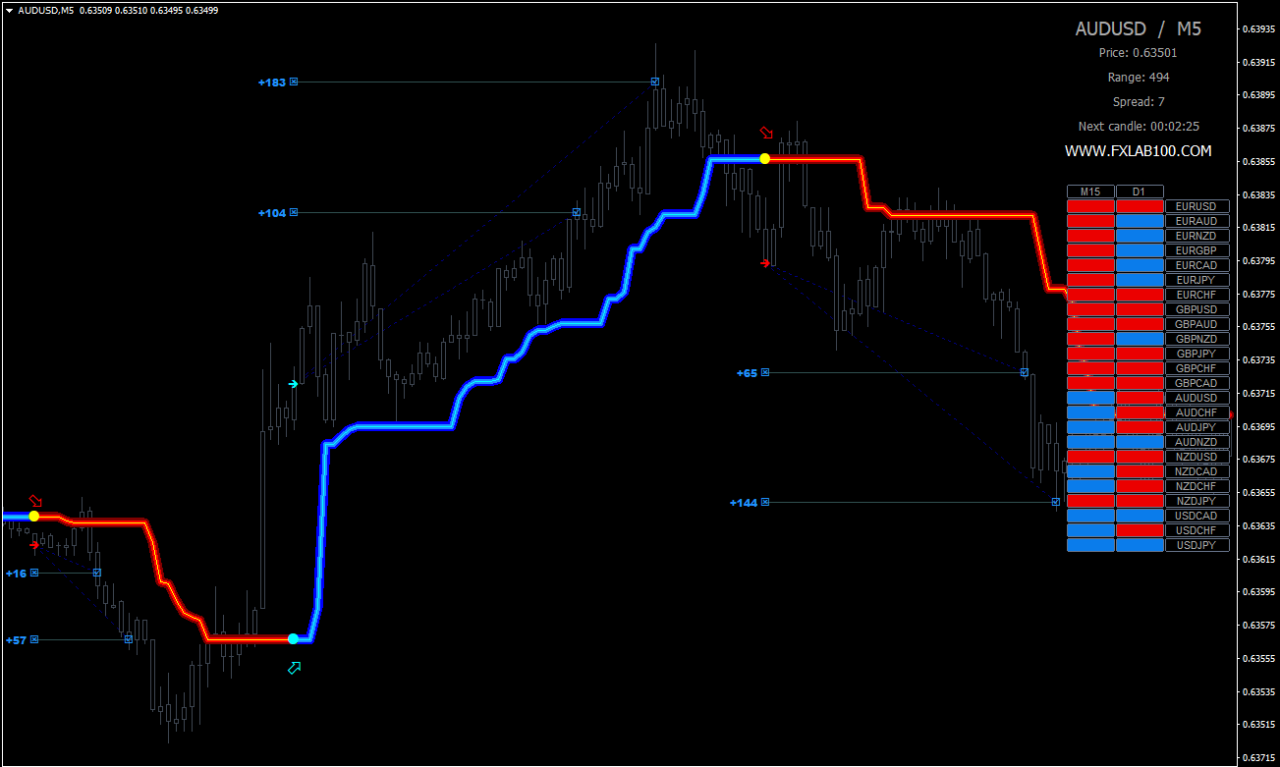

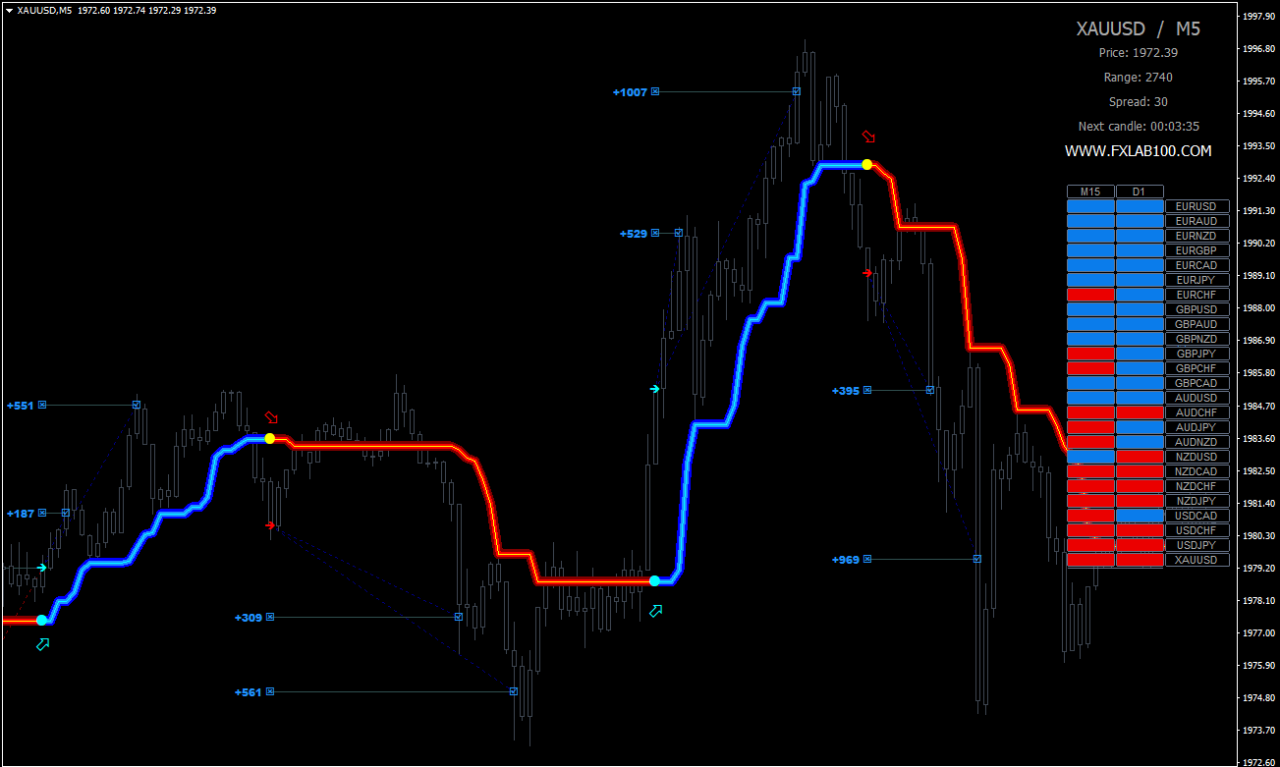

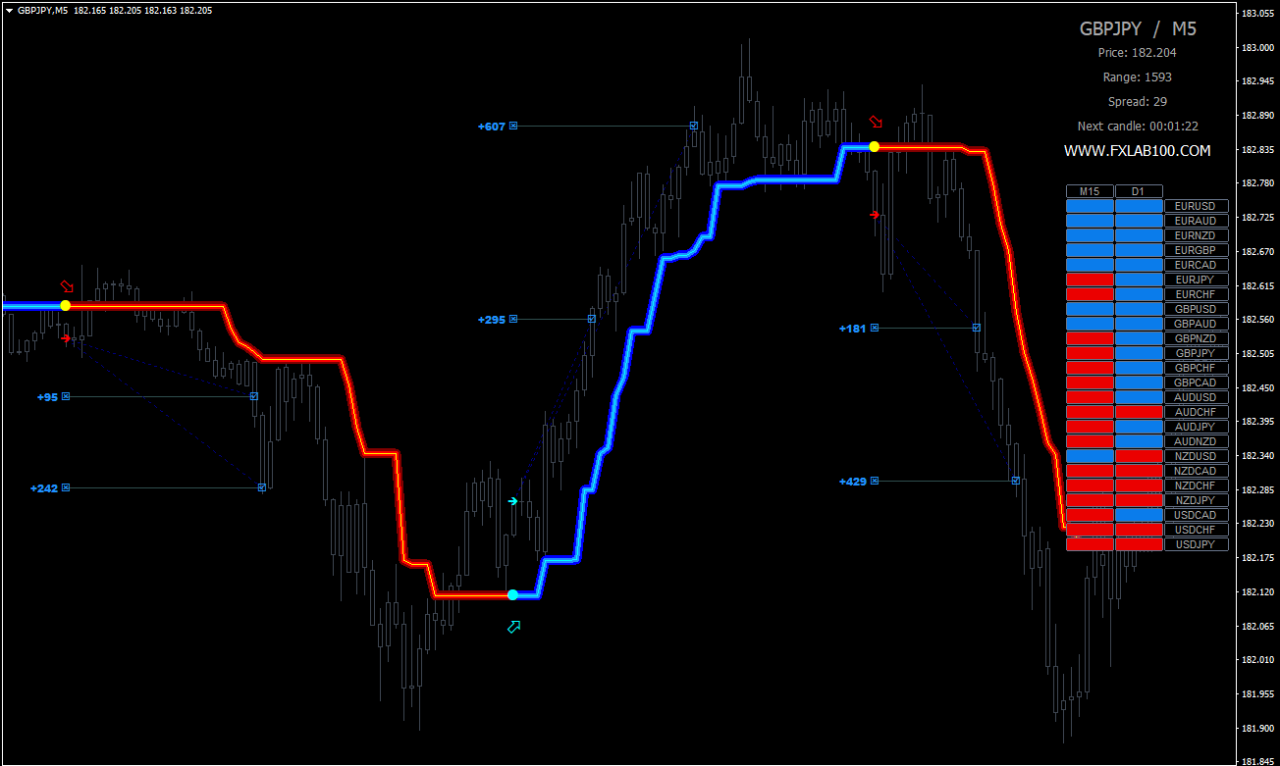

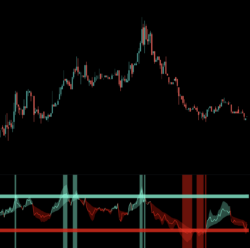

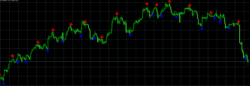

Trading Examples

Take a look how trading signals looks like!

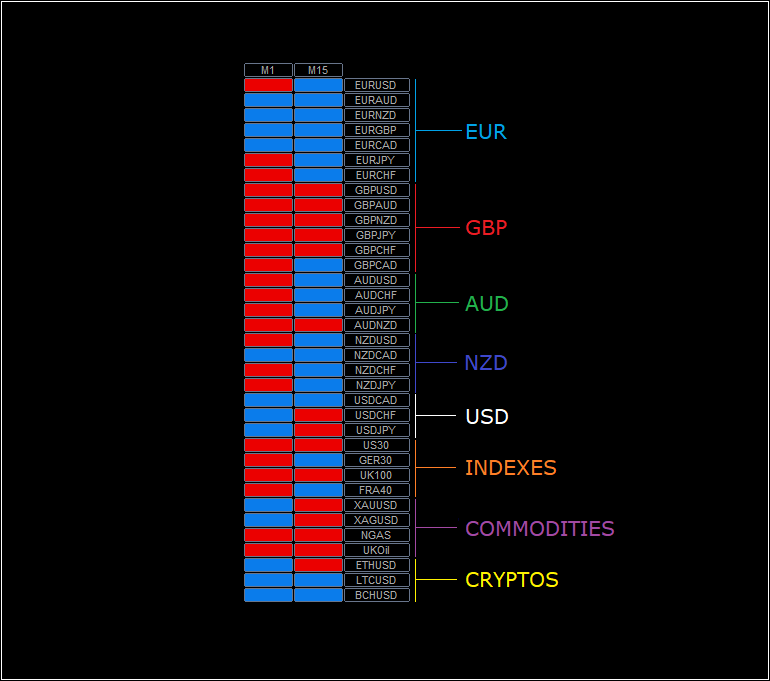

Entries are very easy to read, just match the signal with MTF dashboard to get an entry in line with big players.

RED SIGNAL + RED TIMEFRAME = SELL SIGNAL

BLUE SIGNAL + BLUE TIMEFRAME = BUY SIGNAL

Simple as that.

Software provides advanced MTF confirmation dashboard that will support your entries.

Trade the signals that are in line with BIG players to WIN more!

(You can pick your own trading instruments, just put the symbol to the indicator settings.)

EVERY MODE USES DIFFERENT MTF TIMEFRAMES (SCALPING/DAYTRADING/SWINGTRADING).

Reverse day trading and swing trading are two distinct trading strategies used in the financial markets, primarily in the context of stocks, commodities, and forex. Let’s explore each of these strategies in detail:

Reverse Day Trading:

Reverse day trading is a trading strategy where traders take positions contrary to the prevailing market trends, aiming to profit from short-term price reversals. This strategy is often referred to as contrarian trading because it involves going against the crowd’s sentiment.

Key characteristics of reverse day trading:

- Contrarian Approach: Traders using this strategy believe that markets tend to overreact to news and events, leading to temporary price reversals. They seek to identify these reversals by taking positions against the current trend.

- Short-Term Focus: Reverse day trading is typically a short-term strategy. Traders may hold positions for minutes or a few hours, taking advantage of price movements within a trading day.

- Technical and Fundamental Analysis: Traders may use a combination of technical indicators and fundamental analysis to identify potential reversal points. Common technical indicators include RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and support/resistance levels.

- Risk Management: Due to the contrarian nature of this strategy, risk management is crucial. Traders often set tight stop-loss orders to limit potential losses if the market does not reverse as expected.

- News and Events: News releases and market events can trigger reversals. Traders may look for events that could lead to a change in market sentiment.

Swing Trading:

Swing trading is a strategy that focuses on capturing short to medium-term price swings within an existing trend. Traders aim to identify and capitalize on price movements between support and resistance levels.

Key characteristics of swing trading:

- Trend Following: Unlike reverse day trading, swing traders typically follow the prevailing market trend. They seek to enter positions in the direction of the trend when favorable swing points are identified.

- Medium-Term Perspective: Swing traders hold positions for a longer duration than day traders. Trades can last several days to weeks, depending on the time frame used.

- Technical Analysis: Technical analysis is a primary tool for swing traders. They use chart patterns, technical indicators, and trendlines to identify potential entry and exit points.

- Risk Management: Swing traders often set wider stop-loss orders compared to day traders. This allows them to ride out short-term fluctuations while staying within the overall trend.

- Patience and Discipline: Swing traders require patience and discipline to wait for the right setup and not be swayed by short-term market noise.

- Market Research: Fundamental analysis may be used for a longer-term perspective. Swing traders often research the fundamentals of the assets they are trading to assess the overall health of the market.

In summary, reverse day trading involves going against the prevailing trend and seeking short-term price reversals, while swing trading focuses on capturing price swings within the existing trend over a medium-term horizon. Traders should choose a strategy that aligns with their trading style, risk tolerance, and market conditions. Both strategies have their merits and drawbacks, and success depends on a trader’s skills, analysis, and discipline.

Reviews

There are no reviews yet.