Forex Ertha Renko Strategy Review

- Forex Ertha Renko Strategy Features

- Forex Ertha Renko Strategy Summary

Forex Ertha Renko Strategy will be reviewed in this article. This unique strategy is designed for manual trading using MT4 and uses Renko bar charts instead of traditional line, bar or candlestick charts. To me, any person who is willing to take the time and learn how to implement Renko trading strategies should have a good understanding of trading. The key aspects will be discussed along with their pros and cons. These will help you decide whether this forex software is right for you.

Forex Ertha Renko Strategy

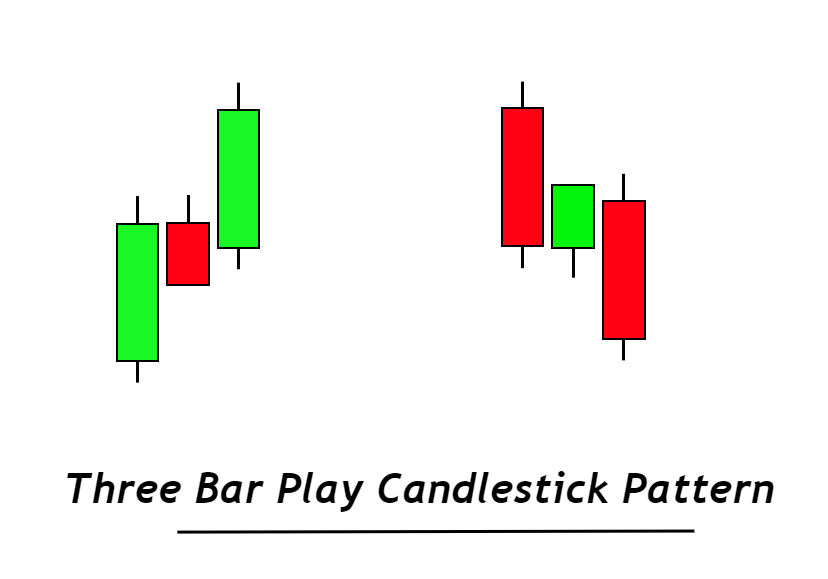

The Ertha Renko Strategy was created to eliminate a lot market noise that is generated by standard candlestick charts. If you’re tired of using the same old Japanese candlestick charts, then you might want to consider the Renko charts. Renko charts remove time from the equation and focus only on price trends. In representing price changes, this is an alternative for Japanese candlesticks. Renko charts, on the other hand, are focused more heavily on details such as price and timeframe. Candlestick charts tend to be less detailed than Renko charts. No matter how much the price fluctuates, a new candlestick will be formed at each time interval. Forex Renko looks like two identically coloured bricks, with each brick being either longer or shorter.

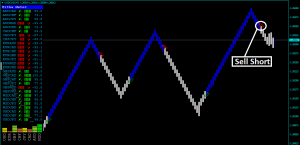

Forex Ertha Renko Strategy USDJPY

Forex Ertha Renko Strategy USDJPYRenko charts such as Heikin Ashi display price movements that are free of minor fluctuations. The trend detection process is easier with filtering. Since time is not included in the system, all bars have the same dimensions. Renko charts are useful for identifying price direction. They can also be used to help eliminate any confusion. The number of price points the indicator must reach to draw one bar. A larger brick size means less movement but more temporary deformations or smoothing. A smaller size brick increases volatility sensitivities. Bricks made from closing prices are placed next to one another at 45 degrees. They have a time axis but it only applies to set movements (closing price) and does not show the elapsed times. Bearish bricks will form higher than the earlier bricks and bullish bricks below them. Renko bricks cannot be drawn together. To print an opposing brick next to another, the asset’s price must be at least twice as high as the previous set. A brick of 50 pip must be printed next to the other in order for the Renko chart showing a change from bullish to bearish, should close below 100 pip. This will save you the time of waiting on trading signals for hours at your computer. The software can be loaded onto Renko charts for the financial instruments you want to track. You will be notified by the software when there’s a sell or buy signal, according to its built-in trading algorithm. You can then decide whether you want to trade or wait until the next signal alert arrives.

Forex Ertha Renko Strategy USDCAD

Forex Ertha Renko Strategy USDCADForex Ertha Renko Strategy Features

- Offline chart builders can create Renko charts, which act as indicators.

- Ertha Renko is an indicator that does not require any maintenance and was created for use offline.

- Ertha Meter offers many functions that allow you to track the currency pairs and their correlation power

- Ertha Renko Strategy is easily customizable to fit your trading style.

Forex Ertha Renko Strategy Summary

For a number of reasons, the Ertha Renko Strategy has my full support. It is a different forex strategy than the ones you could build in the MT4 platform. This is due to its use of Renko charts. You could argue the Renko charting capabilities alone are worth the cost. It could be used to create your Renko trading strategies or Renko charts. Otherwise, you can of course just use it as is “straight out of the box”.However, if you do decide to follow it exactly as explained in the instructions, I think there will be some limitations. Each buy/sell Ertha Renko Strategy signal should be confirmed with my own trading strategy prior to taking any position. It would be impossible to reach all the trading signals it produces blindly. Every trader will have their own unique trading signals. There are good and poor signals in any forex trading system. The strategy is more effective for traders who are able to analyse markets and confirm the signals. Next, we must consider how forex money management works. You could have a forex strategy with the best entry criteria on the planet, but if the stop loss and take profit levels are not sensible, it wouldn’t really matter. I have seen many forex strategies give different results. It is usually due to different money management strategies.

Forex Ertha Renko Strategy

There are pros

- Unique Trading Strategy

- Renko Charts that Work

- You can customize the settings

- Combination of Market Analysis

- Clear Buy/Sell Signs

- Instructions for Use

- All MT4 Forex Brokers

- All trading instruments

- Instructions in detail

- Complete Support

Cons

- MetaTrader 4 is the only available

- Setup is not an easy task

- Not enough filters

- It takes time to learn how to use

- No Verified Results

Responses