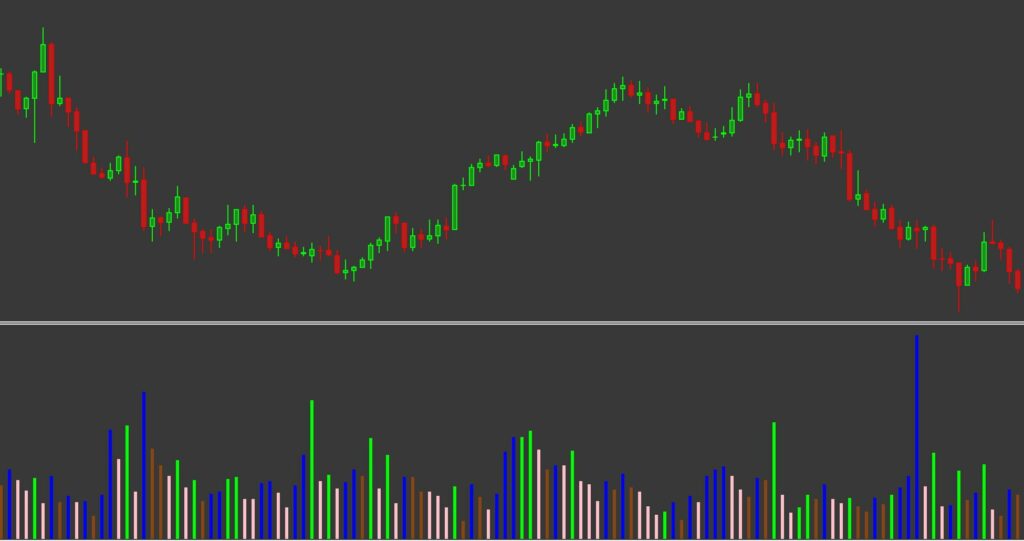

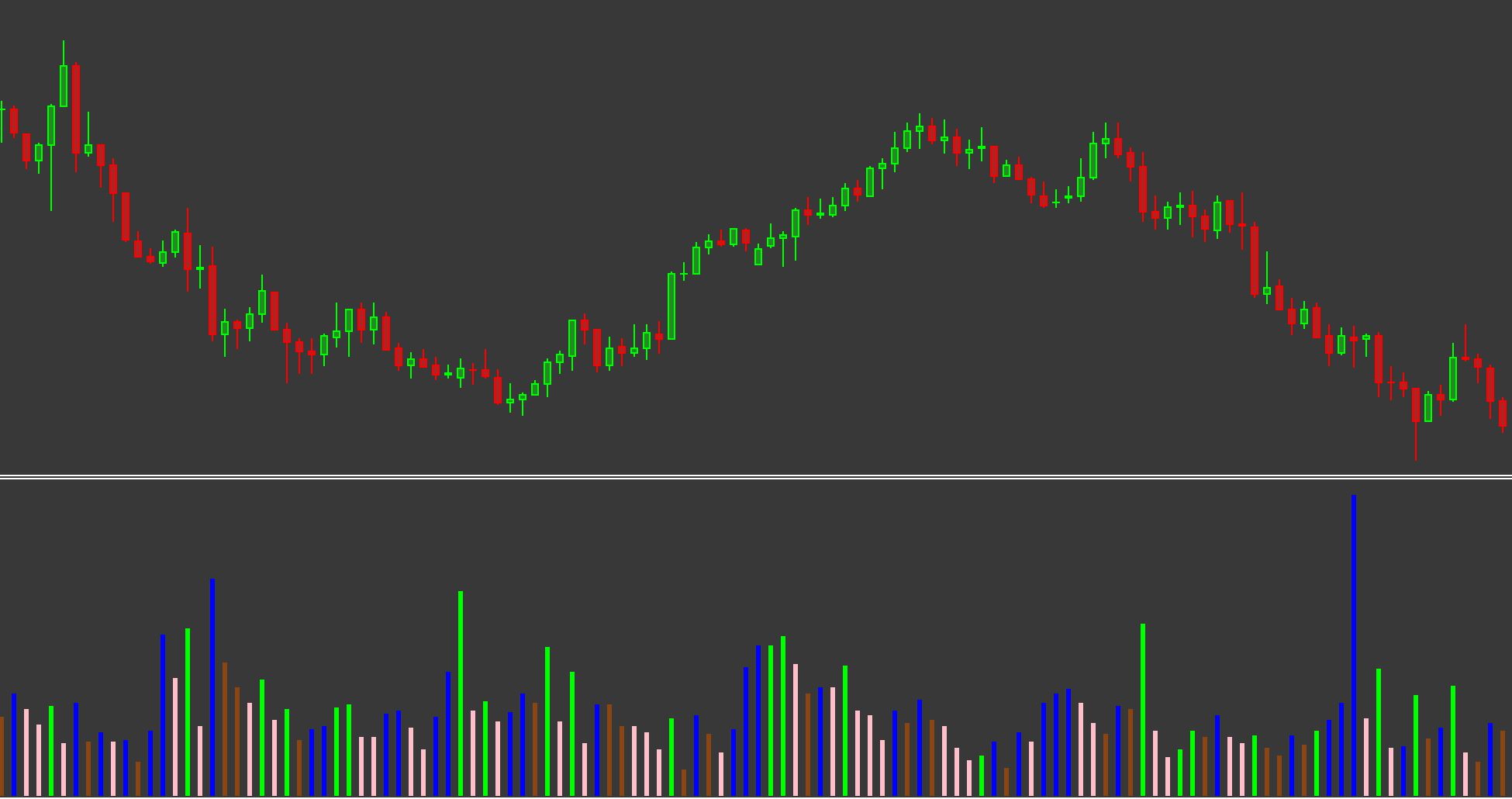

Market Facilitation Index Indicator

this index as the most effective measure of the market’s response to changes in trading volume. Calculation of the Market Facilitation Index indicator. The tool is based on the formula MFI is (high – – low) / volume.

High is the highest value of the candlestick currently in use.

Low is the lowest value of the current candle.

Volume is the tick volume of the trade.

How does the Market Facilitation Index indicator work?

The individual Market Boost Index bars give traders a special signal.

The green bar indicates an increase in volume and an increasing trend. This means that new participants will join the market which means that the current trend will probably continue. This bar is not a signal to join immediately because it is already getting stronger and it is usually too late to enter the market. If you can close the trade before the green bar, it confirms the accuracy of your decision.

A brown bar signals that the current movement of the market is slowing down and therefore traders are interested in this particular asset. A brown bar is usually a sign of a reversal trend, so it will enter the market in the opposite direction of the previous trend. This is not recommended as it is far from the concept that a new trend may emerge after the trend has ended.

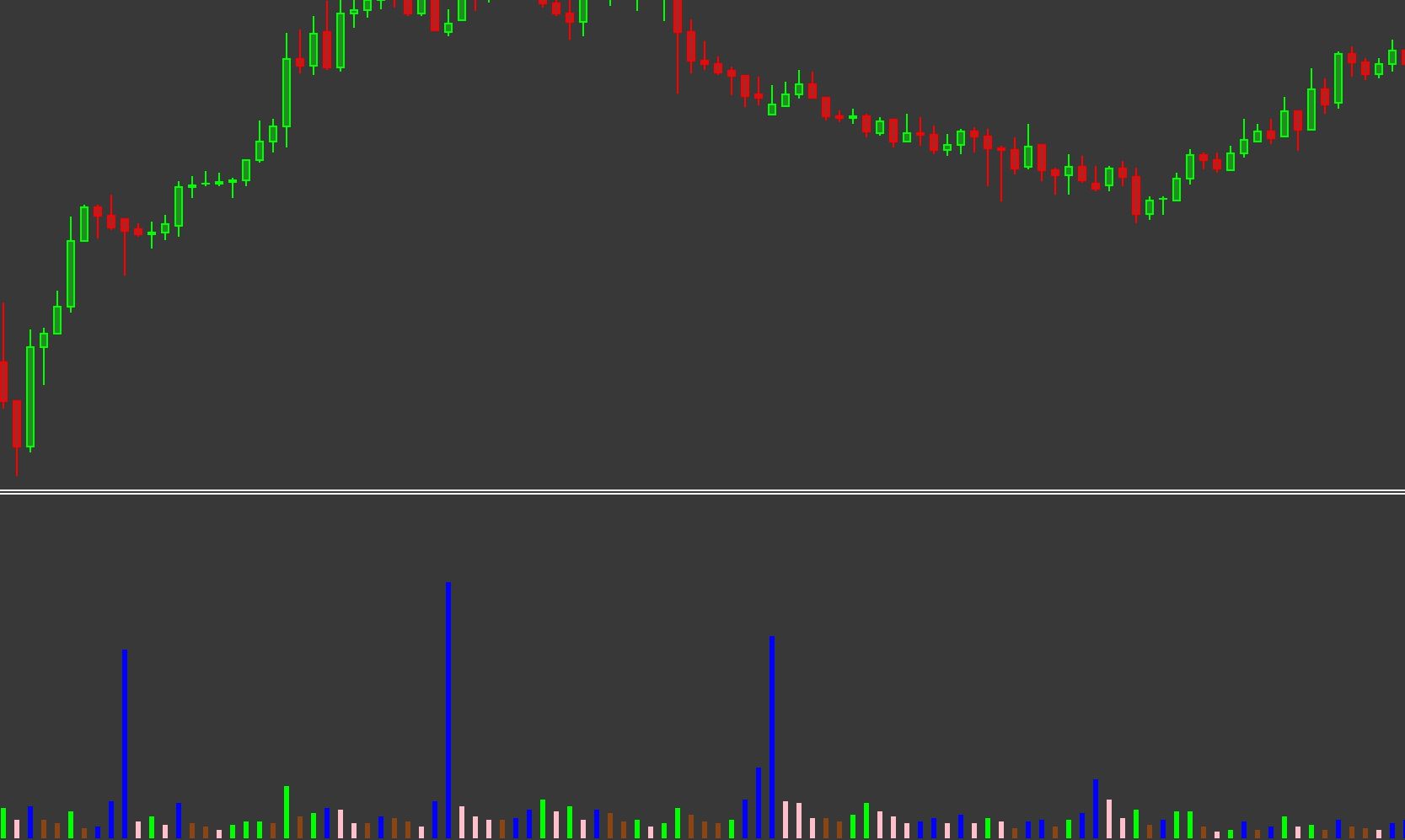

The blue bar chart shows that the current trend is not the result of trading activity, but rather due to a lack of interest in either bear or bull markets. This trend may end at any time. Therefore, when the blue bar appears as an arc, the market situation is considered uncertain.

The pink bar is the most attractive for traders. Its design indicates active trading by both buyers and sellers. Trend reversals are often seen on the pink bar.

Trading strategies for the Market Boost Index indicator

Now let’s discuss trading strategies based on this indicator. Market Boost Index Indicator.

Indicates a Market Boost Index buy setup

A pink bar appears when

The trader places a buy stop loss pending order just a few pips above the previous local high.

The stop loss is set above the previous local low of the account.

Take profit can be 2-3 times the stop loss (depending on what is the SL value and how close the key level is).

Market Facilitation Index indicating a sell setup

A pink column appears in the MFI.

The trader has a sell stop order that is waiting below the previous local low.

The stop loss is placed above the previous local high.

The profit can be 2-3 times the stop loss (depending on how close the SL is to the key level).

Market Facilitation Index Indicator Conclusion

Used to identify the strength of trends and trend reversals within the market. The indicator displays histograms in different colors. Each color symbolizes a specific situation. By far, the pink one is the most important bar chart, as it indicates a possible trend reversal.

Responses