Arbor Review

Arbor, a trading adviser that can be used on demo accounts. We will also be reviewing the presentation which includes information regarding the system.

|

Arbor |

|

|

Type |

|

|

Prices |

$199 and $349 |

|

Strategy |

N/A |

|

Compatible Platforms |

MT5 & MT4 |

|

N/A |

|

|

Time frame |

H1 |

|

Minimum Deposit Recommended Minimum |

N/A |

|

Recommendation Deposit |

N/A |

|

Utilize leverage |

N/A |

|

Trade length |

8 hours |

Trading strategy explanation

Let’s talk about the system and its features:

-

This robot is designed to automatically execute orders on MT4/MT5 terminals.

-

There’s a news filter applied.

-

It calculates precise entry points.

-

This protects orders that have relevant SL or TP levels.

-

This system is a result of years of experience in trading and programming.

-

This robot supports trading cross-pairs.

-

The data from 20 years worth of ticks was used to test the system.

-

Live signals are available.

-

After purchasing the system, it is a good idea to contact the developers directly.

-

A manual will be sent.

-

Telegram support is provided by the developer.

-

It doesn’t work with a Grid and Martingale.

-

There’s one chart setup.

-

Only MQL5 is required to purchase the robot.

-

H1 is the best timeframe.

Backtest data analysis

The developer didn’t provide us with a backtest report. This is a con because we don’t know if the system was tested at all. We don’t know if it has been well tested before its release without this information.

Live trading data analysis

|

Trade Results |

|

|

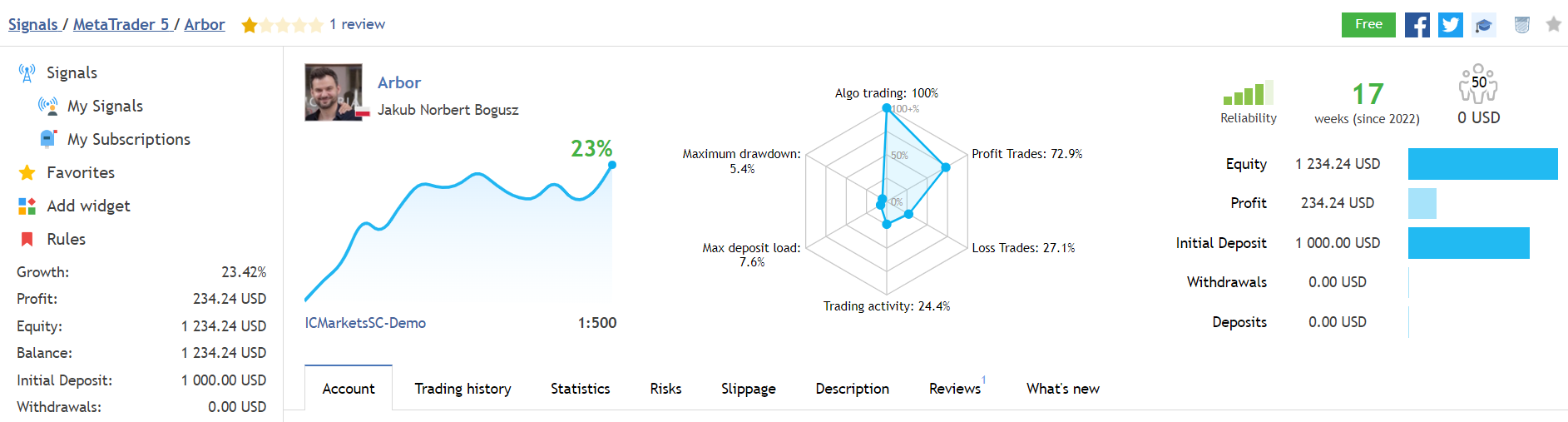

MQL5 account |

Demo (USD), IC Markets |

|

Started |

February 4, 2022 |

|

You can deposit |

$1000 |

|

Balance |

$1234.24 |

|

Gain |

23.42% |

|

Daily |

N/A |

|

Monthly |

6.13% |

|

Drawdown |

5.4% |

|

Profitability |

1.52 |

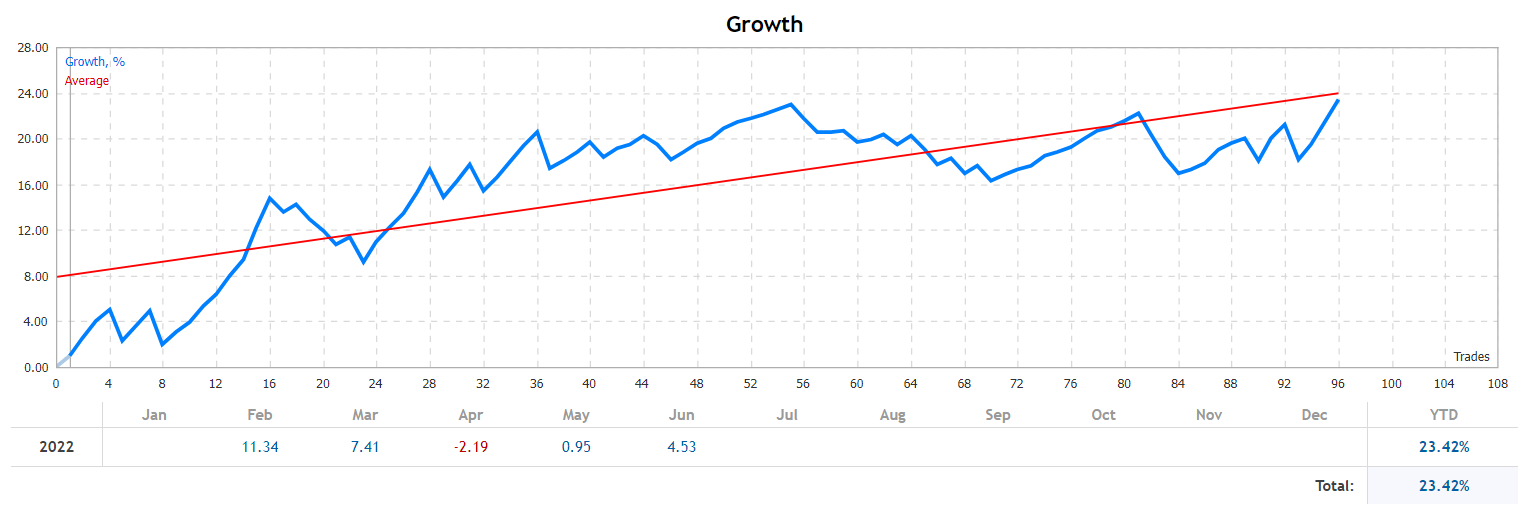

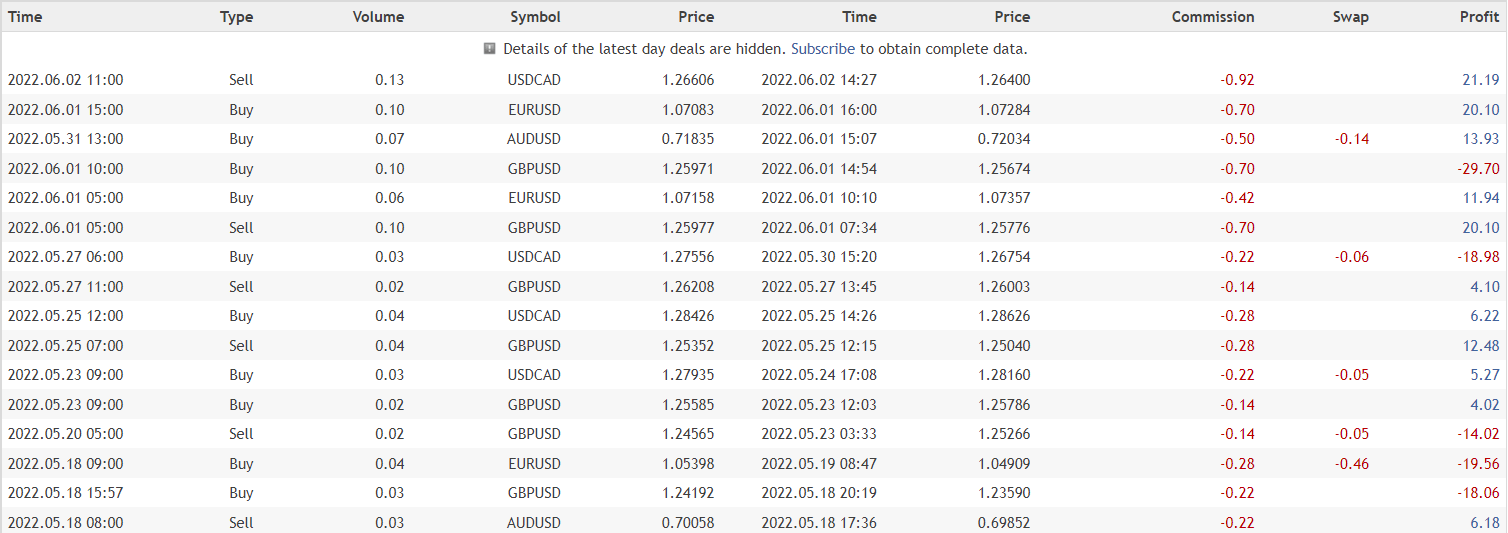

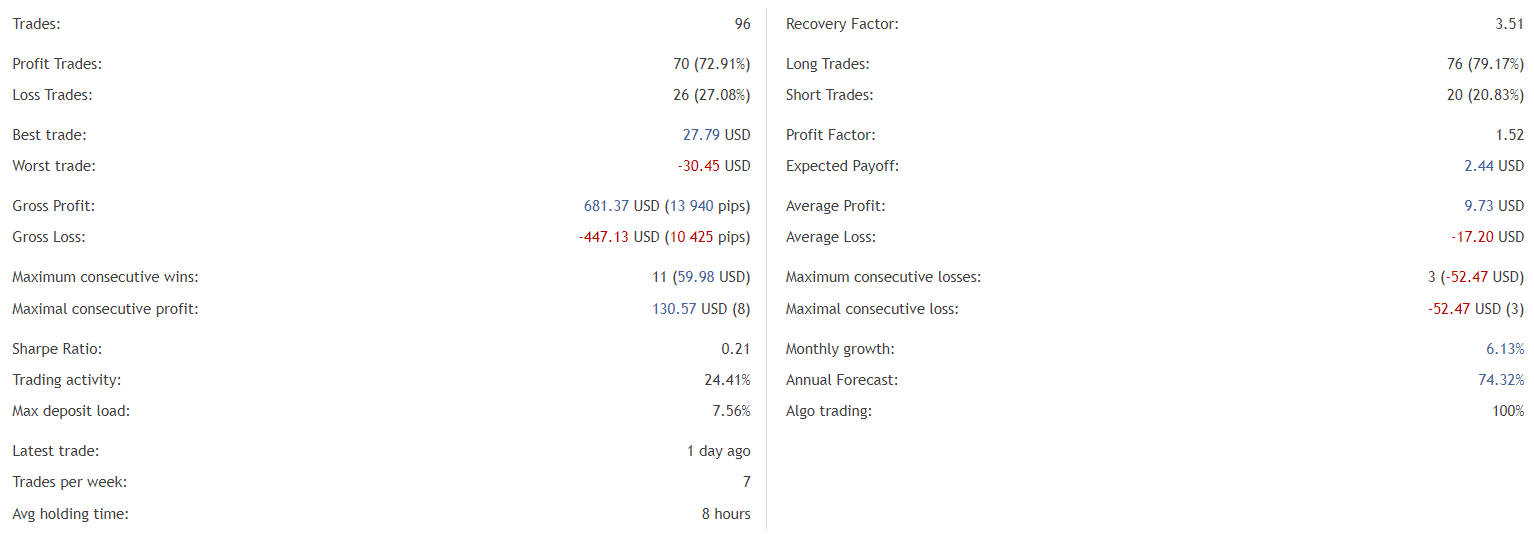

This robot can only trade with a demo account. This means that the developer doesn’t risk his money at all. Leverage is 1:1500. This leverage allows for maximum drawdowns of up to 5.4% and maximum deposits of up to 7.6%. The average win rate of 72.9%. This has resulted in an absolute growth rate of 23.42%.

The robot has now lost April 2022. Also, we can see from the chart that the system doesn’t work predictably.

Even three orders can be lost at a time by the robot. It’s pretty risky.

With the highest trade being $27.79, and the lowest at -$30.45, the robot concluded 96 transactions. The recovery factor looks acceptable–3.51 when the profit factor is a bit less than the average number–1.52.

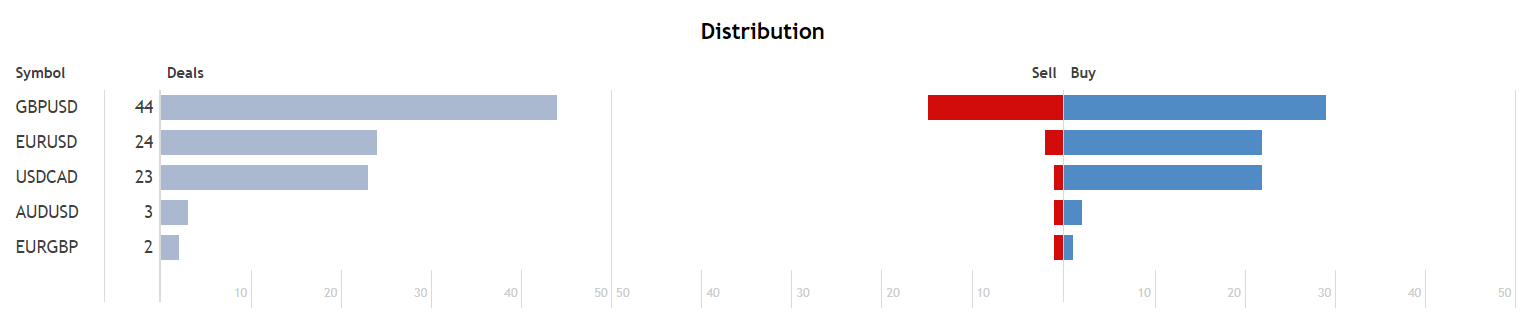

GBPUSD has 44 closed deals and is currently the most traded currency pair.

Vendor transparency

Jakub Norbert Bogusz, a Polish developer with a 3452 rating. His portfolio includes six products as well as five signals. Based on 47 reviews, they have a rate of 4.5.

This presentation contains only positive testimonials regarding the system’s performance.

Pricing

A real account copy can also be bought for $349. Free downloads are available for traders to try the software. A money-back guarantee cannot be provided.

Review summary

|

The pros |

Cons |

|

|

|

|

|

|

|

Arbor works with the demo account and is trying to survive. Its trading results showed that the robot couldn’t provide stable and predictable performance. We expected better performance for the amount it was sold at.

Responses