Description

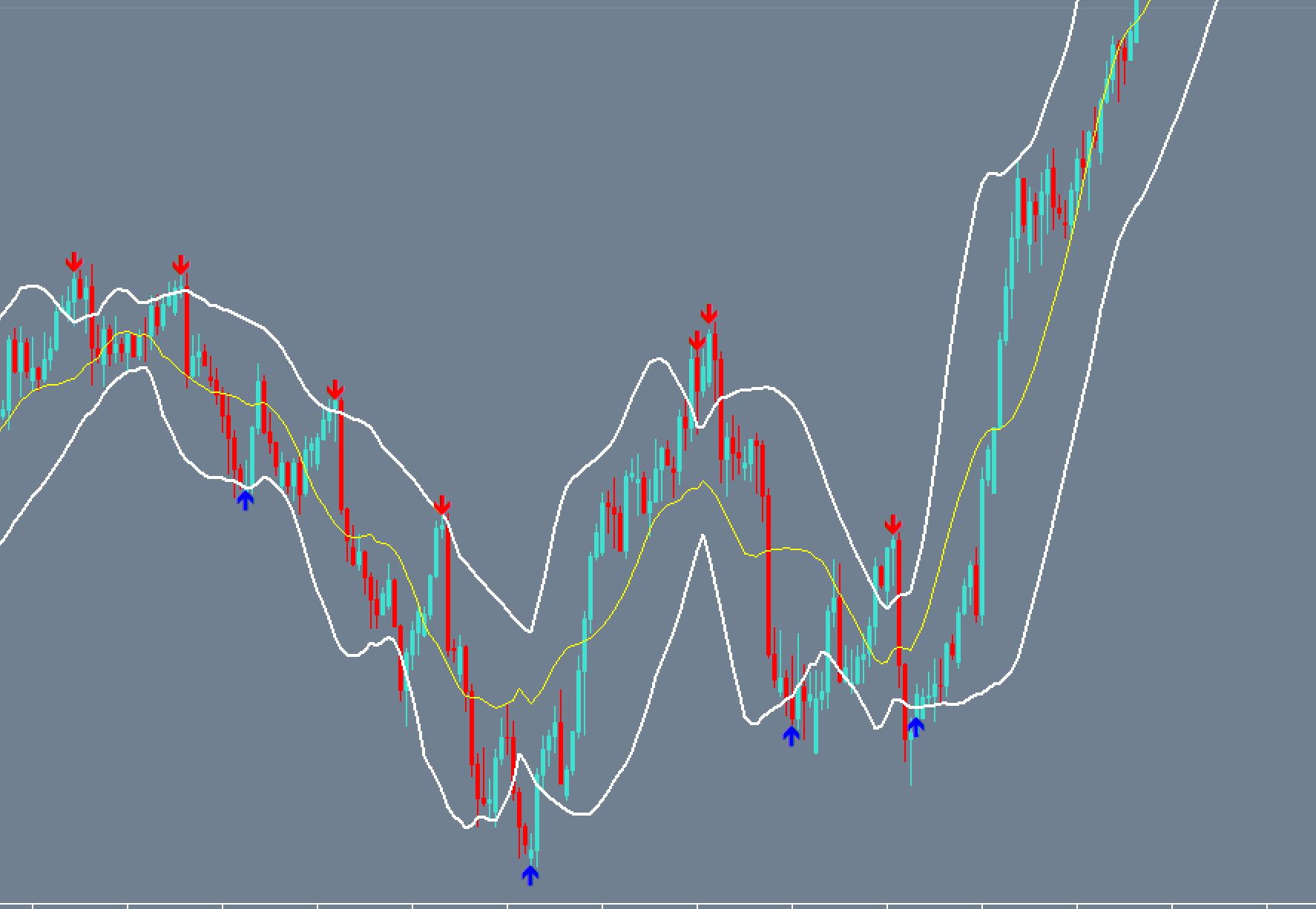

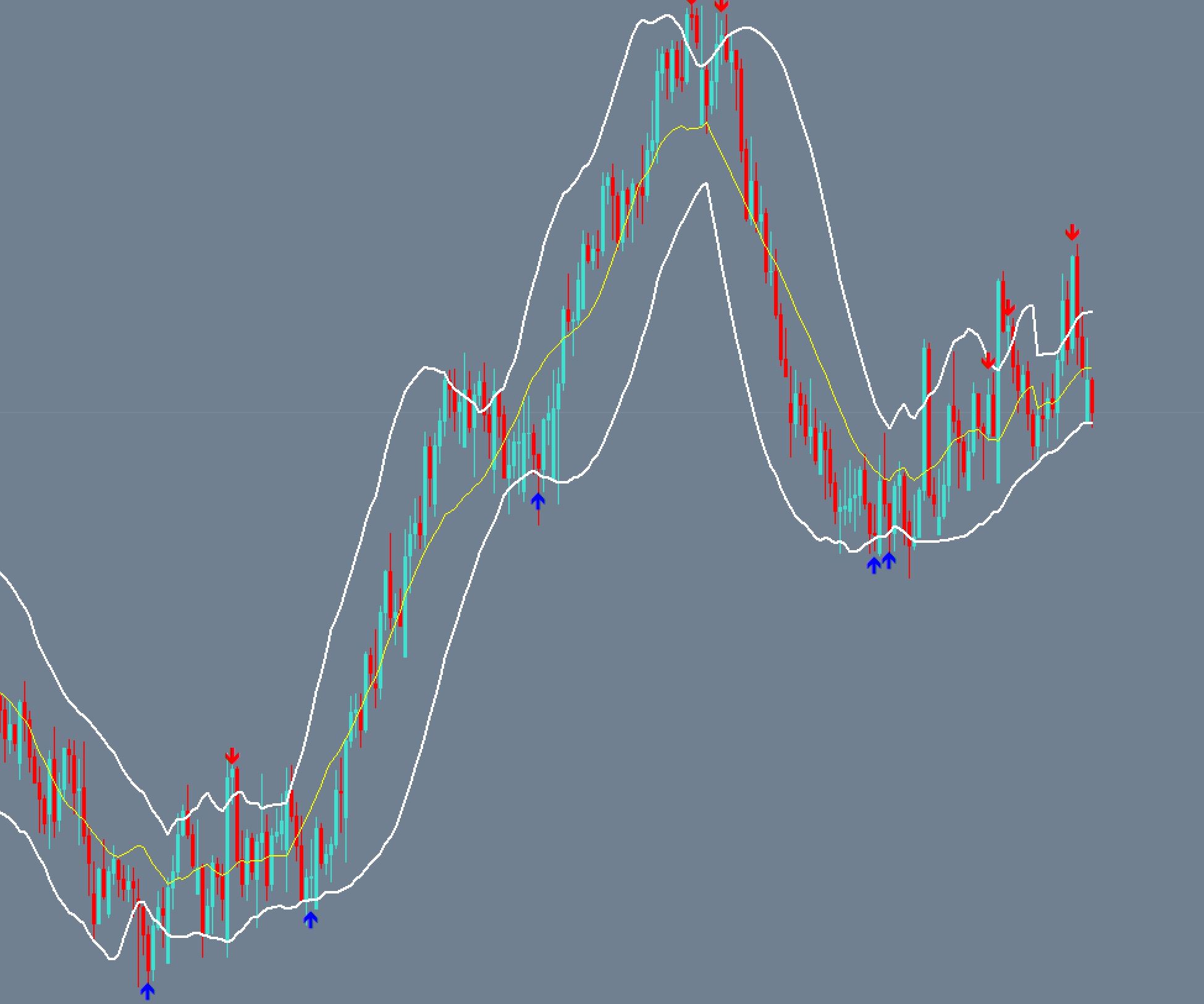

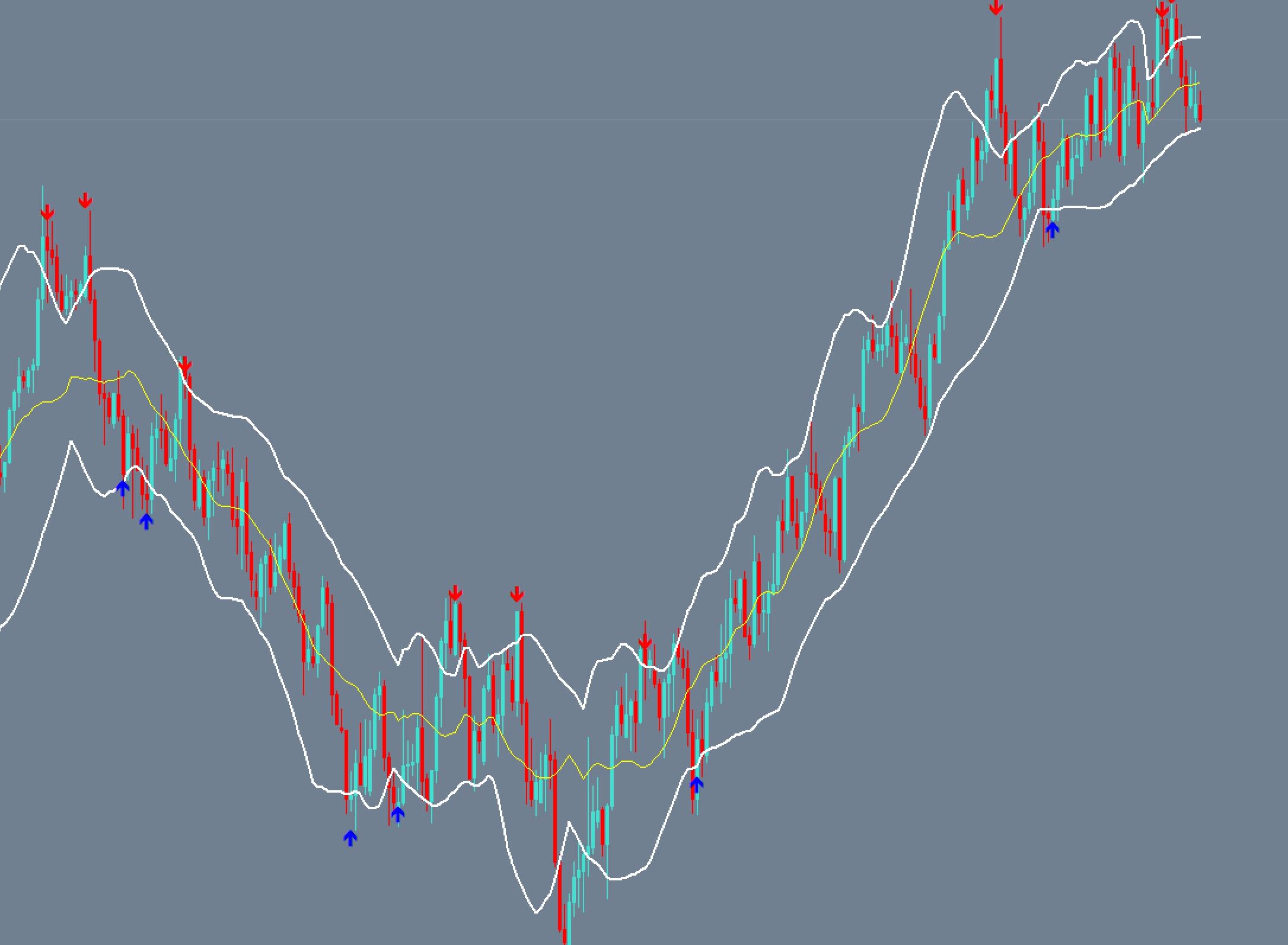

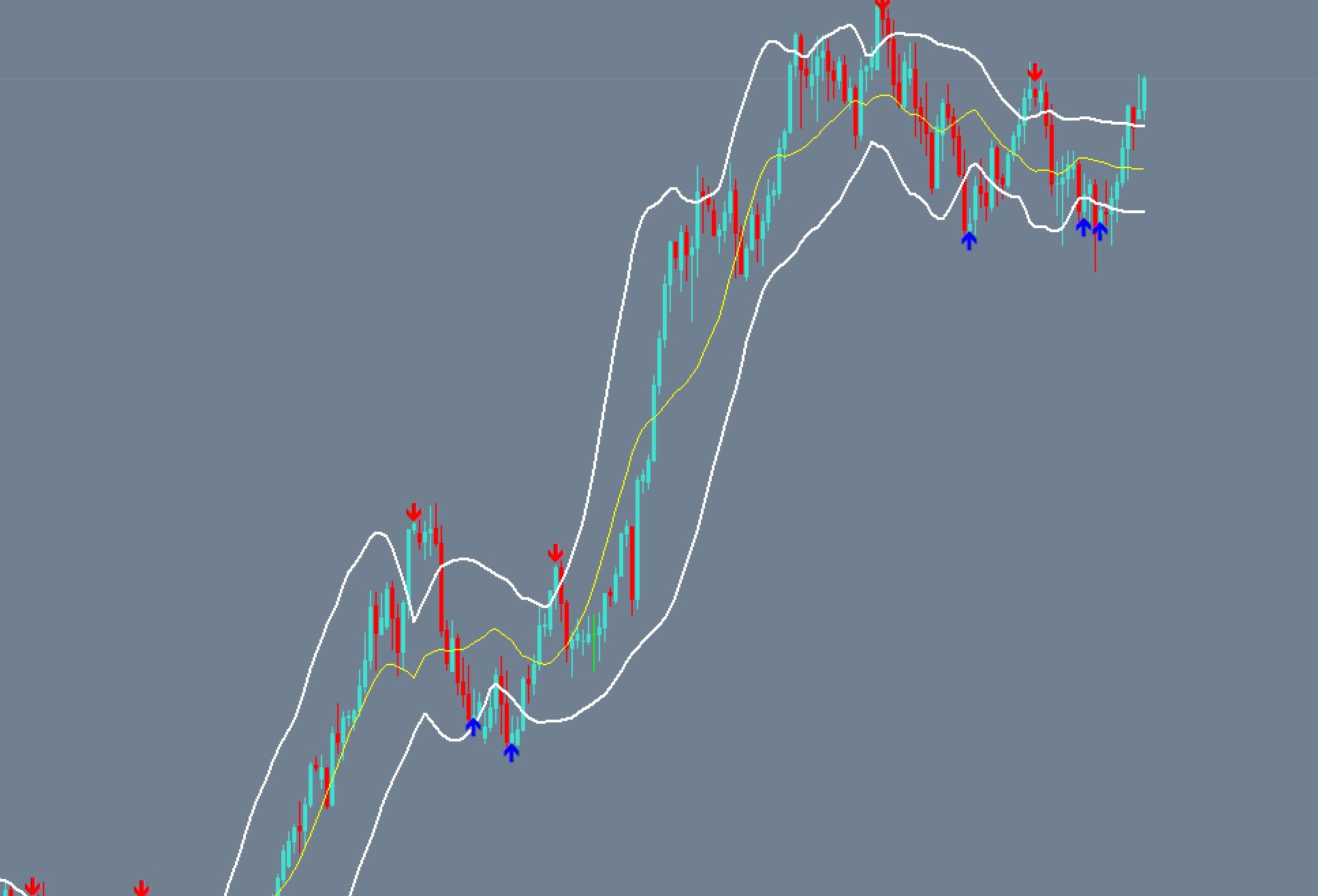

MACD + Bollinger trading signals for all pairs.

Applies to all pairs.

Although risk management is one of the easier topics to master, it seems to be the most difficult for most traders to master. Too often we see traders turning profitable positions into losing ones, with solid strategies leading to losses rather than profits. No matter how smart and knowledgeable traders are about the markets, their own psychology can cause them to lose money.

What could be the reason for this? Are the markets really so mysterious that few people make a profit? Or is it simply a common mistake that many traders tend to make?

The good news is that this problem, while emotionally and psychologically challenging, is ultimately easy to grasp and solve. Most traders lose money simply because they don’t understand or value rink management. Risk management essentially involves understanding how much risk you are willing to take and how much you want to gain.

Without an awareness of risk management, most traders simply hold losing positions for extremely long periods of time, but close them prematurely with profits. The result is a seemingly paradoxical situation, but one that is actually quite common: the trader ends up with more profitable positions than losing positions, but ends up with a negative profit/loss (P/L).

So, what can traders do to ensure they have solid risk management habits? There are some key guidelines that all traders, regardless of strategy or trade content, should keep in mind. Most traders simply hold losing positions for extremely long periods of time, but take profits on profitable positions too soon.

The result is a seemingly paradoxical situation, but one that is actually quite common: traders end up with more profitable positions than losing positions, but end up with a negative profit/loss (P/L). So, what can traders do to ensure they have solid risk management habits?

There are some key guidelines that all traders, regardless of strategy or trade content, should keep in mind. Most traders simply hold losing positions for extremely long periods of time, but take profits on profitable positions too soon.

The result is a seemingly paradoxical situation, but one that is actually quite common: traders end up with more profitable positions than losing positions, but end up with a negative profit/loss (P/L).

So, what can traders do to ensure they have solid risk management habits? There are some key guidelines that all traders, regardless of strategy or trade content, should keep in mind. What can traders do to ensure that they have solid risk management habits?

Risk-Return Ratio

Traders should establish a risk-reward ratio for each trade they make. In other words, they should know how much they are willing to lose, and how much they hope to gain. In general, the risk-reward ratio should be at least 1:2, if not more. Having a solid risk-reward ratio prevents traders from entering positions that are ultimately not worth the risk.

Stop-Loss Orders

Traders should also use stop orders as a way to specify the maximum loss they are willing to accept. By using stop orders, traders can avoid getting into the common predicament where they have many winning trades but only one loss large enough to eliminate any sign of profit in their account. Trailing stops are especially useful for locking in profits. A good habit of more successful traders

is to adopt the rule of moving the stop loss to break-even once your position is profitable by the same amount as you initially risked through your stop-loss order. Also, some traders may choose to close out a portion of their position.

Reviews

There are no reviews yet.