Fibonacci Pivots Indicator

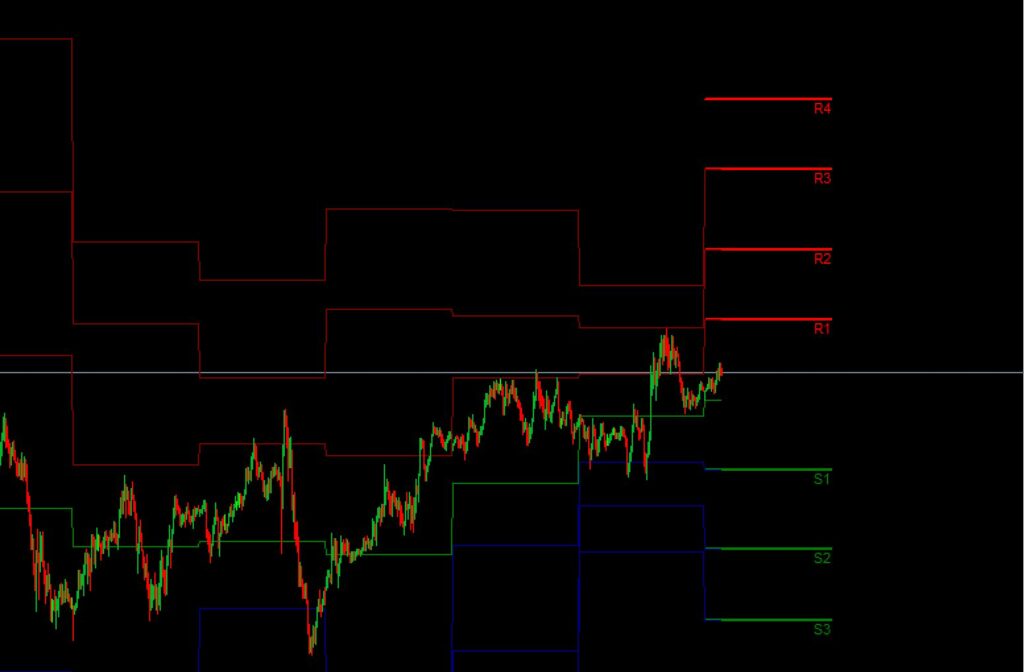

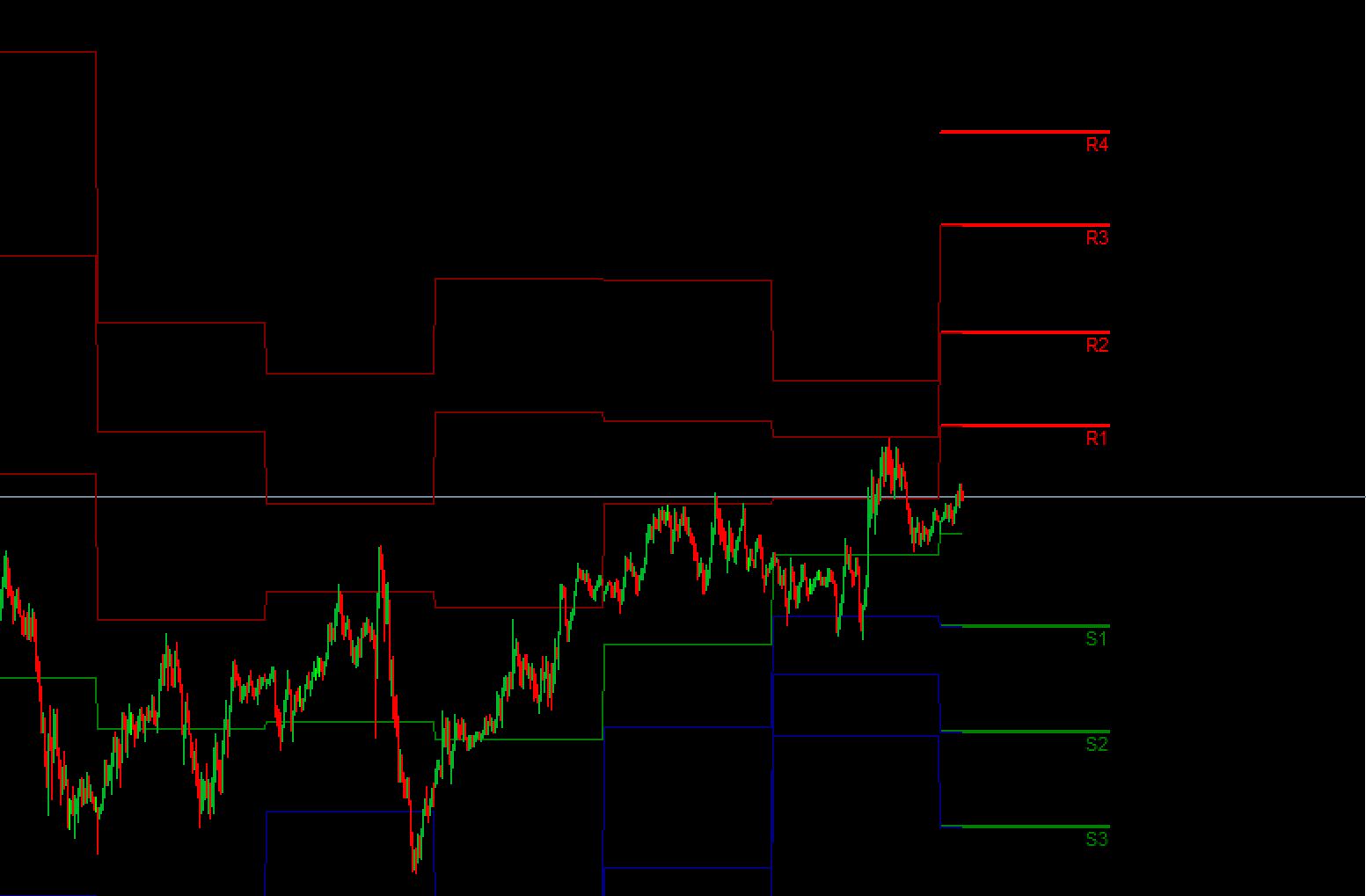

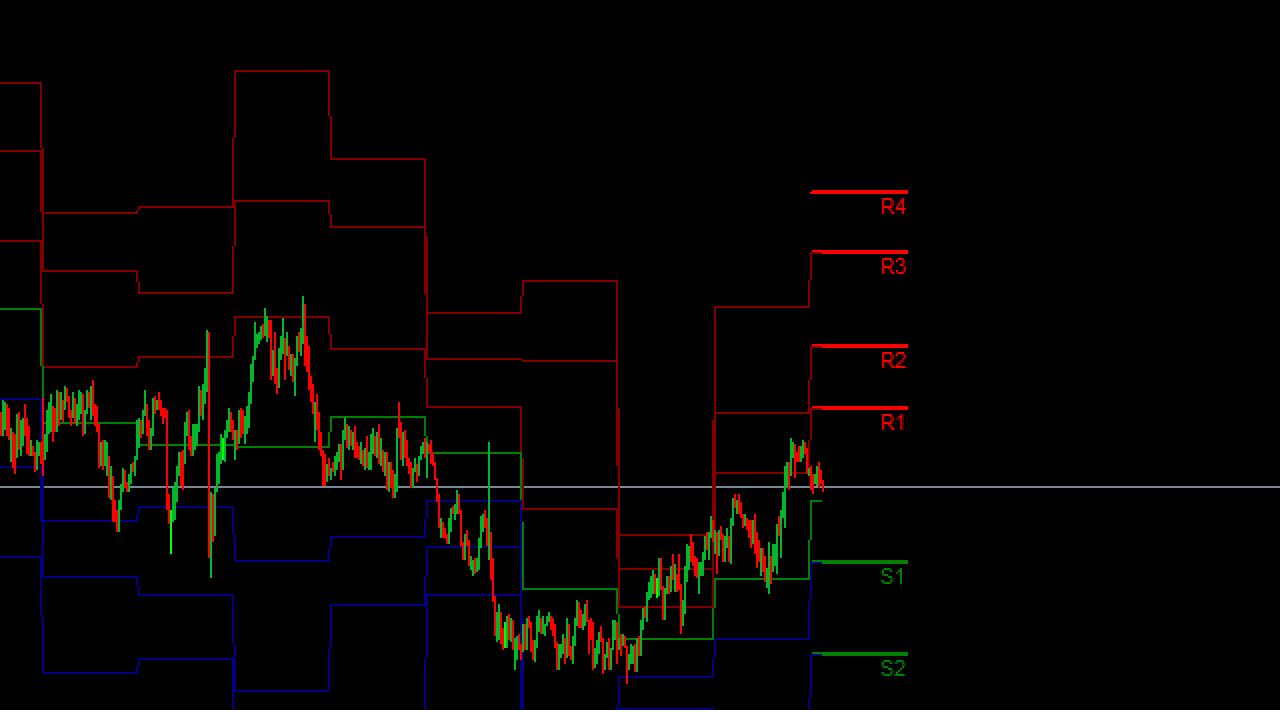

For novice traders as well as experienced traders, it is crucial to determine the most appropriate resistance and support levels. Most traders use pivot levels to analyze the current price action. Combining pivot levels with Fibonacci ratios helps traders identify high resistance and support levels. In addition the indicator offers several versions, so feel free to choose the right one.

Most traders start their day by identifying support and resistance levels. They then apply other indicators to verify these levels. This Fibonacci Pivot Point indicator used in MT4 helps traders instantly identify the most effective range of resistance and support levels.

Finding the possible direction of the day is a different exercise. These pivot points are determined based on the previous day’s high, low and closing values, which are then multiplied by 3. If the price is below the day’s pivot point, this means that the trend is considered bearish. Day traders look for bearish price action when the current price stays above the pivot point level.

Experienced and new traders alike like the Fibonacci numbers and their efficacy for forex trading. Fibonacci numbers are applied to pivot points in order to calculate the most appropriate levels of support and resistance. In addition, in trading, market participants use the Fibonacci ratios, namely 38.2, 61.8 and 76.4 to determine three different levels of support and resistance.

How do I trade the Fibonacci pivot point indicator on Metatrader?

If the price is facing upwards above the pivot point, the buy option is taken. Resistance levels R1, R2 and R3 are take profit targets for profit 1, 2 and 3 respectively. Investors can seek to book profits when these levels are reached. Stop losses are set below the support level S1.

If the price is moving towards R1, the stops are able to move in sequence until they are level. As the price continues to move until it reaches R2, the stop loss can move from R1 to later R2 and R3 as the price rises further.

The following formula is used to calculate pivot points as well as resistance and support levels.

Pivot point = (previous high + previous low + previous close)/3

Resistance 1 = Pivot Point + (Previous High – Previous Low) * 0.382

Support 1 = Pivot – (front high and low)*0.382

Resistance 2 = Pivot + (front high – back low)*0.618

Support 2 = Pivot – (front high and back low)*0.618

Resistance 3 = Pivot + (front high and back low)*0.764

Support 3 = Pivot – (front high and back low)*0.764

Pivots are calculated based on the previous day’s data. Market dynamics can change and do not necessarily follow the trend as indicated by the pivot. Support and resistance levels are determined by Fibonacci numbers and represent a mathematical figure.

To summarize.

These two indicators provide a solid foundation for resistance and support. However, to trade with confidence, further confirmation must be provided by price behavior.

[signinlocker]

Fibonacci Pivots Indicator.ex4

[/signinlocker]

Responses