Best US Forex Brokers CFD Brokers Accepting US Clients

Forex brokers in the United States

The United States, a well-known and important country in the global economy with a strong financial system, is a major player in the forex industry, but they also impose some of the strictest requirements in their operations.

U.S. Regulations

When it comes to trading, especially currency trading which is a very popular choice for US clients, the US has a number of laws and regulations that are implemented with complex rules that limit trading options.

U.S. traders are often restricted from trading with brokers located outside of the U.S. They can choose to trade with a U.S. licensed broker or through an offshore company.

We strongly recommend staying away from offshore brokers as they are extremely risky investments as they are scammers and generally target clients in offshore locations.

For the U.S. regulated trading and Forex sectors are regulated by two authorities. In addition, all brokers operating in the United States must be registered with the NFA (National Futures Association) or CFTC (Commodity Futures Trading Commission). NFA website: www.nfa.futures.org, CFTC website: www.cftc.gov

These bodies oversee financial services, also known as trading brokers, and guarantee the integrity of the marketplace, while also requiring them to ensure complete transparency as well as the highest level of customer safety.

In addition, before any broker is allowed to do business within the United States, it must undergo RFED (Retail Forex Dealer) registration, after which it is further regulated by these two agencies.

Best Forex Brokers in the US

The list below is consistent with the top reviewed brokers located in the US and is also compiled according to specific criteria and their trust scores. CFD brokers are generally less represented in the US due to less stringent rules restricting CFD trading, but are in the list below.

IG – Best overall broker, most trusted

TD Ameritrade – Best desktop platform, US only

FOREX.com – Great all-round offering

Benefits of trading Forex in the USA

Forex trading is available every day of the week, 24 hours a day, which means you can trade at any time. Selling high and buying low can be profitable for traders in the forex market. Profitability is the most important factor for traders in the forex market. Forex traders are usually attracted to trading platforms and free forex accounts.

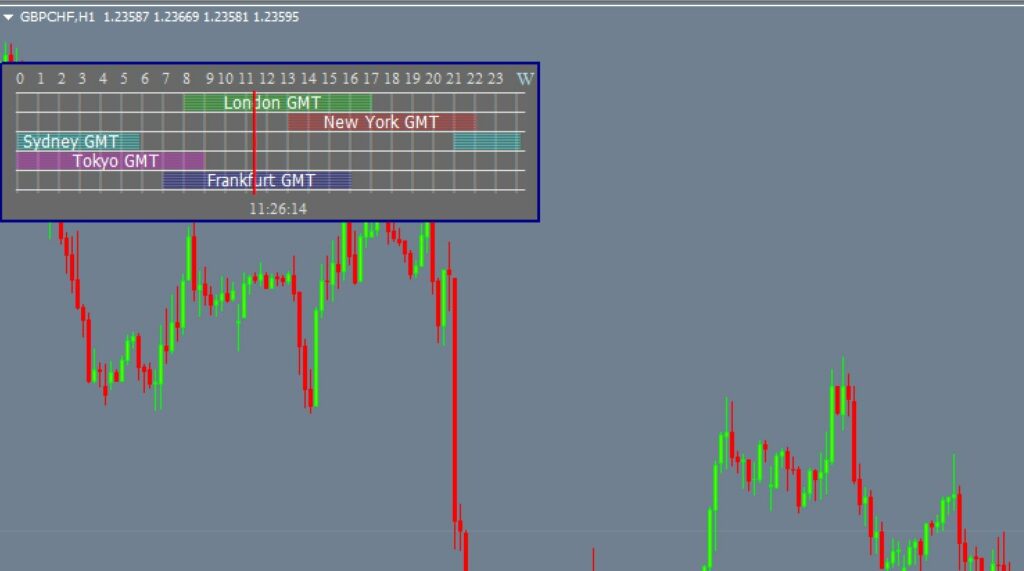

High liquidity: Since the Forex market is the largest financial trading market in the world, that’s why it has a lot of liquidity. During normal trading hours, these currency pairs can close a large number of trades at every hour of the day.

Very high leverage The leverage in Forex trading allows for small margin deposits that can be used to control quite large positions, as exchanging currencies at market rates is not a net value. Despite the higher risk, however, you can still gain from small fluctuations in the exchange rate.

Increase your profits with less money: Forex is leveraged, which means that you can make many trades with only a fraction of the capital you initially invested. The margin trading process is not risk-free and it is important to understand the risks to protect yourself from losses. It is ideal to use margin trading to maximize your profits.

Trade 24 hours a day. You can trade Forex before 5pm and at any other time. From 5pm, trading hours are until 7pm to midnight. It operates five days a week. In the United States, EST is observed on Fridays, even during holidays. Trading can be done at any time during market hours.

Best US forex brokers: what you should look for

To find out which broker is the most reliable forex broker in the US that suits your needs, once you have found an authorized forex broker in the US, you can start a demo account with them. If you are not familiar with the platform used by the broker and wish to avoid costly mistakes, demo accounts allow users to experiment. By avoiding common mistakes and pitfalls, you will save cash by using a demo account.

Regulations and authorization: Before entrusting your funds to a forex broker, you should always be aware of the agencies that oversee the operations of forex brokers and the effectiveness of their methods. With a licensed US forex broker and strict guidelines from the regulators, you can always be protected from fraudulent business practices and can trade with confidence that your money is safe.

Customer service: If you are unable to perform certain tasks of forex trading on your own, the customer service of your chosen best US forex broker should be able to assist you at all times. In addition to transferring stop losses, customer service can be useful in determining the source of trade imbalances or checking your margin balance. Customer service is not the only department responsible for ensuring that withdrawals and deposits are handled efficiently and securely.

Spreads: Forex brokers that require spread commissions are the only option. If the broker earns profits in other, less obvious ways, you should consider that he needs to find a way to earn profits. Always choose a currency trade with low spreads.

Minimum Deposit: For Forex trading, there is generally no minimum amount of initial deposit required. Beginners should consider what amount they need to start trading. The answer can be determined by the size of your investment and profitability. Consider the costs associated with offline and online payments, as well as the available payment methods.

Training in trading: When you are a newbie, it is helpful to learn how to start trading. This is not an important thing, but just a good option as there are other news about forex trading strategies online, such as price action courses as well as forex trading courses. If the course is offered by your broker, this could be a great time saver. It’s also easy to look up the information you’ve learned.

Responses