CCI Divergence Indicator

The Commodity Channel Index (CCI) Divergence indicator is a useful tool for analyzing technical trends. As the name implies, it detects subtle divergences between price and the CCI indicator. Divergence indicates a potential strong reversal point in the market and, therefore, is an excellent trading opportunity.

Finding divergences can be a difficult task. Fortunately, the CCI Divergence indicator can accomplish this task. Although any trader can use this indicator, it is the most effective indicator for traders who trade reversals and divergences.

How to use the CCI Divergence indicator

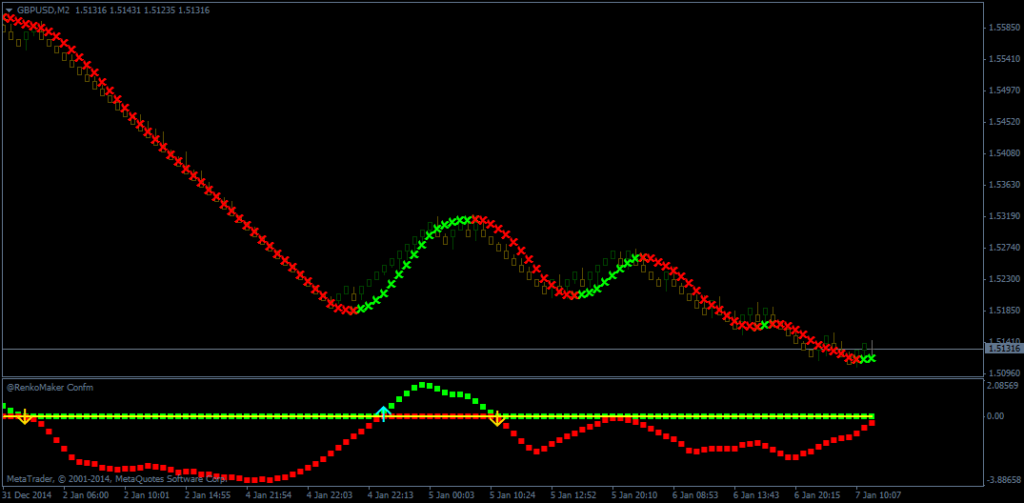

CCI divergences can be identified by the bars that appear in the graph. A green bar marks an uptrend, while a red bar marks a decline. In the event that the instrument detects a bullish divergence, it will return +1 (forming a green bar chart). Conversely, when the divergence is negative, the indicator will drop below -1 (red bars).

Divergence. When there is no divergence, the indicator will return a null value. Also, when there is no divergence, the indicator will not show any bars. In addition to providing high probability entry points for trades, CCI divergence also provides good stop loss and exit points.

Strategies for Selling and Buying

Long Positions Buy when the CCI divergence indicator shows a green arrow in the chart.

Short positions Buy when the chart shows a red arrow, i.e. a bearish divergence.

The chart illustrates the ideal point of divergence. The red arrow signals a potential reversal point in the trend, while the green arrow indicates a potential shift from a bearish trend to an uptrend. The green bars indicate that the bulls are in control of the market, while the red bars indicate that the sellers are in control.

Benefits of the CCI Divergence Indicator

The ability to identify divergences in all time frames can make CCI divergence a great indicator for both experienced and novice traders. However, this indicator is best used in the higher time frames.

One of the benefits of using the indicator for forex trading is that it is very flexible. It works with any instrument and any time frame. It also allows the user to change the tone of any text, candle, background or stop level. It also allows you to use the indicator to determine the most likely settings.

Summary

The CCI indicator is a great indicator for trading reversals. Divergence in appearance can be an extremely reliable signal to make trade entries. This indicator is best used in a time frame of 15 minutes or more. When it has to work in M1 and M5 time frames, the indicator appears frequently, which can be difficult to understand. It may also be too late to start trading at the time when the signal is displayed. It is valid when it is to be used in H1 and H4 frames. It is important to use the indicator in combination with other tools.

Responses