TDI Forex indicator for Mobile

Here is how to set up the full TDI Forex indicator with Market Base Line and Volatility Bands on your mobile or tablet version of MT4 (or any other platform that doesn’t have the TDI).

- Insert an RSI with the color set to your background color or “None” if you have that option.

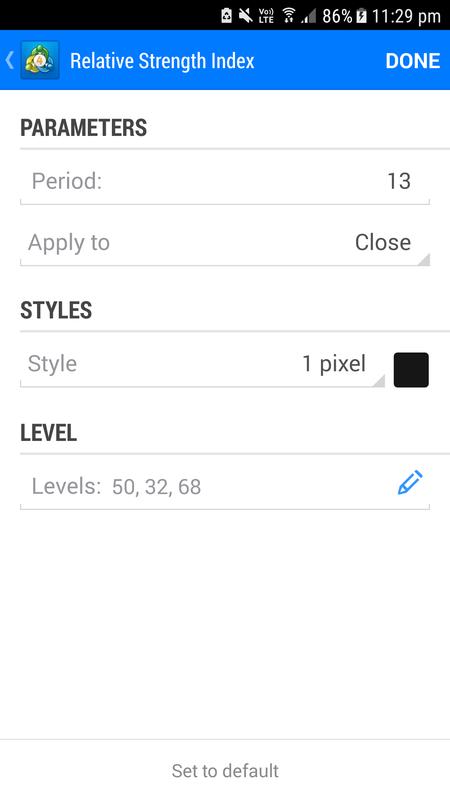

- Set the RSI period to “13”, Apply it to “Close.”

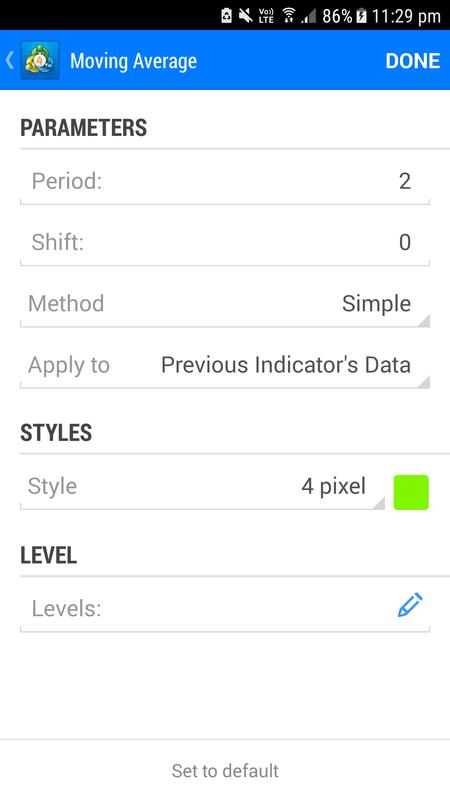

- Now Insert a Moving Average into the RSI’s indicator window and set that period to “2”, “Simple,” apply it to “Previous Indicator’s Data,” and make that line Green.

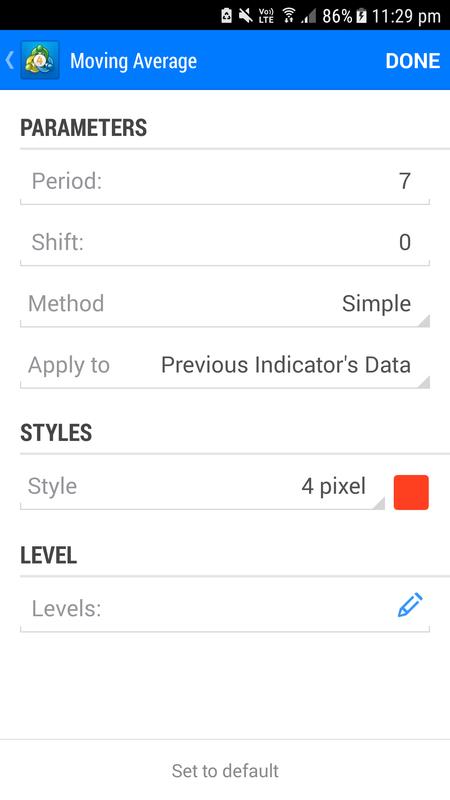

- Next Insert another Moving Average into the RSI’s indicator window and set that period to “7”, “Simple,” apply it to “Previous Indicator’s Data,” and make that line Red.

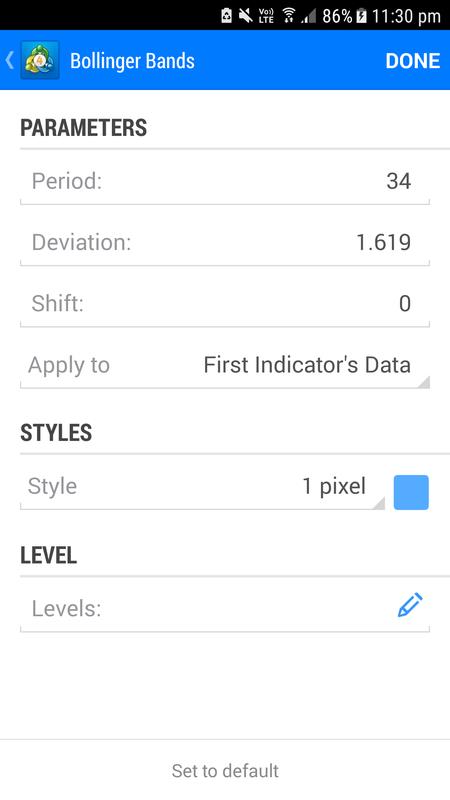

- Insert a Bollinger Band into the RSI’s indicator window and set that to “34” with a deviation of “1.619”, apply it to “First Indicator’s Data,” and set that line to Blue.

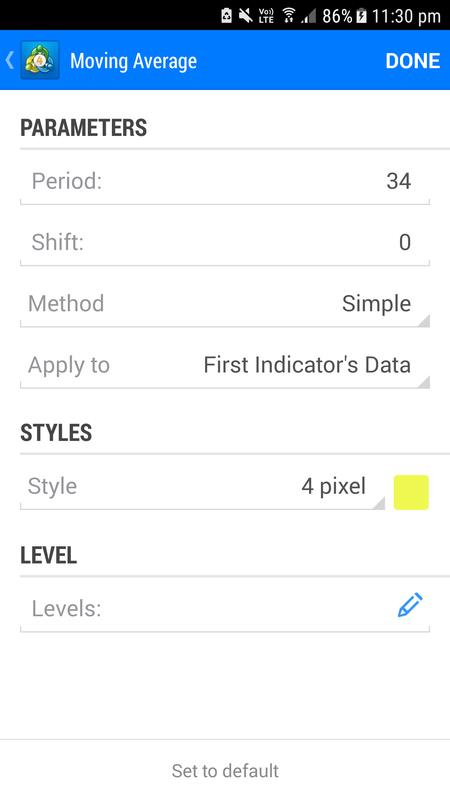

- Insert a Moving Average again into the RSI’s indicator window and set it to “34”, “Simple”, apply it to “First Indicator’s Data,” and put that line to Yellow.

And there you have it. The complete TDI for your mobile, tablet, or any other platform.

Follow the Settings on below Images :

What is the Traders Dynamic Index indicator?

The TDI indicator’s primary purpose is to filter the markets when there is no trend. Once this is filtered and the TDI identifies the trend, the next stage of the indicator is to distinguish the price movements.

This includes finding areas of entry points that traders can trade in the short to medium term timeframe. It is for this reason that the TDI uses three separate indicators which are the RSI, Bollinger Bands and moving averages.

If you independently analyze the TDI indicator, you can see that the moving averages are used to determine the trend, while the Bollinger bands detect periods of high and low volatility through the contraction and expansion of the bands.

Finally, the missing piece to the puzzle is the relative strength index or RSI indicator. The RSI is an oscillator which is used to gauge the momentum. When you combine the information from these three indicators you can see that a powerful trading strategy can emerge.

While it is possible to trade with the three indicators separately, the information can at times be confusing. This is where the TDI comes into the picture, giving the trader a comprehensive view of the markets. Thus, with just the signals from one indicator to go by, it also reduces the complexity.

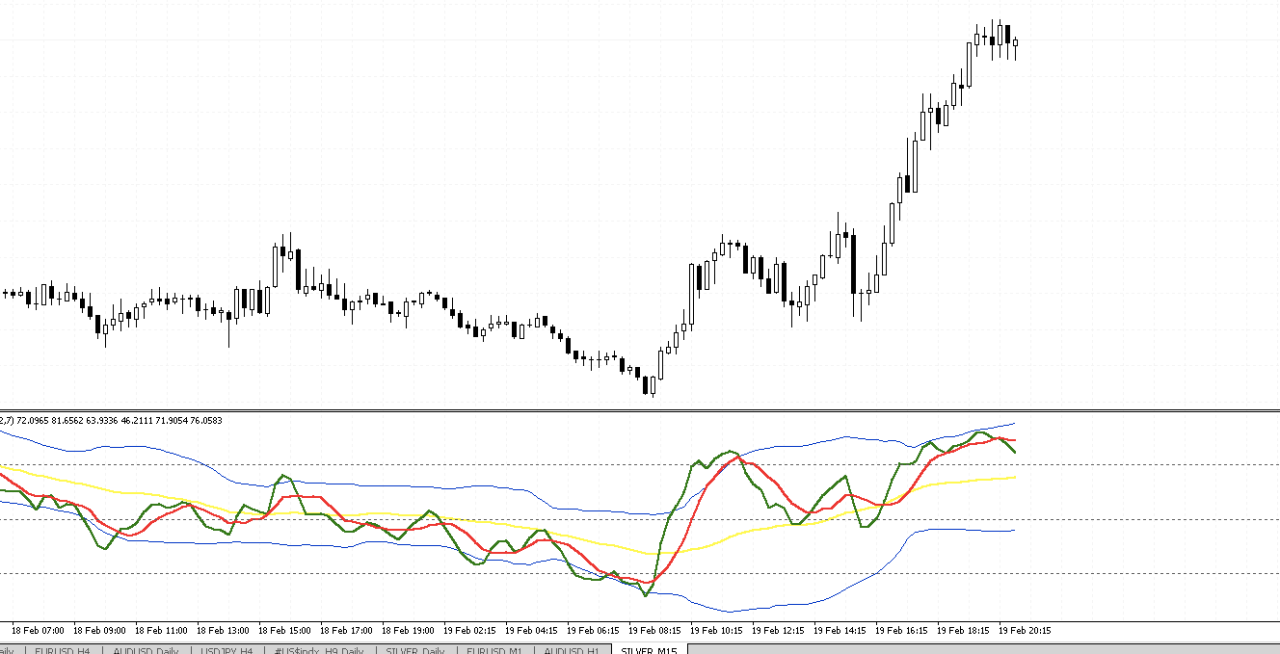

The TDI indicator is built as an oscillator and when you add the indicator you can see in the sub-window on your MT4 platform.

The chart below shows the TDI indicator added to a 15-minute chart.

Configuring the Traders Dynamic index indicator

The TDI indicator has a lot of settings. This means that it can be highly customized. You can either choose the default settings or make use of your own custom settings. The purpose of this next section is to illustrate the different parameters of the TDI that can be configured.

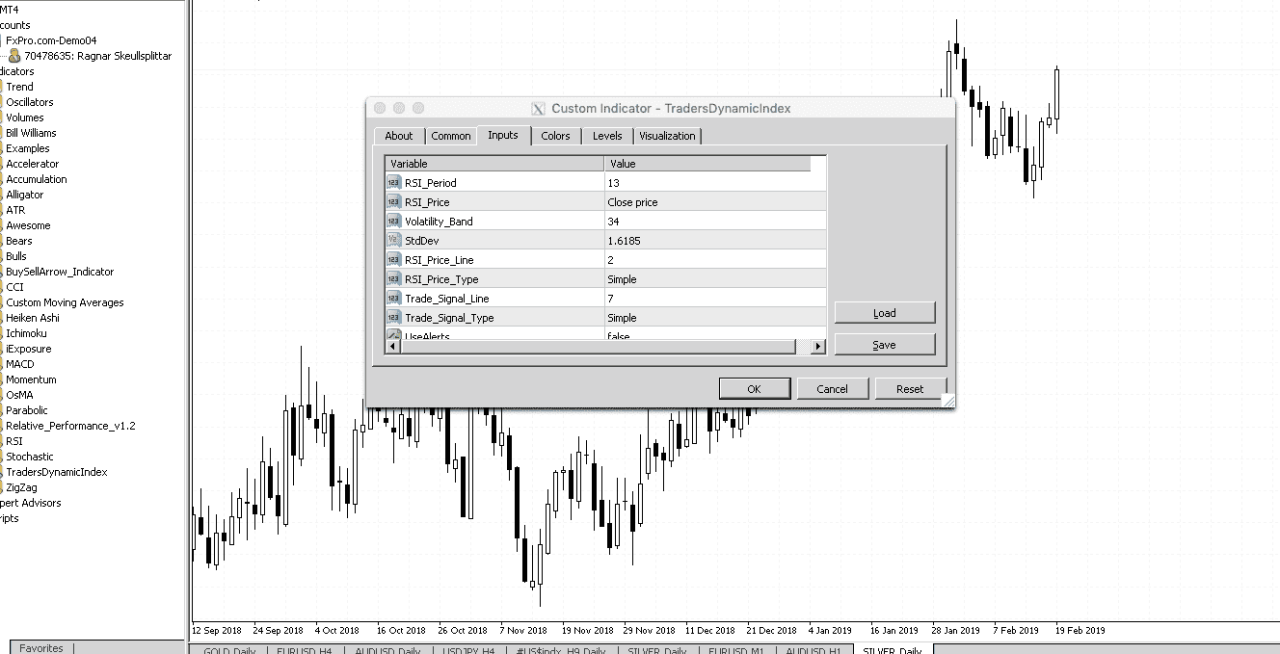

The next picture below shows the configuration window of the Traders Dynamic Index indicator for the MT4 trading platform.

Figure 2: TDI Indicator MT4 Configuration

- RSI Period: The default setting is set to 13. This basically determines the number of previous sessions or candlesticks that you want the RSI to be build upon. You can set this to a higher value but the RSI would then start to lag. Likewise, if the setting is too small, it can make the TDI a bit too sensitive to market swings. The best way to identify the setting you want to use is to figure out a setting that works for you if you were to use the RSI indicator on its own.

- RSI Price: The default setting for this is Price_Close. This determines what price to calculate the RSI for. You can choose other options such as using opening, closing, high or low prices. Bear in mind that the type of price you choose can impact how the indicator works. The closing price is often considered to be the most important price in a price chart. However, some traders tend to prefer using other prices as well.

- Volatility Band: The volatility band setting determines the Bollinger band settings. The default is set to 34. However, if you were using the Bollinger bands on its own, you would use a setting of 21. Therefore, this parameter is also up for customization and the value you want to choose depends on your comfort and familiarity level with the indicator. With the settings, note that if you set the volatility band to a lower level, it can become more sensitive.

- StdDev: As with any volatility bands, the standard deviation is an important factor. The Standard deviation basically determines how much of deviation you would like to use. While the Bollinger bands uses a 2 standard deviation, the TDI indicator comes with a default setting of 1.618. The reasoning behind this is nothing but using the Fibonacci level. You can of course change this and set it two as you would when using the Bollinger band indicator.

- RSI_Price_Line: The default value of this is 2. The RSI price line is basically the setting for the fast moving average.

- RSI_Price_Type: The default is set to MODE_SMA. This is nothing but how the moving average is to be calculated. You can change the mode to anything that is available from the drop down.

- RSI_Trade_Signal_Line: The default value is set to 7 and this is the setting for the slow moving average line.

- RSI_Trade_Signal_Type: The default value for this is the MODE_SMA. This is the moving average type for the trade signal line. It is recommended that the mode for the trade signal type remains the same as the value that you choose for the price_type. But of course, traders are free to experience with the moving average types to suit the best need for the market that they are trading. However, the SMA is known to be lagging as compared to the EMA and therefore, the EMA would make for a better choice.

- UseAlerts: The default is set to false because this parameter simply signals an audio alert every time a signal is generated.

Traders Dynamic Index indicator for MT4 – Summary

To summarize, the TDI indicator for MT4 is a complete trading system that can bring about a new change to your existing trading strategies. Whether you are scalping the markets or swing trading, the TDI indicator can give you a full and all round perspective of the markets.

Due to the fact that the TDI makes use of three different indicators which measure three different aspects of price, namely the trend, momentum and volatility, you can experience a different way of trading without having to use the signals from the three indicators.

The TDI is therefore a versatile indicator that traders flock to. The main advantage of using the TDI indicator for MT4 is that it cuts down on clutter on your charts. It also eliminates the need for using any additional indicator when you use the TDI in your trading strategy.

Given the vast amount of configuration to play around with, traders can also build familiarity with the TDI indicator and also customize this indicator to their choice or preference. This will ensure that the indicator is well configured to capture the security’s volatility and other market conditions.

Responses