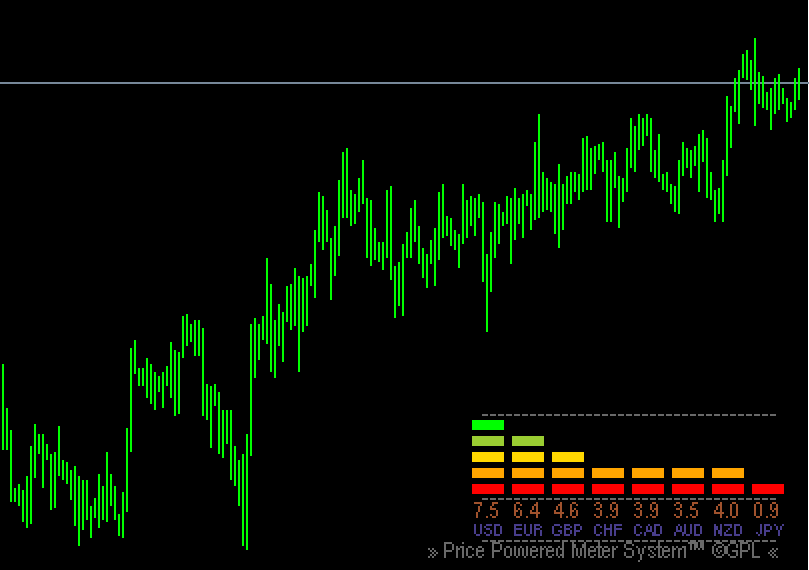

The indicator for Currency Strength for MT4 displays the strength of each currency by analyzing their performance against other currencies. This means that the indicator shows each currency’s strength visually in a histogram in color and as a numeric number. Therefore, forex traders can quickly recognize which are the bullish or bearish currencies and make the perfect pair of currencies to trade. By mixing the strongest currency against the weakest and continuously checking its strength, technical traders can take advantage of the current trend by using a trend-following trading strategy.

The indicator is useful for beginners or experienced Forex traders. Beginners can easily see what the bullish and bearish patterns of the currency pairs are and their inherent strengths. The indicator is available to download for free and is easy to install.

Currency Strength Meter Indicator for MT4 Trading Setup

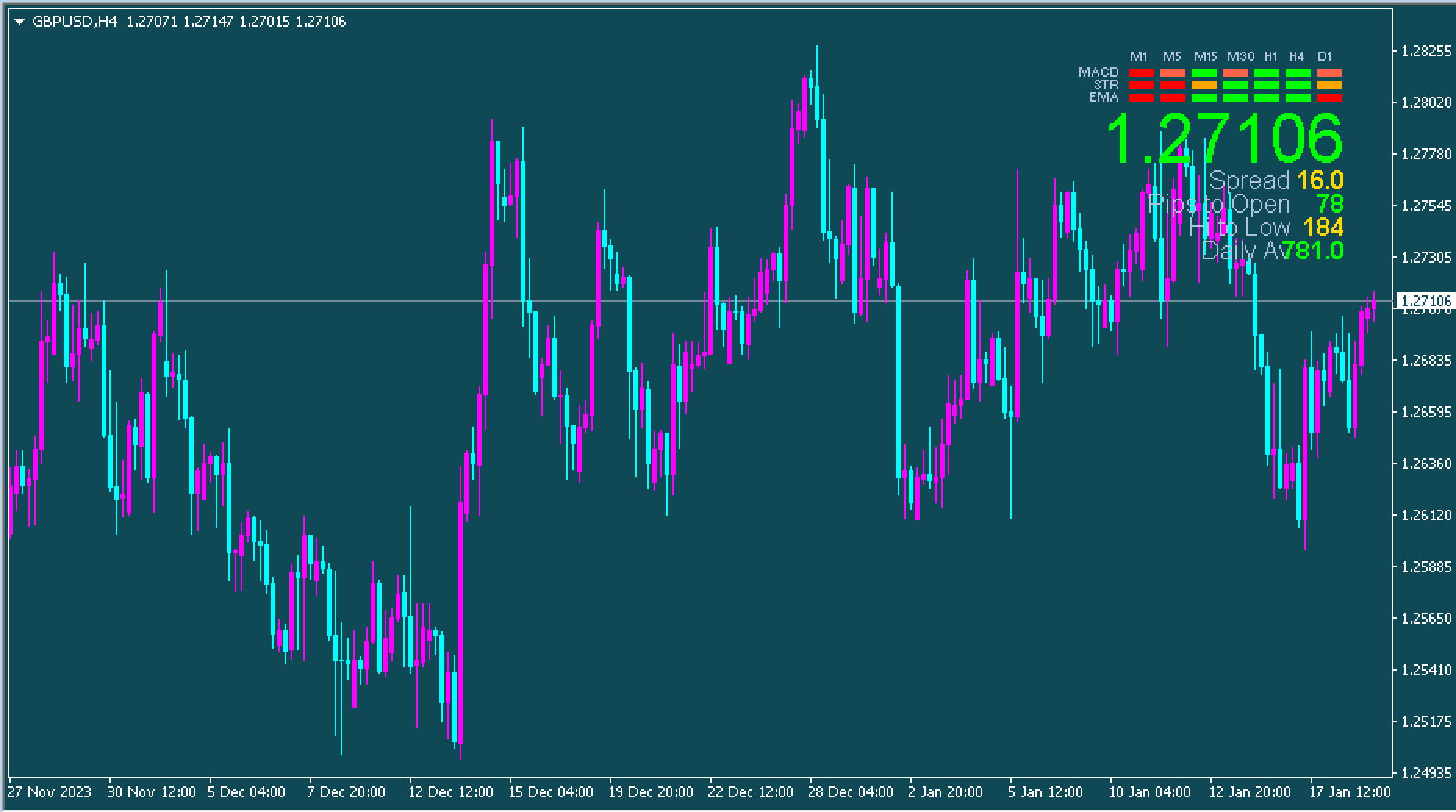

The indicator shows the meter at the lower right-hand corner of the chart. Additionally, the strength of the currency can be seen in a variety of shades based on the currency’s strength. RED for extremely poor, orange Red for weak, light green for strong, and lime for extremely robust. In addition, the strength of the form of a number is determined by Sienna, and the title of the currency is DarkSlateBlue.

Forex traders can make use of this indicator to gauge the strength of a currency against another and determine the strength of a particular currency. Thus, forex traders can combine the strongest currency with the weakest one and then buy or sell in accordance with this. The higher value of a currency indicates the true bullish price trend. However, the lower value indicates an underlying bearish market trend.

However, an increase in strength suggests that it is a sign that the currency has lost strength. Forex traders are able to either close the trade or earn profits only in part. However, if the currency’s strength holds, traders are able to remain in the position and ride to the top of the market until it starts to show weakness.

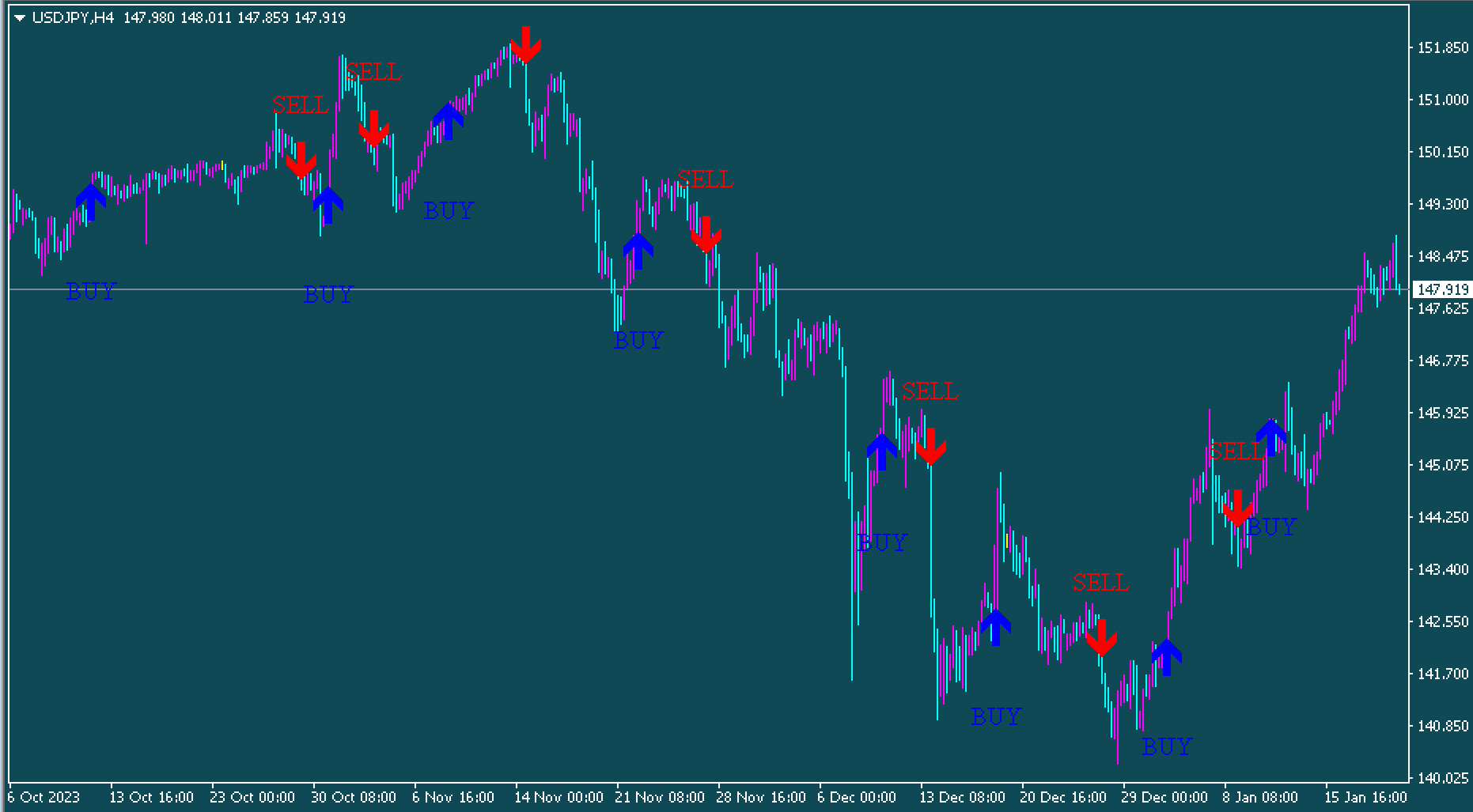

The indicator operates according to the principle that if one currency is experiencing bullish momentum, another currency will be gaining bearish momentum. Forex traders can buy or sell a currency pair after a strong and weak currency is identified, and then pitch them against one another.

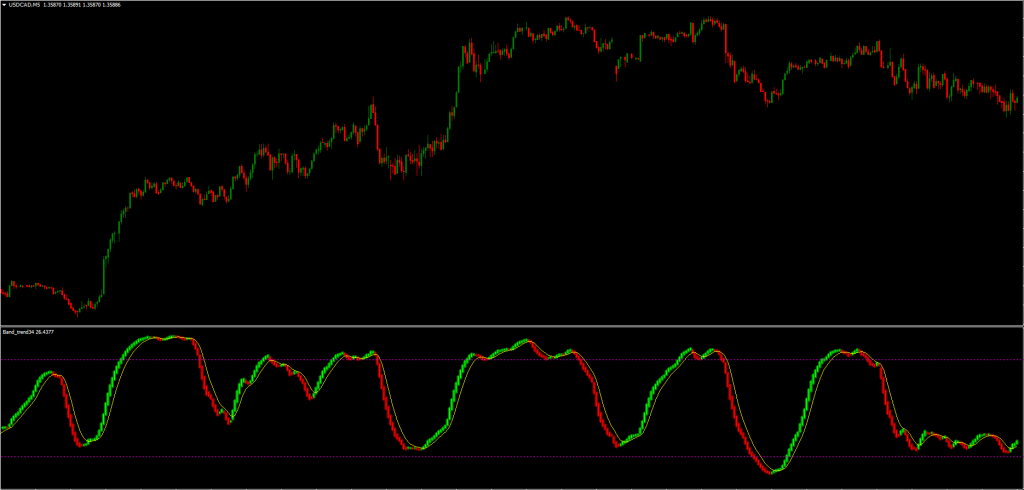

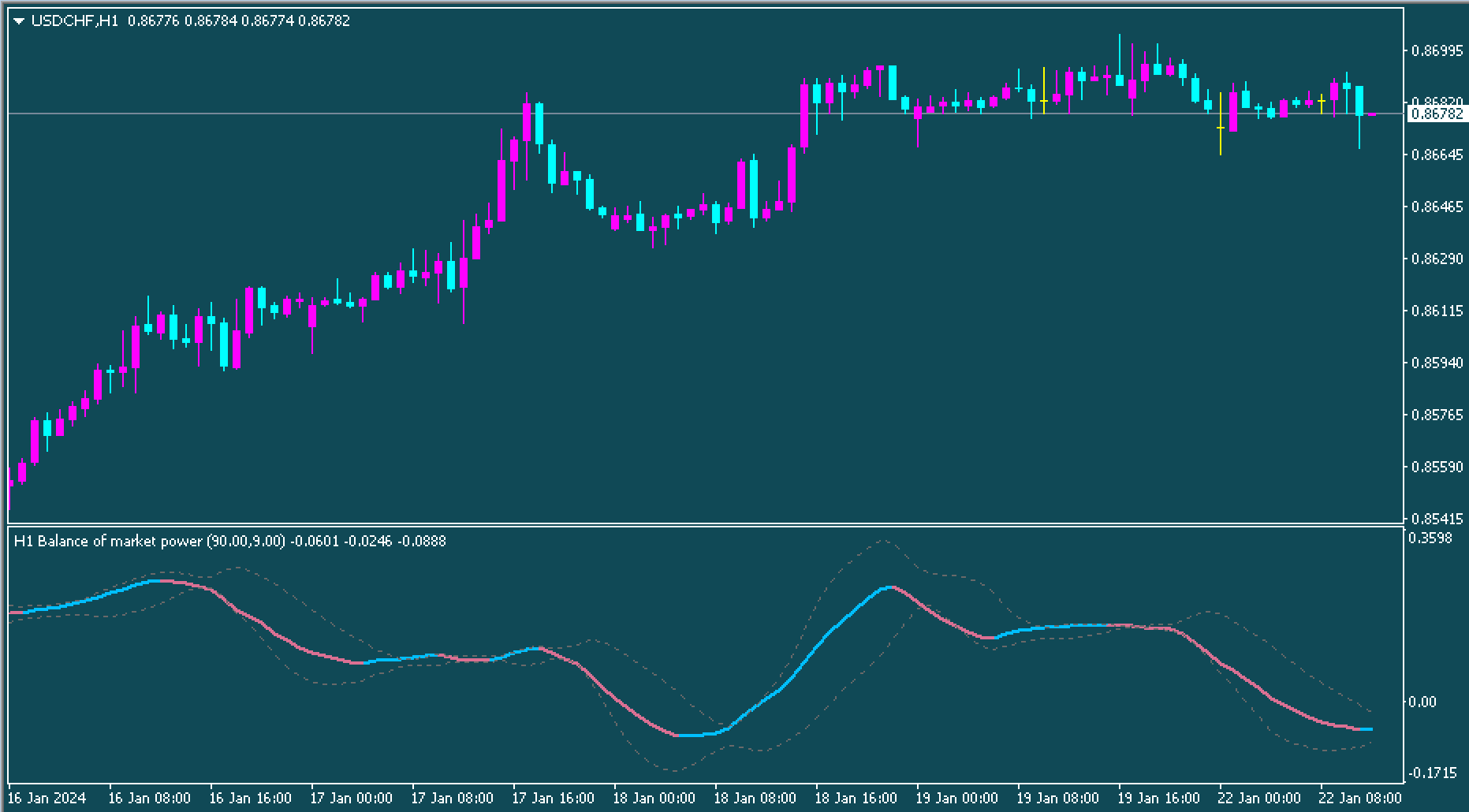

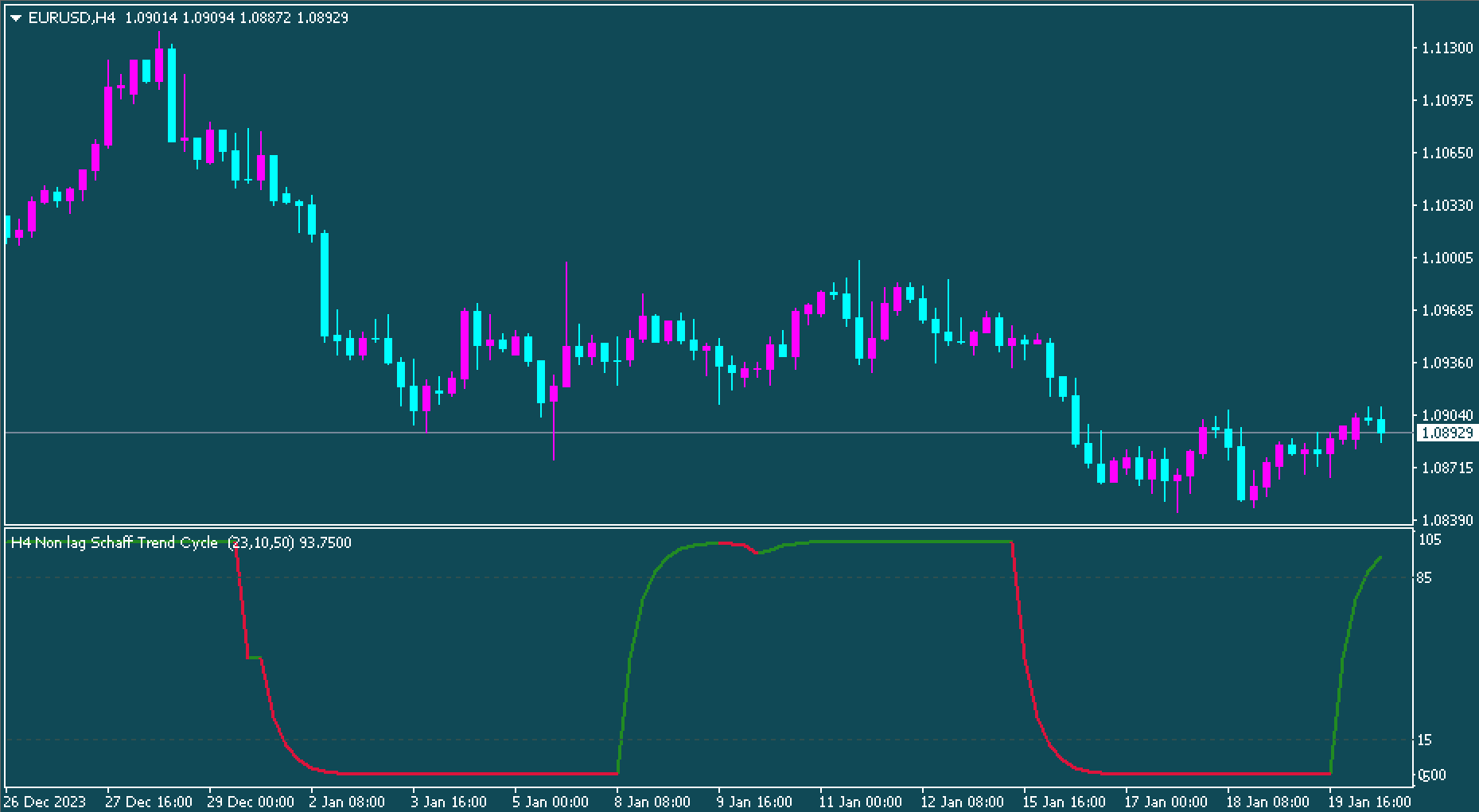

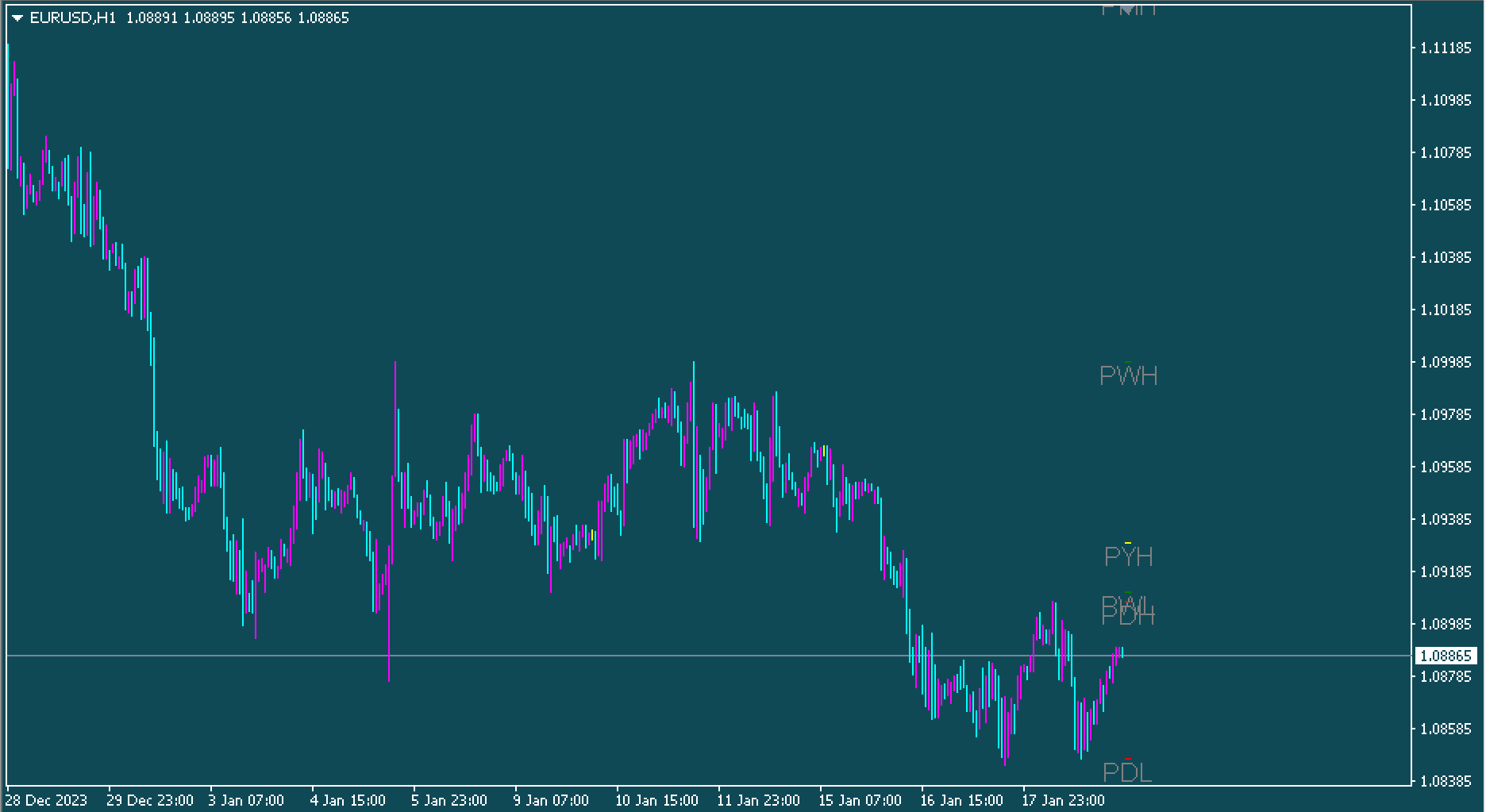

The indicator is effective in all intraday timeframes and also on the weekly, daily, and monthly charts. Therefore, forex traders can utilize this indicator to determine trends in the longer time frame and the best entry and exit points in the lower time frame. The indicator is then employed to trade with multiple- timeframes (mtf).

Conclusion

The Currency Strength Meter for MT4 gives trading signals based on the color of your choice. But the signals for trading yield the most favorable results when the price is bouncing off a channel, support, or resistance. In addition, forex technical traders are able to trade trading signals along with the other indicators of trend. In addition, forex investors can get the indicators for free and install them with ease.