Supply Demand Zones Indicator

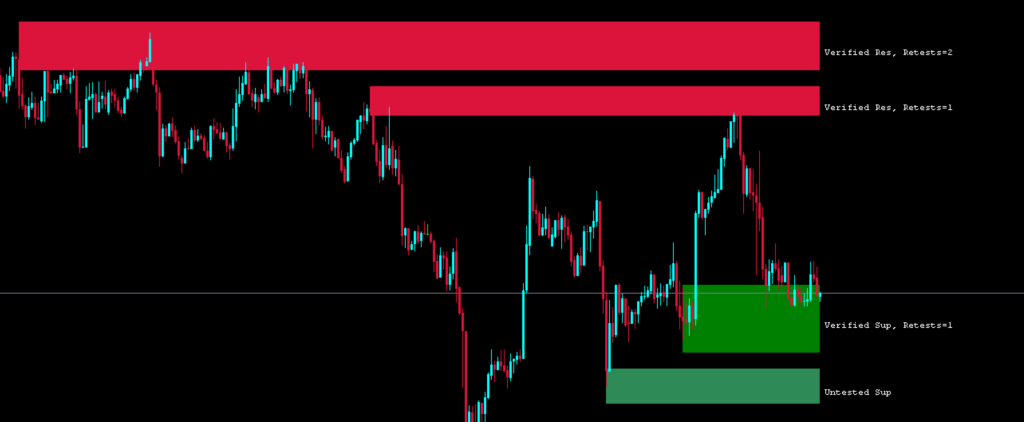

The ability to identify areas of demand and supply is a characteristic of every professional forex trader. Knowing the right positions can increase the profit of Forex traders. The indicator “Supply and Demand Zones” shows these zones in the most efficient way on the charts of MT4.

Supply and Demand Zones

Supply and demand zones are like resistance and support lines. However, there is an important difference between support and resistance lines and zones. Zones provide a greater range of demand and supply, as well as greater resistance and support.

In addition, Forex traders may not buy or sell on the same support and resistance lines. However, most traders trade within zones based on their trading strategy.

How do you use the Supply and Demand Zones indicator for forex trading?

It automatically determines the most profitable zones and displays them on the charts in MT4. It removes uncertainty and allows traders to spot these zones immediately. Traders buy with the expectation that prices will rise from the demand zone. However, they sell in the supply zone, looking for prices to become bearish.

Most traders set their stop loss below the demand zone, but above the super zone. Swing traders usually hold their positions until price is in the opposite zone, while others trade based on an acceptable risk-reward ratio.

How can I profit by trading using the supply frame with a higher time frame or demand zone?

Identifying demand and supply zones at a higher frequency is critical to maintaining the current trend, as super zones with higher time frames are much more stable.

Traders are able to visually detect and identify the areas of both time frames. Because of this, Forex traders can prepare and make successful trades.

The indicator is beneficial not only for new traders, but also for traders who use complex trading techniques.

Limitations.

The indicator automatically draws zones on the charts of mt4, but they have to be confirmed manually by the broker. Out-of-range zones may be invalid and the market may violate them in the future. So, traders should use price behavior to verify their positions.

Summing up.

There is no doubt that indicators for Forex trading are a tried and tested method. The best supply and demand zone indicators give traders an idea of the automatic zones.

Responses