Simple forex renko trading strategy with Renko charts

Simple forex trading strategies are something traders enjoy. But, simple forex strategies can vary from one person to another.

Simple trading strategies may be simple for one trader. A simple forex trading strategy might be one that uses only a few indicators. For another trader it could just be price action-based.

I’m sure traders, regardless of the answers they get, will all agree that simple forex trading strategies are easy. They don’t clutter charts, make it easy for them to see, and have fewer variables (or rules).

A forex trading strategy like Buy when A occurs and B does what? It can be used as an easy strategy that anyone can use. If you look beyond these basics, simple forex trading strategies have a reasonable risk/reward setup. A trading strategy should have a 2:1 risk/reward ratio. Anything beyond that can be very bad.

This website lists many Renko-based forex trading strategies. However I am always on the lookout for a trading system that is not only easy to understand but good enough to trade. These are some of the factors that could qualify it to be a simple forex trading strategy.

So without much further ado, here’s introducing a rather simple trading strategy.

Swing Failure Method

The idea for this easy forex trading strategy came from the concept of swing failure. This is a technique that was described in Dow Theory. This method is not to confused with the RSI Swing Failed method. The concept does contain some similar elements.

It Swing failure method It is a very old, but solid idea in the market. The Dow Theory principles include the introduction of this concept in Charles Dow’s work. The Dow Theory’s swing failure builds upon the concept that in the financial markets, the trend remains in effect until it is acted upon by an external source and the reversal is clear.

If the above seems too complex for you, it actually isn’t as there are different variations of this already used in the markets. Examples include the Alan Andrews’ median lines or pitchfork trading method and the action-reaction line method.

What is the best way to spot a trend?

Charles Dow says that an uptrend occurs when price increases steadily, making higher highs and lower lows (peaks or dips). In a similar fashion, a downtrend is when price falls steadily, making lower highs or lower lows.

It is a sign of a trend change when price doesn’t make new lows or highs and it reverses direction and begins to make new highs or lows.

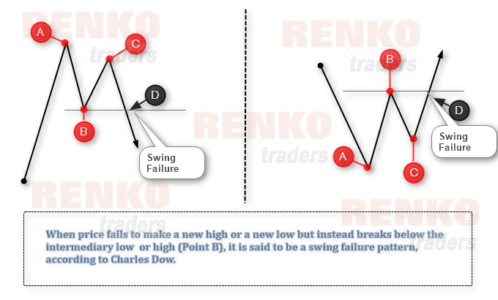

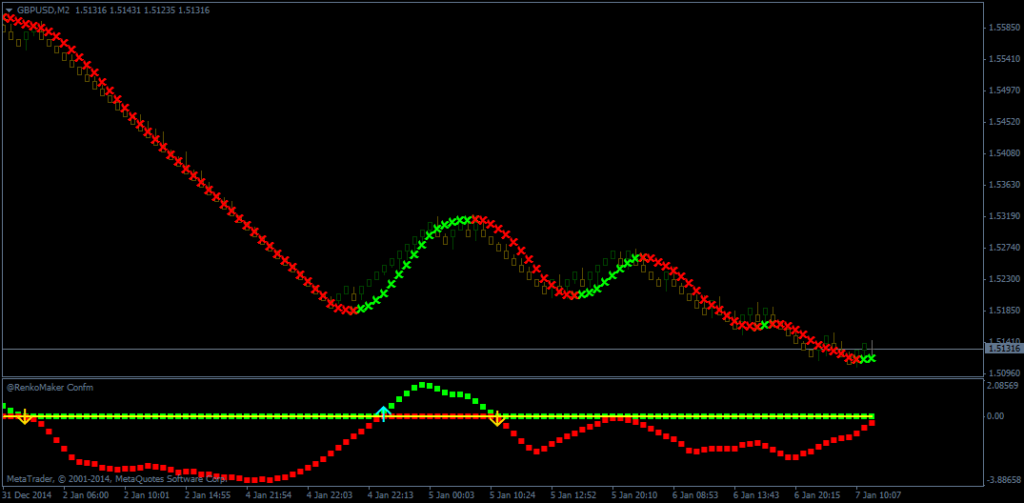

These swing failure strategies are often employed in markets to provide support/resistance levels. The above chart shows the Dow’s Swing Failure method. It is simple and straightforward.

Once we understand the swing chart and how it fails, we can now form an outline of where we should go long or where we should go short. This is a very simple idea of trading.

Swing Failure Trading Strategy: Simple renko trading rules

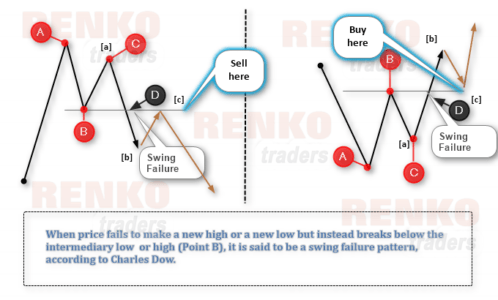

The chart below shows that we are looking for either short or long positions at D. We can also expect some retracement to B. This is where the strategy gets a bit more interesting. After we see a retracement towards D, then we look for the ABC patterns.

To get an idea, take a look at the chart above but make some changes. It is visually simpler and easier than it appears.

For the stop loss, we look at a local low (and don’t mistake this with placing your stops at ‘C’), within the C leg. As for targets, we look at the first target as the point. [a] Then, a second equal or more measure is taken from entry to the first target.

Simple forex renko trading strategy – Trade Examples

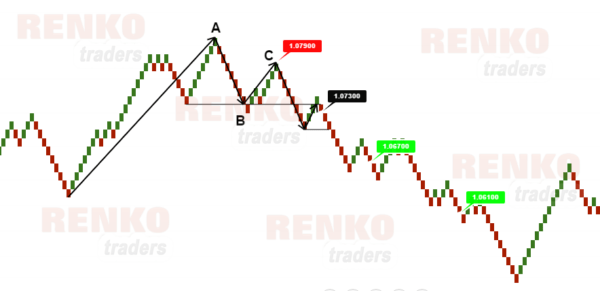

The first illustration below shows a swing failure pattern. It was formed with a lower top in C. But, it took confirmation. Price had to fall below B to confirm the formation. We then had to retest that level to determine resistance. A Renko reversal was established here. The stops were set at C because there was no local high.

First target at 1.0710. Next came a 1:0 target at 1.0710. The trade was then moved to breakeven after the initial target had been met. Therefore, the trade gave a small profit of 20 pips and no risk left.

Therefore, profits increased by 60 and 120 pip after the decline in 1.067 to 1.0610. This was all without risk. The trade generated a total profit of 200 pips. There was an initial risk of 60 Pips. This is greater than the 1:3 ratio risk/reward.

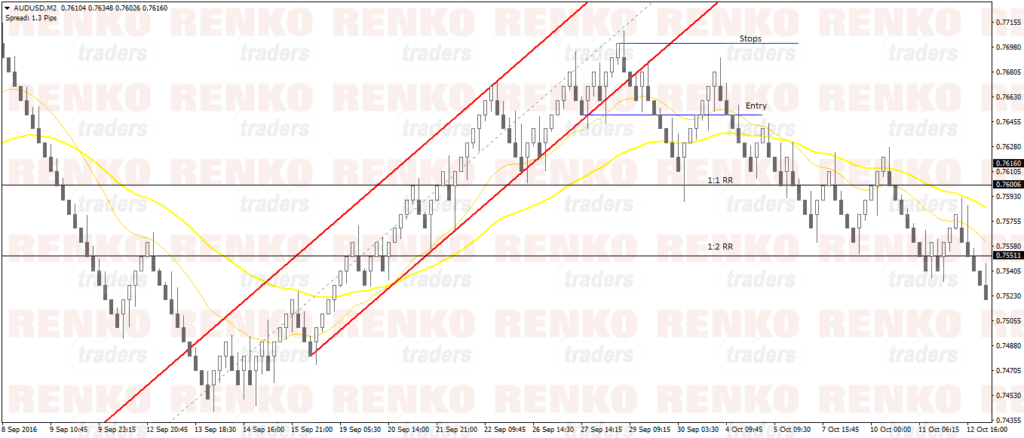

Simple forex renko trading set up – Long example

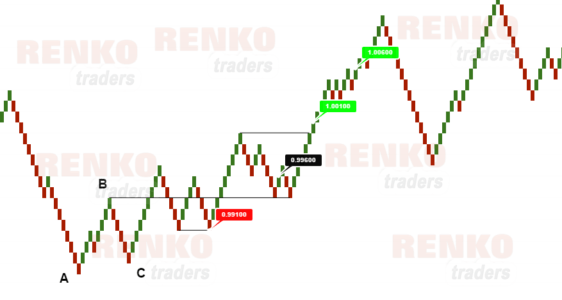

This next example is a longer setup method that’s slightly mixed. This shows that C was the swing failure. However, after price reached B above point B there was no reversal. Instead, price dropped to 0.9910. However, this does not alter our bias except if price falls below 0.9910.

We then can see that price is rising but falling back to B. There’s a reverse Renko at 0.9960. We take this opportunity to buy with stops at 0.9910. We start at 0.9990, the prior peak. Following 1.0010 is the next target.

After reaching the initial target, there was a 50-pip risk. Then it was increased to breakeven. The result was a 40-pip profit. You had virtually no risk with the rest of the 50- and 100-pip profits. You also had the added benefit of having already made 40 pip.

While the initial risk was 50 pips, the trade profited 190 pips. This is 1:3 in terms of risk/reward.

Swing Failure? Simple forex renko trading strategies

From the above two examples, the set up is very simple and doesn’t quite require any indicators. This strategy can be very successful if you are patient. You can see the second example. Impatience would have led to a loss of trades or bad entries.

This simple forex trading strategy works well because it has a low risk reward. Set up the minimum risk reward at 1:2. This makes the system even more solid because you can quickly move your stops to reach break-even. This simple scalping method for renko trades can be used to help you find other ways to trade it.

Responses