DIVO EA Review

DIVO EA works in the Forex market and makes profits. While the information is very brief, there are many details about this system. They were tested and we took the time to see how they performed.

|

DIVO EA |

|

|

Type |

|

|

Pricing |

$545 |

|

Strategy |

N/A |

|

Compatible Platforms |

MT4, MT5 |

|

GBPUSD and EURUSD. EURGBP. AUDCAD, EURCAD. GBPCAD. |

|

|

Timeframe |

M15 |

|

Recommendation Minimum Minimum Deposit |

$100 |

|

Recommendation Deposit |

N/A |

|

Utilize leverage |

1:100 |

|

Trade length |

8 hours |

Trading strategy explanation

Developers provide information on the system as well as its potential features. These developers are listed in the list below.

-

Advisor is an automated trading system that operates on real markets.

-

This can be used with different currencies.

-

Pricing will increase from $545 up to $995

-

This step doesn’t look welcome at all.

-

It doesn’t work with Grid and Martingale strategies.

-

To access files or instructions, we can gain access to the private group.

-

We can get all the support we need from our developer.

-

You have the option to choose bonus settings.

-

It is traded during calm periods.

-

For M15, the default setting is for GBPUSD.

-

GBPUSD and EURUSD are the core pair.

-

Rest pairs include USDCAD, EURCAD and EURCAD.

-

The broker protection function is included.

-

You can use it with orders pending.

-

There is a fixed SL level.

-

There’s slippage and spread protection.

-

The device includes self-diagnostic capabilities.

-

If we have the right knowledge, settings can be optimized.

-

You will need the Hedge type account.

-

It is important to maintain a low profile and minimal slippage.

-

This should only be used with VPS.

-

For each pair, the minimum deposit requirement is $100

-

Leverage should not exceed 1:100

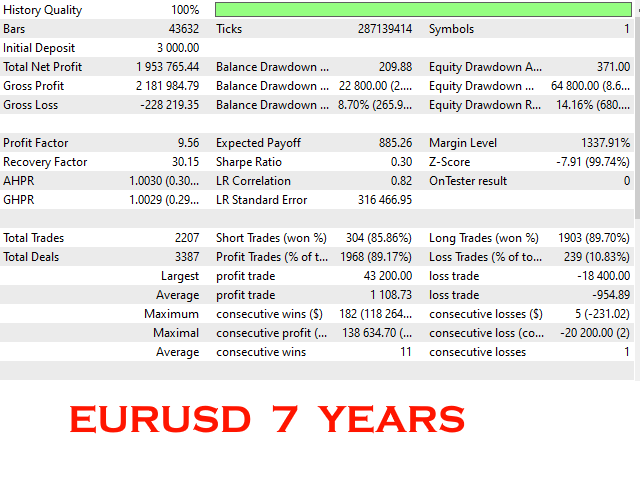

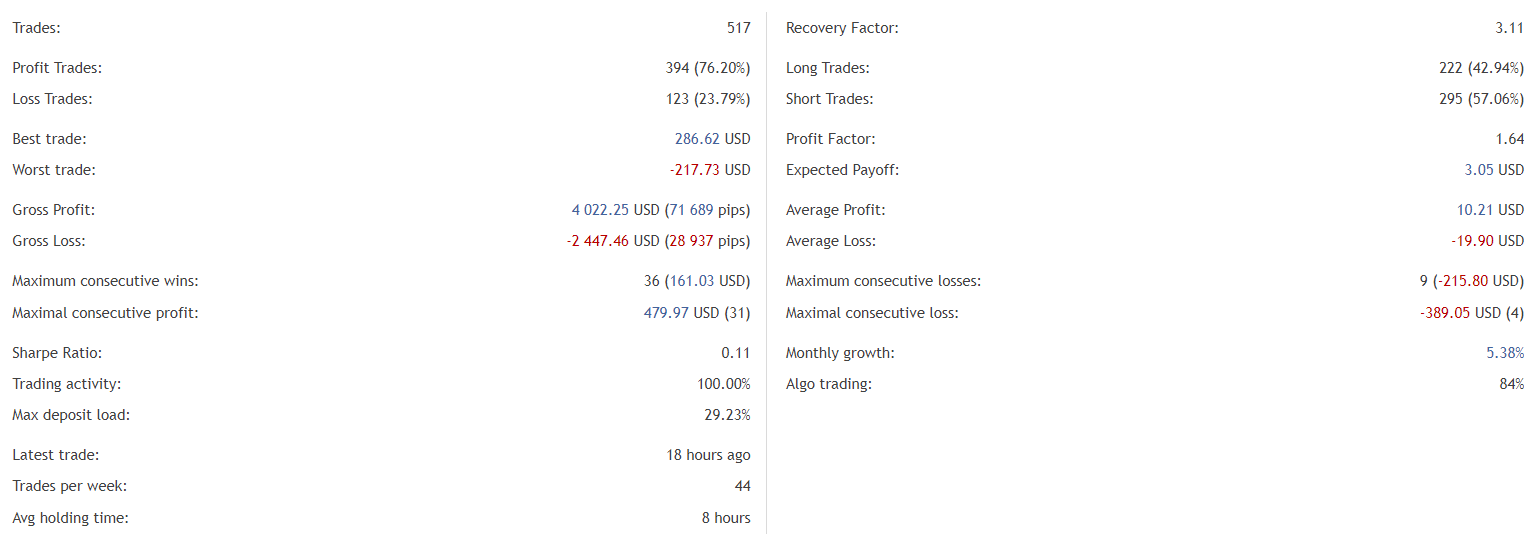

Backtest data analysis

It was evaluated using EURUSD for the data over seven years. The historical quality was 100%. The initial $3000 deposit was enough to make $1,953,765 the net profit. Maximum drawdown was 8.70%. The profit factor was 9.56 when the recovery factor was good as well–30.15. The company has completed 3387 transactions with an 85% success rate in short trading and 89% in long trading.

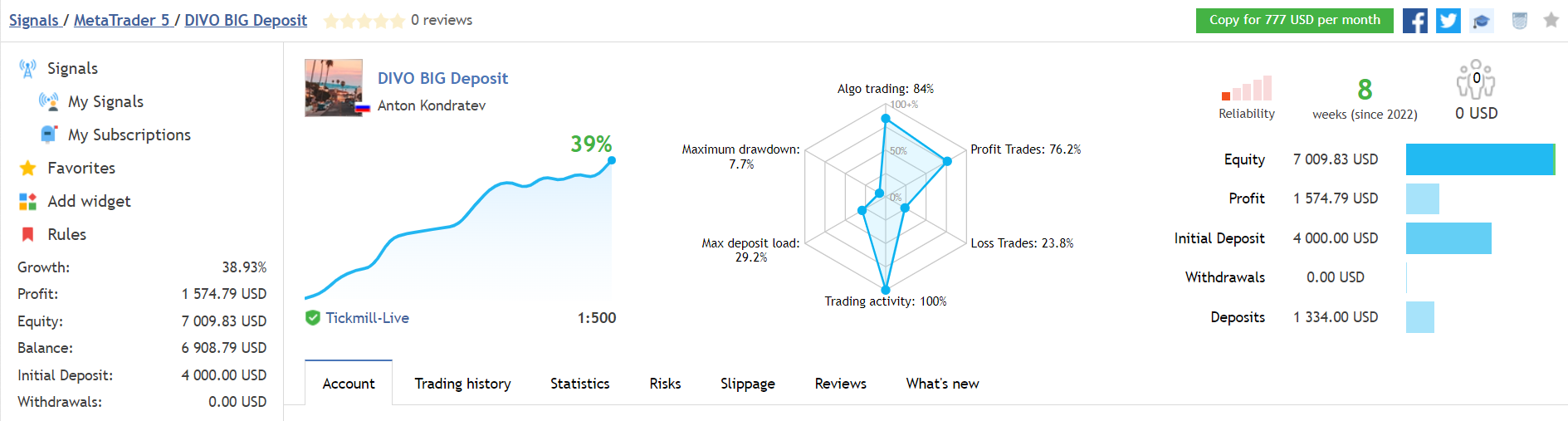

Live trading data analysis

|

Trading results |

|

|

Myfxbook account |

TickMill (USD), Real |

|

Started |

Mai 05, 2022 |

|

You can deposit |

$4000 |

|

Balance |

$6908.79 |

|

Gain |

38.93% |

|

Daily |

N/A |

|

Monthly |

5.38% |

|

Drawdown |

7.7% |

|

Profitability |

1.64 |

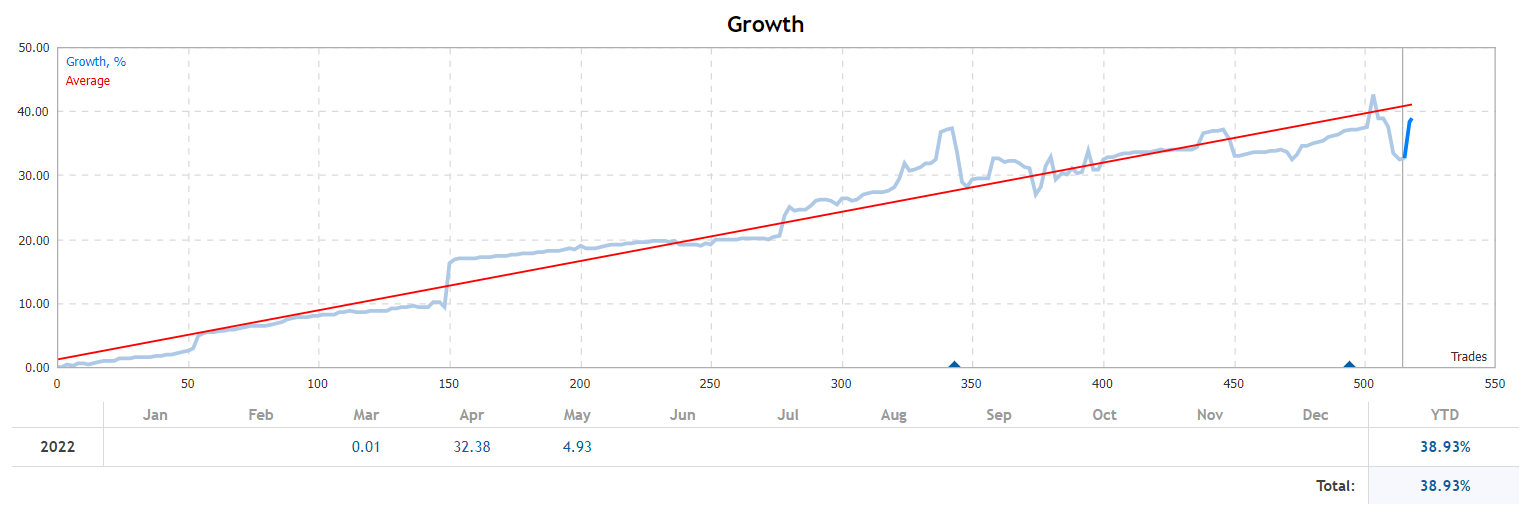

Tickmill’s live account has been automatically updated by the robot. Leverage is 1.500 The maximum drawdown is 7.7% and deposit load is 29.2%. There’s only 84% algo trading. You can trade manual here, so only 84% of the algo trading is available. This win rate is 76.22%. The absolute growth rate is 38.93%.

There are different levels of profitability in the trading system. Its growth chart doesn’t look smooth.

It uses the combination Hedge, Grid, Martingale. It’s an insane level of risk.

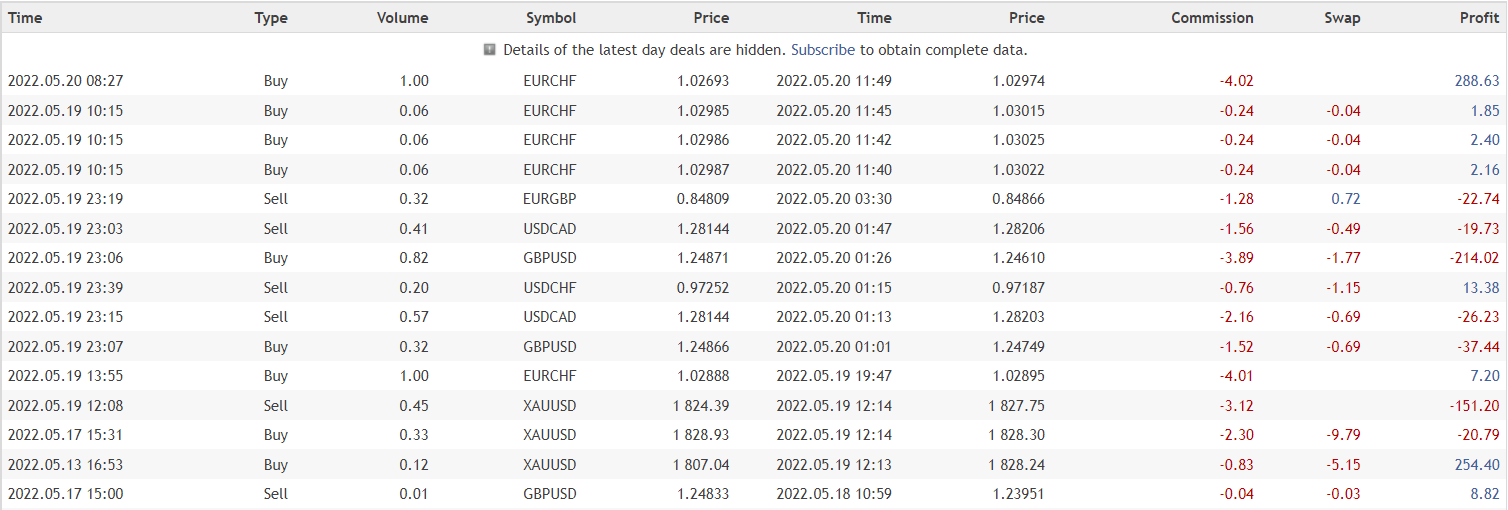

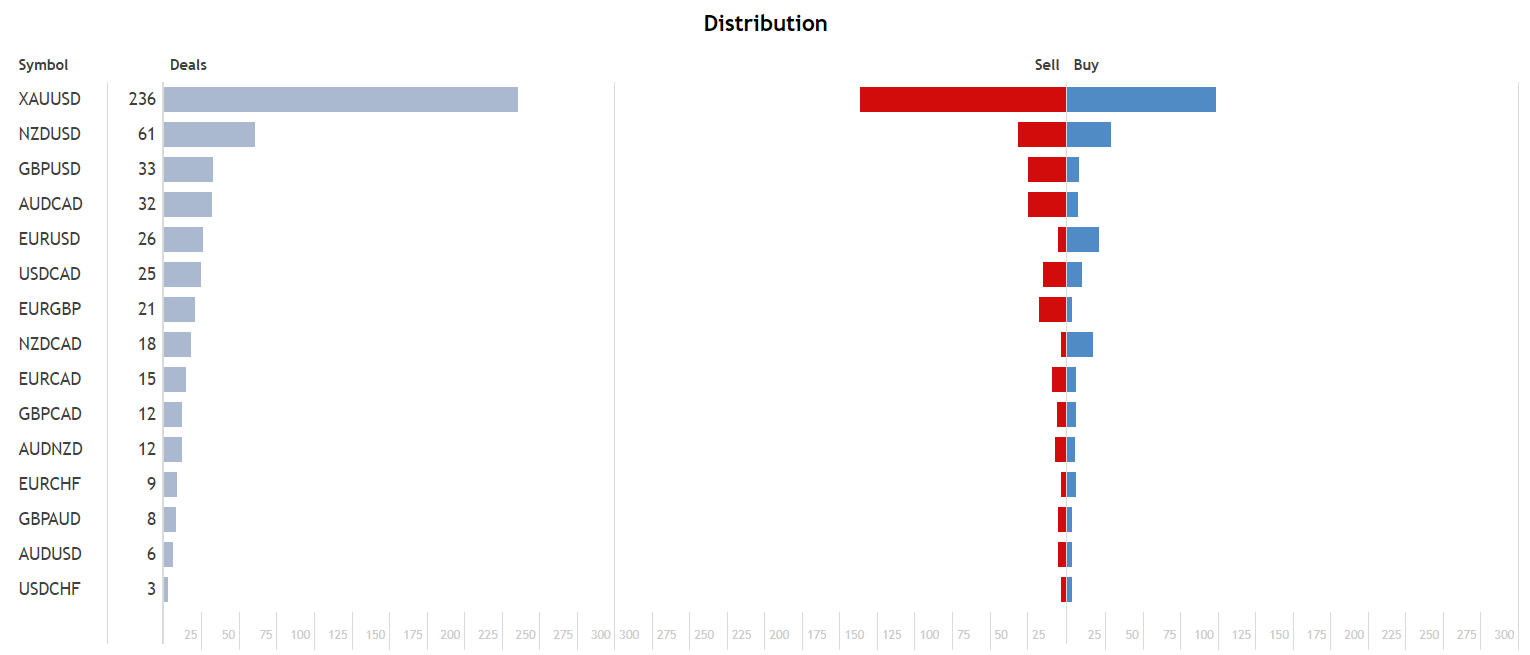

This robot closed 517 trades. Its best trade was $286.62, while its worst trade was -$217.73. The recovery factor is 3.11, and the profit factor 1.64.

XAUUSD, the most traded cross-pair, is at number one.

The company

Anton Kondratev was a registered developer not too long ago. He’s from Russia and his profile has a 3271 rate. This portfolio was rated at 4 on the basis of 35 reviews.

Pricing

You can get the system for only $545 We don’t have any subscription options for the robot. You can get a robot copy to run backtests or check the settings.

Review summary

|

There are pros |

Cons |

|

|

|

|

|

|

|

|

|

DIVO EA (Robot for Order Management) is an automated robot that uses a mix of three risky strategies to handle orders. It trades XAUUSD that wasn’t mentioned in the presentation and most likely we don’t have settings for it to trade. The presentation doesn’t provide intel about settings, risks, money-management, etc.

Responses