The Best financial spread trading brokers

What is a spread betting broker?

A spread betting broker offers clients the option to use online trading so they can place bets on the value of a financial instrument. Spread betting brokers accept bets from clients on a per pip value basis and these bets are designed to be traded. Tax wise, these trades are designed as bets and therefore there is no capital gains tax on the profits.

How to choose a spread trading broker – what to consider.

Spread betting on financial assets is exclusive in the UK and can offer tax benefits to residents living in this country. Fortunately, there are some of the best known well-known, most popular and highly rated brokers that allow financial spread betting through their platforms.

This article will outline what spread betting brokers offer and who they are suitable for, and how to evaluate them to find the most suitable spread betting broker.

When choosing a spread betting broker, spreads are crucial

Check to see if your broker has the tightest spreads available. Spreads, and the extent of them, are a key aspect of trading with an online spread betting broker, as spreads determine how quickly you can make money.

There are other factors to consider as well. For example, brokers may try to get your business by pushing super tight spreads on one or two of their main products, but they will then add spreads on more complex types of assets.

It is also important that when you choose a broker to make sure they offer tight spreads on a regular basis, not just during regular trading hours. Having a tight spread for trading is more critical to your profits than choosing the broker with the most affordable spreads.

However, this ultimately depends on what and how you are trading. For example, if you only trade three or two forex and indices, then the broker that offers the lowest trading costs on those assets may be the best choice, and you may consider using a different account to trade other instruments.

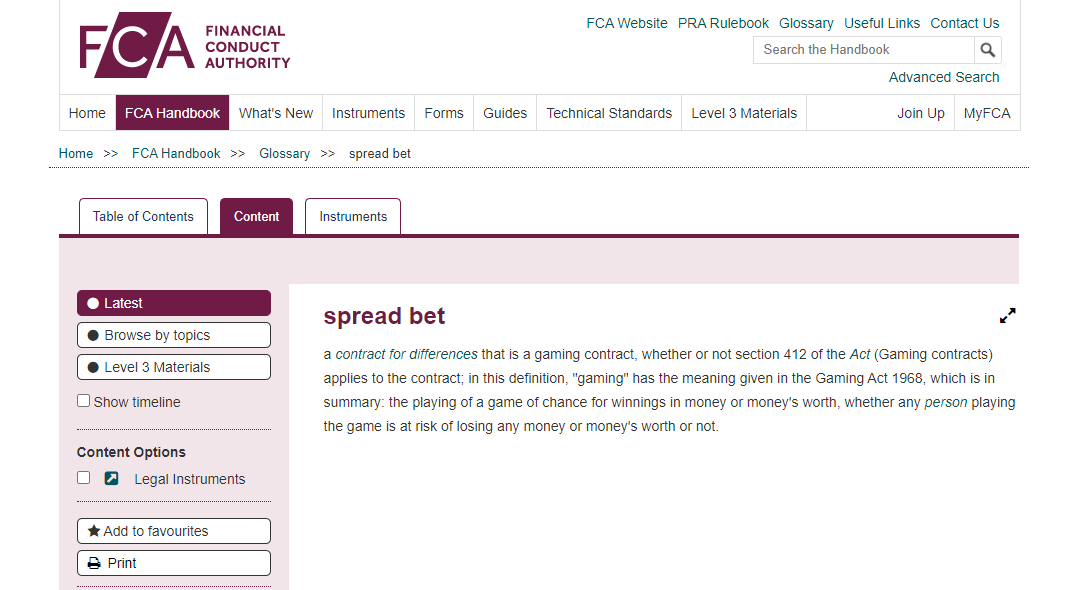

Is spread trading legal?

Spread trading is mainly concentrated in the UK because of its legal authorization and even tax relief on profits, while many countries around the world prohibit spread trading for various reasons. In the UK, spread trading is a UK speculative trading activity regulated by the FCA, the local authority in the UK. Check the official FCA website to verify the license.

What is the difference between CFDs and spread trading?

The concepts of CFDs and spread trading are different. A CFD is a short-term derivative contract in which a trader speculates on the difference in the value of the underlying asset, while a spread trade is simply a bet on the direction of the price movement.

Complete list of financial spread trading brokers in the UK

This is a complete list of regulated brokers that offer spread trading platforms to UK clients.

Min Deposit of 20$ |

Responses