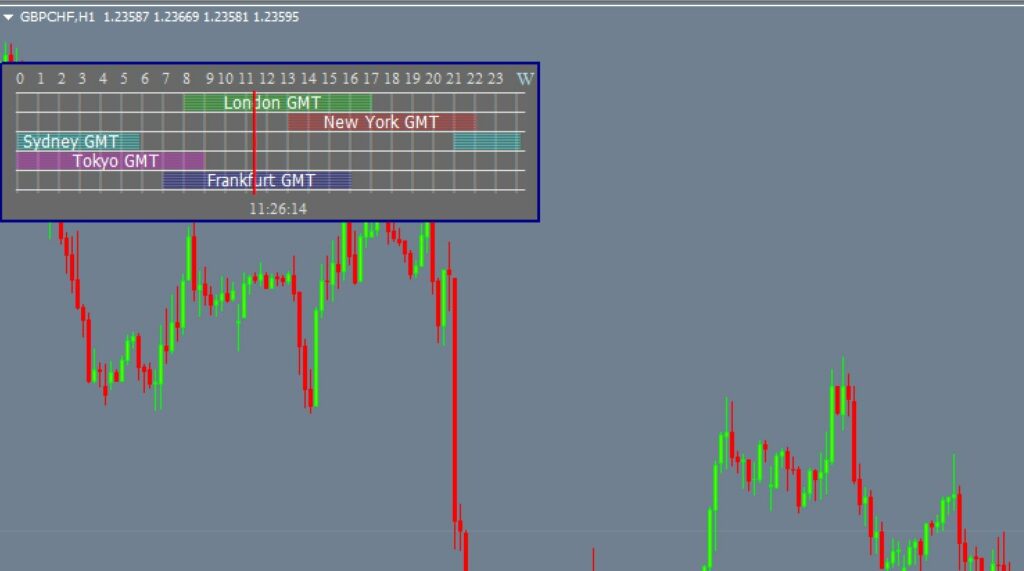

mt4 session time indicator

If you have been trading in the Forex market for a long time, you may have heard about the different trading sessions. You may be confused about the start and end times of trading sessions, or you may not know how to track the changes of a trading session on a chart. This is where a custom indicator can be used.

What is the I-Session indicator?

I-Session is a session splitter indicator. It distinguishes between Asian, European and US sessions on your charts. It allows you to profit from the most volatile times or sessions without any difficulty. It can color code each trading session. Now, you will know what the current trading session looks like.

This indicator helps to determine the price behavior and price range for a particular session.

How do I use the iSession indicator?

The two main functions of the indicator are to identify.

The price pattern (range of trend or countertrend) for a specific session.

The price range for that trading session.

Once you are familiar with these two things, you can use this knowledge to predict or trade the next phase of value. The color of a trading session will reveal which are the high and low boundaries of the exchange rate. You can trade bounces, or breakout price ranges.

Trading strategies for the I-Session indicator

Let’s examine the trading strategies based on this indicator.

Buy Setup

The expectation is that you observe the end of the Asian session and then the beginning of the European session.

If the price is out of the price range of the Asian session, on the other side watch for buying opportunities.

Once the bullish candle closes, start a long-term position.

Place a stop loss just below the price consolidation.

The profit gained is 1.5 times the amount of the stop loss.

Avoid trading when you are trading in a session with a spread of 50 pips or more.

Sell Setups

Expect you to follow the end of the Asian session and then the beginning of the European session.

If the price is out of the price range of the Asian session, on the negative side, you should look for potential selling opportunities.

Once the bearish candle closes, start going long.

Set a stop loss below the nearest price consolidation.

The maximum profit you can make is 1.5 times the stop loss amount.

Avoid trading when the session you are trading has a spread of 50 pips or more.

Conclusion

Although the indicator offers many benefits, always be careful when applying it to your live trading. Always use your demo account to test the strategy or test the information before applying it to your trades.

[signinlocker]i-Sessions[/signinlocker]

Responses