Round Levels Indicator

Every financial institution and market maker that trades in the Forex market has their strategy for accepting orders. These major dealers place their orders at critical levels, also known as “psychological levels”. These numbers are rounded off and end in 0.00 or 0.50. These levels are psychological and may be historical highs, lows or areas where prices have been stuck more than 2 times. These areas are often scanned by those who wish to trade with the largest traders in foreign markets. The Circle Level indicator shows all levels throughout the chart so that traders can understand them more easily.

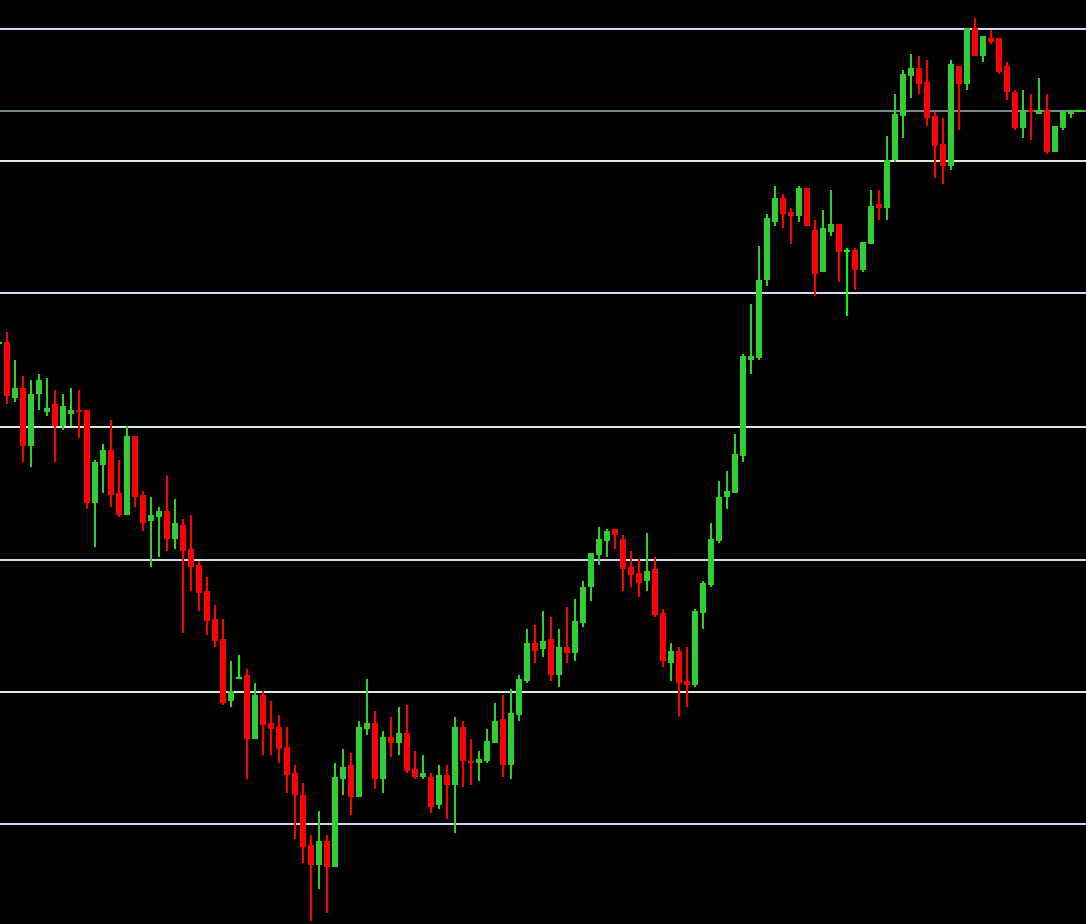

The Circle Level Indicator provides key psychological levels at which prices may stall or even reverse on the chart. These psychological levels of price are drawn horizontally on the chart as white or black lines, like the chart below.

The chart below illustrates the market’s movement. Horizontal indicators that show important levels or psychological price levels. These levels are also the key resistance and support levels that traders must be aware of.

As you can see from the above chart, when the price reaches this important support or resistance zone, it stops and then reverses with an accelerated price movement. This indicates that the bank is trading heavily as well as waiting for orders at these levels. the circular level indicator on MT4 is also a great tool to set stop loss levels and take profit when the price is close to the threshold.

This indicator is very suitable for any market conditions and any time frame. Scalping day traders, swing traders and position traders all use this indicator for entry and exit of buy and sell trades.

The indicator can only be used for one specific purpose. However, the best results can be obtained when combined with Fibonacci tools, market structure analysis, and other tools.

Summary

The Round Levels indicator on MT4 is an effective tool to help traders determine the psychological levels of prices in the charts. These levels can be used to enter or exit positions in a trade. The indicator is most effective in all conditions of the market and is suitable for all types of traders. To get the best results, the indicator must be used in combination with price action as well as Fibonacci tools.

Responses