Equidistant price channel trading strategy on Renko Charts

[wptb id=16694]

The renko trading strategy is built on the equidistant-price channel tool. It’s a price action trading system that uses buy and sell signals that are based upon price interaction with an equidistant channel. This trading strategy has many variations. It all comes down to the quality of the risk-reward ratio, which ultimately determines whether the trades are successful.

Equidistant price channel trading with Renko charts takes some subjectivity. But, more important, it requires the ability to accurately plot the price channel at the right time in order to spot reversals. Non-discretionary trader might find this difficult, however, it can be done with enough practice.

The price channel strategy for trading is short-term and aims to identify short-term reversals within a trend. This counter-trend method identifies the short-term reversals in a trend. Traders need to be aware of the trend that is prevailing (which can either be identified using moving averages, or by simply looking at price action)

The Equidistant Prices Channel Indicator

Tradingview.com and most other charting platforms allow you to automatically choose the equidistant tool in the drawing section. Find the Parallel Channel in the 2nd group on the left-hand side of the screen.

The default price channel indicator for MT4 is not as good as it could be. It lacks a median line. This is why we use Fibonacci channels. Insert > Channels > Fibonacci.

Double-click the Fibonacci channel to configure it. Please click here ‘Fibo Levels’ All levels should be removed. Type in -0.5 in the level and click ‘OK.’

You will get both the outer price channel lines as well as the median channel line.

Draw the equivalent price channel

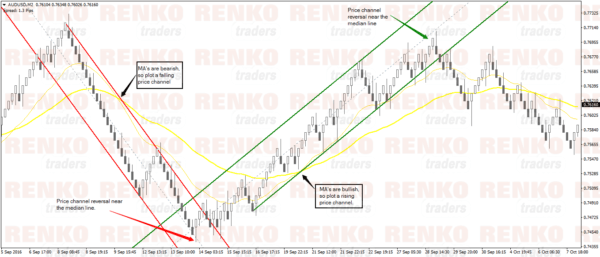

First, understand the trend. Is the trend upward or downward? Once you have answered this question based upon how the moving averages appear on the chart then the next step will be to plot the price channel according to the trend.

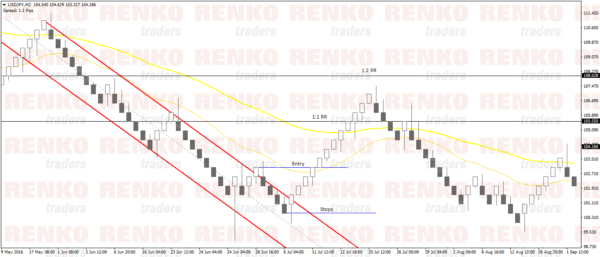

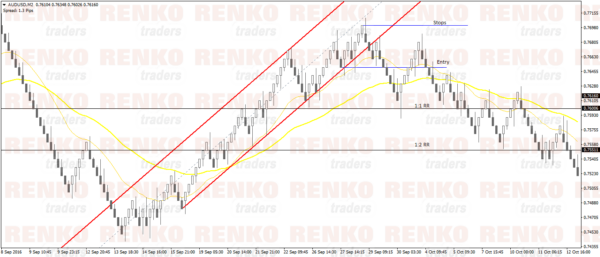

As an example, the chart’s first graph shows that the 20 MA and 50 MA have been moving higher, and then falling lower. The vertical lines are an indication of this trend. This chart shows a changing and rising price channel, as indicated by the Red and Green price channels.

Once you’ve plotted the price channel, wait for confirmation of reversal. We will be discussing this in the next section.

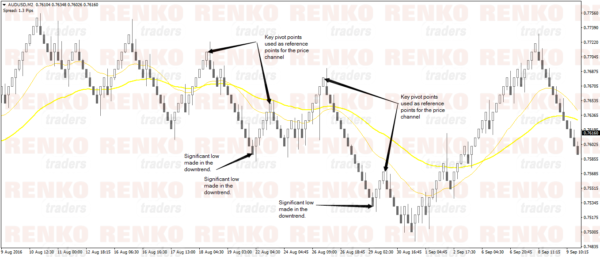

Next, you need to find pivot reversal points. This will allow you to correctly plot your price channel. We only need three pivot points to identify them. You can connect these points using the price channel by using two lower highs, one lower low and one higher low in a downtrend.

This is illustrated in the following chart.

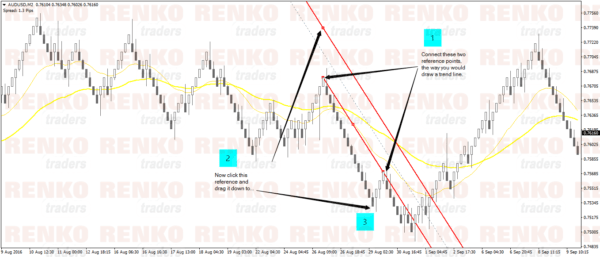

The Fibonacci channel indicators can be used to plot the price channel. Click on the first point, then drag it down towards the second point. It is similar to drawing a trendline. After connecting the two points you’ll see that the channel projects outwards.

Drag the reference point to the right until it is at the end. This will add the median line to the price, making the channel richer.

Price Channel Reversal Set up

One simple pattern is all that you need to be aware of when anticipating a reverse.

You should look for Renko reversals near the median line. Now this doesn’t happen all the time, but bear in mind that the signals are much stronger when there is a reversal Renko bar near the median line. You may find that the reversal occurs near either the lower or upper price channels (in a downtrend).

This chart clearly shows the reversal setup.

It is impossible to expect a perfect reversal every time. Sometimes, price can rally or plummet sharply as illustrated in the chart below. You should just avoid the market in these cases.

The next table shows this.

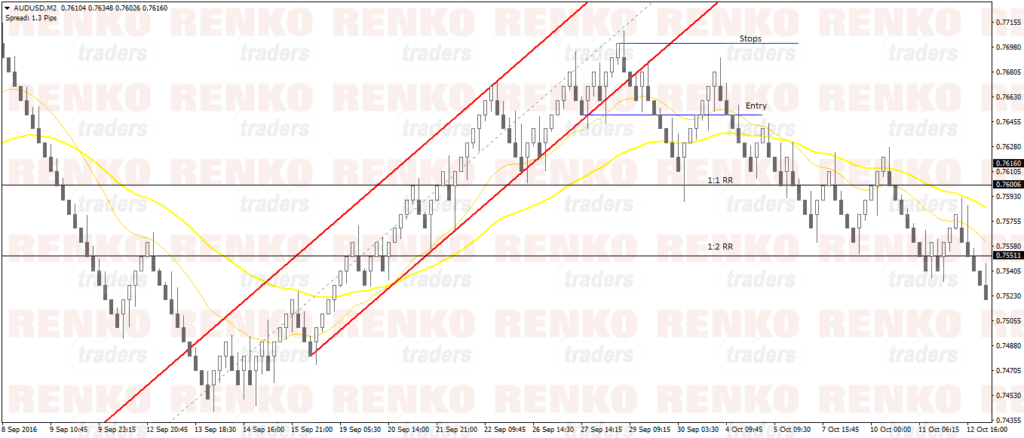

Set your target, stop and entry levels

Now that you know the best way to reverse the median line in the price channel, it is time for planning your entry.

If you are in a downtrend look for the latest high formed prior to the reversal. Place your long positions near this level. Your stops should be placed at the reversal line. You should set your targets for 1:1 and 1:2 RRR. When the first trade’s target is reached, move the stop loss to break even for the second trade.

Equidistant price channel trading strategy – An open ended system

Renko charts allow you to trade the equidistant prices channel strategy. It is an extremely flexible trading system. Either you follow the rules or add your validations and trade management setups. A double top pattern or double bottom near the median line is one way to make sure you are making good profits.

You must be patient and wait for the conditions to permit you to trade with the Renko charts equidistant pricing channel trading strategy. This strategy is for you if price action trading interests you.

And finally, here’s the video that puts together this tutorial and demonstrates how you can trade the Price channels on Renko.

[wptb id=16694]

Responses