Keltner Channel Indicator

The Keltner Channel is a simple trading indicator that can help you identify entry points, increase the profitability of your trades, and be able to predict market reversals. In this article, we will examine the various nuances and specifics of trading with this indicator.

What is the channel of the Kellner indicator?

The indicator is based on channels (which are like Bollinger Bands, Donchie Bands, etc.). This means that it has a lower and upper limit that helps us to determine possible overbought and oversold levels.

The original model of this channel utilized an exclusive modification of the moving averages. In 1960, Linda Raschke modified the indicator to use ATR as an ATR indicator to calculate the width of the channel.

The main difference between Keltner Bands and Bollinger Bands indicators is the way Keltner Bands and Bollinger Bands indicators are calculated, i.e. the lines of the channel. Keltner Bands utilize the ATR, which is the average of all the intervals, while Bollinger Bands use the average deviation. When you compare them, you will notice that Keltner Bands show smoother lines compared to Bollinger Bands.

How do I use it?

Don’t try to sell just because the price is in an uptrend channel. This is because in a strong uptrend, prices can remain overbought for a long period of time. Conversely, the opposite can be true in a downtrend.

Once prices reach the extremes in the market structure, prices usually change direction. For example, the price may reach a support or resistance level.

It is necessary to find a value that is significantly higher than the Kellner channel. This indicates that there is a market at an extreme point and away from its normal value.

However, do not be in a hurry to take long positions in this area. We have learned that in a strong downtrend, prices may stay near the lower boundary of the channel for a longer period of time.

Keltna channel trading strategy

After you have learned everything you need to know about this indicator, it is time to design an investment strategy built on the Keltna Channel. Keltna Channel indicator.

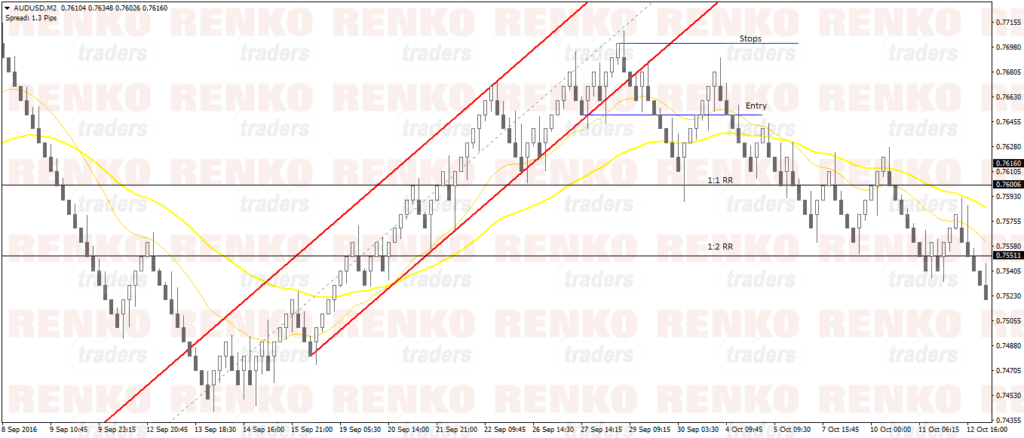

Set up a buy

Allow the price to move towards the support level.

Observe the compression of the Keltna Channel (price is squeezed between the middle and outer lines of the channel).

Make a move in the breakout.

Set the stop loss level below the lower half of the channel.

Take profit when you reach the next resistance marker in the graph.

Sell setups

Let the price move towards the resistance level.

You should wait to see the compression of the Keltner channel (price is squeezed between the middle and outer channel).

Open a position at the break.

Set the stop loss at the upper part of the channel.

Take profit at the next support level shown on the chart.

Summary

Keltna Bands is a channel indicator, similar to Bollinger Bands, with upper, middle and lower channels, however, the calculation is different. The direction of the market changes when the price is closed outside the channel boundaries and enters the main market patterns (support as well as resistance levels). If the price crosses the outer edge of the channel line in a strong trend, beware of bounce trades.

Responses