Waiting Night Review

Waiting Night, a fully-automated system that trades on various currency pairs using multiple built analysis techniques, is called “Waiting Night”. Expert advisors use pending orders to minimize slippage in executions. They also comply with FIFO rules for greater compatibility with brokers. It is relatively new and promising good profitability in the MQL 5 Marketplace. We will evaluate the claims to make sure the product is suitable for investing.

|

Type |

Fully automatic EA |

|

Prices |

$199 |

|

Strategy |

Night scalping |

|

Compatible Platforms |

MT4/5 |

|

Multiplied |

|

|

Timeframe |

N/A |

|

Recommendation Minimum Recommended Minimum |

$100 |

|

Referred Deposit |

N/A |

|

The Leverage |

N/A |

Trading strategy explanation

Developer claims that algorithm uses night scalping to trade USDCAD and USDCHF. The algorithm uses price action, a customized indicator and built-in risk management methods to maximize performance.

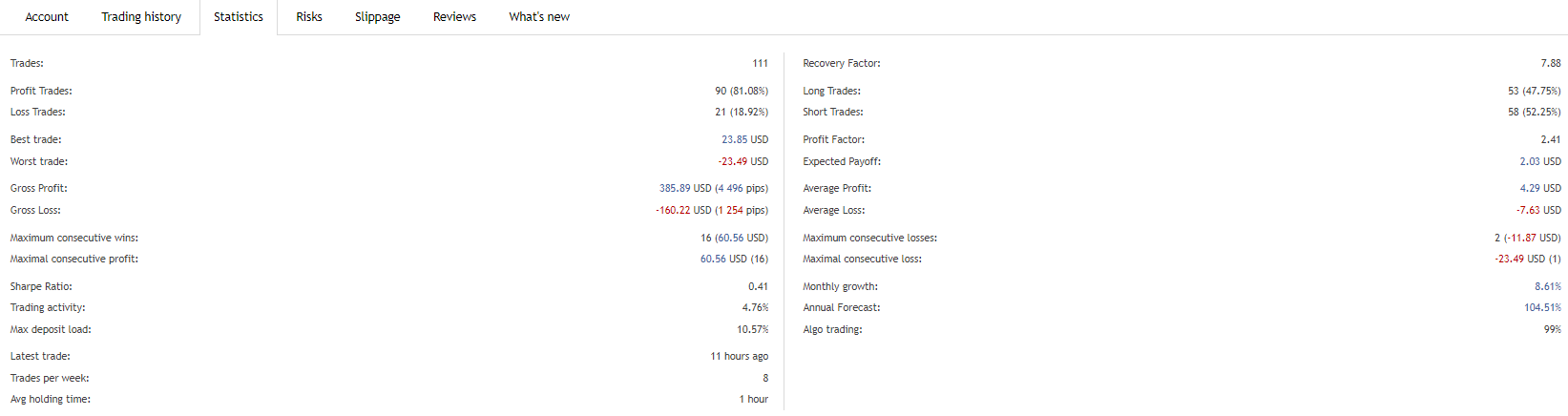

MQL 5 records show that trades are most common towards the New York end. It trades within an hour. This makes it a day trader.

These are the features

Here are the main characteristics of Waiting Night

-

It is not possible to averaging and martingale.

-

You get a volatility filter built into it.

-

Compatible with FIFO brokers

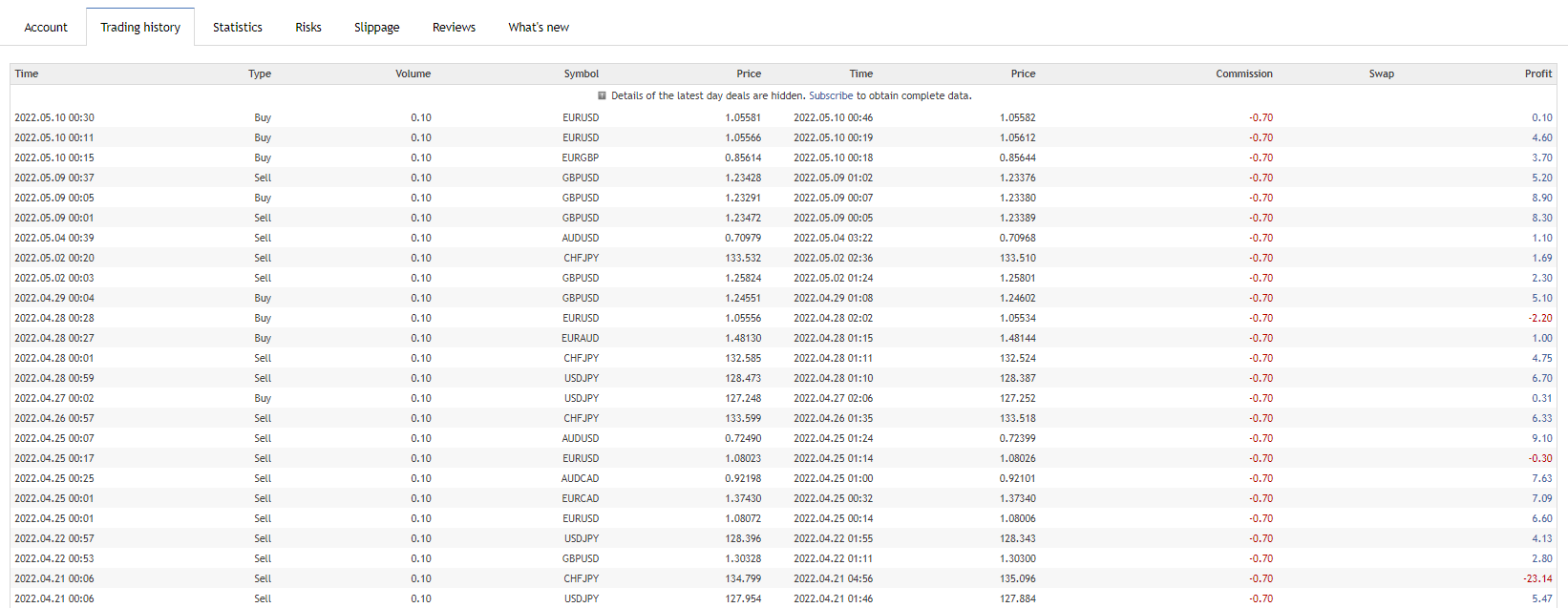

Backtest data analysis

Backtesting records can be found on the robot’s website for the time period of 2003.05.05-2021.12.31. These reports show GBPUSD backtesting results for the time period 2003.05.05-2021.12.31 at a modeling quality 99.9%. These records demonstrate that the system generated a net profit totaling $11201.3 from an initial $10000 deposit. To test whether the system was able to adapt to real market conditions, variable spreads were employed.

EA saw an absolute drawdown at 1.04%. It participated in 3797 trades of which 77.03% were profitable. It is estimated that 2.58 profit factors were used. Continue on to live stats. We’ll see if historical performance matches that of a real account.

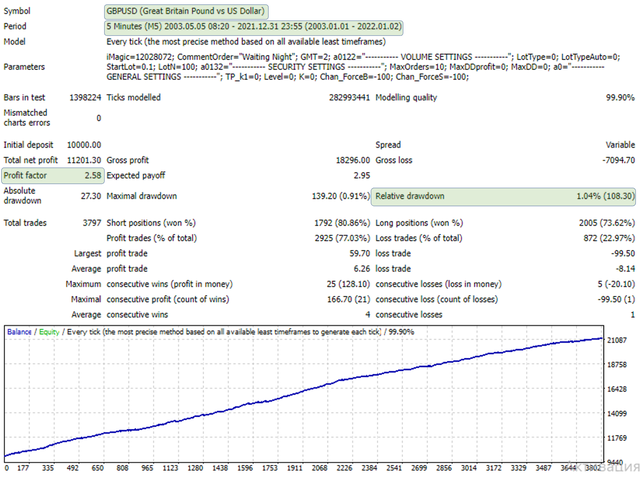

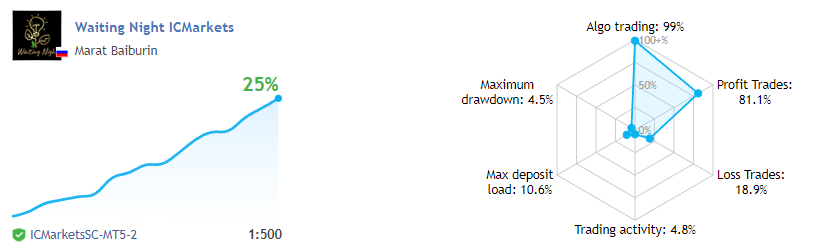

Waiting Night live trading data analysis

MQL5 has verified that the robot can trade live. US Dollars is the currency. From 2022/01/23 to the current date, performance can easily be tracked. The system has a monthly return rate of 5% and a profit factor 2.41. The current balance is $1064.36, with an initial deposit at $938.69. Overall drawdown stands at 4.5%. This is 4x more than backtesting records. It is difficult to determine the true output of live records due to their short life span.

|

Trade Results |

|

|

Myfxbook account |

Real (USD), IC Markets |

|

Started |

January 23, 2022 |

|

You can deposit |

$938.69 |

|

Balance |

$1064.36 |

|

Gain |

+25% |

|

Daily |

0.16% |

|

Monthly |

5% |

|

Drawdown |

4.5% |

|

Profitability |

2.41 |

Pricing

Only a $199 one-time purchase of the algorithm is allowed. According to the MQL5 Marketplace policy, there are no refunds and only one key can be purchased.

Reviews from customers

On the MQL 5 marketplace there are 10 reviews. All customers give it 5 stars. Trader says that they’ve backtested the product extensively and are now testing it in a live environment. Developer is responsive and offers updates.

Review summary

There are pros

-

Do not use martingale or grid

Cons

-

There is no detailed backtesting statement

-

Live records have a very short life span

-

There is no news filter in the coded infrastructure

Waiting Night, a new advisor to expert investors, uses the traditional night scalping strategy that is used by many algorithms on MQL 5. You should also consider factors such as the infrequent live record duration and the absence of customer feedback before you invest.

Responses