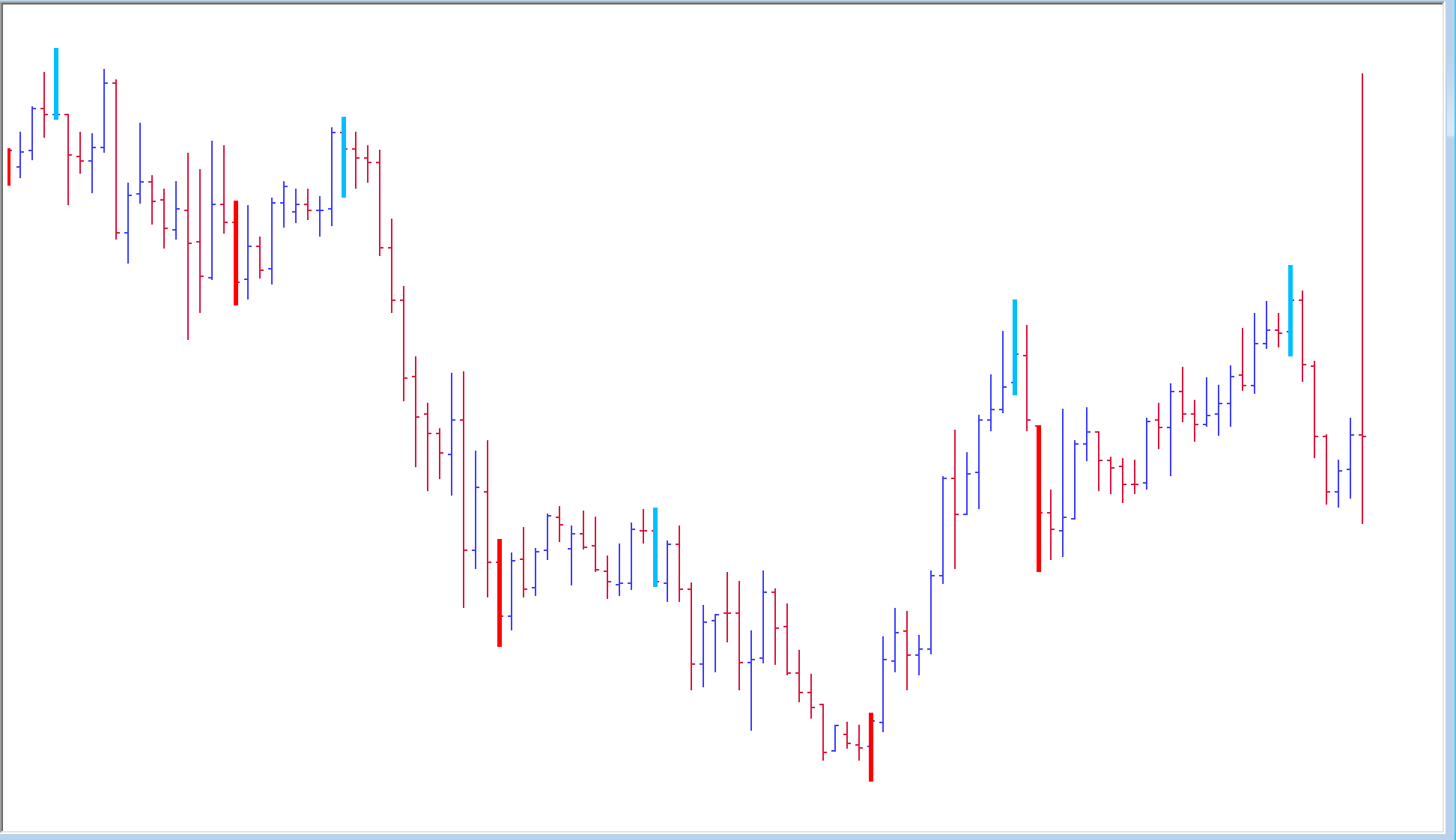

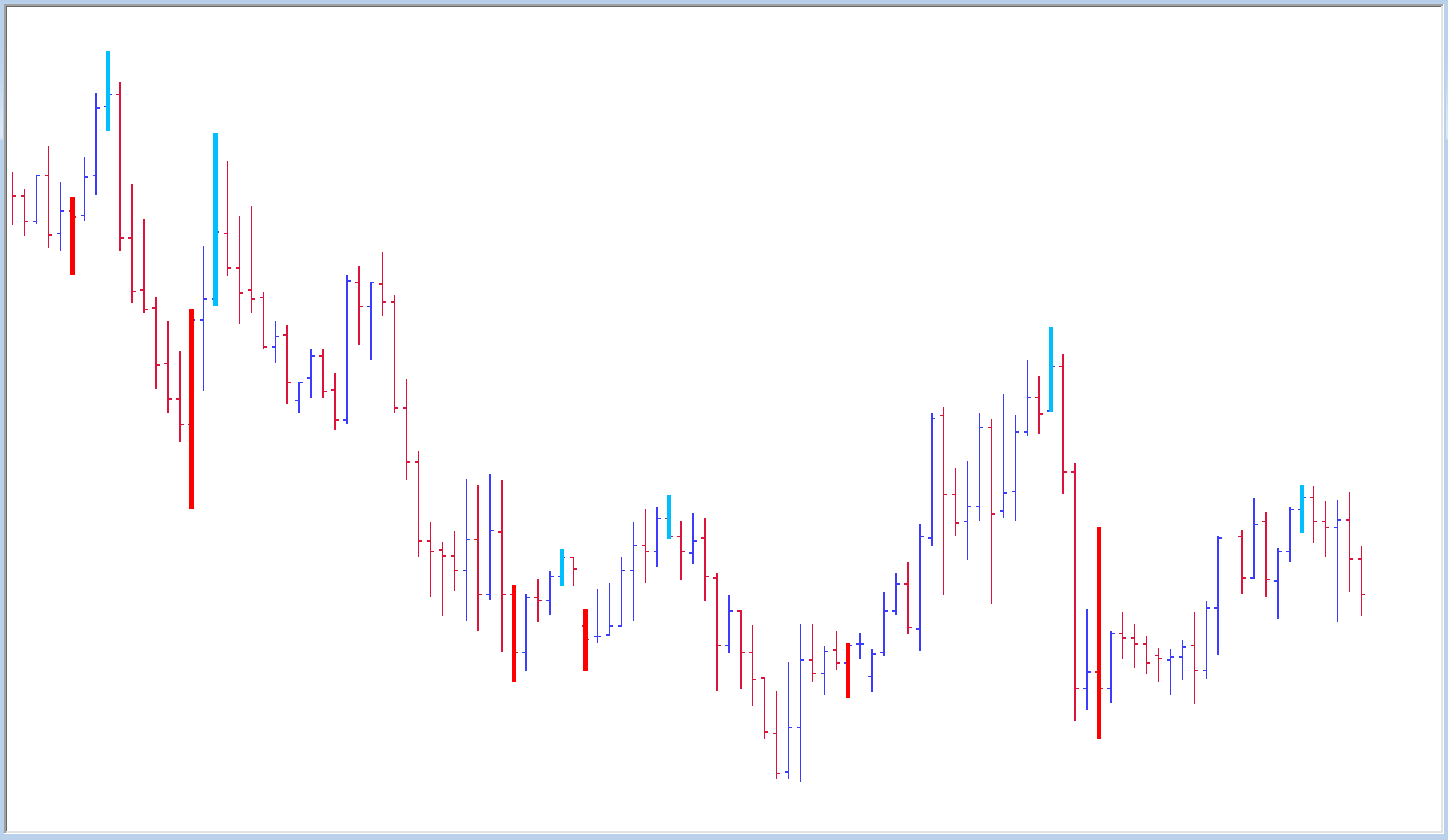

The Reversal Bar indicator for MetaTrader is an indicator for forex that depicts the price reversal bar to indicate the highs and lows of the trend. It has red and sky blue colors for this indicator, which signals the possibility of a retracement in an in an upward or downward direction.

The non-repaint indicator can prove useful to both traders of the trend and the counter-trend to determine the best entry point. In essence, this indicator is suitable to confirm the conclusion of a short-term trend retracement.

Additionally, it is chart-friendly and suitable for both experienced and novice forex traders. In addition, it is perfect for trading in different types, like day/intraday scalping or swing trading.

How to Trade With The Reversal Bar Indicator

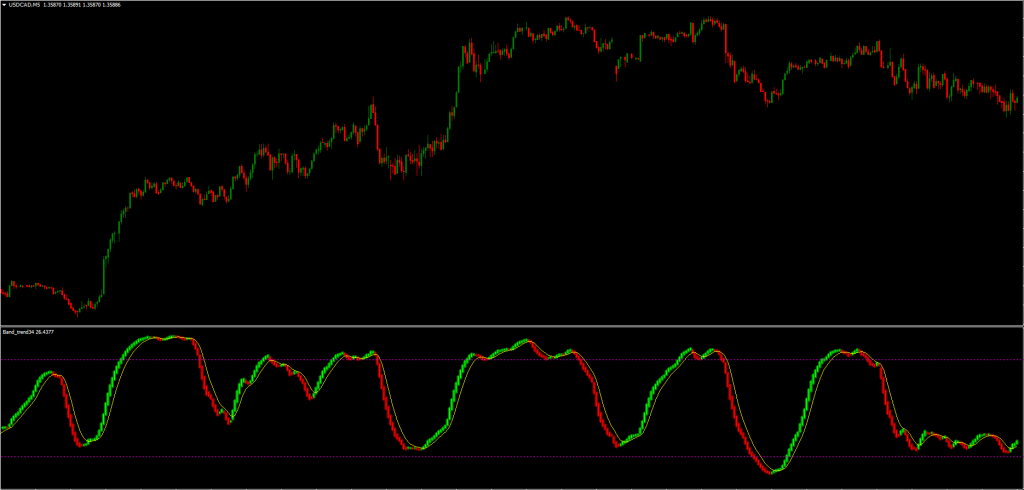

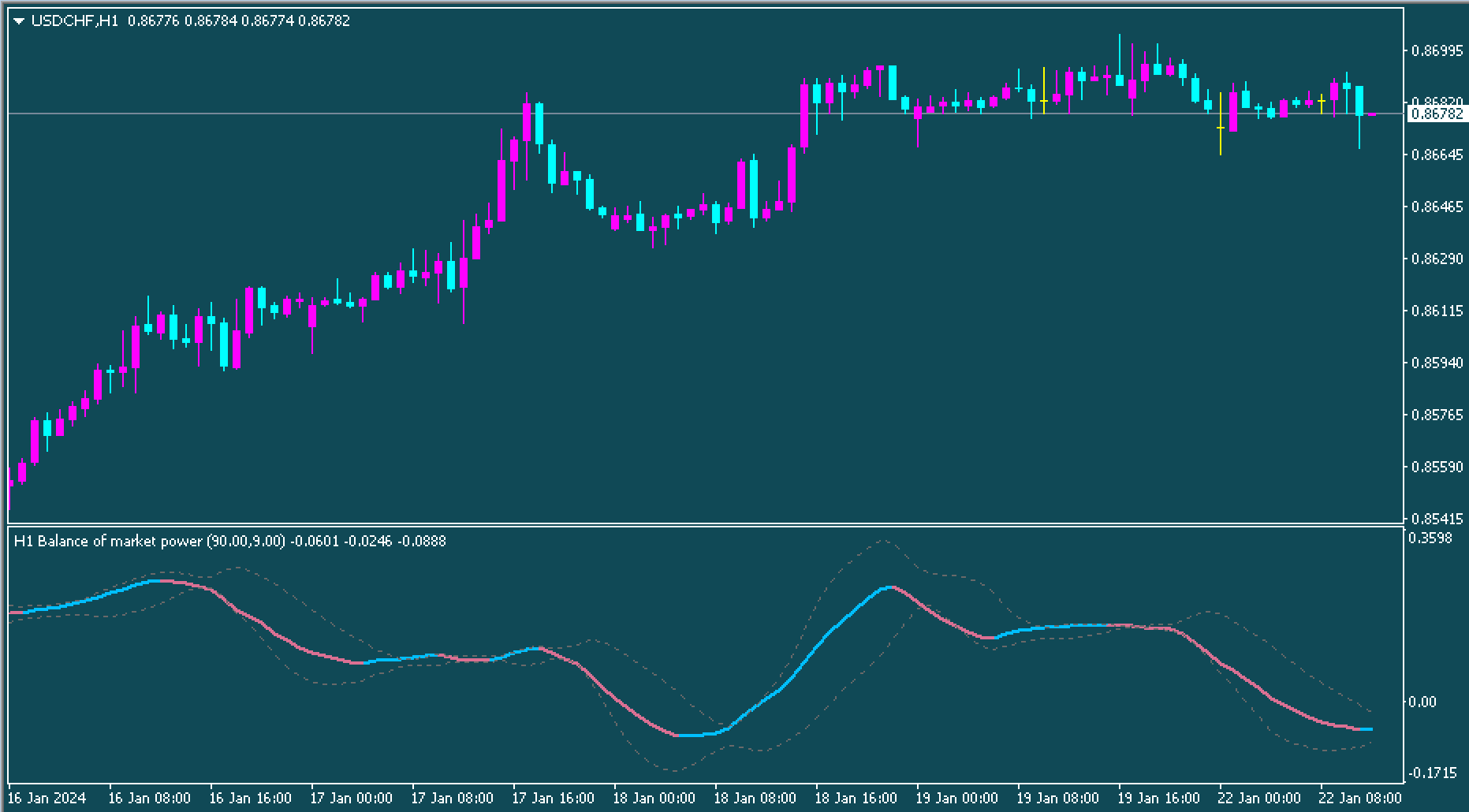

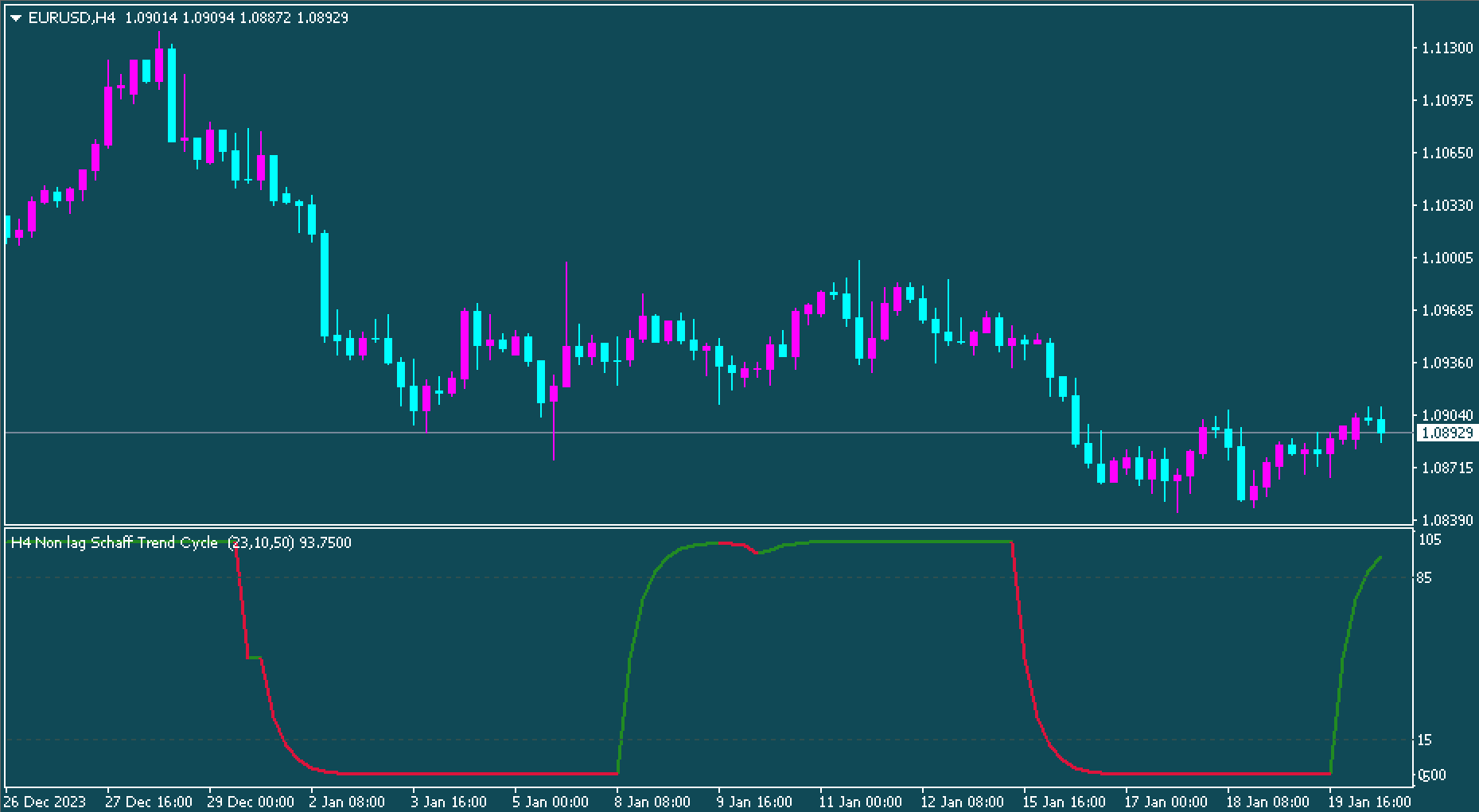

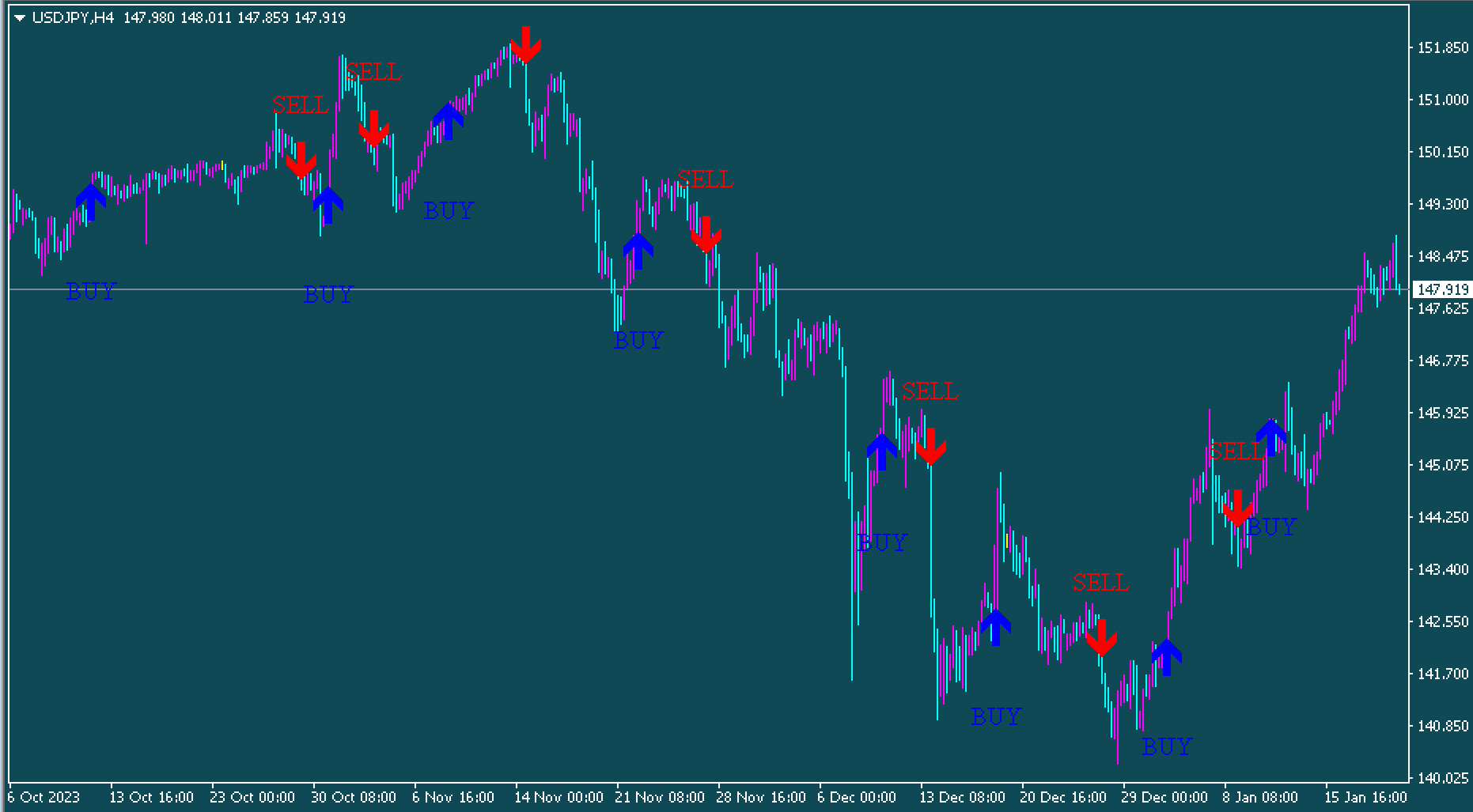

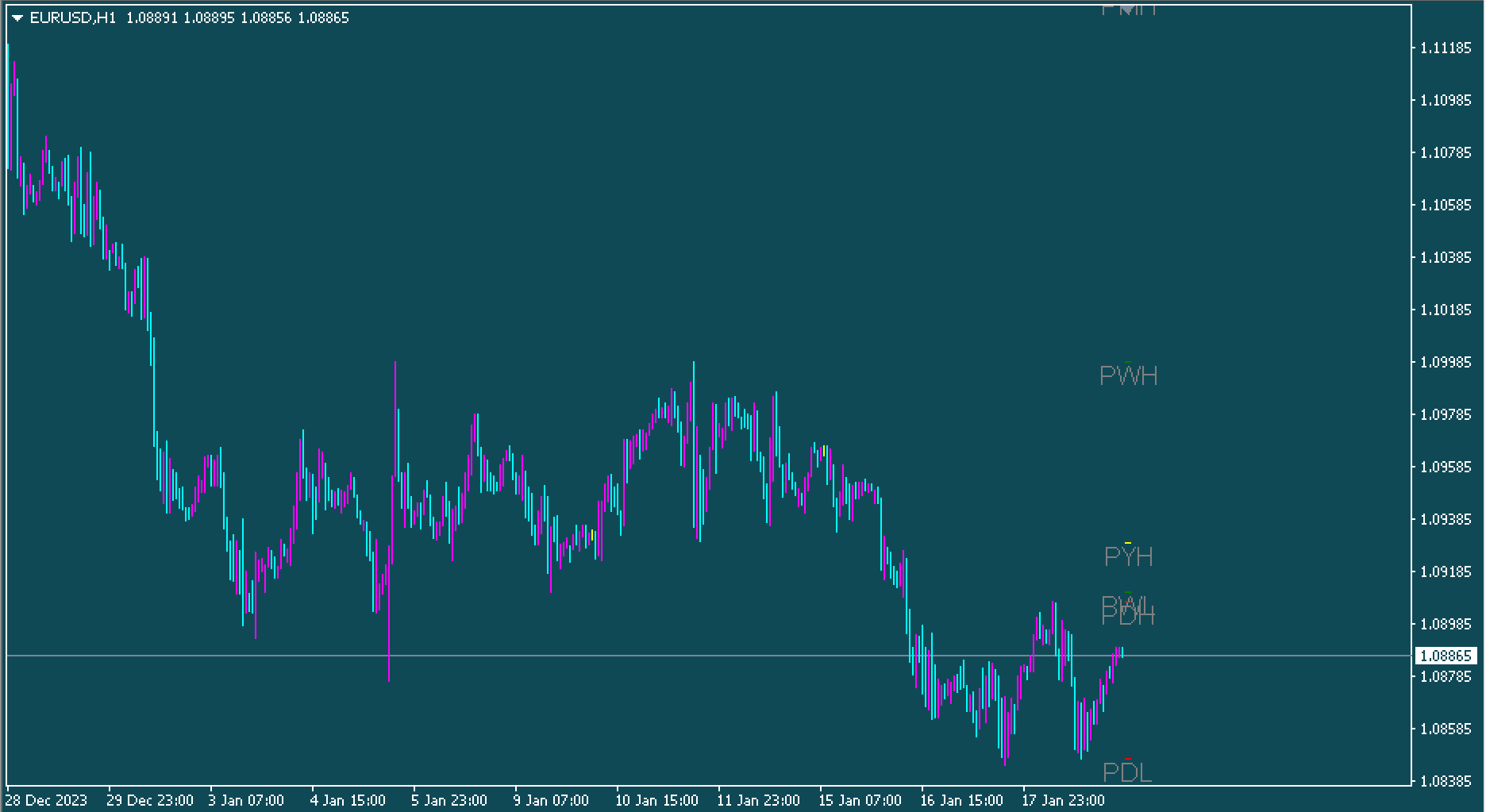

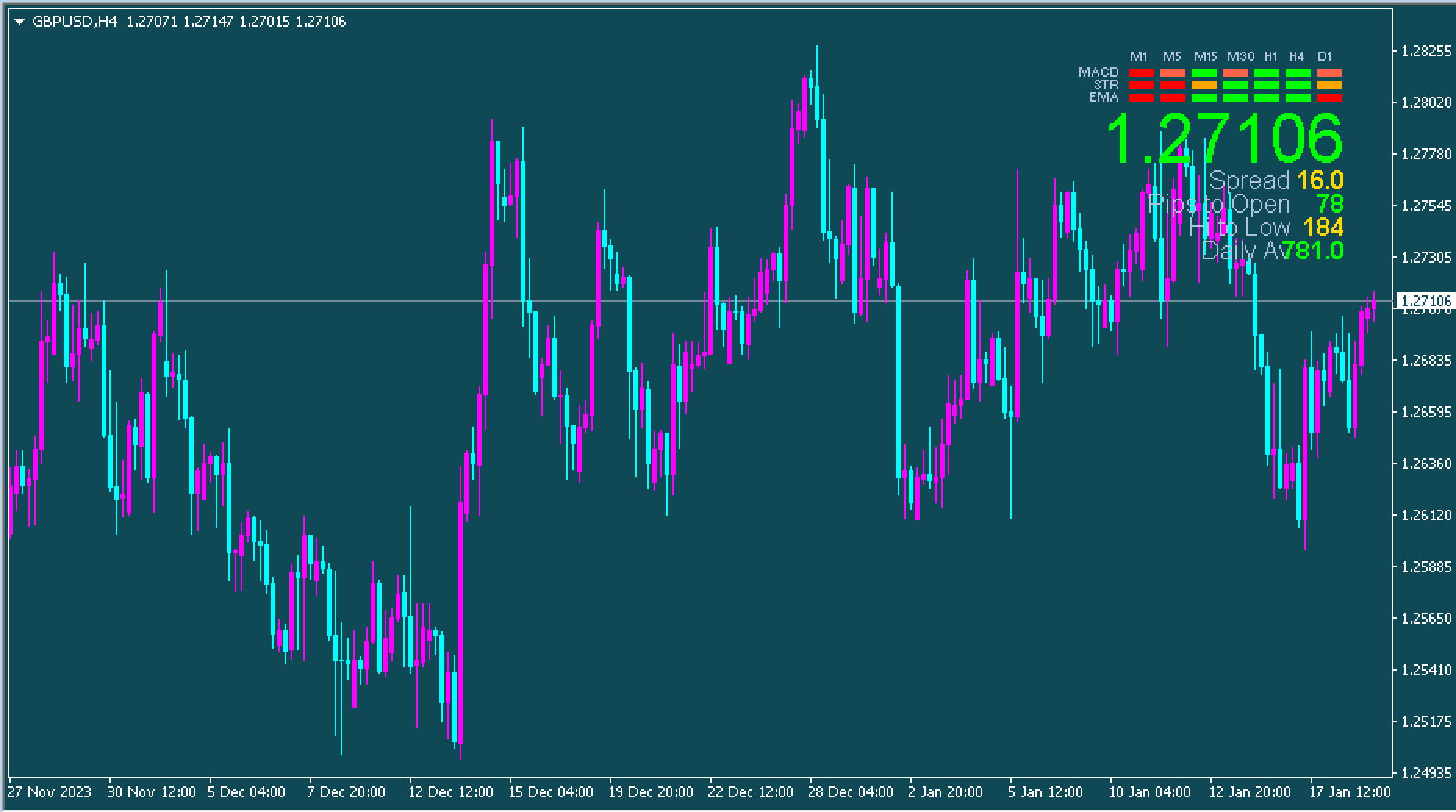

The screenshot above shows what the indicator might look like on the MT4 platform you use. Additionally, it is advised that you use this indicator in conjunction with technical analysis or other indicators of trading to increase effectiveness.

SELL and BUY signals: Firstly, determine the trend that the market is in, which in this case is an uptrend. Then, wait for the indicator’s paint to create the reversal bar in a sky blue before you start a buy or long trade after the price has broken the bar upwards. The buy principle above can also be applied to an entry and setup for a sale.

Conclusion

The Reversal Bar indicator that is available for MT4 was developed to help you determine the low and high price zones that the market could reverse. The indicator is available to download for free.