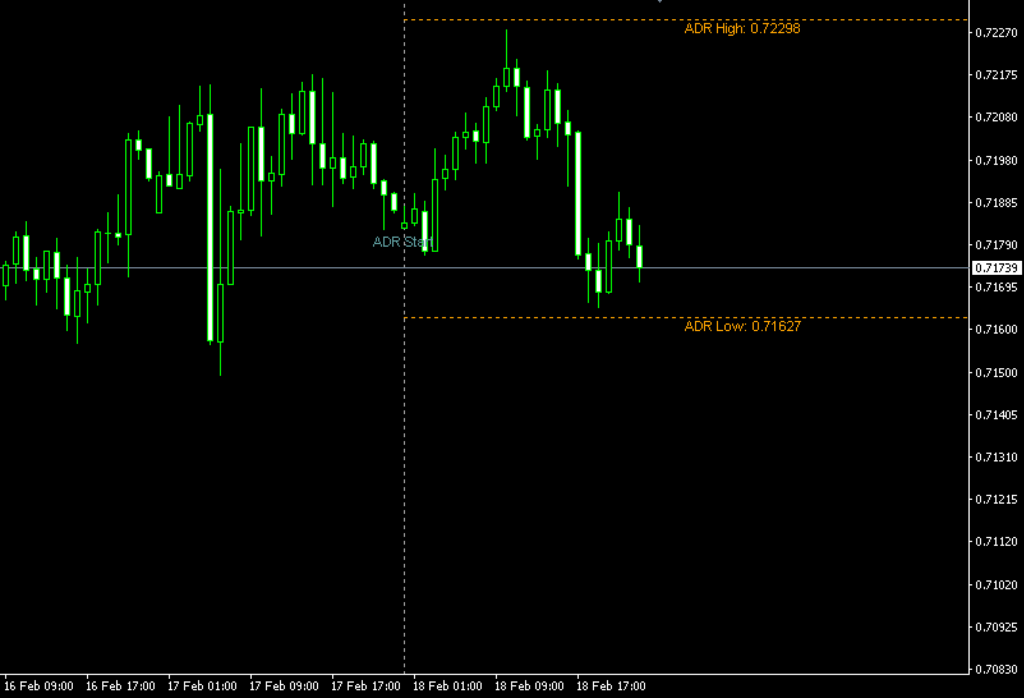

adr indicator

The ADR indicator in MT4 shows the ADR range and the current market range. In addition, the ADR gives the expected market range for each day. In addition, the volatility and rate of change of trading volume at or near the upper or lower limit levels of the ADR indicates the beginning of a trend, or a change or reversal of a trend. the ADR value forms the basis for many other technical forex indicators and is an integral part of many automated trading strategies.

The indicator is ideal for both experienced and novice forex traders. Novice forex traders can spot ADR levels as support and resistance and watch for price action around these levels. For experienced traders, they are able to use the indicator to complement other trading platforms.

ADR indicator setup for MT4 trading

The chart illustrates the work of one of MT4’s indicators. The indicator displays the ADR value on the left side of the chart along with the range for the day. The indicator also displays the top half and bottom half of the ADR range as an outline line extending to the current trading day.

The Daily Average Range MetaTrader indicator calculates its value from the ATR (Average True Range MetaTrader indicator). Therefore, the time period used in the calculation of the daily average range plays an important role in determining the size of the range. A lower ATR value may result in a lower ADR value for historical data. Likewise, a higher ATR will utilize a larger data set to calculate the ADR value. Therefore, technical traders must be careful when choosing the ATR input in their indicator setup so that it fits their trading strategy. However, since each currency pair is prone to volatility, forex traders should try to adapt the ATR settings to their needs.

Forex traders can use breakout trading strategies and reversal trading strategies for ADR trading. Because ADR gives an expected market price, forex traders are able to recognize the extremes of price. As a result, forex traders can buy when the price is close to the lower level of the ADR and then place an order to stop the price from going below the previous low. The most profitable profit point for this type of trade is at the upper level of the ADR.

In the same way that Forex traders can sell once their price is at the top line of the ADR, they can also spot a reversal signal.

The ADR levels have similar results as intraday resistance and support levels compared to intraday charts. Therefore, price behavior at lower or higher ADR levels gives traders the best indicator to conclude whether that price is a reversal or a breakout.

Summary

Forex traders must use the ADR indicator in conjunction with price behavior and other Forex technical indicators for MT4. ADR indicators, such as daily average range breakout and reversal trading strategies, give the most effective results.

Responses