4 Wolfe Wave Rules that Every Trader Should Know

The Wolfe Wave chart pattern is made up of five waves which predict market trend reversal. This chart pattern is one of the least known, yet it provides high-risk trades and high accuracy.

The Wolfe wave pattern is used by professional traders to predict the future and then to trade the direction predicted in lower time frames. It’s the preferred strategy for traders.

This pattern is possible to use in stock, forex and indices.

How can you recognize the Wolfe wave patterns?

Bill Wolfe Wolfe Wave was introduced by a trader. It is an easy pattern to use in all markets, he said.

The following guidelines will allow you to identify this pattern.

Wolfe wave rules

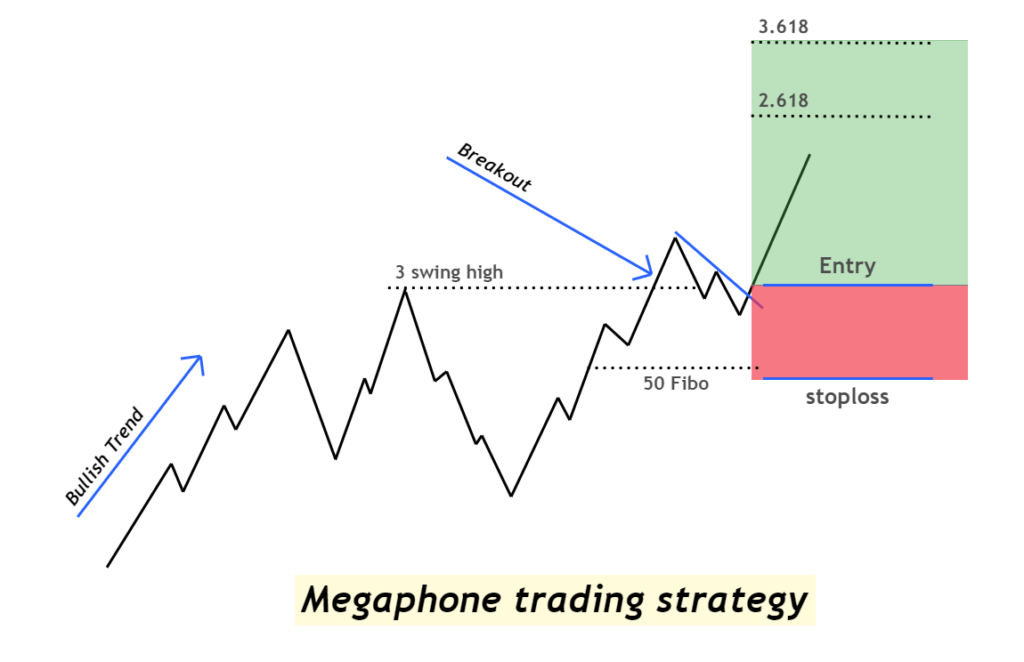

- Rule No. 1 Wave 1 and wave 2 make a price channel. It must include wave 3 and wave 4 So, waves 3 & 4 must remain within the channel.

- Rule 2: Wave 1 should not be less than or equal to wave 3.

- Rule 3: It should not be more than equal between waves 1 and 2 as well as waves 3 through 4.

- Rule number 4 Wave 5 of the final wave should be a break in the channel, representing a breakout. The channel will then close later.

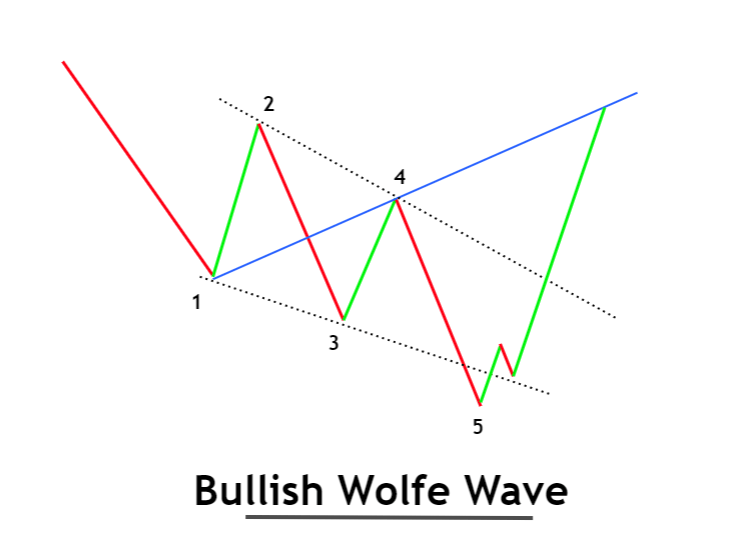

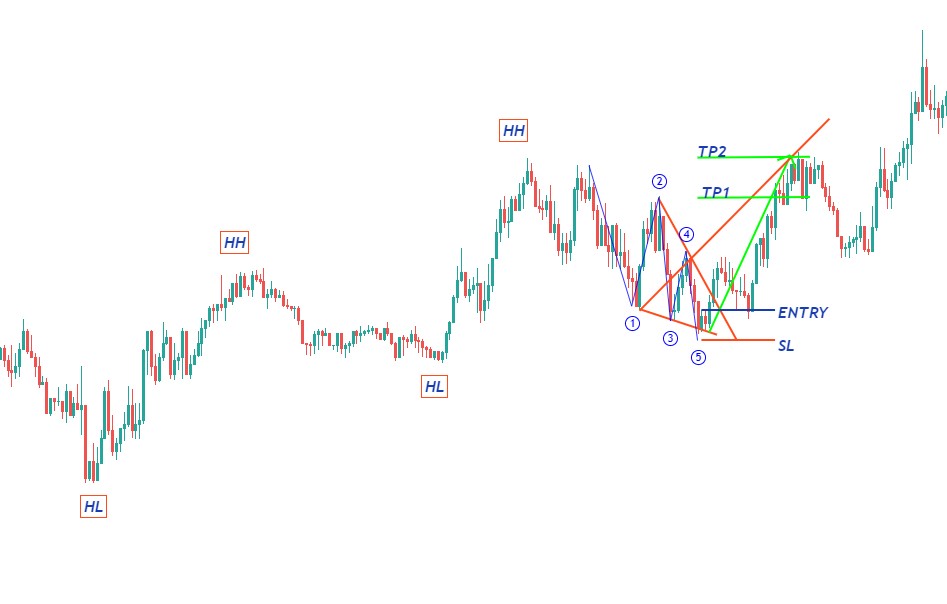

Bullish Wolfe Wave

The bullish pattern will have a descending channel that contains 4 waves of Wolfe patterns. A downtrend will be evident when price makes consecutive lower lows.

The 5th wave will be formed after channel breakout.

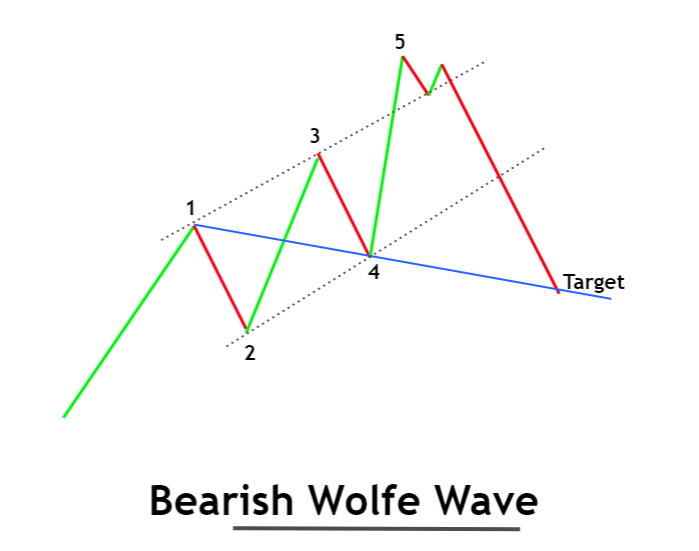

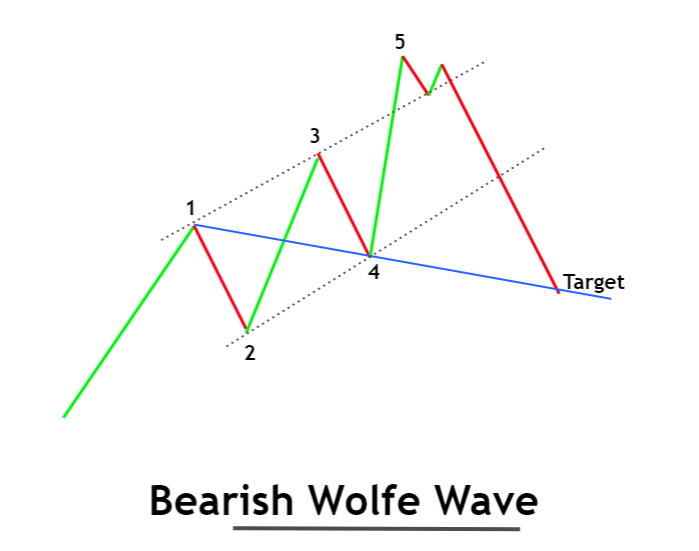

Bearish Wolfe Wave

An ascending channel, which contains the waves, will be formed in the bearish pattern. Price will make consecutive higher highs and higher lows, indicating an uptrend.Advertisements

A bearish trend in the fifth wave will begin after the breakout.

What is the Wolfe Wave Pattern telling traders?

It is easy to see that the Wolfe wave pattern has symmetry. The price chart also shows it. This pattern shows the natural behavior of the Wolfe wave pattern, which is used for technical analysis.

The psychology of traders tells them that after three unsuccessful breakouts, a trend reverse is imminent. Waves (ups or downs) are the price’s constant movement.

The bullish Wolfe wave is an example of this. It shows that the market has reached three lows in the Bullish Wolfe Wave. This indicates that there are oversold conditions now and that a bullish trend will begin. If the channel breaks in a downward direction, it means that institutions are filling their buy orders. This can also be a sign of a bearish trend reversal.

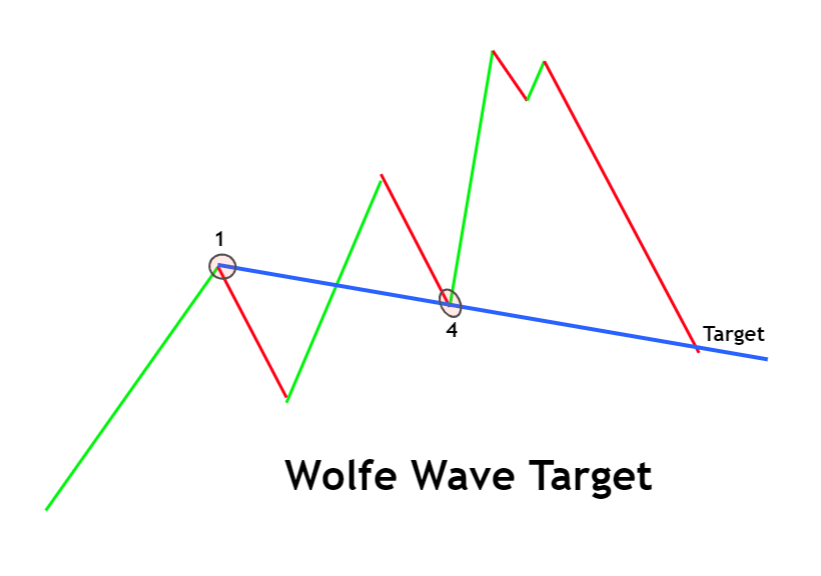

How do you measure the Wolfe wave target?

Then connect the wave 1 starting point to wave 4, and extend the line so that it meets the price.

The same process is used to identify bullish or bearish patterns.

The Wolfe wave has no set target nor take-profit level. Some patterns will have huge risk-reward ratios because it is constantly changing, and others won’t. Therefore, high-risk patterns are best traded.

Wolfe Wave trading strategy

An example will be used to explain Wolfe’s wave strategy.

It is important to first determine the time frame trend. Simply mark the Lower lows, higher highs. You can trade in the direction that the trend is heading.

Next, follow the rules to identify the pattern in the chart. This example shows a trend reverse in the direction that a longer timeframe trend is. Let’s support that we would skip this trade setup if it were against the primary trend.

Entry is the third and most important step. Wait for the price of the channel to open again after it breaks. When the price has closed within the channel, open a buy order. Place stop loss at the lowest price below your target level and measure the targets.

Trades with trends are easy to do.

Conclusion

Wolfe waves, like the Elliott wave are the most effective way to trade and forecast the market. Although this pattern isn’t popular with traders, it offers a great winning ratio and high risk-reward.

Responses