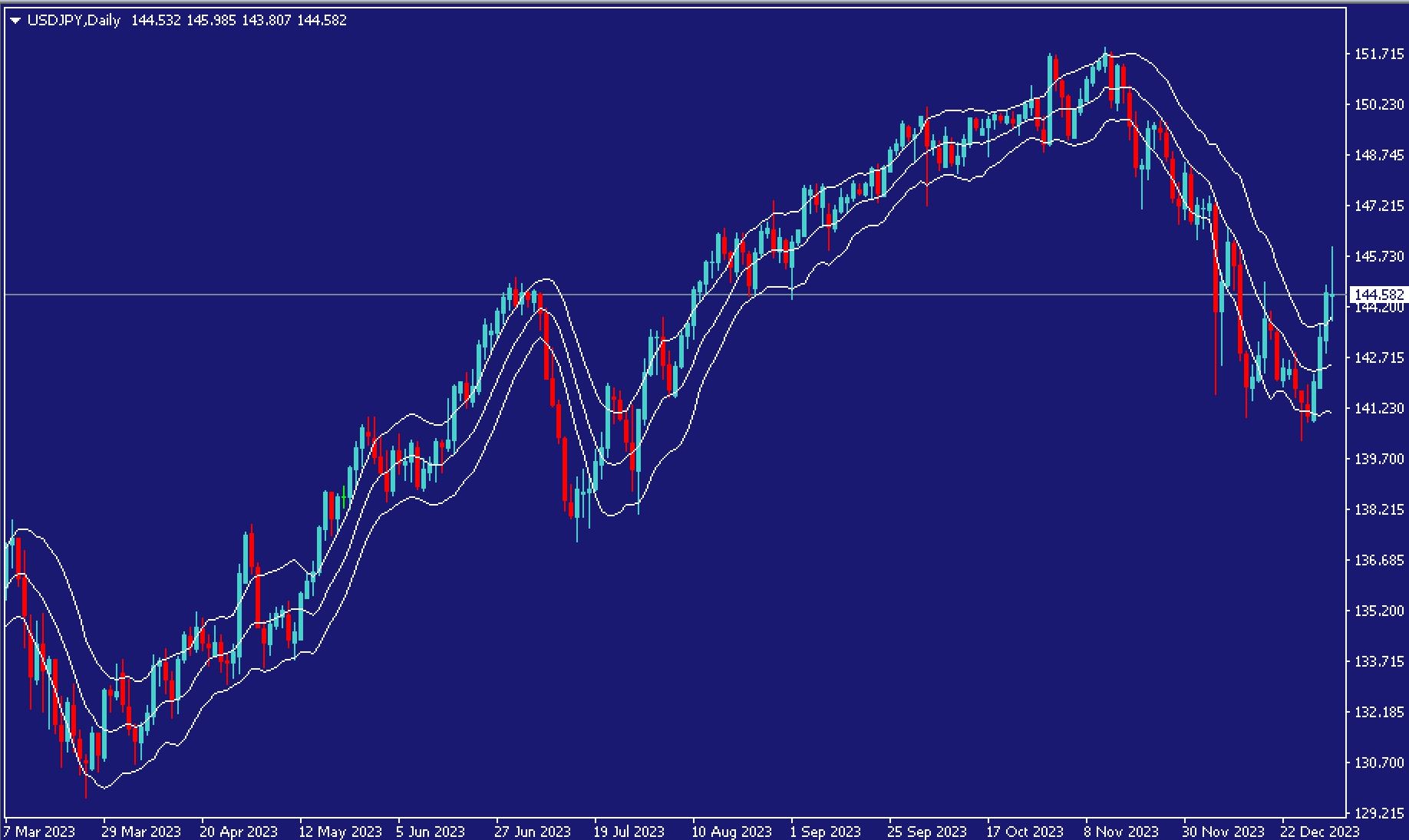

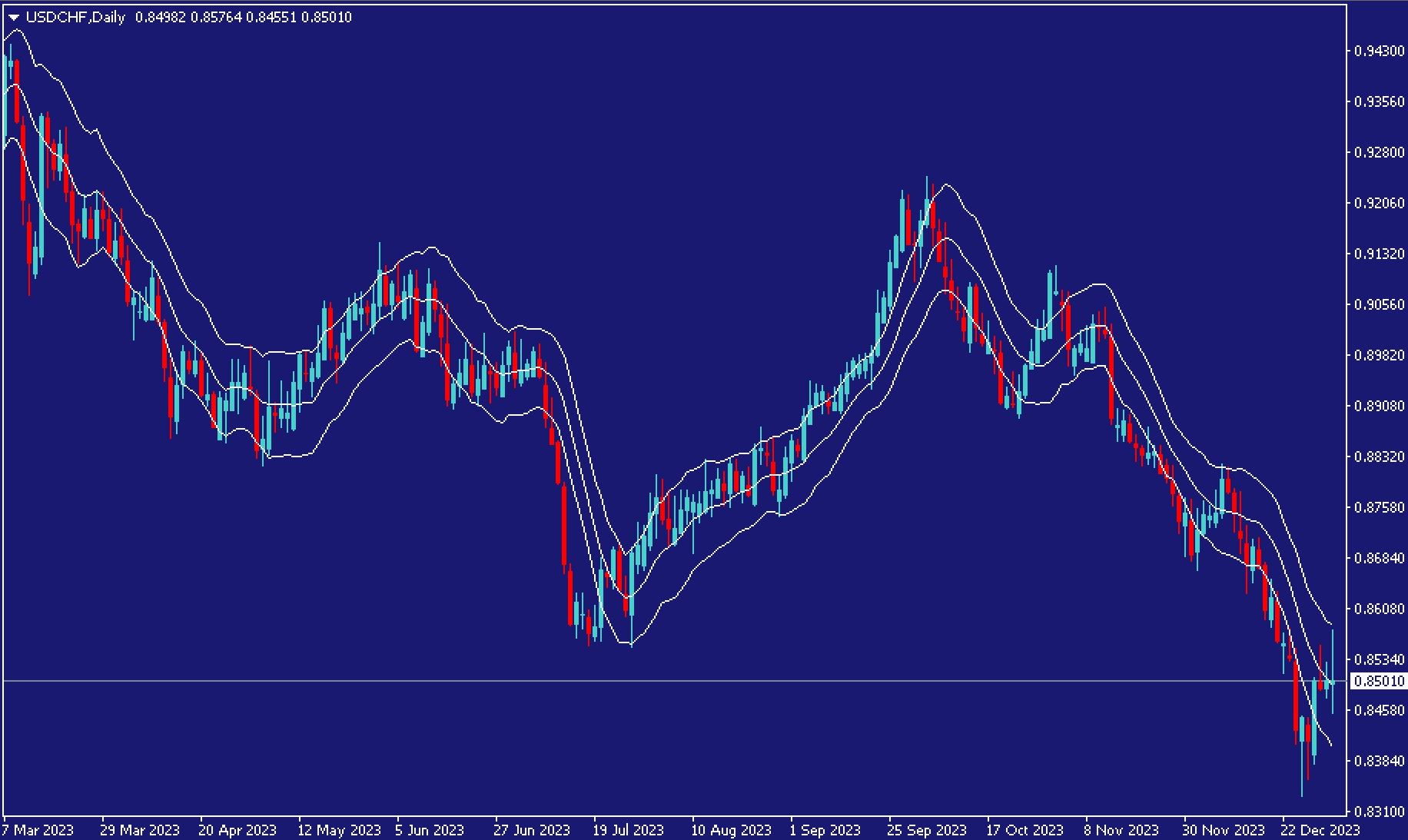

Keltner Channel Keltner Channel is a simple but powerful indicator of trading that can assist you in finding entry points, boost the profit margin of your trades, and be a great tool to forecast market reverses. In this post, we’ll examine all the subtleties and peculiarities of trading with this indicator.

How do you utilize it?

Don’t be tempted to sell simply because the price is in a higher channel. In a high-risk uptrend, prices can stay overbought for an extended period of time. In contrast, the opposite can be true in a downtrend.

The price typically changes direction whenever it is at extreme values within the structure of the market. For example, if the price reaches support or resistance levels,.

It is necessary to locate a value that is significantly higher than what is known as the Keltner Channel. This means it is an extreme point and is far from its normal value.

But don’t be rushed to start a long trade in this area. We’ve already learned that during a strong downtrend, the price could remain near the channel’s lower edge for a longer time.

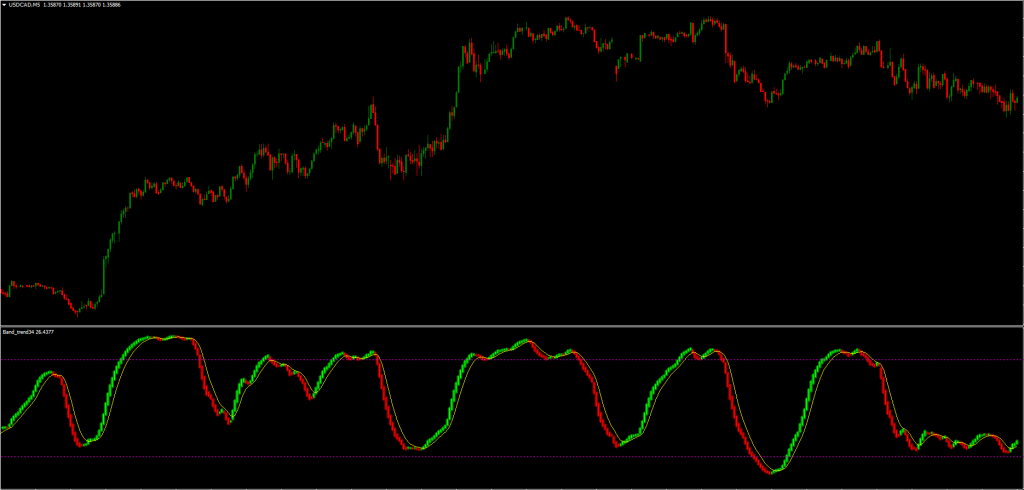

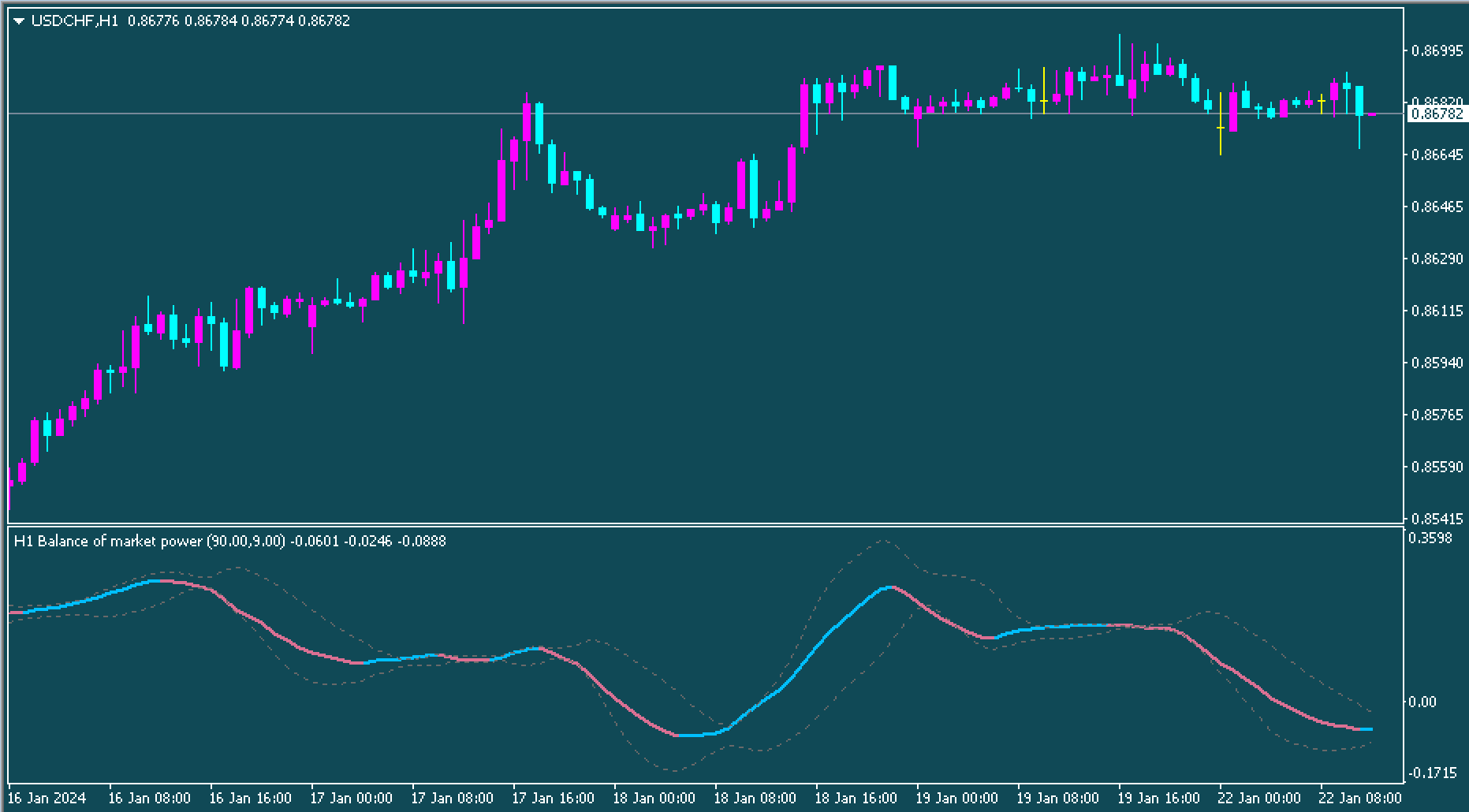

Keltner channel trading strategy

Once you’ve mastered the indicator, now it’s your turn to develop an investment strategy that is based on Keltner Channels. Keltner Channels indicators.

Purchase setup

- Let the price move towards the level of support.

- You should wait until the channel is compressed Keltner channel (the price is squeezed between the middle and outer line of the channel).

- Take a position in the breakout.

- Stop-loss should be placed in the lower portion of the channel.

- Take a profit when you reach the next resistance mark shown on the chart.

Conclusion

Keltner Channel Keltner Channel is a channel indicator that is comparable to the Bollinger Bands, which have the middle, upper and lower line of channel however the method by which the calculation is different. The market’s direction changes when the price crosses the channel’s boundary and moves into the primary market pattern (support or resistance points). If the price crosses the outer channel line within an upward trend, stay clear of bounce trading. The Keltner Channel squeeze occurs when prices are between and 20 MA and the line that is outside of the channel. This indicates a possible price break.